| Welcome to Next Africa, a twice-weekly newsletter on where the continent stands now — and where it's headed. Sign up here to have it delivered to your email. Guinea is poised to reap the benefits of the geopolitical competition between the world's two biggest economies. The West African nation moved one step closer to gaining another high-grade iron-ore mine. That's after lawmakers in neighboring Liberia approved a plan to allow Ivanhoe Atlantic to rail Guinean steel input through their country and ship it on to the US. The arrangement offers the firm the shortest path to market from the Kon Kweni deposit that Ivanhoe says will support the Trump administration priority of boosting mineral supplies, helping to reduce American dependence on China.  The Morebaya port in Guinea. Photographer: Ricci Shryock/Bloomberg The company has even branded the Liberian export route the "Liberty Corridor" and is expected to invest almost $900 million on upgrading the infrastructure. It's a boon for Liberia and Guinea, but also a reminder of how far Washington has fallen behind in the race to secure Africa's abundant — and valuable — commodities. Chinese companies have already invested heavily in African mines. Beijing also dominates the processing and refining of many crucial minerals from cobalt and lithium to rare earths and antimony. American interest in the Liberian rail link echoes its moves in southern Africa, where ex-President Joe Biden pushed the Lobito Corridor to help transport Zambian and Congolese copper through an Angolan harbor. Ivanhoe's Guinean mine will be on a far smaller scale than the vast Simandou project, which is located less than 200 kilometers from Kon Kweni and began exports this month. That venture — mainly owned by Chinese and Singaporean firms as well as Rio Tinto — ships premium quality iron ore via a newly built railway that stretches more than 600 kilometers to a port near Guinea's capital, Conakry. Most of Simandou's production is destined for steel mills in China. Now that the Liberian railway has been approved, Ivanhoe wants to start building Kon Kweni early next year and get into production in 2027. It's a remarkable turnaround for Guinea's mining industry after decades of false starts, cementing its credentials as a key source of some of the world's most important raw materials. — William Clowes Key stories and opinion:

Liberia Backs Ivanhoe Atlantic Rail Deal to Unlock Iron-Ore Mine

China's Mega Mine Threatens to Upend the Iron-Ore Market

Guinea Starts Iron Exports From World's Top Untapped Deposit

Angola Gets $753 Million US, South Africa Loans for Lobito Rail

US Is Missing Out on Africa's Surging Opportunities: Hal Brands  In this special episode of the Next Africa podcast, Bloomberg Opinion columnist Justice Malala joins Jennifer Zabasajja to look at the big moments of the year. In memoriam: Brian Gilbertson, the South African dealmaker who helped build the global mining giant BHP Billiton before his departure as chief executive officer in 2003, has died. He was 82. The Rwanda-backed M23 rebel group said it will withdraw from eastern Democratic Republic of Congo's third-biggest city under US pressure. M23 took Uvira on Dec. 10 alongside Rwandan troops, according to the US, which has backed a peace deal between Rwanda and neighboring Congo. Rwanda denies supporting M23, which is involved in separate peace negotiations with Congo overseen by Qatar. Read our QuickTake on the war here.  M23 fighters inspect surrendered weapons in Uvira, Congo, on Monday. Photographer: Daniel Buuma/Getty Images The Trump administration warned Pretoria of "severe consequences" over what it said was the detention of US government personnel providing humanitarian support to Afrikaners, the latest instance of animosity between the two nations. South African authorities this week arrested seven Kenyan nationals who they say were processing US refugee-status applications for Washington without the required work visas. They deny any Americans were detained. Beninese President Patrice Talon played down the threat posed by plotters of an attempted coup this month and declared that they lacked army or popular support. They were "small-time thugs, manipulated by political and foreign marginal actors," he told reporters. While the putsch was thwarted by the rapid intervention of neighboring Nigeria, the foiled coup rattled a region that has seen a string of recent military takeovers. US President Donald Trump expanded the list of countries facing travel restrictions in the latest move by his administration to crack down on migration following the shooting of two National Guard troops last month. The president moved to impose limitations on Burkina Faso, Mali, Niger and South Sudan, among others, and is continuing the restrictions on 12 countries deemed "high-risk," including Chad, Republic of the Congo, Equatorial Guinea, Eritrea, Libya, Somalia and Sudan.  Travelers at John F. Kennedy International Airport in New York in June. Photographer: Michael Nagle/Bloomberg The African Development Bank's concessional-financing arm mobilized a record $11 billion in its 17th replenishment, an amount the multilateral lender said signals confidence in the continent's development prospects. It includes as much as $2 billion from the OPEC Fund for International Development and up to $800 million from the Arab Bank for Economic Development in Africa, with 19 countries making pledges to the African Development Fund for the first time, it said. Next Africa Quiz — Which country released a Nigerian Air Force plane and its crew after detaining them last week for an unauthorized emergency landing? Send your answers to gbell16@bloomberg.net. Data Watch - South Africa's annual inflation unexpectedly cooled in November, edging closer to the central bank's new 3% target and boosting hopes for an interest-rate cut next month. The lower inflation goal is also giving the rand fresh momentum.

