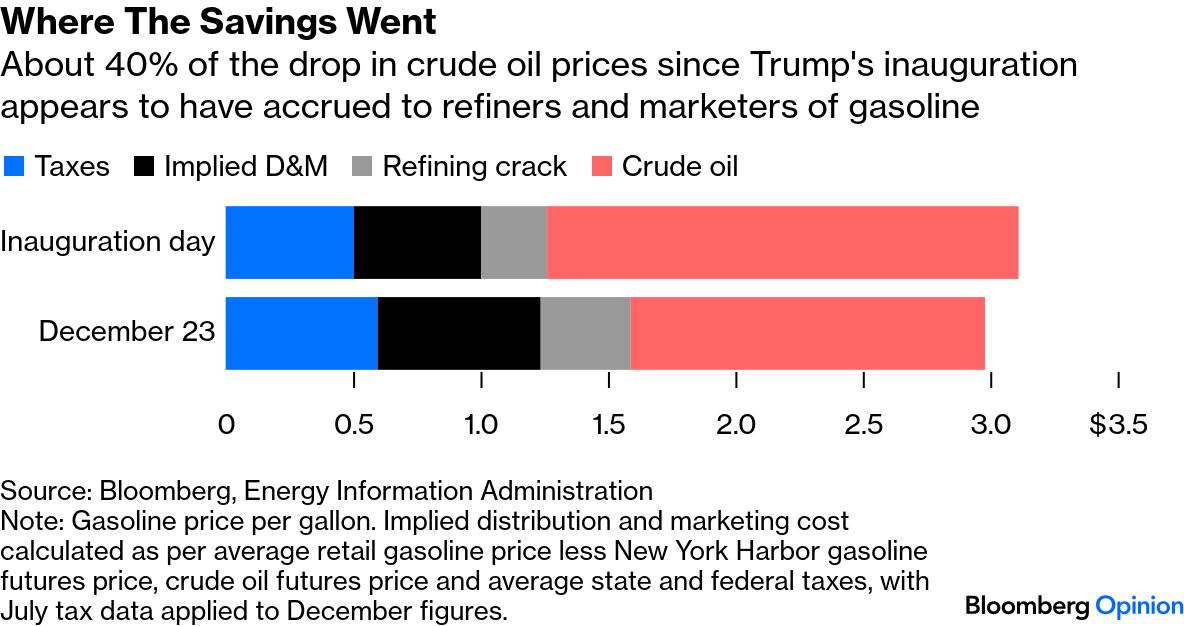

| I'm Jonathan Levin and this is Bloomberg Opinion Today, a special New Year's Eve collection of Bloomberg Opinion's, well, opinions! Sign up here. How Hindsight Capital crushed it | It's next to impossible to outfox the market, even in the best of times. But as 2025 reminded us, that's especially true in the age of Donald Trump — a president with a habit of disrupting, among other things, geopolitics, trade and central banking as we know it. The only sure-fire way to succeed is with perfect knowledge of the future, as John Authers writes in his annual reflection on the performance of Hindsight Capital LLC, his fictional and perfectly-prescient hedge fund. The savvy investment team at Hindsight had some brilliant ideas for the past 12 months, starting with their long silver/short Bitcoin trade. The legendary traders at Hindsight noticed very early on that sovereign debt was piling up around the world and that Washington had little regard for the dollar's reserve currency status. "In such circumstances, it made sense to bet on dollar debasement," John writes. "The way to do that, Hindsight Capital's managers saw, was through precious metals, and particularly silver, which had been overlooked." Even more cleverly, the Hindsight gang paired the silver bet with a short wager on Bitcoin — a risk-appetite trade that had been pumped up by the administration's crypto ties and was already overbought by the time Trump arrived in office. For its part, Hindsight Capital also nailed the tariff trade. Its team understood that China would respond to the US's newfound protectionism by ramping up exports to countries other than the US, even as US air freight suffered. Hindsight played the policy mix by going long the Baltic Dry shipping index while shorting the S&P 1,500 US logistics and air freight index. Don't miss John's video on these ideas here. But what can we expect from the year to come? Probably more wild policy gyrations that only Hindsight Capital can effectively trade through. More uncertainty ahead in 2026 | The year could start with a Supreme Court ruling on the legality of Trump's highly-controversial tariffs, with a decision due as soon as January. No matter what happens, America is likely to continue suffering the consequences of the White House's ill-advised trade policies and their hasty rollout. As the Editorial board explains, one such example is America's agriculture industry, which has been hit by both foreign retaliation and higher prices for machinery, fertilizer and other products, necessitating a bailout. "The tab for the latest round will be $12 billion, and it may not be the last," the Editors write. In 2026, there will also be ongoing pressure on the affordability of energy products including electricity and motor fuel. As Liam Denning writes, Trump is likely to struggle mightily to meet his promise to voters to cut Americans' energy prices in half. Average utility prices have recently risen faster than inflation, and gas prices — while down a bit — are far above Trump's self-imposed target of about $2 a gallon. Although crude oil has fallen by significantly more than gas, the costs associated with distribution and marketing are up substantially and will continue to pressure affordability. "In essence, there is now over a dollar of sticky cost embedded in each gallon in the form of marketing and taxes, more than a third of the current price," Liam writes. The coming year could also be a volatile one in geopolitics. As Karishma Vaswani writes, Trump's newfound bromance with China's Xi Jinping has the potential to sour in a hurry. "While the rapprochement has been welcomed by markets, a lot could go wrong," Karishma says. "They will have the opportunity to meet as many as four times in 2026, providing multiple occasions for relations to head south. Add to that the mid-term elections in the US and uncertainty about artificial intelligence, and next year could easily prove just as volatile as 2025 — if not more so. Even though the downward trend in crude prices has given Trump a helping hand, the administration's goal of slashing energy costs in half looks highly improbable. As the graphic below shows, a significant portion of the drop in crude has accrued to refiners and marketers, rather than consumers. That won't help the president much as he heads into a crucial election year. Among the many geopolitical puzzles for the coming year is what will unfold in America's backyard: Latin America. Tensions are running high between the US and Venezuela, and pressure is mounting for Nicolas Maduro to relinquish power. At the same time, Juan Pablo Spinetto writes that Latin America's voters are shifting rightward. "Step back from the individual races and the broader trend is unmistakable," he writes. According to Latinobarómetro, the share of people placing themselves closer to the right is the highest since 2002. The 'Stranger Things' finale offers needed escapism. — Bryan Reesman

The books our tech writers recommend. —David Lee, Parmy Olson, Catherine Thorbecke

London's culinary moment isn't overhyped. —Howard Chua-Eoan The warning for bankers in Jane Austen's last book. —Lara Williams 'The West' is worth fighting for —Marc Champion New Made-in-USA cars will get a tax perk. A growing number of Americans have bene detained in Venezuela. Trump issued the first vetoes of his second term. How Mexican scientists mapped a dangerous volcano. Kennedy Center renaming divides musicians. Notes: Please send predictions about 2026 (only perfectly accurate ones) to jlevin20@bloomberg.net. |

No comments:

Post a Comment