| Bloomberg Morning Briefing Americas |

| |

| Good morning. The Trump administration is leaning into hardball tactics on day two of the government shutdown. OpenAI overtakes SpaceX as the world's largest startup. And find out how Jane Street's mysterious co-founder is raking in money faster than he can spend it. Listen to the day's top stories. By Maddie Parker | |

| Markets Snapshot | | | | Market data as of 07:02 am EST. | View or Create your Watchlist | | | Market data may be delayed depending on provider agreements. | | |

| Shutdown continues. White House Budget Director Russell Vought is planning to swiftly dismiss federal workers, a sign that Republicans are leaning into hardball tactics to pressure the Democrats into caving as the shutdown entered a second day. Health insurers are betting on a lobbying offensive to ease the way to renewed Obamacare subsidies and forge a path out of the deadlock, while gold held a rally that saw it reach successive records this week on shutdown concerns. | |

| |

| OpenAI has completed a deal to help employees sell shares in the company at a $500 billion valuation, propelling the ChatGPT owner past Elon Musk's SpaceX to become the world's largest startup. South Korea's largest companies Samsung and SK Hynix, who forged initial agreements to supply chips to OpenAI's Stargate project, saw their shares rise sharply. Power down. The Trump administration is planning to cancel billions of dollars earmarked for hydrogen projects in California and the Pacific Northwest, as part of its first tranche of funding cuts following the government shutdown. The move will hit energy projects, including an initiative to improve 100 miles of California's electric transmission lines. A group of hackers claimed to have breached Oracle's E-Business Suite, which runs core operations including the firm's financial and supply chain. The group, which claims to be affiliated with a criminal outfit called Cl0p, in one case demanded a ransom of up to $50 million, according to cybersecurity firm Halcyon. In more tech news, Apple has hit pause on a planned overhaul to its Vision Pro headset to instead prioritize its development of Meta-like AI glasses.  The former Sotheby's headquarters in New York. Photographer: Drew Angerer/Getty Images Manhattan home sales jumped to the highest level in more than two years as affluent buyers armed with cash forged ahead on deals. On the Upper East Side, Sotheby's sold its former headquarters to Weill Cornell for $510 million. Meanwhile, here's how a trio of insurance executives have minted billion-dollar fortunes by betting big on Florida's volatile property insurance market. | |

| |

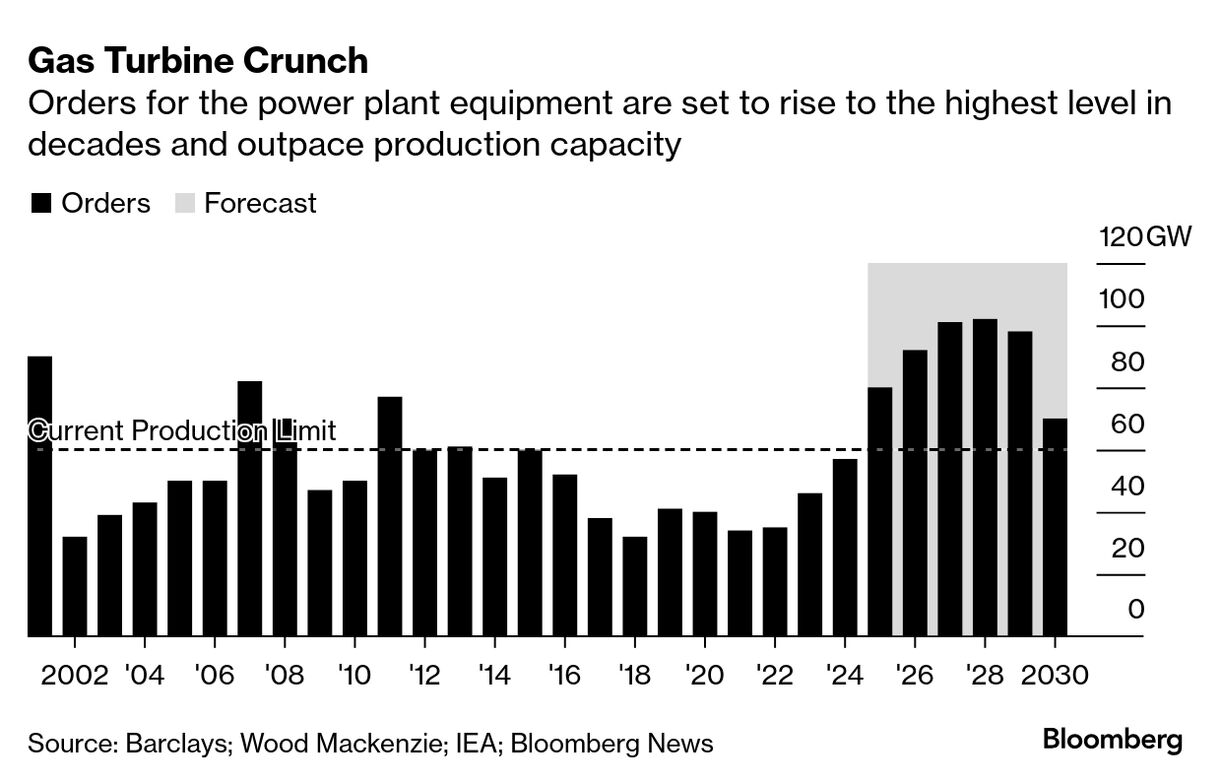

Siemens Energy AG manufacturing plant in Berlin. Photographer: Nicolo Lanfranchi/Bloomberg The world is hungry for power and the AI-driven demand for gas turbines is risking a new global energy crunch. - Orders for turbines to power natural gas plants are vastly outpacing supply, threatening the world's ability to keep pace with rising electricity demand.

