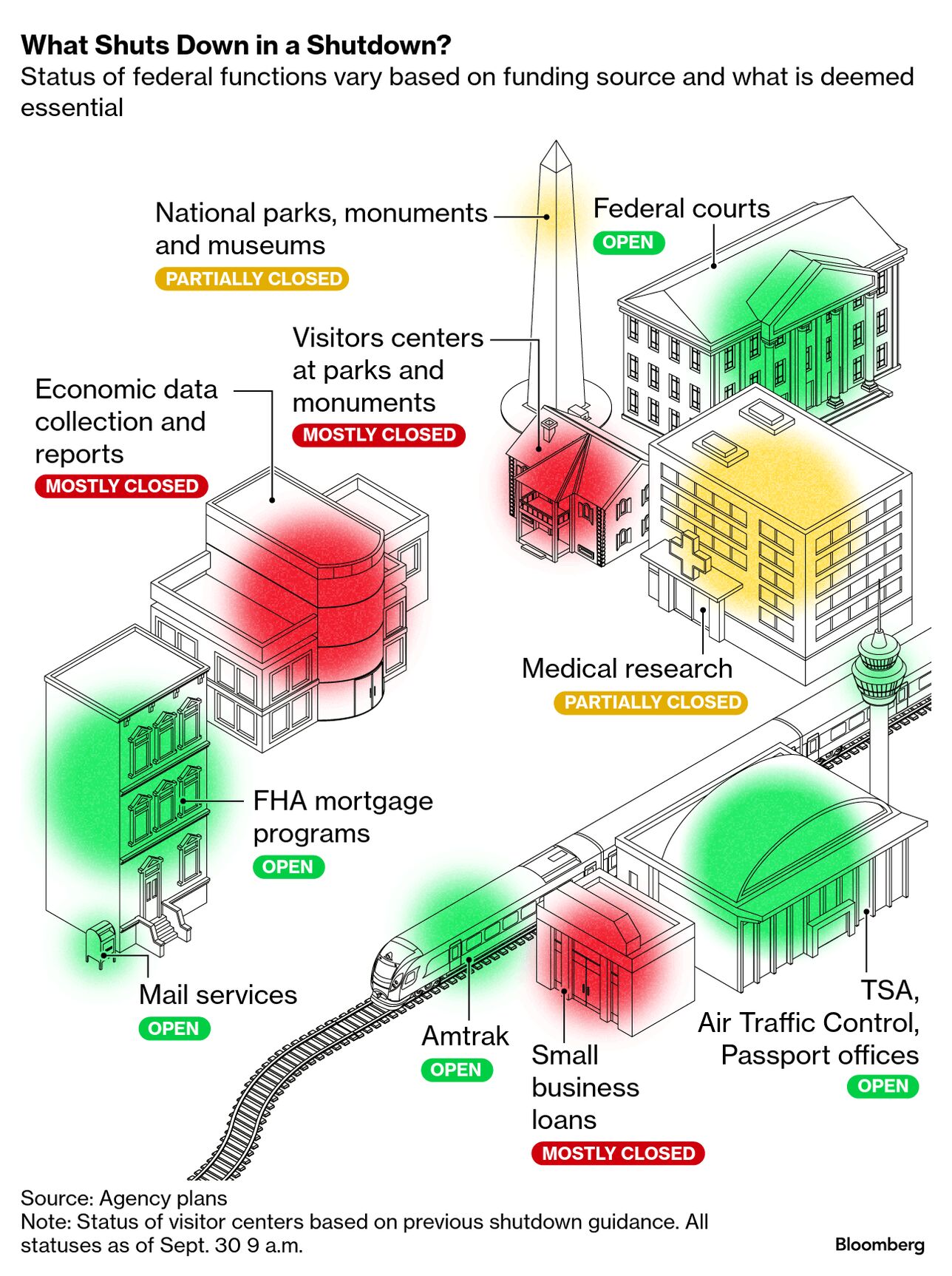

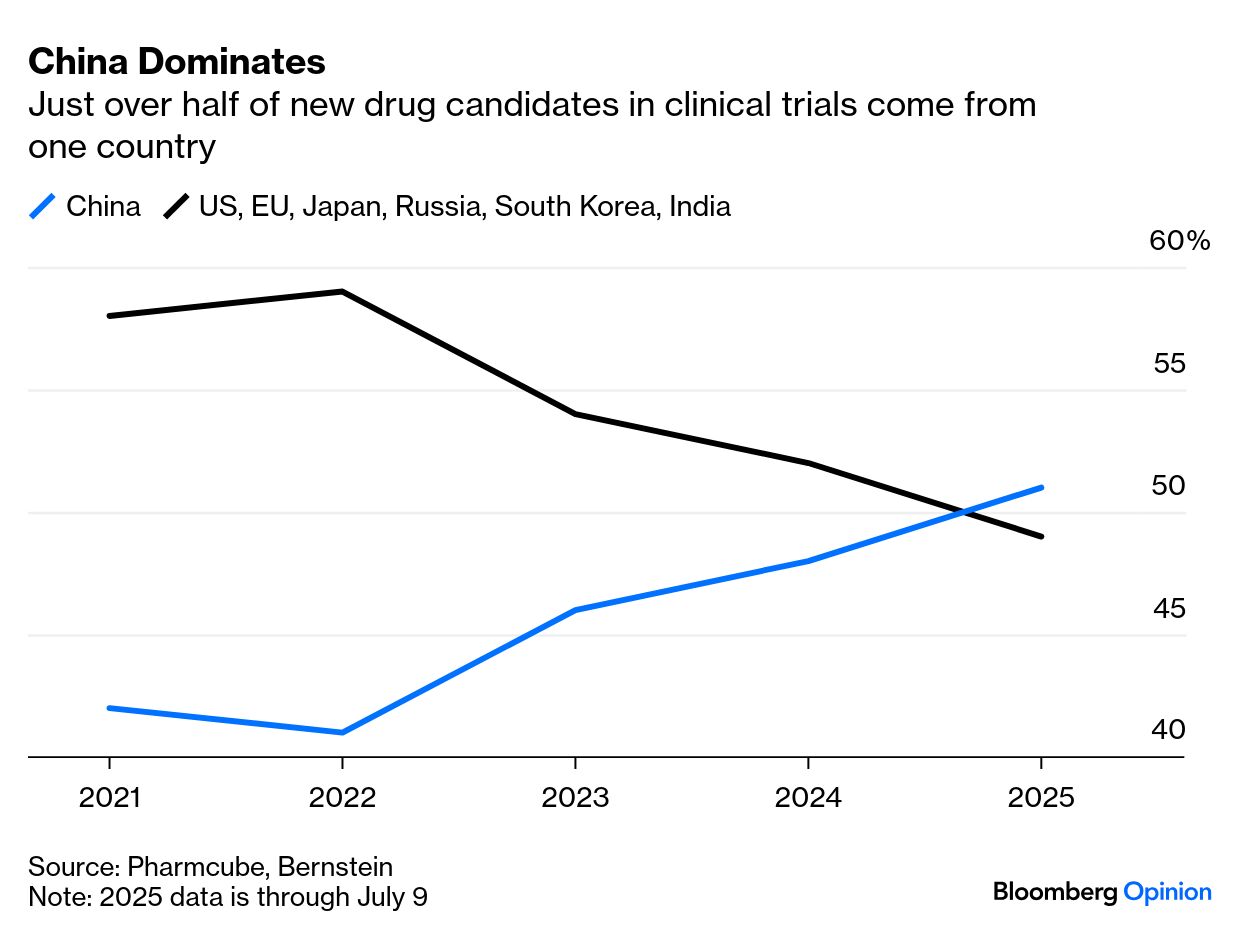

| Man, this government sure has a unique way with words. Secretary of Defense Pete Hegseth brought 800 of the military's most senior officers and other leaders together to tell them that he's tired of seeing "fat troops" and "beardos" on the battlefield. Meanwhile, Republican Senator Lindsey Graham had some choice things to say about his political foes: "A 600-pound man is more likely to pass up a donut than the Democrats are to shut down the government for any length of time, because they love the government as much as a 600-pound man loves a donut." Did I miss something? Is fat-shaming suddenly socially acceptable in Washington?? Although James Stavridis says Hegseth does have a point — "almost all of those 800 leaders would appreciate his call for high standards of physical fitness across the board," he writes — his blunt delivery made for some flashy headlines. As for Graham's shutdown-donut comparison, the impasse in Congress is unlikely to be resolved before the clock strikes twelve. With only a few hours to go until the deadline, Bloomberg News reporters Jennifer Dlouhy and Caitlin Reilly say "the deadlock over spending threatens to paralyze many US government operations for the first time in nearly seven years." Here's a handy guide to show you what's at stake: "Whether it lasts days or weeks, a shutdown is going to be a test of will and narrative for both sides," writes Nia-Malika Henderson. "For Democrats, the question is how long minority leaders Hakeem Jeffries and Chuck Schumer can remain united, with Jeffries playing the lead. For Republicans, at issue is whether they can convince Americans that they actually believe keeping the government funded and functioning is actually worthwhile — a decidedly un-Republican message, particularly in 2025, the year of DOGE." Even so, House Speaker Mike Johnson is giving it a go. "FEMA won't be funded. We have hurricanes off the coast of the United States right now. This is serious business," he told reporters after a meeting with President Trump. Hearing a