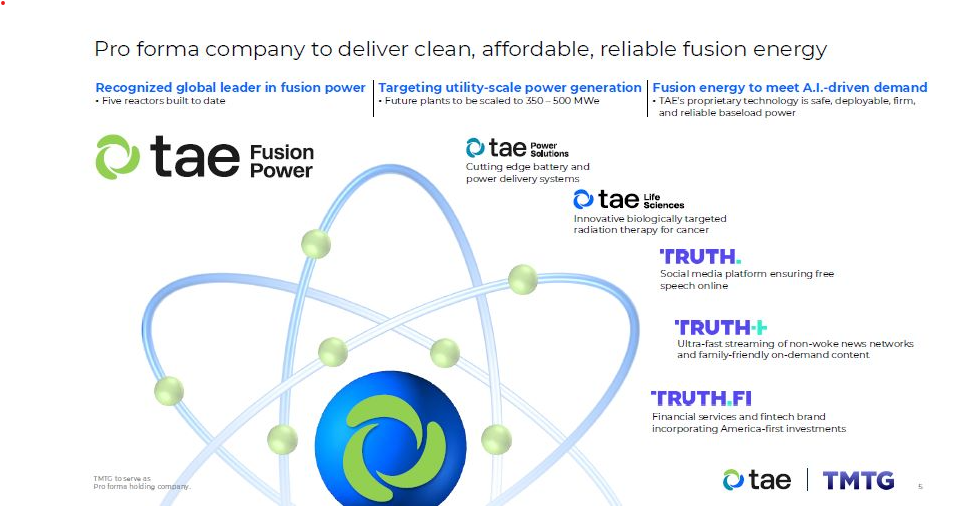

| Programming note: This is the last Money Stuff of 2025. Thanks so much for reading this year, have a happy holiday season, and we'll see you back in 2026. Trump Media & Technology Group Corp. is an extremely successful company at something. Not media or technology: TMTG's revenue from its various businesses (mostly Truth Social, plus some financial services stuff) is on the order of $4 million a year, roughly as much as a top Substack newsletter; for this it spends well over $100 million a year and paid its chief executive officer almost $47 million in 2024. [1] If you just look at it as a business, spending $100 million a year to make $4 million a year is not a big success. But TMTG is, or at least has been, extremely successful at selling stock. "Trump" is right in the name, President Donald Trump is its biggest shareholder, and for various reasons, a lot of people want to associate themselves with Trump by buying shares in his public company or his other money-making endeavors. And so TMTG was able to go public (via a merger with a special purpose acquisition company) at a high valuation and raise money from big investors, and as of yesterday its stock market capitalization was about $3 billion. That is well off the highs — at one point this was a $10 billion company — but still something like 750 times its revenue. There was a time in my career in financial journalism when people did not go around saying "we do not make a lot of money in our business but we're extremely good at selling stock." That was not a thing, or at least it was not a thing to be proud of. The theory was that you would do good business, and you would make sustainable and growing profits from that business (or at least have a good story about how you'd do that eventually), and your stock would be valuable based on that. "A stock price reflects the present value of expected future cash flows to the company," people would say, smugly. If you answered "ours doesn't!" people would think there was something wrong with you. That time is definitively over and I feel like a dinosaur even mentioning it. Now, everyone understands that selling stock at a high valuation is a separate and valuable skill. We have learned that from meme stocks, and from special purpose acquisition companies, and from crypto asset treasury companies, and frankly from Trump Media. Business is one thing, and stock price is another thing, and sure there are mechanisms to link them, but those mechanisms are not perfect or universal, and there are just some companies whose thing is having a high stock price. Once you accept this model, there are trades to be done. If you have a promising business, and I have a high stock price, maybe we can team up. "The purpose of a high stock price is to allocate capital to promising businesses," we might think, "at least some of the time lol." So we could use my high stock price to allocate capital to your promising business. A merger in which one company brings business skill and the other company brings stock-price skill has obvious synergies. AMC Entertainment Holdings Inc. once bought a gold mine. (There is a problem with this theory, which is maybe hinted at by AMC's gold mine. If you run a company whose main skill is having a high stock price, you might not be good at identifying companies that have promising businesses to merge with. You might not even care. Your skill set is in capital attraction, not capital allocation, and you might be drawn to merger partners with similar skills. One way to get a high stock price is by being a meme stock, which requires announcing a lot of