Below is an important message from one of our highly valued sponsors. Please read it carefully as they have some special information to share with you.

The #1 AI Investment

Elon + Nvidia =

Dear Reader,

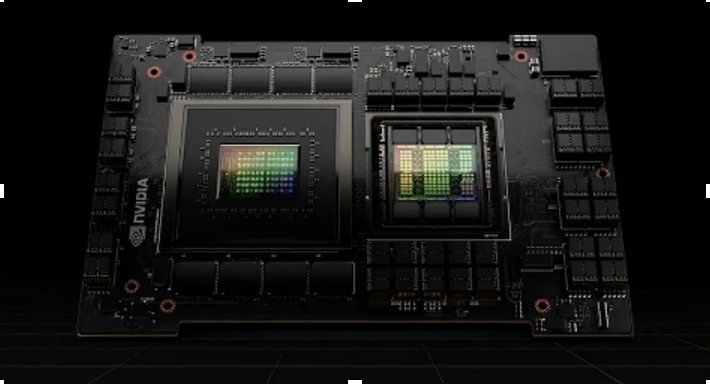

Do you see this weird looking device?

This is Nvidia’s holy grail.

It contains over 3 terabytes of memory…

80 billion transistors…

And can perform over 60 trillion calculations… per second.

This single computer chip goes for $25,000 a pop.

And now…

Elon Musk…

The world’s richest man…

Alongside Nvidia’s CEO Jensen Huang…

Are about to crank it up to 1 million.

At a remote facility in Memphis Tennessee…

You two of them have teamed up with an emerging tech titan…

To build the most advanced AI machine on the planet…

Powered by 1 million of these advanced AI chips.

This Will Unlock the TRUE Power of Artificial Intelligence!

But before you rush out to buy shares of Tesla or Nvidia…

There’s another investment you must consider.

You see, there is ONE company…

That Elon … and Nvidia…

And 98% of the Fortune 500…

Are ALL working with…

To prepare for AI 2.0.

Nvidia’s CEO has even said – this company is ESSENTIAL to their ongoing expansion.

>>>See how you can invest in this revolutionary company today.

Elon is expanding this project RAPIDLY…

And just announced a second AI computer…

That will need this company in order to build.

This may be the single greatest way to build wealth from the AI bull market.

But you must take action immediately.

AI is quickly becoming one of the MAIN focuses in Trump’s new administration…

And once Wall Street sees what this AI can really do — it will be too late.

>>>Go here to learn how to invest in Elon new AI venture.

Regards,

James Altucher

Editor, Paradigm Press

MarketBeat Week in Review – 08/25 - 08/29

Written by MarketBeat Staff. Published 8/30/2025.

Stocks soared to new all-time highs after NVIDIA reported robust earnings. However, major indexes slipped following the July personal consumption expenditures (PCE) price index, which matched expectations.

This data may prolong hopes for a September rate cut, though next Friday's August jobs report could shift the outlook.

Markets will be closed Monday for Labor Day in the U.S. Investors often lock in profits before the long weekend and the historically weak September–October period.

3 Under-$10 Stocks That Could Skyrocket (Ad)

Often, investors will overlook stocks just because they're cheap.

It's a common thought that a cheap price tag means that something must be wrong with the company.

But this couldn't be further from the case in many instances.

Key Points

- Stocks hit all-time highs after the NVIDIA earnings report, but drifted lower after the July PCE inflation reading.

- For now, a September rate cut looks likely; the focus now turns to next week’s August jobs report.

- The markets will be closed on Monday; it’s a good time to catch up on our most popular articles from this week.

Volatility is likely to persist, but the MarketBeat team will stay on top of opportunities in any market environment. Below are this week's most popular stories.

Articles by Thomas Hughes

Thomas Hughes recapped NVIDIA Corp. (NASDAQ: NVDA) earnings and argued that, despite seasonal weakness risks, there are several reasons why NVDA is likely to keep advancing through year-end.

While many eyes were on NVIDIA, MongoDB Inc. (NASDAQ: MDB) surged over 30% after reporting solid results. As Hughes noted, the company is monetizing AI and growing rapidly.

Hughes also pointed out that sometimes "just okay" news can be good news. That's the case with BJ's Wholesale Club Holdings Inc. (NYSE: BJ), where a post-earnings pullback aligns with bullish analyst sentiment, offering investors a better entry point.