Republican official ringing alarm bells about FEMA? That's rich, considering Trump wants to axe the entire operation at the end of the year. But it is serious business, says Mark Gongloff. A lapse at one of FEMA's most crucial arms, the National Flood Insurance Program — NFIP, for short — will worsen an already-dire crisis. "As of this writing, there have been 33 such temporary reauthorizations since 2017. A 34th and 35th will do nothing to solve the program's deep-rooted problems," he writes. "Every day the NFIP is out of commission potentially represents hundreds of millions of dollars in failed home closings."  | | | During his extremely busy day, Trump announced a new deal with Pfizer to help lower drug prices for American consumers. According to Bloomberg News, the company will offer a selection of half-priced products on a direct-to-consumer website called "TrumpRx." It's quite the 180-degree turnaround for the president. Just last week, he was threatening to rain 100% tariffs down on the industry. Now Pfizer can breathe easy — for now. But curiously absent from the White House's fact sheet on the drug-pricing agreement is the perennial thorn in Trump's side: China. In the past four years, Juliana Liu says licensing agreements to take Chinese pharmaceutical products worldwide have nearly quadrupled, with US-bound ones accounting for more than half of the total value. Pfizer and AstraZeneca's supply chains have become so reliant on Beijing that they lobbied hard against a drafted order that would target medical treatments of Chinese origin. Still, it's possible that Trump might retaliate down the road. "From EVs to batteries to mobile phones, Washington has a track record of closing the US market to Chinese challengers, often citing national security reasons," Juliana notes. "As a result, rising regulatory scrutiny of experimental treatments from China is a risk that cannot be ignored." In the coming weeks and months, we'll learn more about how the president plans to run his eponymous drug emporium. I'd sure like a prescription for my nasty bout of Trump Fatigue. |

No comments:

Post a Comment