| Dear Reader, Why isn't this document on every front page in the country?

On March 26... Just one week before Trump's Liberation Day… This document was presented to congress on Capitol Hill. It was written by a task force representing some of America's most powerful companies. Most people have never heard of this elite group… But they speak for more than 1,300 organizations… Including multi-billion-dollar tech giants like Tesla, NVIDIA, and Intel. As far as I can see, this document could be a major reason Trump was willing to pull the trigger on his Liberation Day tariffs… But more importantly, I believe this document spells out the next move in the trade war… And anyone who knows what's inside could prime their portfolios for stratospheric gains. That's why I've lifted the lid on what's hidden in this jaw-dropping document… Because chances are you'll never hear it in the mainstream media. Click here now to see what the document reveals. Regards, Jeff Brown This is a PAID ADVERTISEMENT provided to the subscribers of StockEarnings Free Newsletter. Although we have sent you this email, StockEarnings does not specifically endorse this product nor is it responsible for the content of this advertisement. Furthermore, we make no guarantee or warranty about what is advertised above. Your privacy is very important to us, if you wish to be excluded from future notices, do not reply to this message. Instead, please click Unsubscribe. StockEarnings, Inc |

Sunday, November 30, 2025

⚡ Tesla + NVIDIA rep to Congress: It’s time

🚨 The $1.9 trillion industry AI is about to demolish

| ||||||

🚨 Breaking: Trump’s Secret Plan to Kill the IRS ☠️

| ||||||

| ||||||

|

[December 1st] ⏳ Last Chance to Claim Your Stake in Elon’s Private Company, xAI

| Dear Reader, Even though xAI is a private company… Tech legend and angel investor Jeff Brown found a way for everyday folks like you… To "partner" with Elon on what he believes will be the biggest AI project of the century. Click here to see how you could take a stake in Elon's private company… Without having connections in Silicon Valley… Without having to be an accredited investor… And without having to be rich. In fact, you can get started with as little as $500. And it could be as easy as buying any other stock. Click here now because it's critical that you act before December 1st. Regards, Lindsey Hough This is a PAID ADVERTISEMENT provided to the subscribers of StockEarnings Free Newsletter. Although we have sent you this email, StockEarnings does not specifically endorse this product nor is it responsible for the content of this advertisement. Furthermore, we make no guarantee or warranty about what is advertised above. Your privacy is very important to us, if you wish to be excluded from future notices, do not reply to this message. Instead, please click Unsubscribe. StockEarnings, Inc |

1 Must-Buy Stock For Monday [Dec 1st] 🗓️

| ||||||

| ||||||

|

⏳ This Weekend Only: The Robotics Opportunity Too Big to Ignore – Just $19

| ||||||||

⏳ 24 Hours Left: Unlock Trump's $21T Dollar Shift?

| ||||||

| ||||||

|

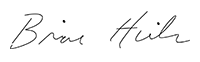

ChatGPT Is Three. Don’t Crack the Bubbly Just Yet

| To get John Authers' newsletter delivered directly to your inbox, sign up here. Happy third birthday to ChatGPT! Nno nneed to guess which st | ||||||||||

| ||||||||||

| ||||||||||

| ||||||||||

| ||||||||||

| ||||||||||

| ||||||||||

| ||||||||||

| ||||||||||

| ||||||||||

| ||||||||||

| ||||||||||

| ||||||||||

| ||||||||||

-

PLUS: Dogecoin scores first official ETP ...

-

Hollywood is often political View in browser The Academy Awards ceremony is on Sunday night, and i...