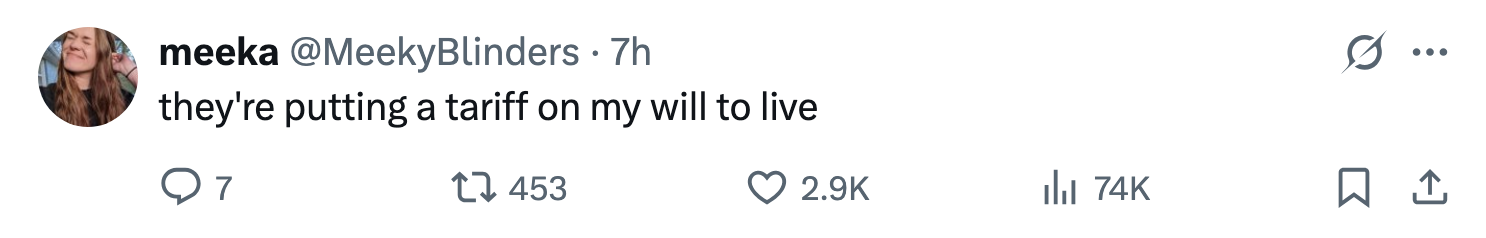

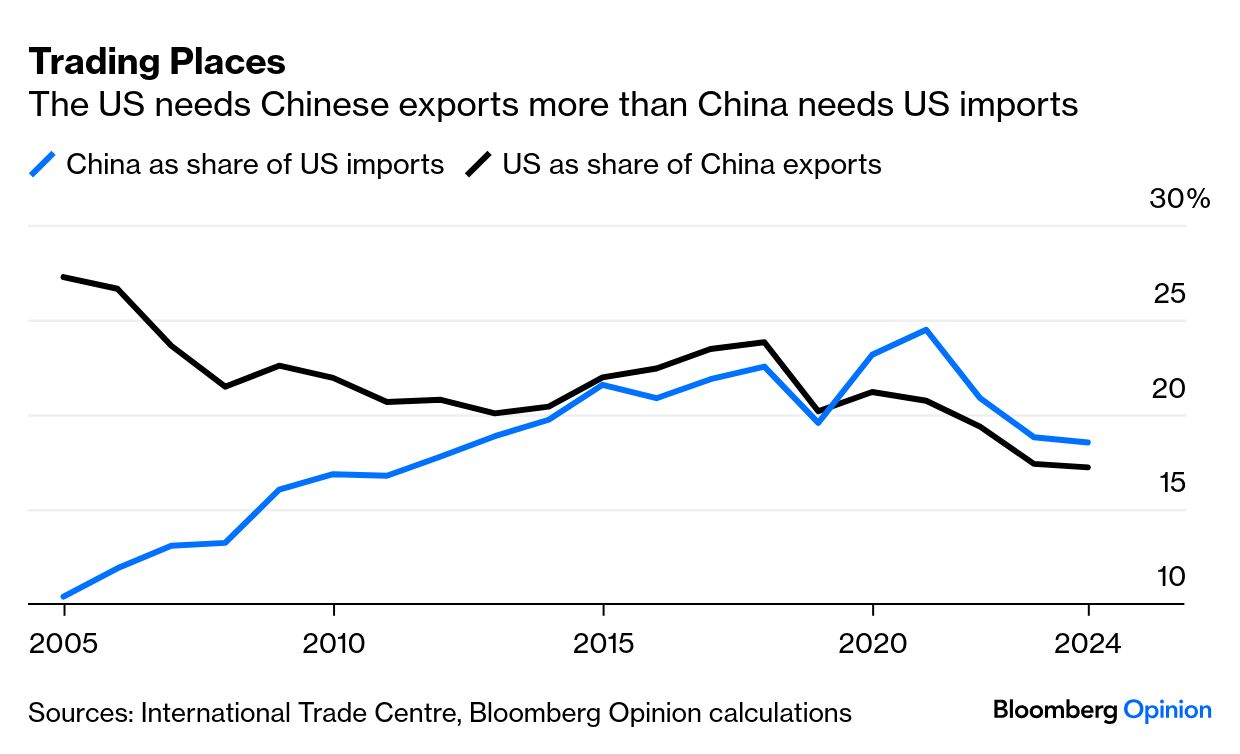

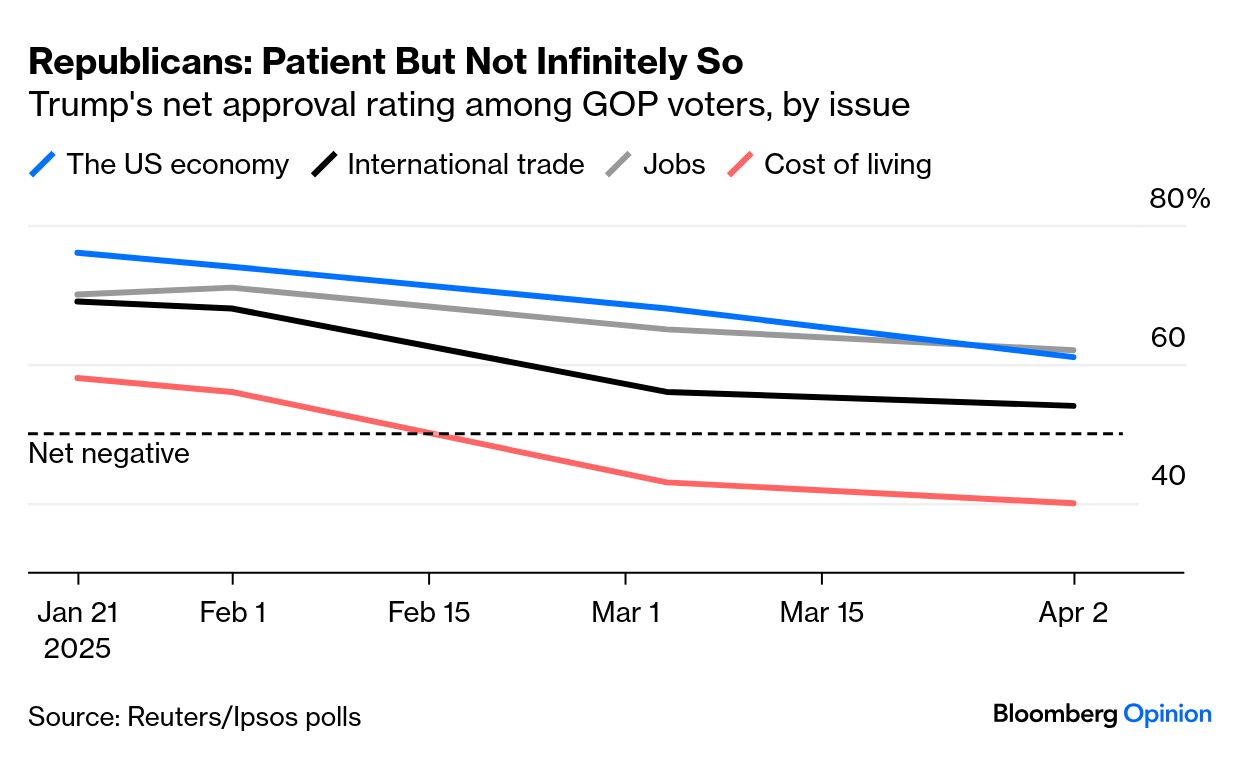

| I dunno, slapping a 104% tariff on a country that you import more than $400 billion in goods from each year does NOT sound like a smart idea! In fact, it sounds completely nonsensical. And the Bloomberg Editorial Board agrees: "Initiating a trade war under such conditions defies economic logic." Don't believe it? Just look at this chart: We need China more than it needs us! It really is that simple. And yeah, I get that the Trump administration is attempting to unravel that dependency. But there's a big difference between delicately unraveling a relationship and calling your third-biggest trading partner a "peasant" like Vice President JD Vance did the other day. Although the parade of world leaders wanting to woo President Donald Trump is long and winding, the cost of obliterating the commercial link between China and the US will be immense, the editors say: "Washington's tariff warriors should remember that whatever small victories they may notch by browbeating smaller nations will amount to little if the US is locked into a risky and expensive confrontation with its greatest rival." The only thing dumber than this trade war would be an actual war, they conclude. If that sentence doesn't put a chill down your spine, perhaps you ought to read this column by Patricia Lopez about steelmakers in the Midwest. Initially, they were excited about a second round of protectionist policies since they benefitted from a 25% tariff on foreign steel in 2018. But round two of Trump's tariffs has been far more