| Read in browser | ||||||||||||||

Welcome to the Brussels Edition. I'm Suzanne Lynch, Bloomberg's Brussels bureau chief, bringing you the latest from the EU each weekday. Make sure you're signed up. EU leaders are locked in discussion in Brussels this afternoon in a last-ditch effort to convince Belgium to use frozen Russian assets housed at clearing-house Euroclear to help Ukraine. As the summit kicked-off this morning, there were signs that some leaders were prepared to turn the screws on Belgium. Danish Prime Minister Mette Frederiksen said she would be willing to vote through a plan for the loan without Belgium "if necessary," because a single member of the 27-nation EU "shouldn't be able to block what is the right thing to do." "With everything that is going on, Europe must be able to make the decisions necessary to protect our populations," Frederiksen, whose country is holding the EU's rotating presidency, told reporters in Brussels. "I would much prefer that we find a solution in unity, but the clock is ticking." For his part, Belgian Prime Minister Bart De Wever remained defiant. In an address to the country's parliament before the summit, he warned that the plan could be a violation of international law and may weaken the euro on international markets. He also called on other countries holding Russian assets to act too. "If we jump, we need to jump together."  Bart De Wever. Photographer: Simon Wohlfahrt/Bloomberg Belgium has argued that other options should be considered to fund Ukraine, including joint debt. But legal representatives from the European Commission and the European Council have told member states that it would need unanimous agreement from all 27 EU countries — a non-starter. Speaking at a press conference this lunchtime after talks with EU leaders, Ukrainian President Volodymyr Zelenskiy said he hoped for a positive outcome on the Russian assets, confirming he spoke to De Wever one-on-one at the summit. A deal on the reparations loan would leave Ukraine in a much stronger position in the ongoing negotiations on a possible peace deal with Russia, he told reporters. "We are more confident at the negotiating table if we have this instrument," Zelenskiy said. The message from most EU leaders as they arrived for today's meeting was that they're prepared to stay as long as it takes to get a Ukraine funding deal over the line. One official compared it to the days of the eurozone crisis when Greece was on the brink. Back then, key EU figures like German Chancellor Angela Merkel broke off into small negotiating groups with the Greek leaders in a bid to get the government to agree to deals. Time will tell if similar diplomatic strategies will unfold tonight in an effort to get Belgium's assent. The Latest

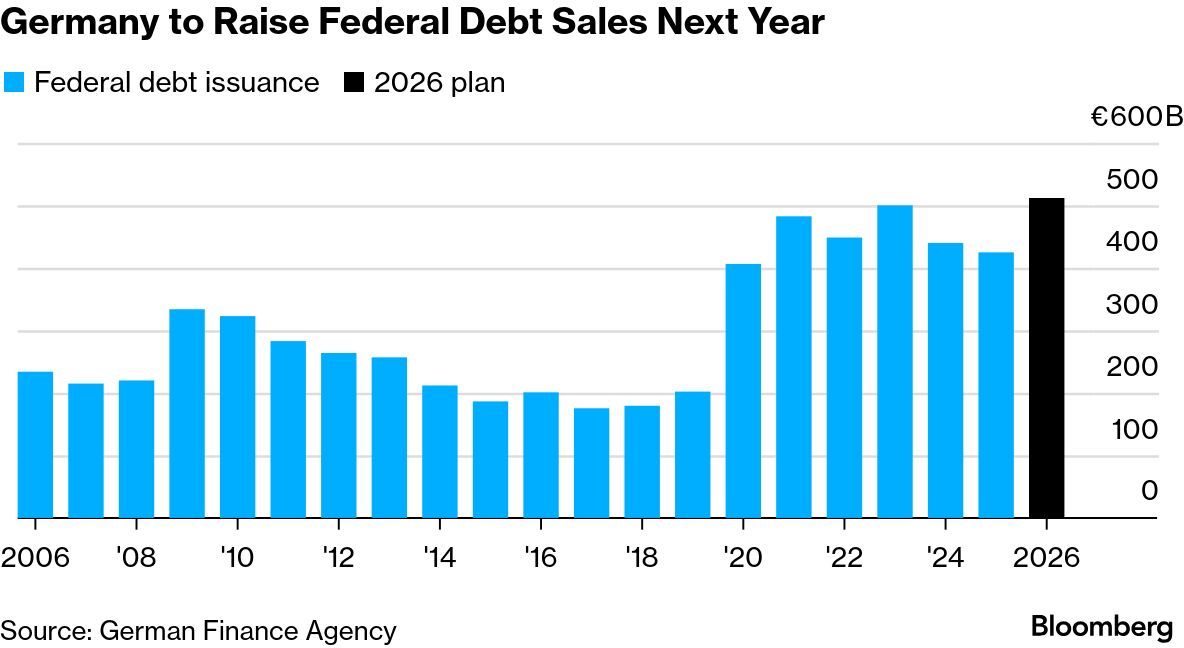

Seen and Heard on Bloomberg EU Foreign Policy Chief Kaja Kallas expressed skepticism about the US proposal to reestablish economic ties with Russia as part of discussions to end Moscow's war against Ukraine. "Russia is not a rule-of-law country and we've seen companies being nationalized, so I say 'good luck with that'," Kallas told Bloomberg TV in an interview ahead of today's EU summit. Chart of the Day Germany will increase federal debt sales by a fifth next year to a record €512 billion to fund a spending splurge aimed at fixing its crumbling infrastructure and modernizing its armed forces. Chancellor Friedrich Merz's government is trying to revive Europe's biggest economy, which has struggled to grow since the pandemic. His government has pledged to deploy a €500 billion infrastructure fund over the coming decade. Coming Up

