| By Natasha White Debt swaps pioneered by Credit Suisse to fund nature conservation are enjoying a second life, as bankers see an opportunity to apply the model to everything from post-war reconstruction to energy security. The swaps help governments refinance debt at more favorable terms and put any savings toward a pre-determined policy goal. After a drought in dealmaking since late last year, as many as four new swaps may be completed by the end of 2025, according to Jake Harper, senior investment manager, private credit at Legal & General Group Plc. But none of them has a nature-focused goal, he says. The development feeds into a broader movement in ESG (environmental, social and governance), as investors and issuers stretch the label to cover areas they see as more relevant to the current geopolitical moment. Examples include efforts by Citigroup Inc. to put together a deal to help Ukraine rebuild after the war. Antonio Navarro, a former Credit Suisse banker and co-founder of boutique credit fund ArtCap Strategies, says the way debt swaps are structured makes them well suited to responding to political developments. "At the end of the day, these are policy instruments," Navarro says. He launched ArtCap in 2023, the same year Credit Suisse was acquired by UBS Group AG in a state-engineered rescue. This year, he's been pitching an energy security swap that would channel savings into US oil and gas imports, as well as help finance the construction of liquefied natural gas plants in emerging markets. Navarro began pitching such deals to multilateral development banks and the US International Development Finance Corporation (DFC), a government agency, after Donald Trump's return to the White House brought with it an agenda to revive America's fossil-fuel industry. US government priorities overseas look set to play a major role in shaping the market for debt swaps. DFC has offered political risk insurance on more than half the deals that have completed to date. The US is also a major shareholder in many of the multilateral development banks that help de-risk debt swaps to make them more palatable for private investors. The DFC will likely be involved in Citigroup's efforts to put together a reconstruction swap for Ukraine if it goes ahead, Bloomberg has previously reported. The agency is already managing an agreement signed with Ukraine earlier this year that grants the US privileged access to new investment projects to develop Ukraine's natural resources. How debt swaps work: The deals generally target governments in developing nations looking for ways to reduce their debt burden in exchange for pledges to target sustainable goals. Old debt is bought back, sometimes at a discount, with the repurchase paid for through the issuance of new bonds or loans. Public agencies such as multilateral development banks are often brought in to provide risk mitigation in the form of guarantees on the new debt, to reduce the likelihood that private investors will lose money. Their presence also helps keep the price of the debt down for borrower nations. The deals, which are private, have faced criticism for their lack of standardization when it comes to reporting both fees and savings. Investors attracted to the market often focus on the environmental or social impact of their financial contribution.

