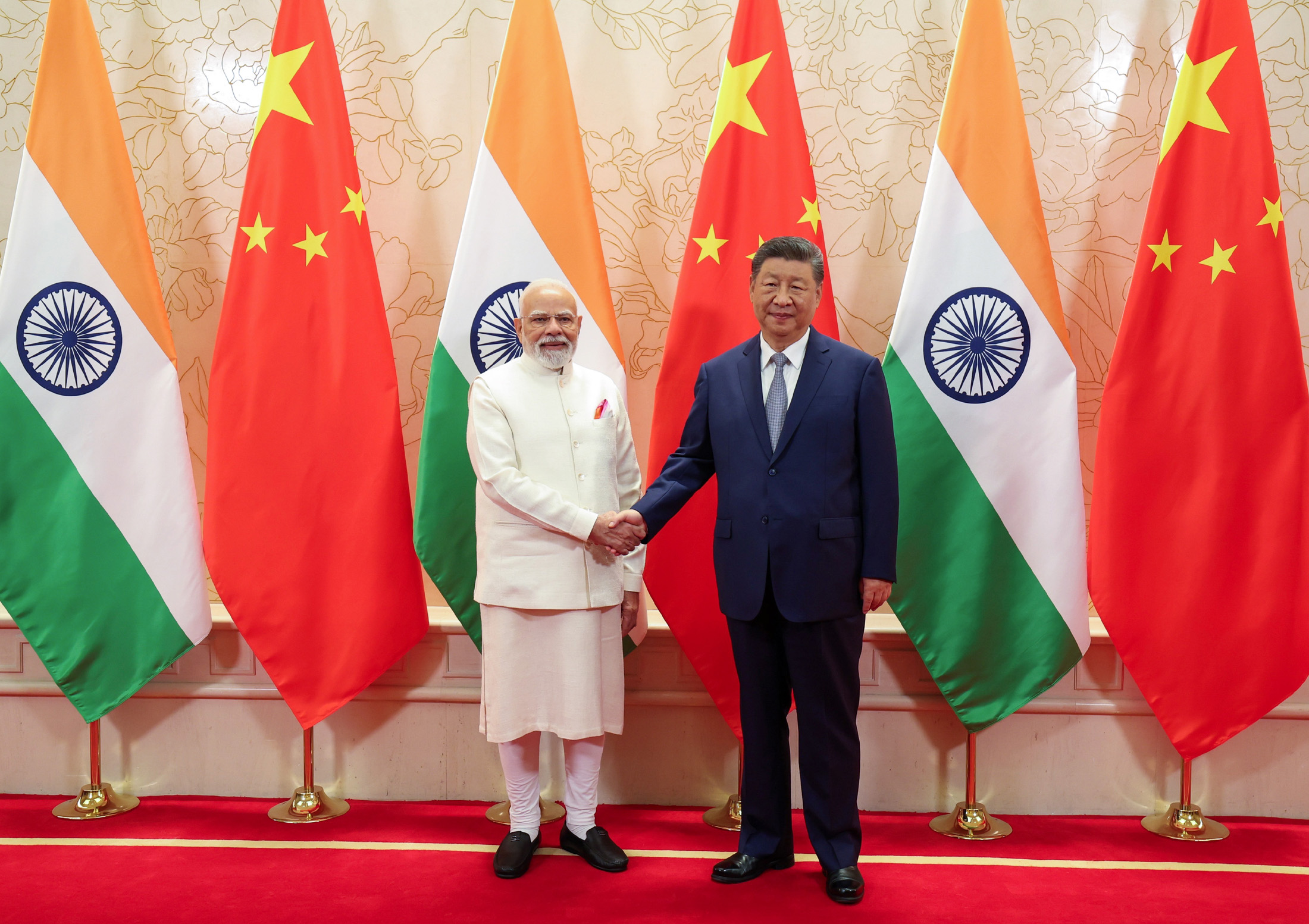

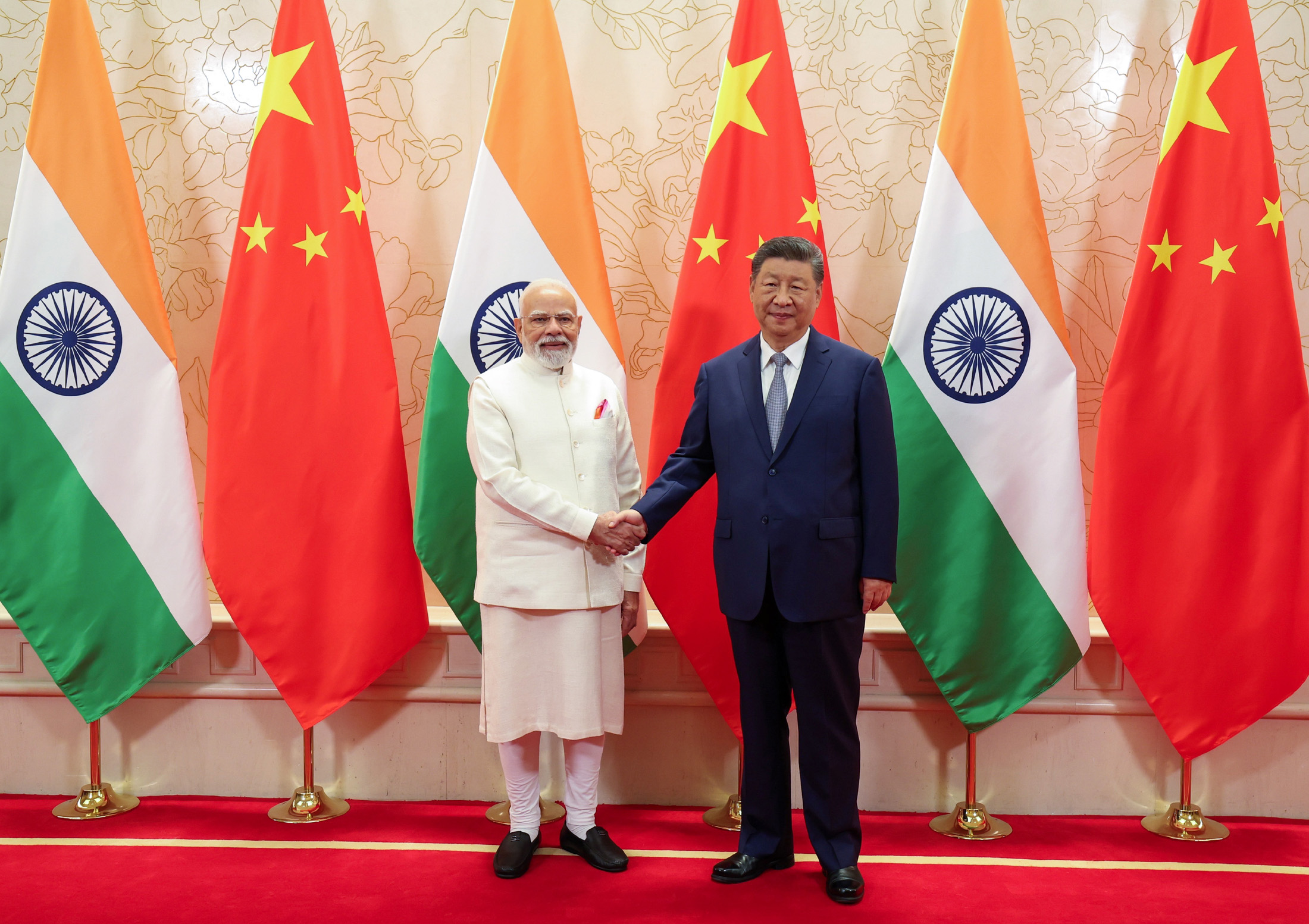

| Here's what my colleague, market strategist Mike "Willo" Wilson says happened while we were sleeping… US stocks suffered a tech led month-end sell off. The S&P 500 Index eased 0.6% but still managed to post its fourth straight monthly advance. A gauge of the dollar was little changed, hovering just above the August low. The Kiwi and Aussie edged higher versus the greenback on Friday and the AUD/NZD cross rate rose for a fifth week. The Federal Reserve's preferred inflation measure matched economist estimates, keeping hopes for more aggressive easing this month in check. ASX futures indicate a soft start to the week. Chinese President Xi Jinping and Indian Prime Minister Narendra Modi held their first meeting since Donald Trump returned to power, with the longstanding Asian rivals pledging deeper cooperation as they deal with the economic fallout from the US trade war. Modi announced the resumption of direct flights between the two countries, and said ties in the past year have stabilized after soldiers pulled back from the friction points on the border.  Narendra Modi, left, meets Xi Jinping in Tianjin, China. Photographer: Press Information Bureau, Government of India/Press Information Bureau, Government of India The next few weeks will give Wall Street a clear reading on whether this latest stock market rally will continue — or if it's doomed to get derailed. Jobs reports, a key inflation reading and the Federal Reserve's interest rate decision all hit over the next 14 trading sessions, setting the tone for investors as they return from summer vacations. Former New York Mayor Rudolph Giuliani has been hospitalized for injuries suffered in a car crash in New Hampshire, a spokesperson said. Giuliani's car was struck from behind at high speed on Saturday, said Michael Ragusa, the head of the former mayor's security. He was diagnosed with a fractured thoracic vertebrae, injuries to his left arm and a lower leg as well as multiple cuts and bruises. Indonesian President Prabowo Subianto, contending with protests over the cost of living, claims the mantle of nation builder, writes Daniel Moss in Bloomberg Opinion. Yet his ambitious and pricey plans aren't economic development as usual. They resemble a muscular form of state capitalism, one dependent on the the leader's imprimatur. Welcome to Indonesia Inc. |

No comments:

Post a Comment