Below is an important message from one of our highly valued sponsors. Please read it carefully as they have some special information to share with you.

The #1 AI Investment

Elon + Nvidia =

Dear Reader,

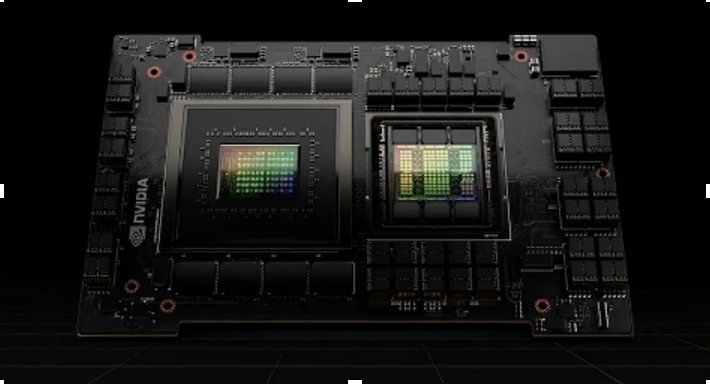

Do you see this weird looking device?

This is Nvidia’s holy grail.

It contains over 3 terabytes of memory…

80 billion transistors…

And can perform over 60 trillion calculations… per second.

This single computer chip goes for $25,000 a pop.

And now…

Elon Musk…

The world’s richest man…

Alongside Nvidia’s CEO Jensen Huang…

Are about to crank it up to 1 million.

At a remote facility in Memphis Tennessee…

You two of them have teamed up with an emerging tech titan…

To build the most advanced AI machine on the planet…

Powered by 1 million of these advanced AI chips.

This Will Unlock the TRUE Power of Artificial Intelligence!

But before you rush out to buy shares of Tesla or Nvidia…

There’s another investment you must consider.

You see, there is ONE company…

That Elon … and Nvidia…

And 98% of the Fortune 500…

Are ALL working with…

To prepare for AI 2.0.

Nvidia’s CEO has even said – this company is ESSENTIAL to their ongoing expansion.

>>>See how you can invest in this revolutionary company today.

Elon is expanding this project RAPIDLY…

And just announced a second AI computer…

That will need this company in order to build.

This may be the single greatest way to build wealth from the AI bull market.

But you must take action immediately.

AI is quickly becoming one of the MAIN focuses in Trump’s new administration…

And once Wall Street sees what this AI can really do — it will be too late.

>>>Go here to learn how to invest in Elon new AI venture.

Regards,

James Altucher

Editor, Paradigm Press

3 Energy Stocks That Could Rally If the Oil Bears Are Wrong

Written by Chris Markoch. Published 8/21/2025.

Key Points

- Chevron is growing Permian production and adding Guyana exposure after completing its Hess merger.

- Exxon Mobil is the largest Permian operator, with LNG and Guyana projects offering additional upside if demand strengthens.

- Schlumberger offers high-beta potential as long-cycle offshore and international projects accelerate with higher oil prices.

OPEC+ nations' recent decision to boost production has stoked concerns of an oversupplied market, compounded by rising hopes of a Russia-Ukraine ceasefire or peace deal.

This macro narrative has weighed on energy stocks, making the sector one of the worst performers. Oil equities, in particular, haven't rallied despite robust cash flows.

How high will gold surge? (Ad)

Weiss Gold Veteran Makes Shocking New Call

Weiss expert Sean Brodrick went out on a limb last year and declared a historic event would send the yellow metal to $3,150. People laughed at him at the time, but he was off by just two days. Now, Sean has a shocking new prediction for gold … and reveals a little-known way to get ahead of this bull market.

But the bear case for oil may be overcrowded. Demand appears underestimated, and a shift higher in prices could propel energy stocks into late 2025 and 2026. Some top names are also best-in-class picks.

The Bull Case for Higher Oil Prices

First, the Federal Reserve: the CME FedWatch tool shows an 83.2% chance of a 25-basis-point rate cut in 2025. Even a single reduction would likely boost industrial activity, travel, and freight—bullish for oil.

Second, while data-center demand grabs headlines, residential use of electricity and heating fuels remains sticky and seasonal. In many regions, oil-fired generation still contributes, making this consumption less elastic than assumed.

Third, OPEC+ has not committed to further supply increases beyond September, potentially tightening the market and supporting prices.

Finally, geopolitical risks—whether renewed conflict or higher tariffs on major importers like India—could persist longer than expected.

Chevron: Permian Growth and Guyana Exposure

Chevron Corp. (NYSE: CVX) is up 7.7% in 2025 after climbing 9.9% from its April 52-week low. The completed merger with Hess Co. adds exposure to Guyana's high-quality reserves.

Yet Chevron's core growth engine remains the Permian Basin, where it produces 800,000–850,000 barrels of oil equivalent per day (boe/d). The company continues to improve capital efficiency in the basin, a key growth driver.

On MarketBeat, analyst forecasts give CVX a consensus price target of $164.11, implying roughly 5% upside. Several analysts have raised targets following the Aug. 1 earnings report.

Exxon Mobil: Permian Leadership and Guyana Payback

Exxon Mobil Corp. (NYSE: XOM) has been the largest single operator in the Permian since completing its Pioneer Natural Resources acquisition in 2024, producing about 1.6–1.8 million boe/d. Exxon aims to reach 2 million boe/d by 2027.

Beyond the Permian, higher oil prices should bolster LNG prices and accelerate returns from its Guyana operations.

XOM is down roughly 0.8% in 2025 and trading in a range despite an April spike. Analysts' consensus target of $125.84 offers about 17% upside, plus a 3.71% dividend yield.

Schlumberger: A High-Beta Play on a Long-Cycle Upturn

Schlumberger (NYSE: SLB) provides high-beta exposure for investors seeking more leverage to an oil-demand surprise. Oilfield services stocks are more volatile than the integrated majors but can deliver outsized gains if demand exceeds expectations.

SLB's multi-year projects and international backlog could drive the strongest upside in the sector if demand rebounds. The company's "picks and shovels" are critical to upstream producers.

After strong 2024 demand, 2025 volumes have lagged, and SLB is down 12.8% this year. However, MarketBeat's consensus price target of $49.28 indicates over 47% upside.

to bring you the latest market-moving news.

This email message is a sponsored message from Paradigm Press, a third-party advertiser of TickerReport and MarketBeat.

Contact Us | Unsubscribe

© 2006-2025 MarketBeat Media, LLC dba TickerReport. All rights reserved.

345 N Reid Pl., Sixth Floor, Sioux Falls, SD 57103-7078. United States of America..

No comments:

Post a Comment