| Bloomberg Evening Briefing Americas |

| |

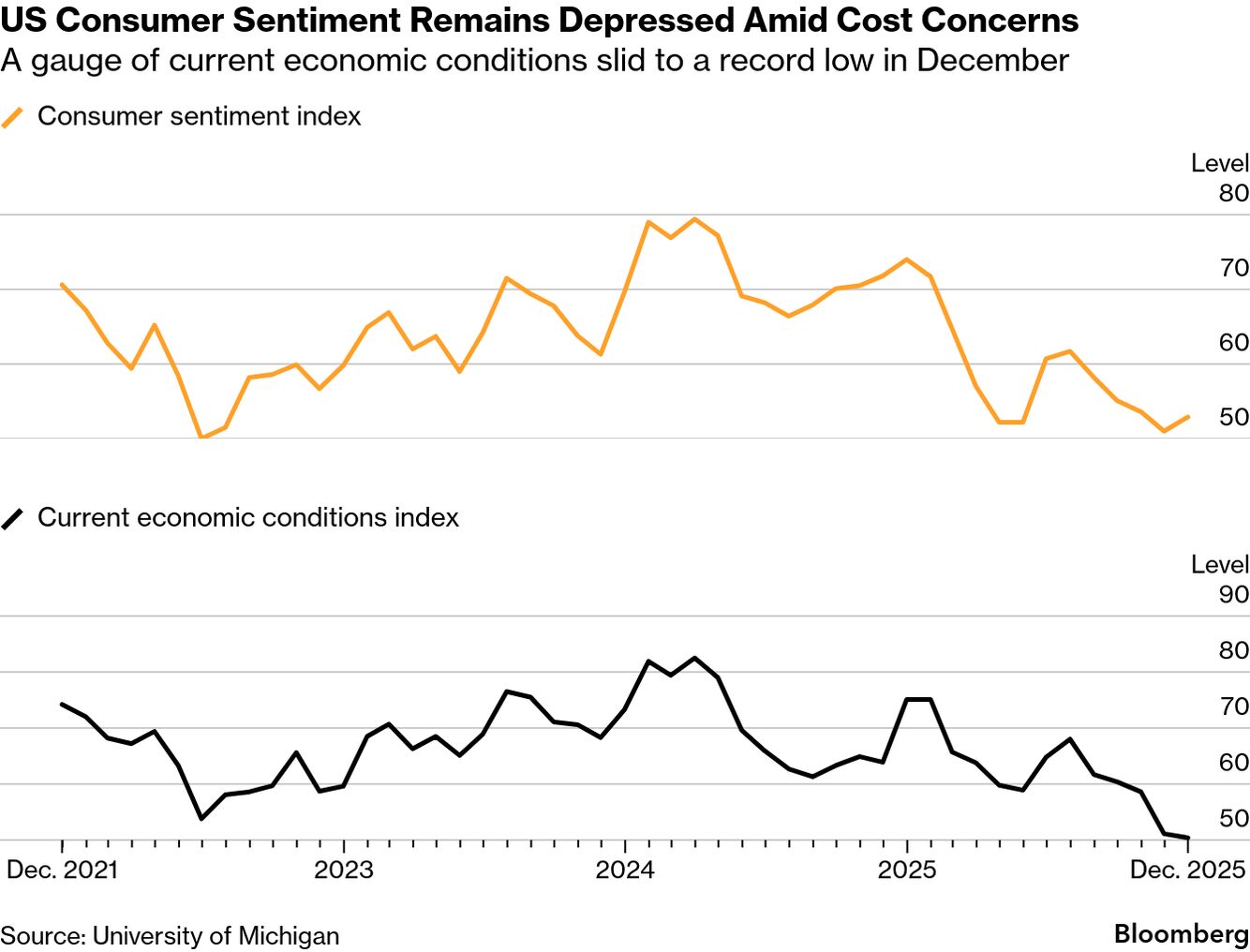

| The good news for the US economy is that consumer sentiment rose in December. The bad news is it rose by less than expected, with Americans remaining depressed over affordability concerns (despite a certain someone's claim it's all a "hoax"). The University of Michigan's final December sentiment index climbed 1.9 points to 52.9, while the median estimate in a Bloomberg survey of economists called for a reading of 53.5. Then there's the worse news: "Sentiment remains nearly 30% below December 2024, as pocketbook issues continue to dominate consumer views of the economy," Joanne Hsu, director of the survey, said in a statement. Markets however didn't seem bothered, with stocks rising while traders faced the expiration of a record pile of options that threatened to trigger sudden price swings. A rally in several tech names that have been under scrutiny over their artificial-intelligence spending lifted equities. The back-to-back advance in the S&P 500 wiped out its loss for the week. Nvidia led gains in megacaps and even Oracle surged 7%. Here's your markets wrap. —David E. Rovella | |