Articles by Sam Quirke

Electric vehicle names have had a tough year, but NIO Inc. (NYSE: NIO) is climbing like it's 2021. Sam Quirke explained why NIO stock is attracting analyst upgrades and may have further upside.

In a challenging month for many technology stocks, three technical indicators are giving the green light on Qualcomm Inc. (NASDAQ: QCOM). Quirke highlighted how these indicators are flashing green and what investors should watch next.

Tesla Inc. (NASDAQ: TSLA) is also showing technical strength after its Aug. 22 breakout. Quirke detailed why this could be just the beginning for Tesla bulls.

Articles by Chris Markoch

Short sellers have cheered a roughly 17% drop in Palantir Technologies Inc. (NASDAQ: PLTR) from its peak. However, Chris Markoch warned this may not be the time for bears to celebrate, as the company's track record of beating expectations could spark a short squeeze.

Industrial stocks have been among 2025's top performers. Markoch identified three industrial companies that stand to benefit from the administration's focus on energy, aerospace and onshoring.

With higher-for-longer Fed rates widening the gap between consumer segments, Markoch also offered two ways to play both ends of the retail spectrum.

Articles by Ryan Hasson

As September approaches, all eyes remain on the Federal Reserve and potential rate cuts. For those who believe a cut is imminent, Ryan Hasson highlighted five stocks and ETFs that could benefit.

Articles by Gabriel Osorio-Mazilli

Emotional trading can create opportunities for nimble investors. Gabriel Osorio-Mazilli identified three undervalued stocks held back by sentiment, not fundamentals.

He also highlighted Super Micro Computer Inc. (NASDAQ: SMCI) and why a key fundamental metric suggests buying the recent dip.

Finally, Osorio-Mazilli explained why analyst revisions could drive SoFi Technologies Inc. (NASDAQ: SOFI) even higher.

Articles by Leo Miller

Leo Miller examined the bull run in Paramount Skydance (NASDAQ: PSKY), noting short interest could fuel a post-merger squeeze ahead of October earnings.

With many top retail stocks having reported, Miller provided a retail roundup profiling two winners and one big loser.

Miller also tackled Mark Zuckerberg's recent sales of Meta Platforms Inc. (NASDAQ: META), explaining why the transactions look more bullish than bearish.

Articles by Nathan Reiff

Nathan Reiff kicked off the week by spotlighting three stocks attracting bullish analyst sentiment ahead of earnings.

He also made the case for three dividend stocks with strong growth and stability that analysts favor.

And for those seeking AI exposure without the hype, Reiff highlighted three AI-focused ETFs.

Articles by Dan Schmidt

Dan Schmidt reminded readers that you never get broke taking profits. He flagged three overbought stocks poised for a pullback.

Schmidt also pointed to bearish signals in Costco Wholesale Corp. (NASDAQ: COST), arguing that, despite meeting earnings, good enough may not be enough for an overbought stock.

Articles by Jeffrey Neal Johnson

Jeffrey Neal Johnson explored the evolving eVTOL space, highlighting Vertical Aerospace Ltd. (NYSE: EVTL) as a compelling alternative to Joby and Archer after a recent bullish analyst upgrade.

He also argued that while hype surrounds new-age defense names, AeroVironment Inc. (NASDAQ: AVAV) offers combat-proven technology and scalable manufacturing.

Finally, Johnson explained how Cisco Systems Inc. (NASDAQ: CSCO) is crafting a new growth story that investors may want to buy.

Articles by Jordan Chussler

Jordan Chussler highlighted a healthcare ETF that is leading the market's rotation into the sector.

He also examined nuclear energy's surge and why data center demand may sustain the bull case.

With federal subsidies for wind and solar under threat, Chussler reminded readers that the renewable energy story is far from over—and global opportunities remain.

to bring you the latest market-moving news.

This email content is a paid sponsorship from Paradigm Press, a third-party advertiser of TickerReport and MarketBeat.

Contact Us | Unsubscribe

© 2006-2025 MarketBeat Media, LLC dba TickerReport. All rights protected.

345 North Reid Place #620, Sioux Falls, SD 57103. U.S.A..

No comments:

Post a Comment