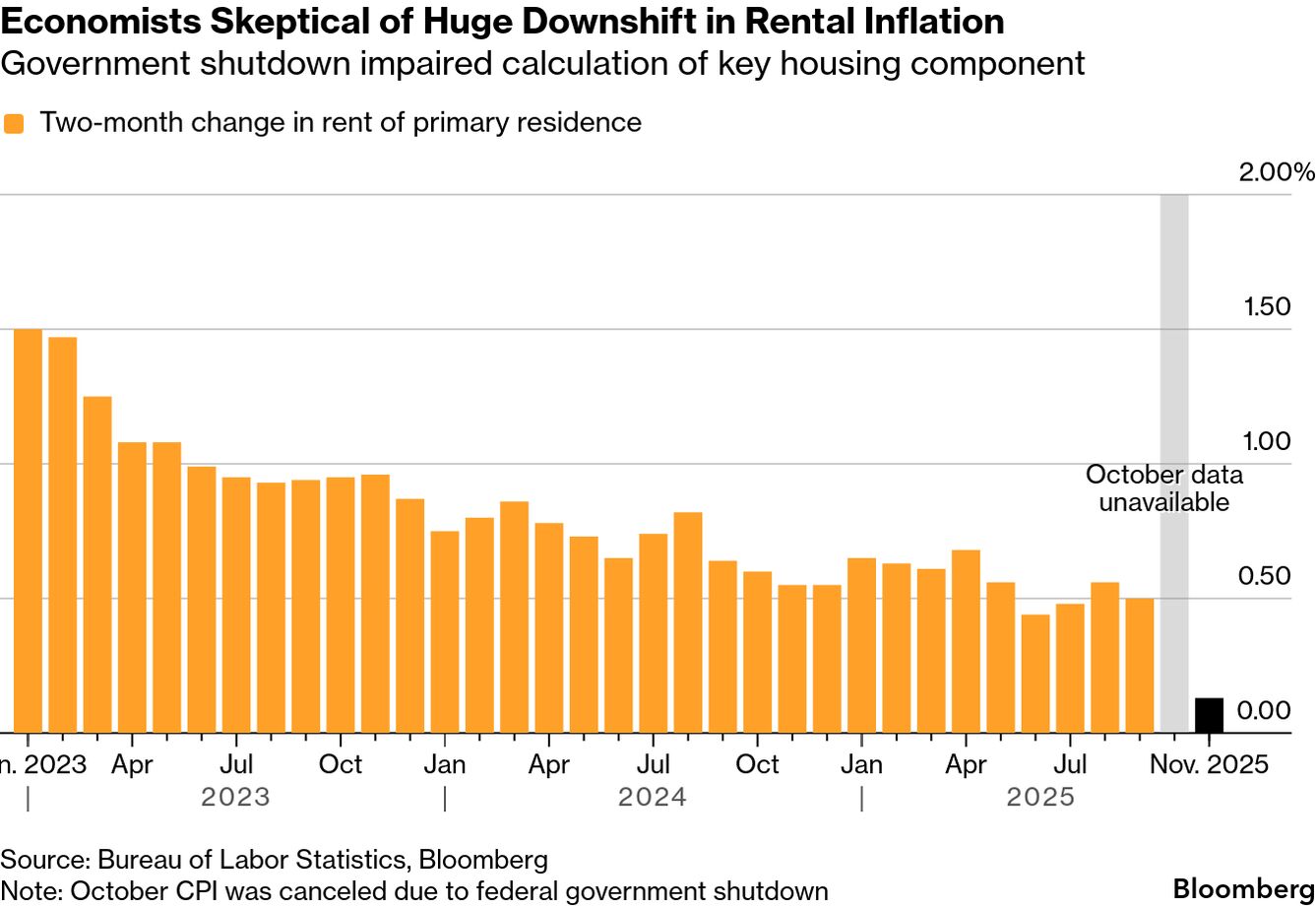

| The titles of analyses of today's inflation numbers from the Trump administration included "Lost in Translation" from TD Securities, "Delayed and Patchy" per William Blair and "Swiss Cheese CPI report" from EY-Parthenon. In the aftermath of the Trump administration's decision to cite a government shutdown as reason not to issue data, the president's comments that any affordability crisis is a "hoax," and simmering concern over his August firing of the head of the Bureau of Labor Statistics, long-awaited data from the agency was released Thursday. It stated that US inflation, which has been rising for much of the past year, cooled to a four-year low last month. The so-called core CPI, which excludes food and energy, increased 2.6% in November from a year ago—the slowest pace since 2021, the BLS said. That also happens to be below every estimate in a Bloomberg survey of economists. Some economists seem to agree on something else: the numbers are off. Indeed, inflation in several categories that had long been stubborn seemed to nearly evaporate, according to the government. Chief among those were shelter costs, which make up about a third of the consumer price index, but other categories like airfares and apparel notably declined. Several forecasters pointed to the absence of October data—which resulted in pages of blank spaces in the widely watched report—as effectively the same as assuming no price growth for the month. That culminated in sizable downward pressure on the November inflation figures, they said. Some noted the shortened collection period could have also skewed the data. "This one-of-a-kind report produced anomaly after anomaly, almost all pointing in the same direction," Stephen Stanley, chief US economist at Santander US Capital Markets, said in a note. "I think it would be unwise to dismiss the results entirely, but I also believe it would be rash to take them at face value." —David E. Rovella |

No comments:

Post a Comment