| Bloomberg Evening Briefing Americas |

| |

| US unemployment hit 4.6%, a number not seen since the depths of the Covid pandemic as the American labor picture continues to darken. US job growth remained sluggish in November as nonfarm payrolls increased by only 64,000 after declining 105,000 in October, according to the Bureau of Labor Statistics, part of the Department of Labor. The decline in October payrolls, the largest since the end of 2020, was due to a plunge in federal employment as workers who accepted the Trump administration's deferred resignation offers officially dropped off payrolls. A separate report out Tuesday showed retail sales were little changed in October as a decline at auto dealers and weaker gasoline receipts offset stronger spending in other categories. And figures from S&P Global showed US business activity expanded in December at the slowest pace in six months, while a measure of input prices jumped to a more than three-year high. Markets reacted poorly. —David E. Rovella | |

What You Need to Know Today | |

| |

|

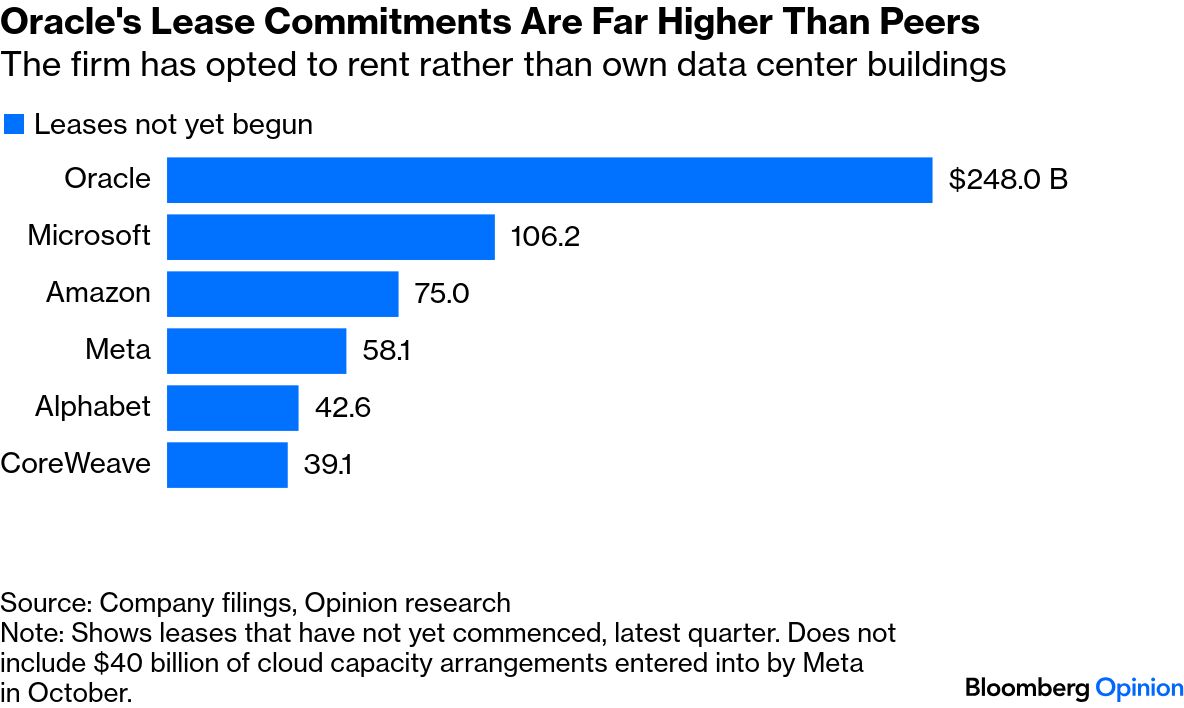

| Of all the eye-popping numbers that Oracle published last week on the costs of its artificial-intelligence data center buildout, the most striking didn't appear until the day after its earnings press release and analyst call, Chris Bryant writes in Bloomberg Opinion. The more comprehensive 10-Q earnings report that appeared on Thursday detailed $248 billion of lease-payment commitments, "substantially all" related to data centers and cloud capacity arrangements, the business-software firm said. These are due to commence between now and its 2028 financial year, but they're not yet included on its balance sheet. That's almost $150 billion more than was disclosed in the footnotes of September's earnings update. CreditSights analysts Jordan Chalfin and Michael Pugh called the lease disclosure a "bombshell." It could make investors even more skittish about Oracle's AI infrastructure plans, because of the mismatch between the long duration of the property leases and much shorter contracts with key customers such as OpenAI. | |

