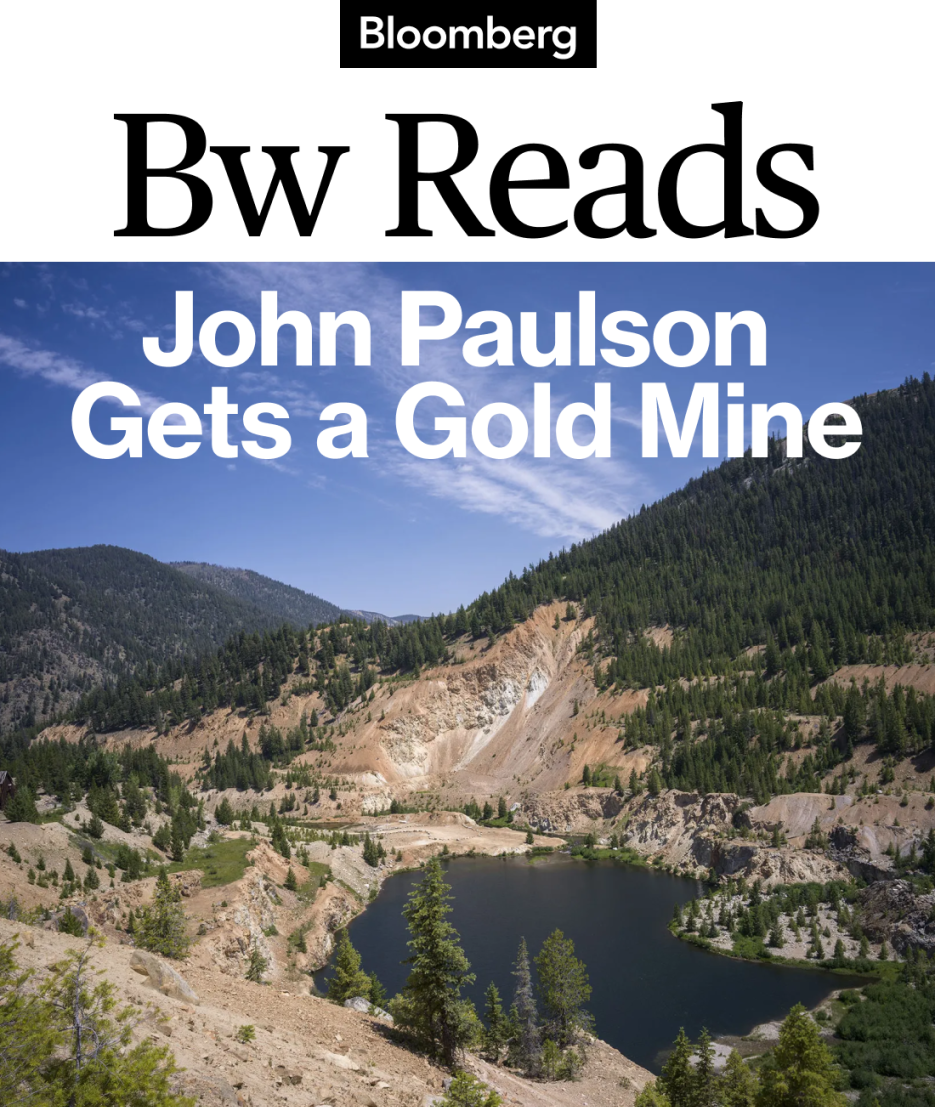

| Welcome to Bw Reads, our weekend newsletter featuring one great magazine story from Bloomberg Businessweek. In this edition, Sheridan Prasso and Joe Deaux write about the Pentagon's push to develop a domestic supply of antimony, a mineral used in ammunition production that's often found alongside gold deposits. That could be a bonanza for a billionaire hedge fund manager and Trump supporter. You can find the whole story online here. You can also listen to it here. If you like what you see, tell your friends! Sign up here. Yellow Pine Pit, gashed out of the serrated peaks of Idaho's Salmon River Mountains, wears its history in its colors. Bands of rust and gunmetal, ash and buttercream are a testament to the mine's crucial role in World War II. Along the shores of a lake that now fills its depths protrude boulders of stibnite, the rock that contains the critical mineral antimony. Without it, lead bullets would be soft and howitzers wouldn't fire. When China, the world's largest producer of antimony, started curtailing exports four years ago and banned them to the US altogether in December 2024, the news set off alarms in Washington and spurred efforts to revive long-dormant production in the US. The abandoned mine's owner, Perpetua Resources Corp., started calling itself "the best and nearest-term solution." Perpetua's largest shareholder: billionaire investor and Donald Trump supporter John Paulson, who owns a 26% stake. The company's proposal to reopen and expand what's known as the Stibnite Mining District got its final federal permit in May, soon after President Trump announced a push to develop a domestic supply of critical minerals. So one morning in September, in a clearing overlooking Yellow Pine Pit, company executives, government officials and a US Army general gathered for a kick-off ceremony to laud what they called the national security benefits of Perpetua's project. An "American Antimony" banner stretched over a pile of stibnite rocks.  Paulson at a kickoff ceremony in Idaho in September. Photographer: Sheridan Prasso/Bloomberg But industry experts and several military officials interviewed by Bloomberg Businessweek say they don't see the project as the best way to secure a US antimony supply. The amount the company says it can recover would be enough to meet domestic demand for only about two years, and the grade of the ore is substantially lower than deposits elsewhere. The relatively low grade means it will cost more to refine the antimony to meet military and commercial standards, which some of those people say is economically unsound. Although the talk at the ceremony was all about antimony, the real value of the project is further down the periodic table. Gold is often found alongside antimony, and Paulson, who made a fortune betting against subprime mortgages in 2007, has long been a goldbug. With the price soaring above $4,300 an ounce in December, the 4.2 million ounces of gold Perpetua expects to mine over 15 years would be worth more than $18 billion, far exceeding the value of the antimony it can recover. The company says gold is expected to account for as much as 95% of the project's revenue. After the speeches, taking a pause from eating a beef wrap to talk briefly with a Businessweek reporter, Paulson explained the economics. "The reason why we like gold is you can buy the gold in the ground at a fraction of the cost," he said—about $450 per ounce. Perpetua has received more than $80 million from the Pentagon