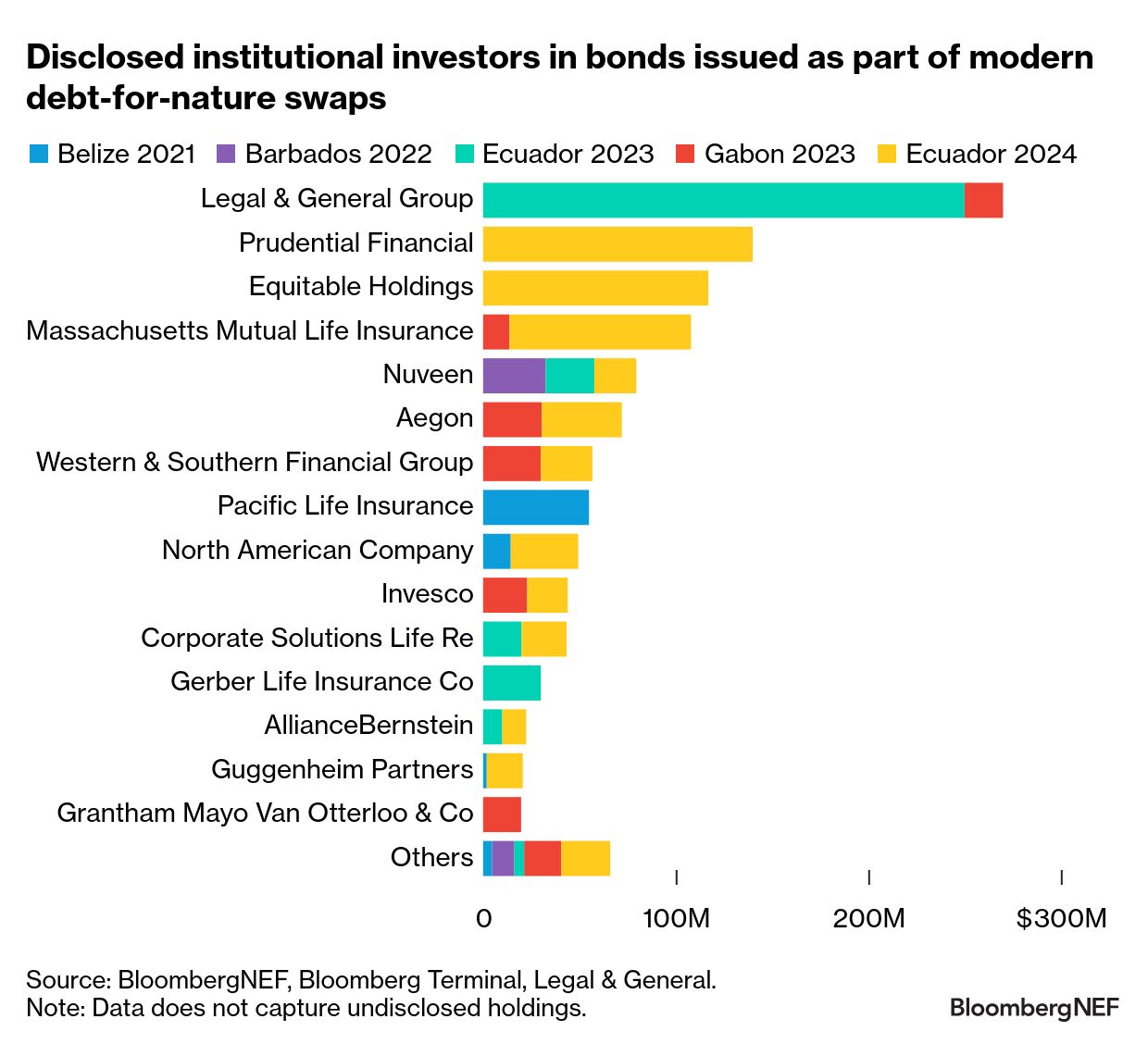

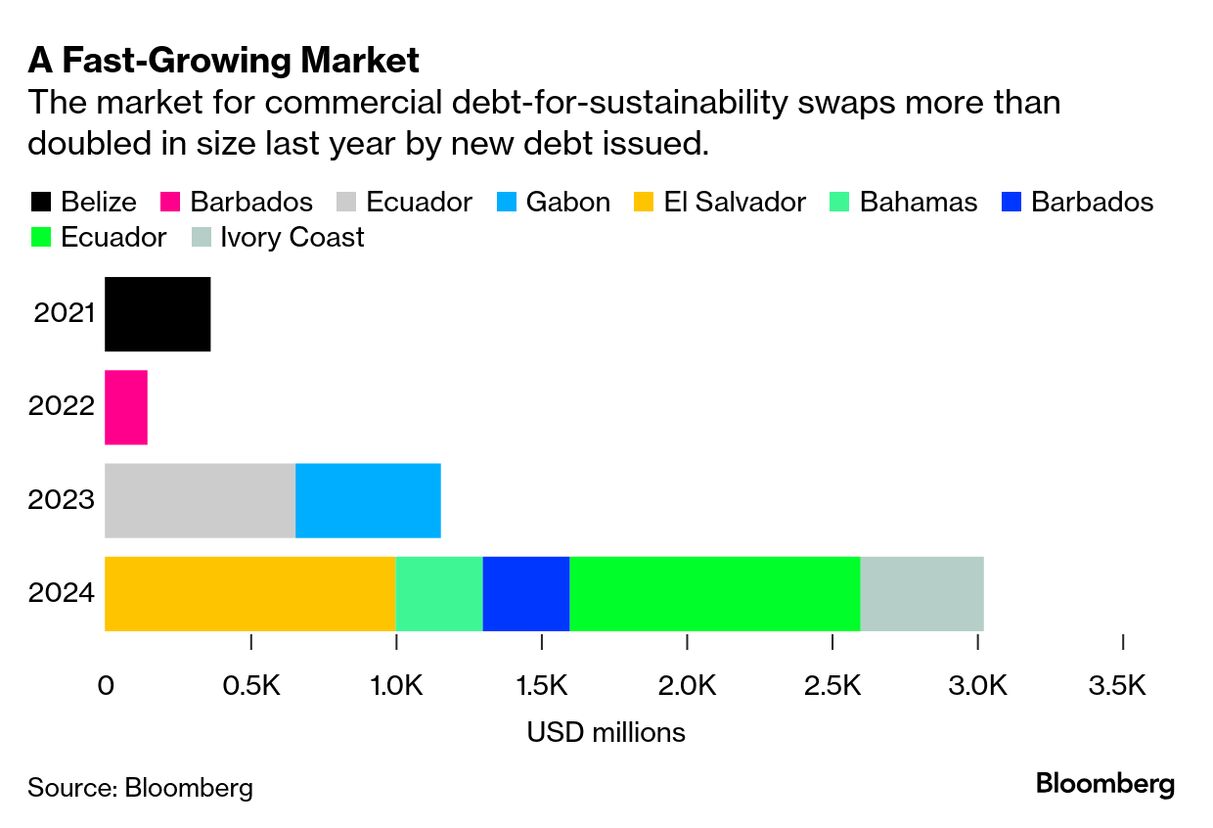

Marine de Bazelaire, former European head of sustainability at HSBC Holdings Plc, says borrower nations should be wary of engaging in debt swap deals that shift control of domestic priorities to overseas entities. "At the end of the day, we're talking about the wealth and real assets of countries and their capacity to monitor what is core to their sovereignty," she says. The commercial debt swap market, which has existed in its current form since 2021, more than doubled in size last year to roughly $4.7 billion. It could eventually help unlock as much as $100 billion in funds for nature and climate-related goals alone, according to a group of nonprofits working on a pipeline for developing nations. Harper at Legal & General, which has invested close to $500 million in debt-for-nature swaps, says the new deals expected to complete later this year are linked to non-nature United Nations Sustainable Development Goals that span affordable energy to poverty reduction. The Inter-American Development Bank, which has been involved in many of the debt swaps to date, is now seeing demand for structures that allow savings to be channeled into education and health, according to Ilan Goldfajn, the bank's president. Ramzi Issa, co-founder of credit fund Enosis Capital, says the financial profile of debt swaps makes them particularly suited to environmental projects. Issa, who led the team of bankers at Credit Suisse that pioneered the swap structure and was involved with the first such transaction back in 2021, says the instruments provide the kind of long-term, steady cash flow that's required for conserving natural ecosystems. That's in contrast to general infrastructure, which is something that can be done with standard project finance, he says. He also cautions that the kinds of investors traditionally drawn to debt-for-nature swaps may be less inclined to allocate capital to deals that don't have clear sustainability goals. The "distinguishing factor" from other financings "is this policy and project component," Issa says. "From the investor side, that's what's been driving demand." Read the full story on Bloomberg.com. |

No comments:

Post a Comment