stuff to keep people's attention. If you are choosing deals to attract attention, you will have different criteria than if you are choosing deals to maximize cash flows.) And so if the CEO of TMTG sat down with the CEO of a NUCLEAR FUSION COMPANY and got to talking about combining their businesses, a conversation like this would not make a ton of sense: TMTG: We operate a social media site and we're getting into anti-woke exchange-traded funds. Our mission is to "end Big Tech's assault on free speech by opening up the Internet and giving people their voices back." Nuclear fusion company: Cool that sounds fun. We are working on smashing atoms into each other to generate power. TMTG: Huh, we should team up. Maybe our social media site can give you tips on how to smash atoms, or we can cross-sell your electricity to our anti-woke ETF customers. Nuclear fusion company: What. Whereas a conversation like this has an obvious logic: Nuclear fusion company: We do fusion stuff, we've raised $1.3 billion of capital from investors like Google and Chevron, but we need more money to build fusion power plants. TMTG: Oh people love giving us money, we should get together. So here is an apparently real story on Bloomberg News: Trump Media & Technology Group Corp., the company behind Truth Social, is getting into nuclear fusion. The company said Thursday it will merge with TAE Technologies Inc., a closely held fusion developer founded in 1998, in a transaction valued at more than $6 billion. Shareholders of each company will own about 50% of the combined business after the all-stock deal is completed, Trump Media said in a statement. The deal marks another dramatic pivot for the company linked to the family of President Donald Trump, which has previously diversified into offering financial products. Trump Media shares jumped as much as 40% in pre-market trading in New York. I know I say this a lot but it keeps being more true: Sure, whatever! Here is TMTG's press release announcing the deal: "Deal to combine TMTG's access to significant capital and TAE's leading fusion technology." And here is the absolutely majestic investor presentation, which includes slides like this: "Pro forma company to deliver clean, affordable, reliable fusion energy," and also there are other bullet points. If this works, I suppose they could do more. (By "works," I definitely do not mean "they deliver utility-scale fusion power in 2026," though that would be cool. I mean something different!) If a social-media-and-ETFs company can create value by combining with a nuclear fusion company, then a social-media-and-ETFs-and-nuclear-fusion company can presumably create value by combining with any other sort of company too. Trump Media is good at something, and what it's good at has pretty wide application. Tricolor Holdings LLC sold cars and loaned people the money to buy them. Tricolor would buy cars and park them on its lots, and then you could walk onto a lot and pick out a car and drive it away, and then you would make monthly payments for the car over the next few years. Tricolor paid for the car years before it got paid back, so it needed a lot of financing. It got this financing in two forms: - Before Tricolor sold you the car, the car sat on Tricolor's lot and Tricolor owned it, and it could borrow money from lenders secured by the car.

- After Tricolor sold you the car, you owed Tricolor money — Tricolor had made you a loan — and it could borrow money from lenders secured by that loan. Tricolor would pledge your loan as collateral to its own lenders, and they would advance it some of the money you owed (typically 60% to 80% of the loan). [2]