to test the feasibility of refining its antimony to military standards. The company's vice president for external affairs, Mckinsey Lyon, in testimony at a congressional hearing in February, said the funding has been critical: "Without DOD's focus on antimony, and the Defense Production Act funds made available, we would not be here today." But she said in an interview in July that it's only the gold that makes the plan feasible: "It wouldn't be economic to just get the antimony out of the ground." Perpetua's Stibnite Gold Project is seeking to expand the old mine and develop two additional pits, an ore processor and a waste storage facility in what is now national forest, primarily on US government land. Some opponents of the plan say the government is helping fund what is essentially a gold mine backed by a Trump-connected investor. Under an 1872 mining law, still in effect today, companies don't have to pay royalties to extract minerals from federal land. "So, in essence, all this public land here is being privatized for the company's profits," says John Robison, public lands and wildlife director at the Idaho Conservation League. His organization is one of six groups suing the US Forest Service and other federal agencies involved in granting a permit to Perpetua. The suit alleges the agencies neglected less environmentally harmful alternatives, including mining only antimony, and failed to account for irreversible damage to air, fish and wildlife, including Chinook salmon and other threatened species in a critical watershed. The Nez Perce Tribe is suing the Forest Service and the Department of Agriculture, saying they issued a permit in violation of an 1863 treaty with the US government guaranteeing the tribe the right to hunt and fish on the land. That case, filed in federal court in August, cites the threat of "substantial, irreparable, and lasting harm" to streams and wetlands. A hearing hasn't been scheduled, and the Forest Service declined to comment about pending lawsuits. Perpetua, which has denied all allegations pertaining to environmental damage, wasn't named as a defendant in either case but was allowed to intervene. "Perpetua's planned mining, remediation, and restoration activities will leave water and habitat better than it is today," the company said in a court filing in the Nez Perce case, responding on behalf of all the defendants. Blocking the mine would jeopardize its property rights and the $400 million already invested in exploration and cleanup work, it said, and "would harm the national security interests of the United States." The environmental groups, which are separately challenging state permits, say they don't want to stop the mine entirely, just correct what Robison calls its "fatal flaws." The Nez Perce are seeking a total halt to allow the tribe to continue its work restoring habitats that the old mine damaged. Both groups have fought the project since Perpetua's predecessor, Midas Gold, started exploratory drilling more than a decade ago. "The whole reason this mine exists is because of gold, but they don't have any real way to make a fungible antimony product at the level that this mine is going to produce," says Corby Anderson, an engineering professor at Colorado School of Mines and director of its Kroll Institute for Extractive Metallurgy. "I think they've couched the project effectively within the shroud of critical minerals." Keep reading: John Paulson Gets a Gold Mine in America's Critical Minerals Scramble |

No comments:

Post a Comment