| Read in browser | ||||||||||||||

Welcome to the Brussels Edition. I'm Suzanne Lynch, Bloomberg's Brussels bureau chief, bringing you the latest from the EU each weekday. Make sure you're signed up. European leaders left the EU summit on Friday morning with a funding deal for Ukraine. But their judgment and credibility have taken a hit. Having insisted for weeks that using frozen Russian assets to help Ukraine was the only show in town, they backtracked within hours. Despite efforts by Germany, the Netherlands and others to get the group aligned, Italian Prime Minister Giorgia Meloni was among those who voiced opposition during the marathon talks. Instead, EU leaders agreed a €90 billion loan to Ukraine secured against headroom in the EU budget, with Hungary, Slovakia and the Czech Republic effectively securing an opt-out from the plan. Speaking after the summit, European Commission President Ursula von der Leyen and German Chancellor Friedrich Merz tried to put a brave face on things, arguing that the permanent immobilization of the Russian assets was the "big win" and their priority had always been simply to get money to Ukraine. Merz admitted, however, that the summit had been "a real test for me" and that things developed differently than he had expected.  Friedrich Merz Photographer: Krisztian Bocsi/Bloomberg Although the frozen assets give Europe leverage over Moscow, the EU's failure to garner sufficient support to use those assets to fund Ukraine will be cheered in Moscow, at a critical point in the peace negotiations with Ukraine. Above all, the outcome is a victory for Bart De Wever, the canny and divisive Flemish nationalist who became Belgian prime minister in February. "Today's decision safeguards trust in European institutions, markets and the euro," he said after the summit, adding that it showed that the voice of small countries counts within the bloc. In a double blow for the EU, Italy also joined France in delaying a vote on the Mercosur trade deal with South American countries. While a vote is now expected on Jan. 12, the failure to agree this week means that von der Leyen and European Council President Antonio Costa miss the Mercosur summit in Brazil this weekend, where they were due to sign the pact. The EU insists it's just a small delay, but after 25 years of negotiations, officials worry that patience may be wearing thin among South American countries. It also sends a worrying signal about the EU's ability to strike trade deals at a time when Europe is trying to diversify its trade links away from the US and China. As Brussels empties out and EU officials head back to their capitals for the holiday break, the EU faces an uncertain 2026. The Latest

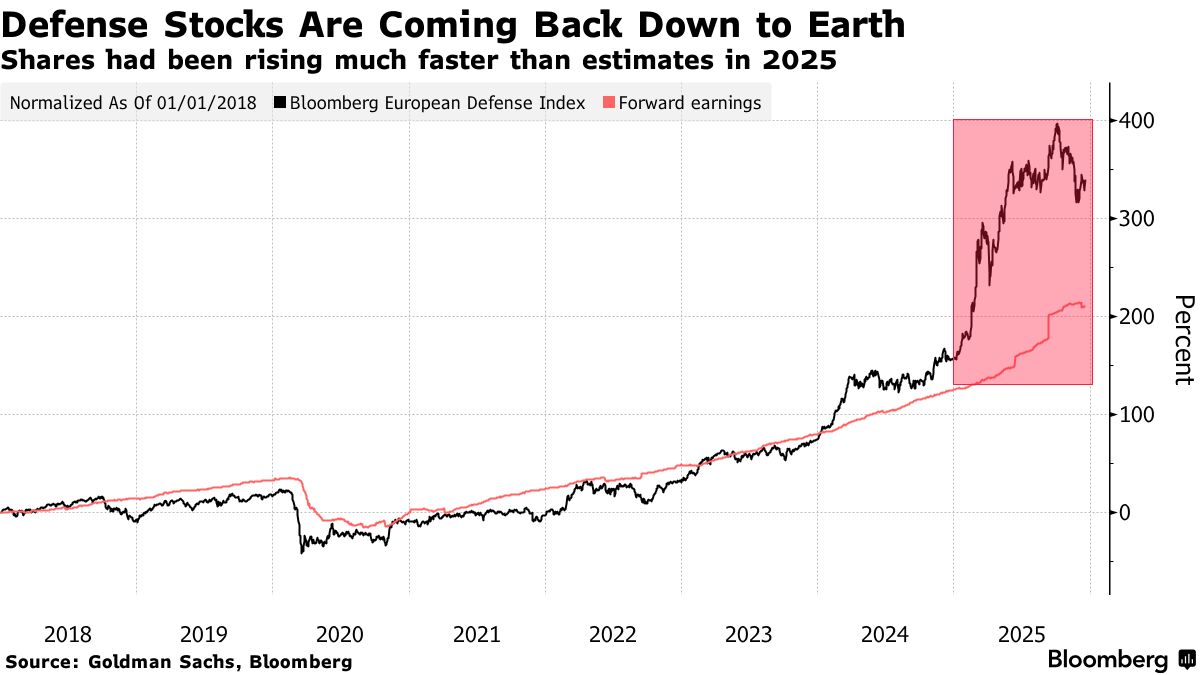

Brussels Edition will be taking a break for the holidays. We'll be back in your inbox on Monday, Jan. 5. Seen and Heard on BloombergInvestors need to think about the risk of higher interest rates in the euro zone next year, according to Michael Metcalfe, head of macro strategy at State Street Global Markets. He told Bloomberg Radio that they are starting to see signs of inflation "re-accelerating a little bit" in online data. "We shouldn't underplay the role that fiscal policy is going to play in monetary policy next year," he said. Chart of the Day A sharp fourth-quarter pullback in Europe's defense stocks has shone a spotlight on the shifting narrative for what's been a key driver of the region's equities rally this year. Recent signs of movement in Ukraine peace talks have cooled investor sentiment, with a Goldman Sachs basket of the region's defense shares about 19% below an October peak. Coming Up

Final Thought Johann Strobl Bloomberg Raiffeisen Bank International CEO Johann Strobl will retire next summer, leaving his successor Michael Hoellerer to address the bank's unresolved challenges, including selling off its Russian unit. Hoellerer will need to find an exit from Russia and mend the reputational damage from continuing operations in the country, as well as jump-start business elsewhere to catch up with peers. Like the Brussels Edition?Don't keep it to yourself. Colleagues and friends can sign up here. How are we doing? We want to hear what you think about this newsletter. Let our Brussels bureau chief know. We're improving your newsletter experience and we'd love your feedback. If something looks off, help us fine-tune your experience by reporting it here. Follow us You received this message because you are subscribed to Bloomberg's Brussels Edition newsletter. If a friend forwarded you this message, sign up here to get it in your inbox.

|

Friday, December 19, 2025

Brussels Edition: Ukraine loan comes at a cost

Subscribe to:

Post Comments (Atom)

Why these daily trades are fast becoming one of my favorites

PLUS how you can get started as soon as tomorrow Sponsored ...

-

PLUS: Dogecoin scores first official ETP ...

-

Hollywood is often political View in browser The Academy Awards ceremony is on Sunday night, and i...

No comments:

Post a Comment