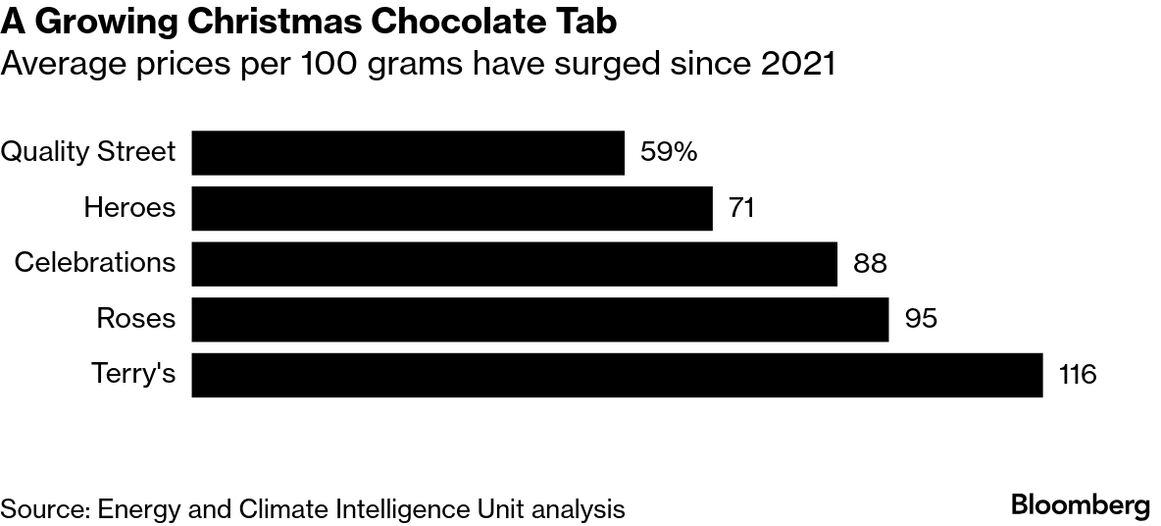

| By Keira Wright and Ruth Liao Meg O'Neill's rapid rise to the top of one of the world's biggest fossil-fuel companies has been unencumbered by doubt. At a moment when oil executives are still being pressed to move away from hydrocarbons, she has a different argument: that the world is nowhere near done with them. So when BP Plc stunned markets by naming an external chief executive officer for the first time, the choice of O'Neill signaled more than a leadership change. It marked a recalibration for BP, bruised by a failed pivot toward renewable energy, years of uneven financial performance, and pressure from activist investor Elliott Investment Management to return the company to its core oil and gas focus.  Meg O'Neill Photographer: Brent Lewin/Bloomberg O'Neill, who has led Australian oil and gas giant Woodside Energy Group Ltd. since 2021, arrives with a reputation for operational rigor and a belief that natural gas, particularly liquefied natural gas, is a long-term necessity. To supporters, she is exactly the leader BP needs. To critics, she represents an industry choosing regression over reinvention. "Her appointment as CEO seems well-aligned with BP's reversal from green energy back to core oil and gas profitability," said Susan Sakmar, a University of Houston Law Center visiting assistant professor and expert on the oil and gas market. "Good news for BP." She takes on her new role amid a wider political split over energy. US President Donald Trump's revived "drill, baby, drill" mantra and promises to roll back years of climate rules that, he argues, drove up energy costs have led to a renewed emphasis on oil and gas. And while Asian consumers are hungry for more fossil fuels, BP in Europe faces a different reality of tougher carbon-reduction mandates, stricter disclosure rules and regulatory pressures to show progress toward cutting emissions. O'Neill will have to navigate both worlds at once. Read the full story on Bloomberg.com. By Emma Court Christmas candy shoppers in the UK are set to feel the climate pinch this year. Prices of popular chocolate boxes have as much as doubled over the past four years, according to a new analysis by the nonprofit Energy and Climate Intelligence Unit. Rising cocoa commodity prices in recent years have reflected climate shocks such as drought taking a bite out of West African harvests. Other ingredients, including sugar and milk, have also been impacted by climate change, the report says. The uptick in commodity costs is increasingly filtering through to consumers at the store in the form of higher prices and ingredient and labeling changes. Some chocolate makers have swapped in cheaper ingredients, which has sometimes affected their ability to call their products chocolate at all. (Many countries have labeling rules outlining how much cocoa a product needs to contain to be considered chocolate.) The ECIU report looked at brands like Nestle's Quality Street, Mars's Celebrations and Mondelez's Roses and Heroes that sell assortments of chocolates, as well as Terry's Chocolate Orange, owned by Carambar & Co. It found prices are rising and boxes are shrinking. The analysis thus relied on average prices per 100 grams, collecting data from supermarket websites, archived webpages and news articles. Mondelez and Mars said in statements that higher input costs, particularly for cocoa, and other business factors are driving shifts in pricing and package sizes, while Nestlé noted that the cost of manufacturing and other things affect each year's new line-up. Carambar & Co did not immediately return a request for comment. Subscribe to the Business of Food newsletter for a weekly look at how the world feeds itself in a changing economy and climate.  The Argentine flag Photographer: Sarah Pabst/Bloomberg Despite endless financial difficulties, Argentina has seen a remarkable increase in clean energy over the past decade. It has gone from practically zero to almost 18% of its electricity sourced from renewables. In doing so, Argentina has overcome a challenge faced by many countries that are considered uninvestable by major financial institutions. Sebastian Kind, former undersecretary at the ministry of energy in Argentina, joins Akshat Rathi on Zero to tell the story of Argentina's renewables blitz. Listen now, and subscribe on Apple, Spotify or YouTube to get new episodes of Zero every Thursday.  Jaycee Pribulsky Source: Apollo Global Management Apollo Global Management is building out its risk review process to reflect the impact on asset valuations of extreme weather. The decision comes amid a rise in the damage done to physical assets by floods, storms and wildfires. Apollo, which has been conducting so-called top-down analyses for such risks since 2023, is now broadening that approach to allow for a more granular process to identify company-level risks before closing deals, says Jaycee Pribulsky, Apollo's chief sustainability officer. "Both private equity and private credit teams are expanding bottom-up, asset-level evaluations of physical and transition risks," she told Bloomberg. "Climate-driven disruptions can directly impact operating costs, supply chains and insurance markets," and that makes financial risk factors "more immediate" The development feeds into a growing awareness that extreme weather events increasingly have the potential to dramatically alter asset values. That's as managers like Apollo look to reassure investors more broadly that valuation models in private markets are sound. Read the full story on Bloomberg.com Galvanize, the asset management firm co-founded by billionaire investor Tom Steyer, has acquired a portfolio of seven industrial properties in the Chicago area as part of a plan to allocate $1.85 billion to buildings that it can decarbonize and resell. Xcel Energy switched off electricity for about 50,000 customers in Colorado Wednesday to lessen the risk that high winds will topple power lines and start fires. |

No comments:

Post a Comment