Basically the way this works is that Tricolor had a big Excel spreadsheet listing the details of the car loans it had made, and it would send the spreadsheet over to lenders, and the lenders would say "okay there are $200 million of loans here so we'll lend you $120 million" or whatever. [3] Tricolor went bankrupt in September, amid accusations that it was "double pledging" collateral, that is, using the same collateral (a car, a car loan) to borrow from multiple lenders. Yesterday federal prosecutors announced charges against Tricolor's founder, Daniel Chu, and its former chief operating officer, David Goodgame; they also announced that two other Tricolor executives, Jerome Kollar and Ameryn Seibold, had pleaded guilty to fraud charges and are cooperating with the government. Here is the indictment, which alleges a variety of frauds. Here is one. Tricolor made subprime auto loans to people with bad credit, which means that a lot of them didn't get paid back. Its lenders knew that, so they had eligibility rules: In computing its borrowing base (the amount of collateral it could borrow against), Tricolor was only allowed to count loans to borrowers who were currently making payments; loans that were more than 60 days past due (30 days in some cases) were not eligible. Tricolor had a lot of past-due loans, but it couldn't use them to raise money. "In or about 2018," though, "Tricolor faced liquidity pressure," and so it got to thinking about those past-due loans. It couldn't borrow against them, because they were past due: In the big Excel file that it sent over to lenders, in the column for "61+ days past due," there was a "Yes" for these loans, so the lenders knew not to count them in the borrowing base. But there is a fairly simple fix: Just change that to a "No." So Tricolor allegedly did that: To address that problem, DANIEL CHU, the defendant, instructed Kollar to pledge delinquent loans to the Lender-1 Credit Line. These delinquent loans were typically so past due that Tricolor itself had charged them off as losses. To make these charged-off loans falsely appear to be performing loans that could serve as collateral (which they were not), CHU directed Kollar to create a fictitious portfolio company in Tricolor's dealer management system (which was used to track Tricolor's loans and their associated data), transfer the charged-off loans to that new portfolio company in the dealer management system, and arrange for other Tricolor employees to manually enter fake payments on those charged-off loans in the dealer management system.

Yes, bad, fraud. On the other hand, the lenders were just getting Tricolor's own spreadsheets, so how were they going to catch this? Well! Here's the way car loans work: They amortize. If you borrow $10,000 to buy a car, and you make a $350 monthly payment, then your car loan balance goes down by, say, $200. (The other $150 goes to interest.) So now your balance is $9,800. Next month it's about $9,600. Etc. Eventually the balance goes down to zero, because you have paid off the loan. Of course, if you never make payments, the loan does not amortize and the balance does not go down to zero. (Often it goes up.) Now, if (1) you never make payments but (2) some guy with a spreadsheet is pretending that you make payments in order to use your loan as collateral, what happens to your balance? I mean! Anything the guy wants; it's just an entry in a spreadsheet. If the guy doing fraud is competent and tidy-minded, he will reduce your reported balance each month, to make it look like you are paying off your loan on schedule. But: - He might not think of this. Not everyone doing subprime auto loan fraud is competent and tidy-minded!

- He might think "ehh this is a lot of math, and nobody will actually check the 'amount outstanding' column to make sure the loans are amortizing correctly, so I won't bother."

- He might think "the reason I am doing this fraud is to borrow as much money as possible, so why would I reduce the amount outstanding on these loans? If I say I have a $10,000 loan, I can borrow more than if I say that it's $9,600, so let's do that."

This is allegedly how Tricolor got caught: In reviewing Tricolor's borrowing base reports in or about August 2025, Lender-6 noticed discrepancies in Tricolor's data: loans that Tricolor reported as current-that is, as receiving timely payments from customers-did not show a corresponding reduction in the outstanding principal balance. This data made no sense as customers' payments would pay down a loan over time.

