| Read in browser | ||||||||||||||

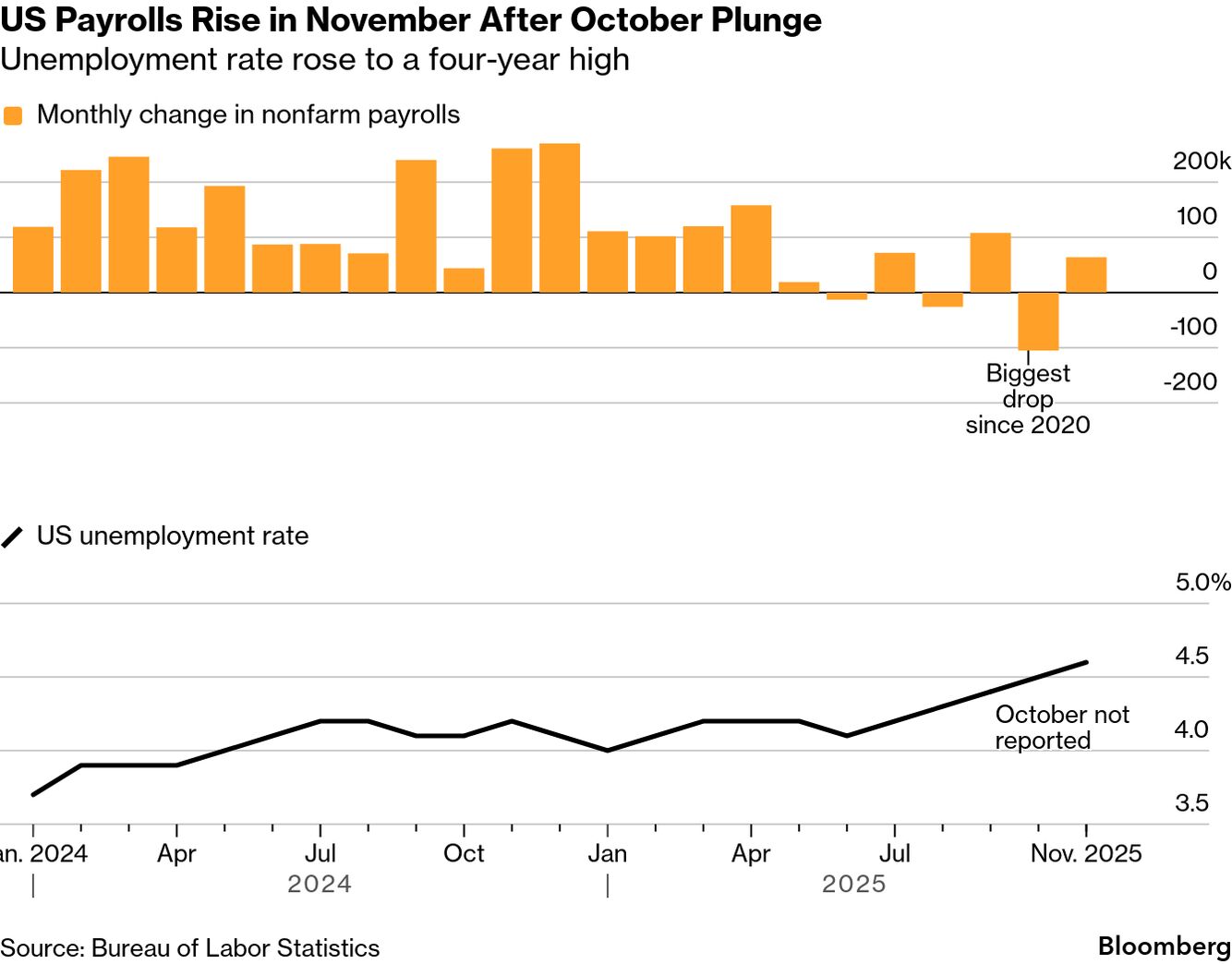

Rich Henderson here from Bloomberg's Melbourne bureau. Today, we have further details from Sunday's horrific tragedy. The father and son blamed for killing 15 people traveled last month to an area of the Philippines linked to Islamic State. On our weekly podcast, Rebecca Jones and columnist David Fickling discuss how the attack will change the country. In finance, AustralianSuper announced the departure of its longtime chief investment officer, opening up one of the country's biggest investing jobs. What's happening nowThe two gunmen blamed for killing 15 people at Bondi Beach on Sunday traveled to an area of the Philippines last month where Islamic State-aligned groups have operated, officials in Manila said. A car registered to one of the gunmen contained explosive devices and two homemade Islamic State flags, according to police, as further details from the tragedy emerge. Separately, police in India confirmed that one of the gunmen was an Indian national.  Bondi Beach has long stood as a symbol of Australia's easygoing spirit. But the recent terror attack during a Hanukkah celebration shattered that image, leaving a nation in mourning and reflection. In our latest podcast, Rebecca Jones is joined by Bloomberg Opinion's David Fickling to explore why this attack cuts so deeply, not just for those directly affected, but for the Australian identity itself. Listen and follow The Bloomberg Australia Podcast on Apple, Spotify, on YouTube, or wherever you get your podcasts.  Mourners gather at a tribute at the Bondi Pavilion. Photographer: Saeed Khan/AFP via Getty Images Read this essay from Chief Asia Correspondent, Ros Mathieson - who in 1996 was working as a journalist in Australia on the day of the Port Arthur massacre. Ros explores how the push to tighten gun laws after the Sydney attack tests a once-strong political consensus — and highlights the US's enduring paralysis on firearms.  Click image to play. AustralianSuper's longtime chief investment officer Mark Delaney will step down in June, freeing up one of the country's most high-profile investing jobs. Under Delaney's tenure, the A$400 billion pension fund — Australia's largest — has expanded further into private markets and opened investment offices in New York and London. Two of the big four banks expect higher rates next year. CBA anticipates one hike from the Reserve Bank of Australia, while NAB expects the central bank to deliver two, as the country faces persistent inflation. What happened overnightHere's what my colleague, market strategist Mike "Willo" Wilson says happened while we were sleeping… US stocks edged lower for a third