- The industry is dominated by three major players who supply dozens of the largest turbines each year, but that's not remotely close to satisfying demand.

- Suppliers have been caught flat footed by the acceleration in orders and in the US, natural gas fuel accounted for about 40% of electricity generation.

- President Donald Trump's policy moves against renewable energy, in addition to the proliferation of data centers and a thirst for more power, are expected to exacerbate demand further.

Bloomberg Screentime: Join us Oct. 8-9 for the definitive gathering of leaders driving the future of entertainment, media and technology. Learn more here. | |

| |

A McDonald's restaurant in Texas. Photographer: Jake Dockins McDonald's quest to reclaim the title for the world's biggest restaurant is kicking off in Texas. The goal is to get to 50,000 locations, a multibillion-dollar effort that's focused on fast-growing areas in its backyard. | |

| Big Take Podcast |  | | | |

| |

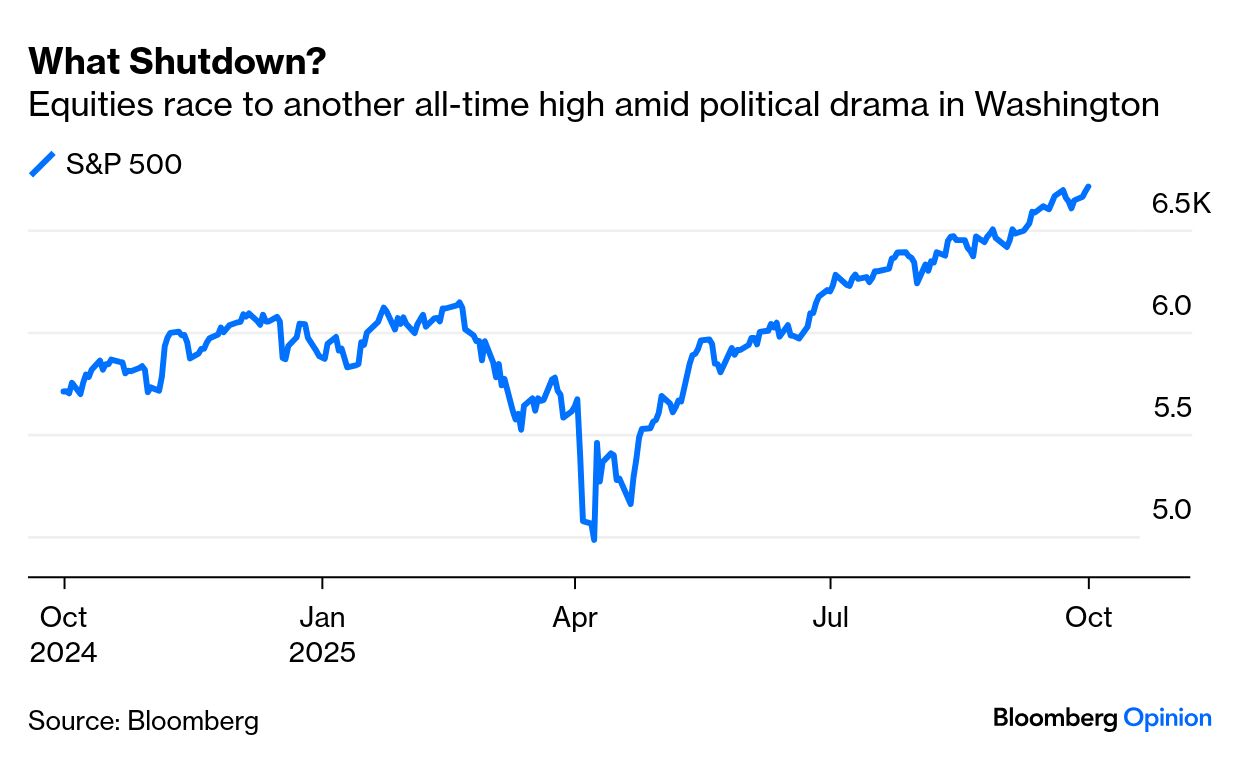

| Shutdown shrug. Government shutdowns seldom occur without warning, John Authers writes. This helps explain why they have limited impact on financial markets, but Wednesday's sharp dip in Treasury yields underscored why a funding lapse cannot be discounted. | |

| More Opinions |  | |  | | | |

| |

Jane Street co-founder Rob Granieri. Photo Illustration by Jimmy Turrell; Photos: Facebook Mystery at Jane Street. Find out how the firm's secrecy-loving co-founder is raking in money faster than he can spend it on Burning Man, his own casino and, unwittingly, an African coup. | |

| Just One More |  | | | |

| Love crosswords, charts, or a challenge? Meet Alphadots—the word puzzle with a plot twist and Bloomberg's newest game. Today's clue is: Western union? Play now! | |

| Enjoying Morning Briefing Americas? Get more news and analysis with our regional editions for Asia and Europe. Check out these newsletters, too: - Markets Daily for what's moving in stocks, bonds, FX and commodities

- Breaking News Alerts for the biggest stories from around the world, delivered to your inbox as they happen

- Supply Lines for daily insights into supply chains and global trade

- FOIA Files for Jason Leopold's weekly newsletter uncovering government documents never seen before

Explore all newsletters at Bloomberg.com. | |

| |

Like getting this newsletter? Subscribe to Bloomberg.com for unlimited access to trusted, data-driven journalism and subscriber-only insights. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. Want to sponsor this newsletter? Get in touch here. | | | You received this message because you are subscribed to Bloomberg's Morning Briefing: Americas newsletter. If a friend forwarded you this message, sign up here to get it in your inbox. | | |

No comments:

Post a Comment