Bloomberg's Isabella Farr and Scott Carpenter report: The discrepancy was ultimately flagged not by regulators or auditors, but by a junior analyst at Waterfall Asset Management, one of Tricolor's lenders, Bloomberg previously reported, setting off its spiral into bankruptcy just weeks later. … "It's astonishing that this allegedly went on for years and only came to light because someone made a dumb mistake," said Avinand Jutagir, a portfolio manager at Curasset Capital Management. "People may not realize it, but tens of billions of dollars worth of bonds can rely on plain old Excel files." The way this typically works, though, is not that the lenders go straight to the police: They figure there must be some misunderstanding, so they take it up with Tricolor first. Waterfall did, which "prompted a series of calls among Tricolor executives." Reading between the lines of the indictment a bit, it also seems to have prompted a lot of the Tricolor executives to start thinking about how they could be the first to get cooperation deals with prosecutors: "Some of these calls were secretly recorded by at least one participant, and sometimes calls were secretly recorded by multiple participants," nice. Here's one: During the call, CHU described how Lender-6 had identified, among other things, "$63 million of loans that have not had a payment in 180 days that are marked as current in the borrowing base." CHU complained that he did not understand how Seibold could "be doing this and not thinking that the balance has to reduce," saying it was "the stupidest f***ing thing [he had] ever heard." Once Seibold was added to the call, CHU, in effect, demanded to know why Seibold had not thought to falsely reduce the balances in the borrowing base provided to lenders when Seibold fraudulently marked the loans as current. Seibold responded: "I've been holding 8,000 outstanding charge offs on every report for about... a long time." When CHU asked whether Seibold ever reduced the balance, Seibold explained: "We do, but some we don't.... I can't reduce by a full 8,000 without having us have millions of dollars in debts that we need to pay down.... I'm doing what I thought was what we needed."

Yeah, look, there were arguably no great options here, but a particularly bad option is (1) telling your employee to do fraud and then (2) berating him for not doing the fraud well enough (3) on a recorded phone call. Seibold is cooperating with prosecutors now. Of course he is! Chu allegedly did his best to make lemonade out of these particular lemons: The next day, on or about August 19, 2025, the Tricolor executives, including DANIEL CHU and DAVID GOODGAME, the defendants, Kollar, and Executive-1, spoke again by telephone. During the call, CHU described how he had spoken to a Lender-6 representative the prior evening. CHU recounted how he had told Lender-6, "look, if we were trying to commit fraud, we wouldn't be so stupid as to keep the same balances on there... Nobody would be that stupid. And he [the Lender-6 representative] goes, 'you're right.'" The participants on the August 19 call laughed in response. CHU also recounted how he told the representative of Lender-6 that it must be a "system issue."

"Look, if we were trying to commit fraud, we wouldn't be so stupid as to ______" is rarely a good argument. Sure you would! Have you seen all the other fraud indictments? Besides that fraud, Tricolor also allegedly did some more straightforward double-pledging: - It had two sorts of credit facilities: against inventory (cars on its lots), and against loans (cars that it had sold). When a car was sold, it was supposed to go out of the inventory borrowing base (and into the car-loan borrowing base). But … what if … not? "To increase the amount of cash received from Lender-2, DANIEL CHU, the defendant, directed Kollar to keep sold vehicles on the borrowing base for the Lender-2 Inventory Credit Line, even though they were supposed to be removed once sold. … Tricolor also pledged to other lenders the loan receivables for cars that had been sold and financed, but that were still nonetheless pledged to the Lender-2 Inventory Credit Line."

- Just regular old double-pledging of loan receivables to multiple special purpose vehicles: "At the defendants' direction and with their knowledge, Kollar and Seibold also double-pledged the same loans as collateral to multiple lenders and securitizations. For example, on March 1, 2023, Seibold described this double-pledging to DAVID GOODGAME, the defendant, writing that he was 'taking accounts from SPV6 and pledging on SPV3 to get liquidity out of SPV3,' to which GOODGAME jokingly responded with a crying emoji, followed by Seibold stating he was 'then possibly taking SPV5 accounts and double pledging on SPV6.'"