What You Need to Know Today | |

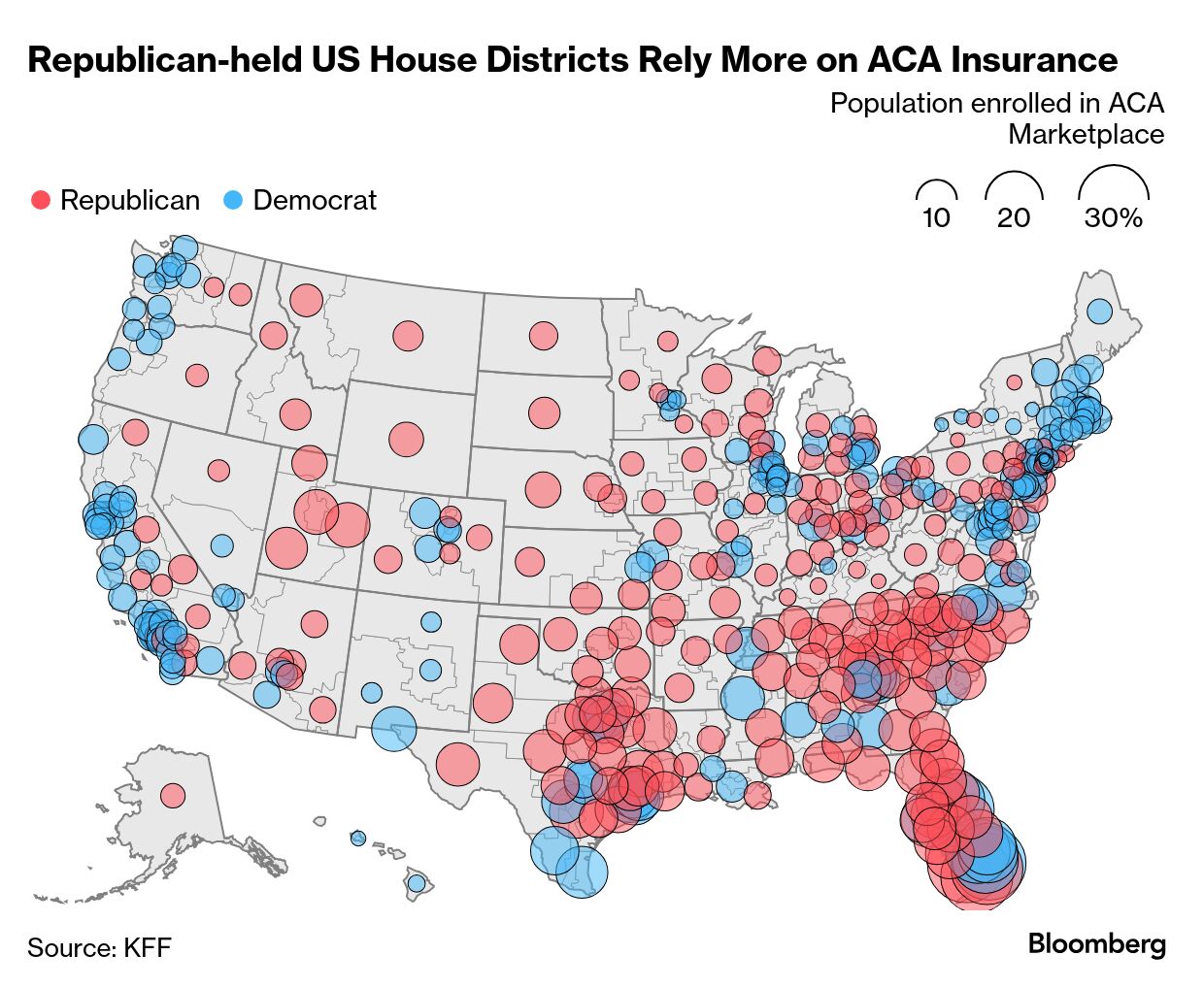

| The Republican-controlled Congress has left Washington for the year without extending Affordable Care Act subsidies. That decision by the GOP hands Democrats (who had sought the extension in the government shutdown fight) a sizable hammer heading into midterm elections. Health care premiums for more than 20 million Americans will, on average, more than double in 2026, effectively putting insurance out of reach for millions amid persistent inflation and rising unemployment, now at 4.6%. Together with Republican restrictions on and cuts to benefits for the poor and disabled as part of President Trump's "big beautiful bill," tens of millions more Americans will face exceedingly hard choices when it comes to healthcare and food. Despite the benefit reductions, the bill's tax cuts—largely benefitting the wealthy and corporations—have set the US on a path to exceed $40 trillion in debt. | |

|

| A star at Steve Cohen's Point72 Asset Management is leaving to launch his own hedge fund while having managed to secure the largest initial backing Point72 has ever granted an exiting trader. Veteran portfolio manager Alex Silverstein is spinning out his health-care trading team and the money it manages to start Sirenia Capital Management. Point72 will be the largest day-one client, investing hundreds of millions of dollars into the fund. Point72 has backed departing traders only a handful of times. But amid a fierce war for talent, it's become more open to the idea of supporting select portfolio managers wanting to strike out on their own, rather than losing access to winning traders. | |

|

| The private credit industry is said to be facing fresh scrutiny from top global regulators over some of the ratings being assigned to debt in the $1.7 trillion market. The Financial Stability Board, which monitors global risks, has high-level concerns about the potential for "ratings shopping" in private markets, where firms can seek grades on transactions from multiple providers and opt for the most favorable one. Officials at the Basel-based institute are also concerned that ratings in private credit are not subject to the same rules as securitization, where safeguards introduced after the global financial crisis typically mandate the use of multiple independent credit ratings and strict management of conflict of interests. | |