day, led by blue chips, as data made the US jobs market look sluggish. Treasury yields and the dollar eased, while Aussie and kiwi were little changed. The RBNZ this morning said it will consider moving to eight policy rate meetings a year. ASX futures suggest a steady open for local stocks this morning. The Trump administration threatened to retaliate against the European Union following efforts to tax US tech companies. Officials in Washington have singled out the likes of Accenture and Spotify as potential targets. Jobs growth in the US was sluggish in November as the unemployment rate ticked up to a four-year high, underscoring continued cooling in the labor market.  Warner Bros. Discovery is planning to reject Paramount Skydance's hostile takeover bid due to concerns about financing and other terms, people familiar with the matter said. The founder of First Brands, the bankrupt auto-parts supplier, asked a judge to dismiss a lawsuit accusing him of misappropriating hundreds of millions of dollars. Patrick James said firms that provided his company with off-balance-sheet financing engaged in "predatory" practices. What to watchAll times Sydney • 10:30 a.m: Westpac Leading Index One more thing... Electric vehicles charging station in Atlanta, Georgia, US. Photographer: Megan Varner/Bloomberg The global transition to electric vehicles is beginning to unravel the way major changeovers often do: slowly at first, then all at once. This week brought a cascade of signals that the EV era is entering a more uncertain, more contested phase. The European Commission backed away from what had been the world's most aggressive timeline for phasing out internal-combustion engines, granting manufacturers and consumers more time to move off gasoline. A day earlier, Ford Motor announced $19.5 billion in charges tied to the retreat from an electric strategy it vowed to go all in on eight years ago. We're improving your newsletter experience and we'd love your feedback. If something looks off, help us fine-tune your experience by reporting it here. Follow us You received this message because you are subscribed to Bloomberg's Australia Briefing newsletter. If a friend forwarded you this message, sign up here to get it in your inbox.

|

Tuesday, December 16, 2025

New details emerge about Bondi gunmen

Subscribe to:

Post Comments (Atom)

[TOMORROW LIVE 1PM ET] Tony Cracked the Code

December 16, 2025 | Read Online Hey, I've seen Tony Rago do what few traders ever do—build a setup from scratch and teach it t...

-

PLUS: Dogecoin scores first official ETP ...

-

Hollywood is often political View in browser The Academy Awards ceremony is on Sunday night, and i...

No comments:

Post a Comment