|

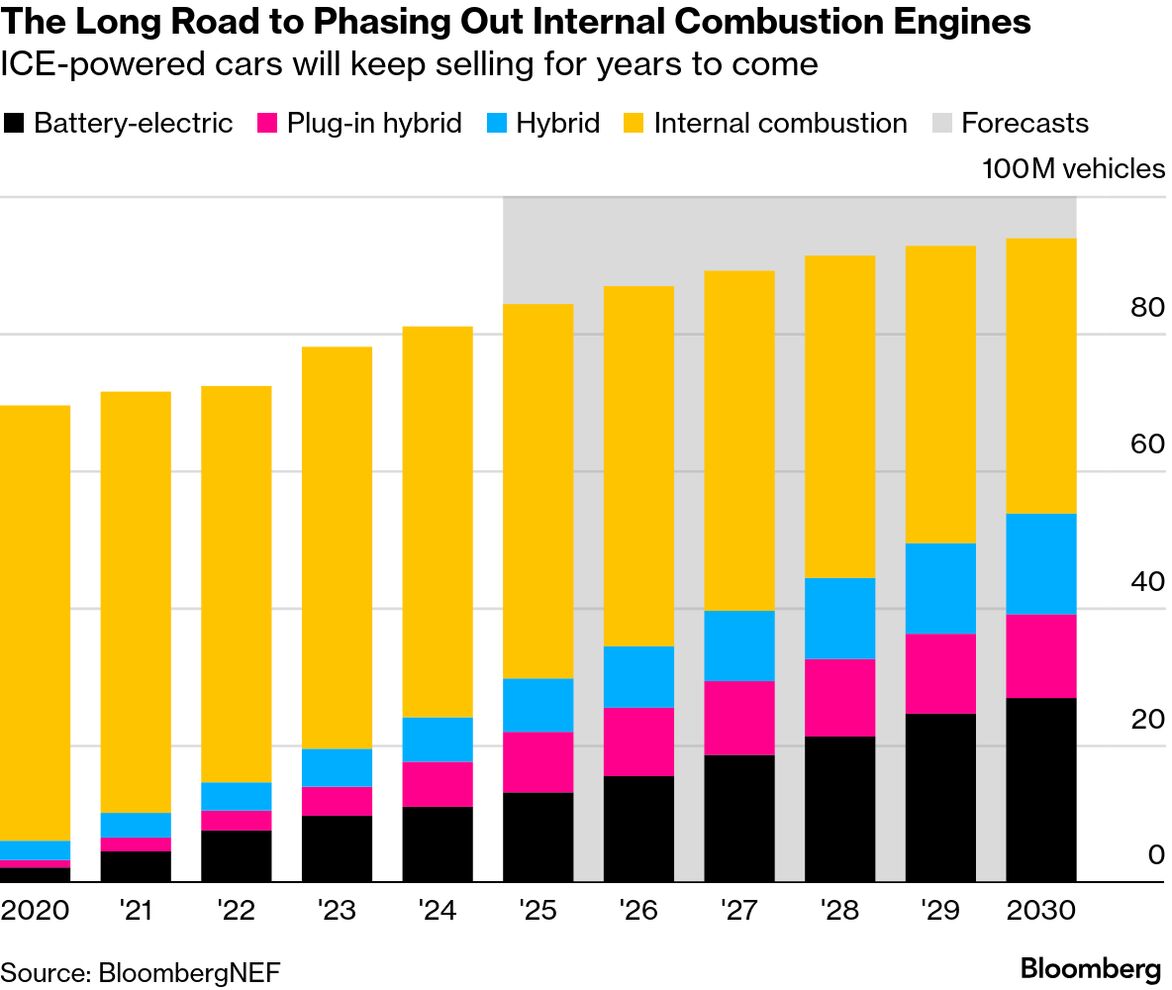

| Just because global warming is accelerating doesn't mean efforts to combat it will. In fact, the news is getting grim for those hoping to avoid the worst climate change has to offer, as this week brought new signs the electric vehicle era is sputtering. The European Commission backed away from what had been the world's most aggressive timeline for phasing out internal-combustion engines, granting manufacturers and consumers more time to move off gasoline. And a day earlier, Ford Motor announced $19.5 billion in charges tied to its retreat from an electric strategy it vowed to go all in on eight years ago. | |

|

| First Brands founder Patrick James asked a judge to dismiss a lawsuit accusing him of misappropriating hundreds of millions of dollars, contending firms that provided his company with off balance-sheet financing engaged in "predatory" practices that helped tip the auto-parts supplier into bankruptcy. Last month, First Brands Interim Chief Executive Officer Charles Moore testified that new managers brought in after James stepped down uncovered evidence of massive financial fraud. At a federal court hearing in Houston, Moore described how fake invoices and double-pledged collateral were used to trick lenders into giving First Brands new loans. | |

|

| |

|

| Amid a growing domestic and international furor over what legal experts warn are extrajudicial killings of noncombatants, the Trump administration announced on Tuesday that it had killed eight more people on alleged drug boats in the Eastern Pacific. The administration has yet to publicly disclose any evidence that its targets have indeed been ferrying drugs or posed any threat to US military forces. The strikes were carried out "at the direction" of Defense Secretary Pete Hegseth, the Pentagon said in a social media post that included a 47-second video of boats being destroyed. Hegseth, according to a report in the Washington Post, ordered the killing of all aboard an earlier target, allegedly resulting in US military personnel killing two survivors of a second strike. These latest strikes come as the Trump administration faces mounting scrutiny over its pressure campaign on Venezuelan President Nicolas Maduro and the potential threat of US attacks on the country. Trump has insisted his attacks are aimed at drug trafficking. Venezuela is not considered a drug producing nation. The New York Times on Tuesday reported that a key motivation behind the Trump administration's targeting of Venezuela is allegedly access to its oil reserves. | |

|

| |

What You'll Need to Know Tomorrow | |

| |

| |

| |

| Enjoying Evening Briefing Americas? Get more news and analysis with our regional editions for Asia and Europe. Check out these newsletters, too: Explore all newsletters at Bloomberg.com. | |

| |

Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. Want to sponsor this newsletter? Get in touch here. | | | You received this message because you are subscribed to Bloomberg's Evening Briefing Americas newsletter. If a friend forwarded you this message, sign up here to get it in your inbox. | | |

No comments:

Post a Comment