|

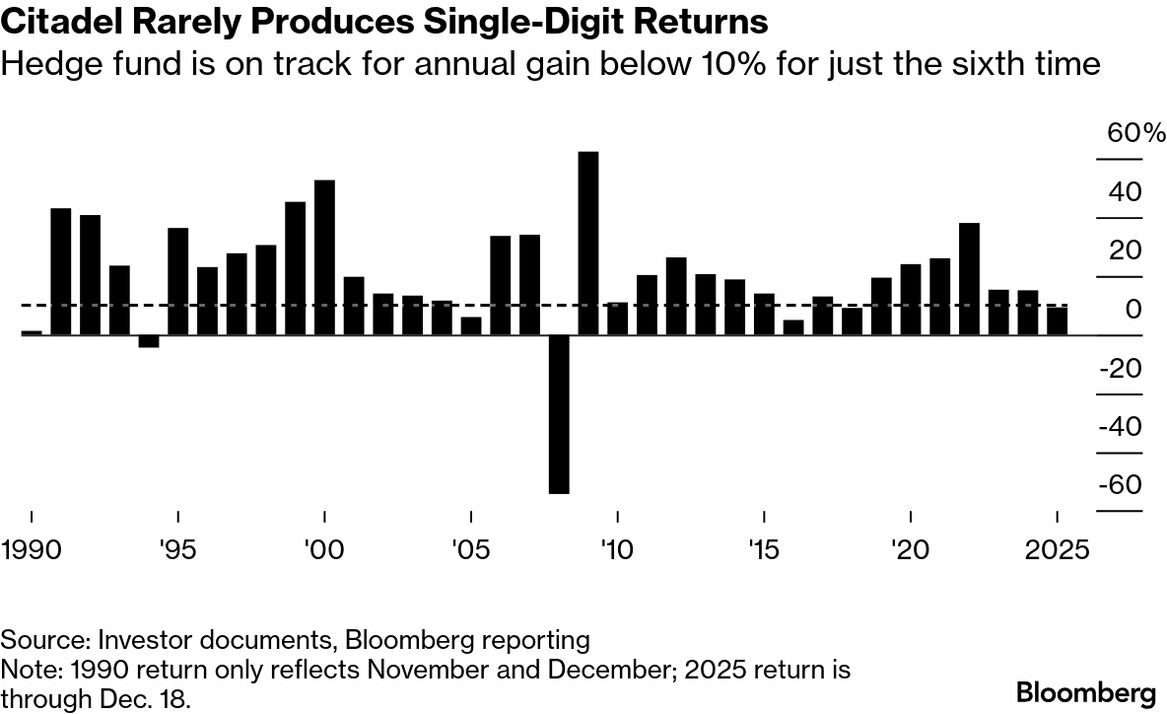

| Bad news for Ken Griffin. Citadel is on track for its worst annual return since 2018 after his wagers on natural gas fizzled out. The flagship fund is said to have gained only 9.3% through Dec. 18. It made money in stocks, fixed income, credit and quantitative strategies, and even eked out a profit from commodities, including natural gas, after recovering from losses earlier in the year. To be sure, Citadel isn't alone in hitting an energy-trading rough patch. Big oil companies, merchant traders and other hedge funds have all struggled to profit as erratic swings triggered by geopolitical turmoil and Donald Trump's trade war made it tougher to put on trades and stick with them. | |

|

| Ukraine for the first time hit an oil tanker from Russia's shadow fleet in the Mediterranean Sea, a fresh escalation in its drone strikes on ships helping carry barrels for Moscow. The 820-foot Qendil was said to be hit more than 1,200 miles from Ukraine's borders and was empty at the time. As well as strikes on refineries and oil platforms—including a fresh one on Friday—Ukraine in recent weeks has been ramping up the targeting of Russian-associated ships in a bid to reduce oil revenues that help finance the Kremlin's war. | |

| |

|

| Toronto is awash in unsold condos, but more keep getting built. Over 8,200 units are sitting on the market, with prices already down 20% from the peak. Another 10,000 are on the way, too far into construction to be called off. It's the hangover of a building boom that made Canada's largest city home to the most construction cranes in North America. As units pile up, a record number of developers are being pushed into insolvency, while the survivors scramble to reinvent. As the shakeout unfolds, an industry that accounts for a disproportionate share of Canada's economy hangs in the balance. | |

|

| |

What You'll Need to Know Tomorrow | |

| |

| |

| |

| Enjoying Evening Briefing Americas? Get more news and analysis with our regional editions for Asia and Europe. Check out these newsletters, too: Explore all newsletters at Bloomberg.com. | |

| |

Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. Want to sponsor this newsletter? Get in touch here. | | | You received this message because you are subscribed to Bloomberg's Evening Briefing Americas newsletter. If a friend forwarded you this message, sign up here to get it in your inbox. | | |

No comments:

Post a Comment