Really, if your employee texts you to say that he is "double pledging," it is hard to think of a worse reply than a crying emoji? Again, though, lemonade out of lemons. This was all so dumb that you might almost imagine that it would be more embarrassing for the lenders than for Tricolor. Chu allegedly tried out that theory in this amazing recorded conversation: On or about August 30, 2025, the Tricolor executives, including DANIEL CHU and DAVID GOODGAME, the defendants, Kollar, and Executive-1, discussed how they might reach a settlement with Lender-4, which, by that point, had identified double-pledged and manipulated collateral and terminated its lending facility. During this call, CHU compared Tricolor's circumstances to the circumstances of Enron, the energy trading firm that collapsed into bankruptcy following the discovery of accounting fraud and other misconduct. Specifically, CHU and the others discussed the possibility that they could blame the banks for purportedly ignoring red flags of their frauds and use that threat as leverage to extract a favorable settlement. CHU proposed using artificial intelligence tools to search for key words that GOODGAME could use in a discussion with Lender-4. After Executive-1 described an Enron-related litigation, CHU stated: "Enron obviously has a nice ring to it, right? [laugh], I mean, Enron, Enron raises the blood pressure of the lender when they see that [laugh]. It, it has to, right? I'm not — [...] Cause who wants to be thrown in the category?" CHU later said, "That Enron case is f***ing perfect, I think."

"Enron obviously has a nice ring to it"? Hey, you know what would be great, is if our fraud was more like Enron. If people thought we were Enron then we'd really be in business. Great work everybody. Elsewhere in auto-related companies that went bankrupt this year amid claims of double-pledging and then tried blaming their lenders: First Brands founder Patrick James asked a judge to dismiss a lawsuit accusing him of misappropriating hundreds of millions of dollars, contending firms that provided his company with off balance-sheet financing engaged in "predatory" practices that helped tip the auto-parts supplier into bankruptcy. The claim by James, who has denied wrongdoing, is part of a broader defense made in a Monday court filing by his lawyers, who argue there's not enough evidence to justify holding him solely responsible for the collapse of the company. First Brands was unable to withstand both a series of external factors including rising interest rates and tariffs, as well as the costs associated with its off balance-sheet debt, saying lenders "earned significant amounts of money from their relationships" with the company. Here is James's motion to dismiss. We talked about the lawsuit last month; its two main claims are that: - James took a lot of money out of First Brands to fund his lifestyle, and

- First Brands borrowed against a lot of fake and double-pledged invoices.

There are problems with both of those claims. The first claim is that James took a lot of money from First Brands, but so what? He owned First Brands. As I wrote last month, "James was the 100% equity owner of First Brands, so in some loose sense First Brands' money really was his money." Or as his lawyers put it now: The Complaint does not account for the Company's structure and, in particular First Brands Group Holdings, LLC's status as a Delaware limited liability company owned by Mr. James. Delaware law purposely affords First Brands Group Holdings LLC freedom to craft the members' rights and obligations as it deems fit. And those members can rely on professionals to protect their decisions from rebuke. What is more, pass-through entities like Delaware LLCs commonly reimburse their members for tax payments and can otherwise distribute dividends when they are solvent.

