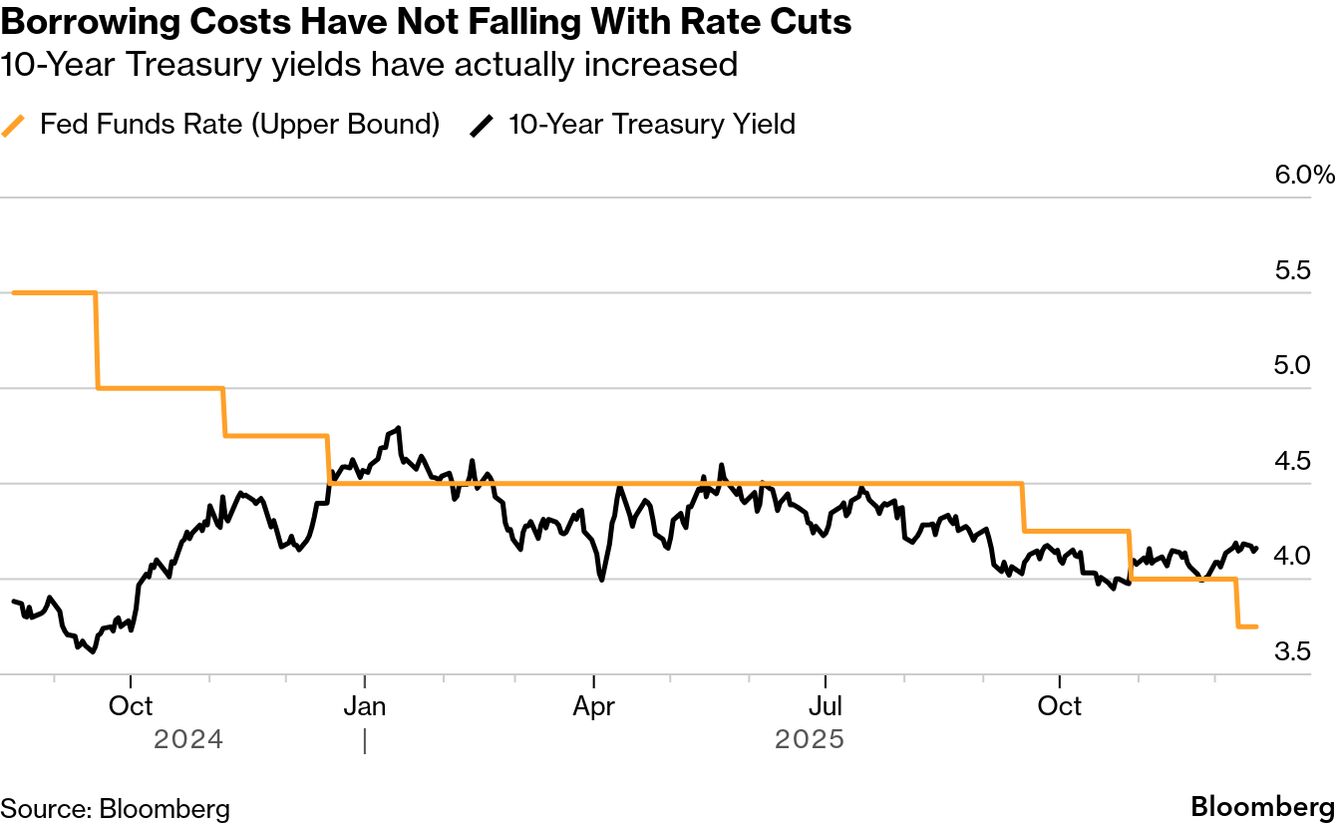

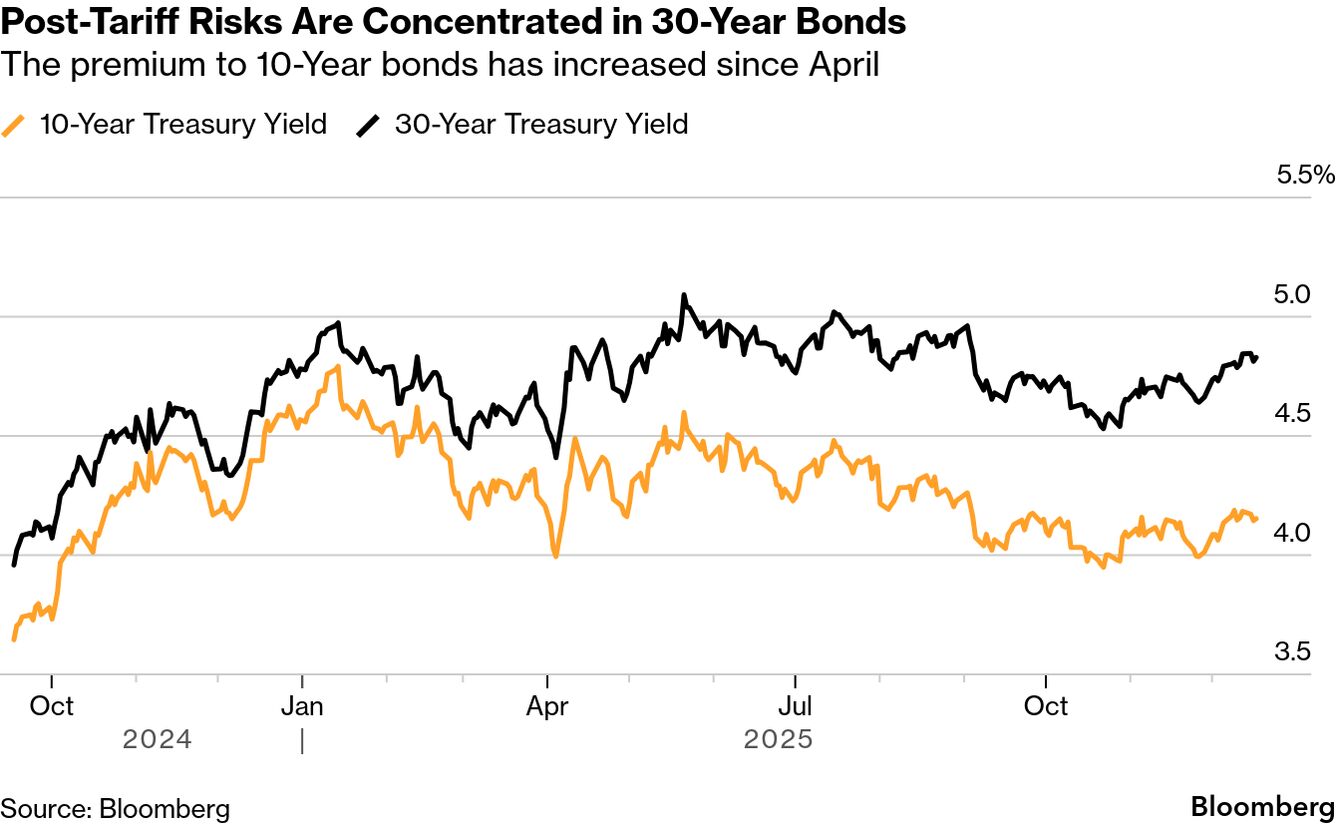

| Most major central banks have stopped cutting interest rates. Japan is raising rates. The European Central Bank could be hiking soon too. If the Fed doesn't at least stop easing, the dollar will fall further, importing inflation to the US. Even if the Fed stays accommodative to protect the job market, investors' bond portfolios would lose value. We've seen 175 basis points of cuts cumulatively since the Fed first lowered benchmark rates in September 2024. Yet the 10-year Treasury yield is 40 basis points higher. Treasury investors are simply swapping one risk with another in their calculus — economic growth with inflation. If the goal was to ease financial conditions for corporate and household borrowers, the cuts haven't done the job. While much of the rise in costs is in the longest-dated debt of 30 years, the risk for borrowers is that the upward pull takes over the benchmark 10-year yield. The negative impact of higher discount rates on future cash flows would tighten conditions even as the Fed cuts rates. There's an upside risk too. A big difference in the AI bull run to the Internet bubble is the lack of initial public offerings. Mom-and-pop investors have no pure-play to invest in the space like they did with Amazon or Yahoo in the 1990s. While OpenAI would fit the bill, with operating losses so huge, going public now would backfire. Instead, three other candidates could help widen the equity rally beyond the established tech giants. The first two are Fannie Mae and Freddie Mac. Right now, the two companies are adding so many mortgage-backed securities to their balance sheet that it might just be suppressing mortgage rates. Continued massive purchases and an IPO of the two mortgage giants would give a shot in the arm to a sector that's been a drag on growth. And then, there's aerospace company SpaceX preparing to let insiders sell shares at a valuation of $800 billion. That's 60% higher than OpenAI's last valuation round. Unlike OpenAI, "SpaceX has been cash-flow positive for many years," according to CEO Elon Musk. He recently told employees that the firm is entering a regulatory quiet period, signaling a 2026 IPO is likely to happen. That would be enough to extend the bull market run. To put a number on IPOs, we could see almost $3 trillion of private valuation go public in 2026. The US economy would probably have been close to a recession in the first half of this year without the massive spend on AI. Given the AI hype is starting to lose momentum, the market needs a new driver for the next leg up in the equity rally. A high-profile IPO, combined with tax cuts on top of deficit spending could do the trick. That is if the market escapes the risk of recession, or worse, stagflation. Question: This time next year, where do you expect the S&P 500 to be? Let us know in the latest Markets Pulse survey. |

No comments:

Post a Comment