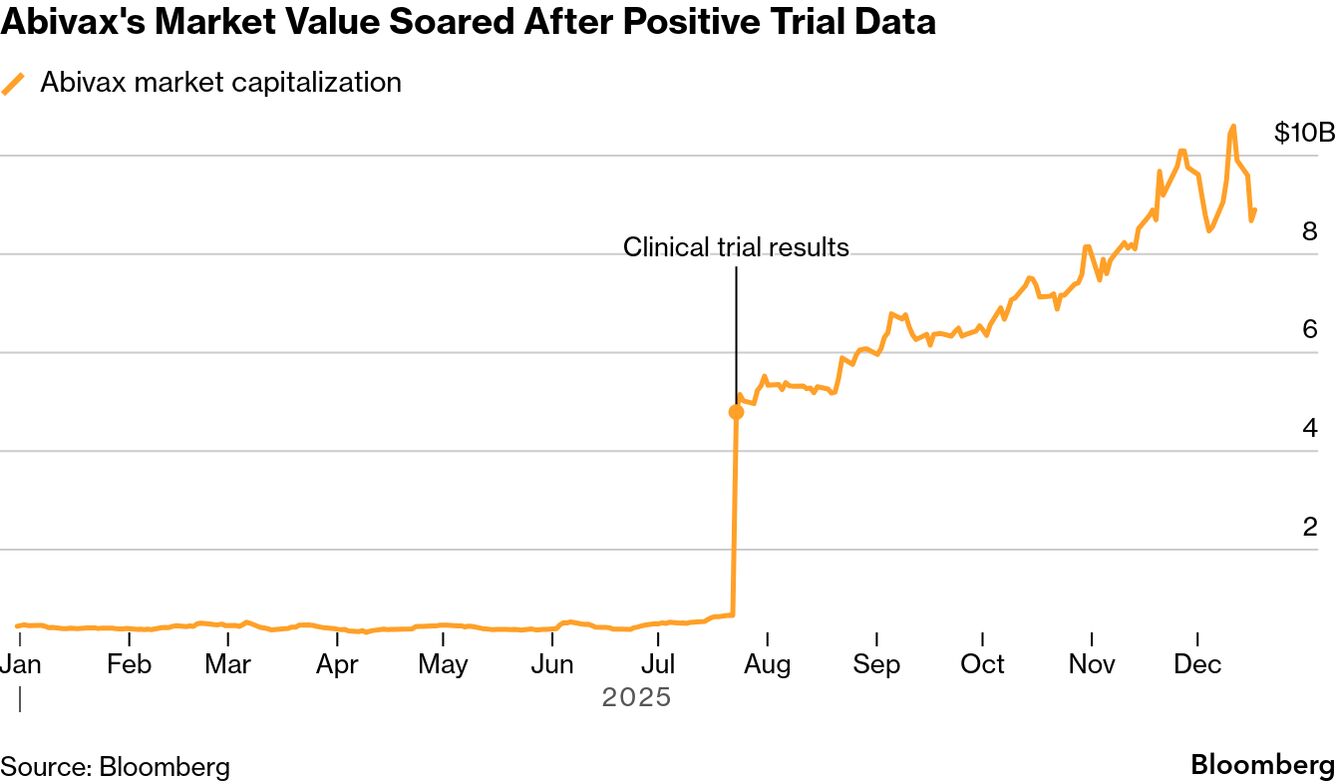

Final Thought It's been a big year for European biotech stocks. Abivax soared about 1,300% after successful trial results for a bowel-disease drug, Argenx was added to the elite Euro Stoxx 50 Index, and smaller names including Valneva and Inventiva also had impressive rallies. Now, investors in the sector are looking ahead to clinical trial results in areas including obesity, Lyme disease and autoimmune disorders. Like the Brussels Edition?Don't keep it to yourself. Colleagues and friends can sign up here. How are we doing? We want to hear what you think about this newsletter. Let our Brussels bureau chief know. We're improving your newsletter experience and we'd love your feedback. If something looks off, help us fine-tune your experience by reporting it here. Follow us You received this message because you are subscribed to Bloomberg's Brussels Edition newsletter. If a friend forwarded you this message, sign up here to get it in your inbox.

|

Thursday, December 18, 2025

Brussels Edition: Belgium feels the heat

Subscribe to:

Post Comments (Atom)

🚨 3 Gov’t Stakes in 90 Days. Here Comes #4.

The next government-backed move may already be visible. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏...

-

PLUS: Dogecoin scores first official ETP ...

-

Hollywood is often political View in browser The Academy Awards ceremony is on Sunday night, and i...

No comments:

Post a Comment