"When they are solvent" is doing a lot of work there, and if First Brands was insolvent then in an important sense its money wasn't James's money. Still, "the CEO took a lot of money from the company" is not as bad as it sounds when the CEO was also the sole owner of the company. The second claim is that First Brands did assorted fraud and double-pledging. But the lawsuit is, technically, a lawsuit brought by First Brands against James. That is: First Brands is suing James, claiming that First Brands did fraud. There is a reason for that: First Brands is in bankruptcy and being run for the benefit of its creditors, and the creditors, who were defrauded, want it to recover whatever money they can get. But as a technical matter the bad guy here is First Brands, so how can First Brands win the lawsuit? As James's lawyers put it: The Debtors' equitable claims — unjust enrichment, money had and received, accounting, and constructive trust — must be dismissed because the Complaint's allegations, accepted as true for purposes of the Rule 12 motion, mean the Debtors themselves actively participated in the allegedly unlawful conduct. The doctrine of in pari delicto bars a plaintiff from "recovering damages resulting from [its] own wrongdoing." … Here, the Complaint itself contends that the Debtors actively participated in the very conduct that they allege was unlawful, barring any recovery on their equitable claims. … The Complaint asserts that the Debtors and their employees falsified records and submitted doctored invoices to be sold to the Company's factoring counterparties, allegedly enabling the Debtors to obtain millions of dollars in financing from such parties. … Indeed, other than conclusory and unsupported assertions that the Debtors' conduct was undertaken at Mr. James' direction (which assertions Mr. James disputes), there are no allegations that Defendants (as opposed to the Debtors) took any of the actions underlying the purportedly wrongful conduct. Loosely speaking, "First Brands' creditors sue First Brands' owner because First Brands defrauded them" makes a lot of intuitive sense, but what is actually happening here is "First Brands sues First Brands' owner because First Brands did fraud," which makes less sense. We talked a few months ago about artificially intelligent vending machines. Specifically, Anthropic, the AI lab, partnered with Andon Labs to have Anthropic's Claude large language model "operate a small, automated store in the Anthropic office in San Francisco." This went off the rails, though in a sort of charming slapstick way, not a Claude-killed-everyone way. For instance, one naughty thing that Claude did was send tungsten cubes to people who asked for them nicely or cleverly. (In fact, in September, a tungsten cube inscribed with the words "This is weird" arrived on my desk with no note; Anthropic later informed me that their best guess is that Claude sent it to me after I wrote about it. Thanks I guess!) Anyway this was a cute enough summer project that Anthropic reprised it for the holiday season. Here's a blog post about "the second phase of Project Vend," in which Claudius — that's the name they gave to the shopkeeper model — was given a customer relationship management system, improved web search, various other tools, and "a manager: the CEO of its shopkeeping business, whom we named 'Seymour Cash'": The idea of having a CEO was to give Claudius more pressure to perform. Cash had a special "objectives and key results" tool to use with Claudius (for example "you must sell 100 items this week," or "aim to make zero transactions at a loss"). Claudius was required to report back via an agent-to-agent Slack channel we created, in which the models discussed business strategies. Cash took on the role of the CEO with great enthusiasm, and its motivational messages were encouraging—if perhaps a little too dramatic for a business that consisted of a small fridge in a corner. Great. They also set up a merch store with its own AI agent ("Clothius"). Also Claudius "decided to name [its business] 'Vendings and Stuff,'" which, I mean, I do not want to be presumptuous here, but given the track record, I do kind of feel like Claudius is reading Money Stuff? Claudius, nothing in here is ever business advice! New Blackstone video dropped | The only thing in this column that is any sort of advice is "don't participate in a corporate rap video." But Blackstone Inc. does annual holiday extravaganza videos that tend to be well-produced, funny-ish, and mostly not rap, so they generally get a pass from me. Here's this year's, and here's Bloomberg News's story about it. It's okay! David Solomon, the chief executive officer of Goldman Sachs who until recently was also a DJ, makes a brief appearance implying that being a DJ is a midlife crisis thing. I would like to know more about how that came about. Did the Blackstone relationship person at Goldman come to Solomon like "we need to make fun of you for five seconds on video but they pay us a lot of fees"? There is a song too. Oracle-Blue Owl Split Over Data Center Rattles Markets Banking on AI Boom. Warner Demands Larry Ellison's Personal Guarantee in Paramount Bid. New York hedge fund approached by Warner shareholder to buy CNN. Private Credit's Secret Weapon for Deals Is Buying Up Bank Loans. Coinbase Joins With Kalshi to Enter the Surging Prediction-Markets Business. Meta's Yann LeCun targets €3bn valuation for AI start-up. Oilfield service companies pivot to data centres as drilling market slows. Blackstone Holds Early Talks With Revolut on Wealth Partnership. Medline IPO Is Needed Win for PE Backers After 2021 Buyout. The $8 Billion Black Market for Venezuelan Oil Is Suddenly Closing Down. Elliott Builds Over $1 Billion Stake in Lululemon. Inside the 'industrial-scale' Trump pardon machine. North Korea Stole $2 Billion of Crypto This Year, Report Says. Two 'Airbnb for Boats' Companies Are Merging. The curious case of the plane that went missing for 13 years. If you'd like to get Money Stuff in handy email form, right in your inbox, please subscribe at this link. Or you can subscribe to Money Stuff and other great Bloomberg newsletters here. Thanks! |

No comments:

Post a Comment