- Namibia is seeking to raise $411 million in private investment as part of a $1.76 billion energy-expansion plan to boost renewable-electricity generation.

- Diageo agreed to sell its majority stake in East African Breweries to Japan's Asahi in a $2.3 billion deal.

- African governments will turn to unconventional ways to meet financing costs expected to reach almost $83 billion next year, the highest level since 2021, according to BMI, a unit of Fitch Solutions.

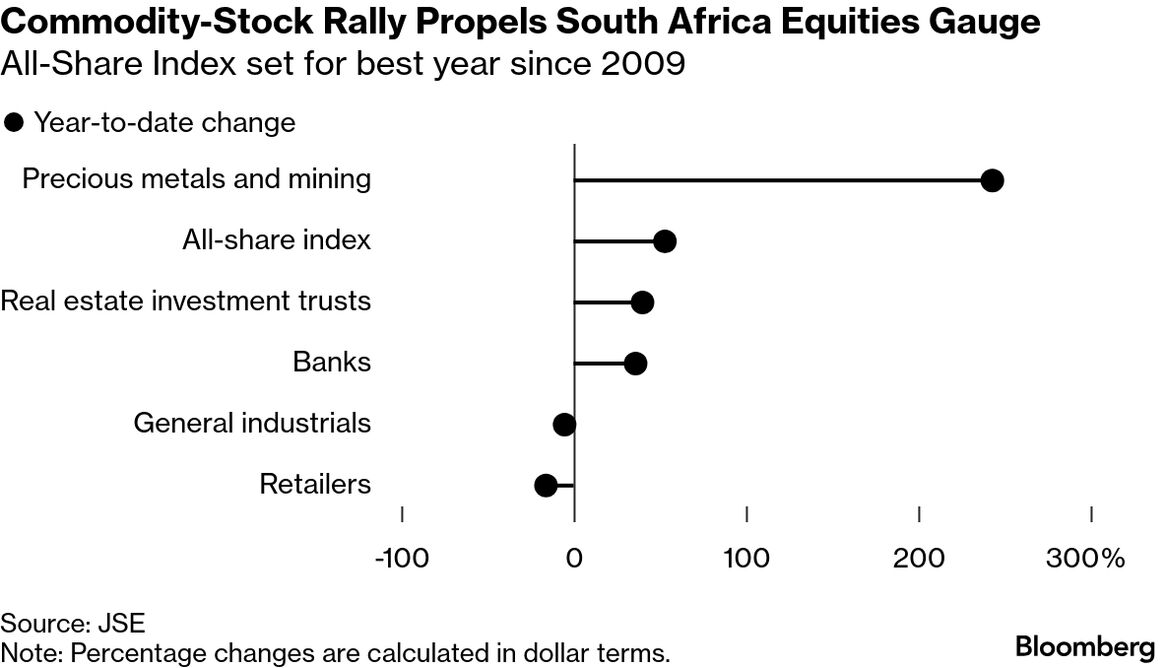

- Stocks of non-commodity South African companies look set to rally next year, according to a veteran fund manager at Ninety One, the nation's top investment firm.

Coming Up - Dec. 22: Lesotho inflation data for November, start of a two-day summit of the Alliance of Sahel States

- Dec. 23: Botswana third-quarter GDP data

- Dec. 24: Zambia December inflation, November trade data & GDP for the third quarter

- Dec. 25: Egypt interest-rate decision

|

No comments:

Post a Comment