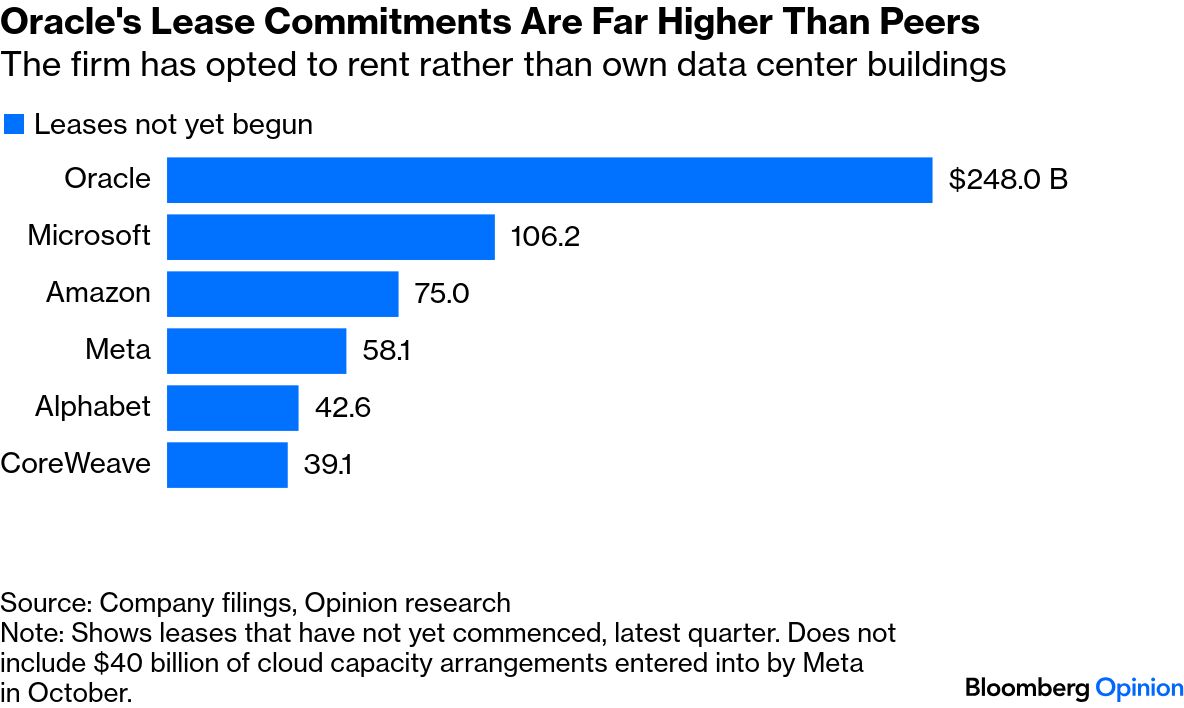

Oracle's Hidden Bombshell | It's a truth universally acknowledged that rent is expensive. But I seriously cannot imagine renting anything for $248 billion. With that kind of money, you could buy all the art in the Louvre — if it were for sale — and still have $213 billion left over to snatch up the entire Hawaiian archipelago plus 210 Boeing jets. Or, I guess you could … lease a bunch of boring, energy-sucking data centers for the same amount. But who on earth would do that? Oracle. Oracle would do that: Absent from Oracle's earnings press release last week was any mention of its $248 billion in lease-payment commitments, nearly all of which are related to data centers and cloud capacity arrangements that are not yet included on its balance sheet. It amounts to what some analysts are calling a true "bombshell." "While Oracle doesn't have to start paying rent until the sites are finished, leases lock in massive annual payments far into the future. And yet AI demand and technology requirements remain uncertain," Chris Bryant writes. When Oracle does start paying up, its data landlords may be laughing all the way to the bank since property leases tend to be long, while AI contracts are pretty short. "Roughly 75% of [Oracle's] $523 billion contracted revenue backlog is expected to be booked in the next 60 months," Chris explains. The OpenAI deal is a bit longer — $300 billion spread over five-ish years — but who knows whether Sam Altman's cash-burning startup will be able to fulfill its spending obligations. "There's also a danger of technological obsolescence," notes Chris. "Oracle depreciates its servers and networking equipment over six years, similar to hyperscaler peers. Even assuming that's realistic, it faces some very big depreciation expenses and may have to do costly upgrades of the tech in its data centers midway through a lease." So, to recap: Oracle is paying an absurd amount of money to RENT data capacity that might not even be needed and there's a nonzero chance it'll have to PAY MORE money to update all its tech down the road? Yikes. A business newsletter is probably *not* the first place you'd go to looking for hot takes about a gay hockey romance sending TikTokers into psychosis, but maybe it should be! Despite the rave reviews and god-tier fan edits, Natalie Schriefer says HBO's Heated Rivalry has "reignited an unhealthy debate over who gets to tell the stories of marginalized communities." In a viral Vulture interview late last week, I Love LA actor Jordan Firstman said the show's sex scenes looked like "two straight hockey players pretending to be gay." The show's two leads — Hudson Williams and Connor Storrie — haven't addressed their sexualities, but Firstman doubled down, saying, "I don't respect you because you care too much about your career and what's going to happen if people think you're gay." "Expecting people to disclose their sexuality before they're ready isn't just a minor annoyance associated with fame. It can be dangerous, depending on a person's circumstances," Natalie writes. When Kit Connor, who played a bisexual teen in Netflix's Heartstopper, came out in 2022, he tweeted, "i'm bi. congrats for forcing an 18 year old to out himself. i think some of you missed the point of the show." Reading Natalie's column in the aftermath of Rob Reiner's tragic death made me realize just how far Hollywood has come on queer culture — and how far it has to go. Back when Reiner played Mike Stivic on All in the Family in 1971, there was a gay character. "Some people weren't very comfortable with that," Reiner recalled in a Variety op-ed in 2015. The show, Ronald Brownstein says, "stands as a true hinge point in television history" because it "cemented the idea that television could be used to comment meaningfully on the society around it." Throughout his career, Ronald says Reiner was "deeply committed to liberal causes," one of which was a successful effort to overturn California's ban on same-sex marriage. Without that kind of steadfastness, who knows if we'd even have a viral TV show about gay hockey players in 2025. |

No comments:

Post a Comment