Dear Reader,

When billionaires like Jeff Bezos and Bill Gates line up behind an emerging technology, it’s worth paying attention.

That’s exactly what’s happened with a little-known company founded by an ex-Google visionary.

Alexander Green calls it “one of the most overlooked opportunities in AI right now.” Heck, that’s why Alex himself is even an investor!

And he’s eager to share ALL the details with you now. GO HERE to discover:

- The founder’s extremely unusual journey.

- Why early investors are paying attention.

- How this small company could unlock a potential $27 trillion economic windfall.

- And why Alex believes widespread adoption is just one announcement away.

As you’ll see, the clock is ticking on this.

GET THE FULL RUNDOWN FROM ALEX NOW.

Good investing,

Rachel Gearhart

Publisher, The Oxford Club

P.S. It’s not just Bezos and Gates backing this breakthrough... Google has, too. As well as Sutter Hill Ventures – early backers of Nvidia.

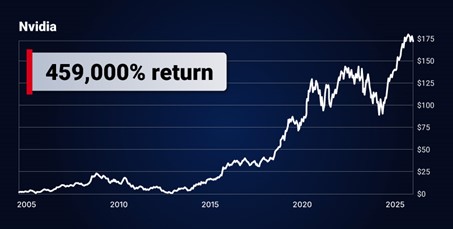

Anyone who followed them into Nvidia after its IPO in 1999 would be sitting on a 459,000% return today.

|

Now this small cap is poised to be their next huge success story... And this is your chance to join them on the ground floor.

After the Fed's Rate Cut, PNC Could See a Mortgage Refinance Boom

Written by Jordan Chussler. Published 9/21/2025.

Key Points

- The Federal Reserve's first rate cut since 2024 is expected to be a boon for the financials sector as borrowing and refinancing become more attractive.

- Super regional banks will likely see a rush of mortgage refinancing while also freeing up cash flow that could encourage M&A activity.

- PNC, with its large retail branch network and mortgage offices across the U.S., could benefit from homeowners looking to get out from under high-rate home debt.

The financials sector has delivered a solid performance this year, posting a 10.82% year-to-date gain—good for fourth among the S&P 500's 11 sectors. With the Federal Reserve's first rate cut since December 2024 now behind us, financials may enjoy further momentum into the second half of 2025 and beyond.

Lower borrowing costs typically benefit banks and insurers. Companies can refinance existing debt, fund new capital expenditures at cheaper rates and potentially ramp up M&A activity with freed-up cash flow.

I was reviewing your account this morning and... (Ad)

Your account is not currently signed up for MarketBeat's free Monday morning stock ideas. Our team is going to be releasing an important pick on Monday morning (at 11am ET) and we want to make sure that you are able to see it.

Add your name to the distribution list hereI'm particularly focused on how rate cuts could revive an otherwise stalled U.S. housing market. According to the Consumer Financial Protection Bureau (CFPB), new mortgage originations—whether for purchase or refinance—were near their lowest monthly levels since at least 2006.

Yet in the run-up to this week's FOMC meeting, CNBC reported a nearly 60% surge in refinancing demand as 30-year fixed rates hovered near their lowest point in almost a year. With more cuts likely through the rest of 2025, regional banks such as PNC Financial Services Group (NYSE: PNC) could see a meaningful boost in loan originations.

PNC's Ongoing M&A Push

Early this month, PNC announced a $4.1 billion acquisition of FirstBank—adding 120 branches and roughly $26 billion in assets—which expands the bank's footprint into Colorado and Arizona, two of the hottest housing markets in the country.

CFPB data show that, while overall origination activity remains subdued, pockets like Arizona are bucking the trend, with mortgage originations up nearly 32% year over year. The FirstBank deal makes PNC the largest bank in the Denver market and brings its branch count in Arizona above 70, lifting consolidated assets to about $575 billion.

This transaction underscores PNC's strategy as a serial acquirer. Over the past 19 years, the bank has completed 24 acquisitions. From 2017 to 2019 alone, it closed six deals. The FirstBank purchase is PNC's second major M&A move in 2025 and just its second since 2022.

That acquisitive streak has paid off handsomely. In 2006, before the wave of deals began, PNC's market capitalization stood at $18.12 billion. Today it sits at $80.20 billion—a gain of nearly 343%. Over the same period, the stock has rallied from under $64 per share to $203.77, an appreciation of 221%.

Strong Fundamentals and Growth

PNC's balance sheet and income statement reflect that growth. Since 2016, the bank has achieved:

- 56% increase in total assets

- 50% rise in net income

- 85% jump in earnings per share (EPS)

In its Q2 earnings reported on July 16, PNC delivered $3.85 in EPS—beating Wall Street's consensus of $3.56—and recorded its strongest loan growth since Q4 2022. At a forward price-to-earnings ratio of 13.35, analysts expect EPS to climb about 12.7%, from $15.37 to $17.32 next year.

PNC has also raised its net interest income guidance from 6% to 7%, reflecting the benefits of recent M&A activity and anticipated loan growth. Institutional investors own nearly 84% of the stock, while short interest is just 1.82%. The bank's 3.34% dividend yield marks 14 consecutive years of payout increases.

This email is a sponsored message provided by The Oxford Club, a third-party advertiser of The Early Bird and MarketBeat.

If you have questions or concerns about your newsletter, please contact MarketBeat's South Dakota based support team at contact@marketbeat.com.

If you no longer wish to receive email from The Early Bird, you can unsubscribe.

© 2006-2025 MarketBeat Media, LLC.

345 N Reid Place, Sixth Floor, Sioux Falls, S.D. 57103-7078. United States..

No comments:

Post a Comment