sweeping, and steel manufacturers are feeling the pain. "Any benefit [a] company might have derived from protective steel tariffs may be wiped out by the array of tariffs that are affecting demand for new cars and trucks," she writes. Plus, China is a top trading partner for Patricia's home state of Minnesota: "Iron Rangers are tough, but they're not naive." What about the rest of Trump's voters? Surely most Republicans are still on board with the president's stick-it-to-the-man policies. Well, sorta: As the above chart shows, Trump still has the majority's approval in all economic areas, save for inflation. "There's a sense here among folks [that] they've been sold out by coastal elites and foreigners and they're going to give this plan time to play out," Gregg Keller, a veteran Republican operative in St. Louis, told David M. Drucker. "For now, Trump has political leeway to prove critics, and history, wrong. Republican voters and others who find his sort of populism appealing are for now more convinced by his sales pitch about fairness and economic equity than they are by the academic carping of economists or the turbulence of the financial markets," David writes. Speaking of the turbulence in financial markets: John Authers' official designation for the start of the week was "Manic Monday," in part thanks to a fake headline by an anonymous X account and a wacky selloff of US Treasuries: This type of behavior is "the opposite of what you'd expect in the context of a stock selloff that's brought the S&P 500 Index to the doorstep of a bear market," writes Jonathan Levin. Why are people dumping bonds so willy-nilly? He suspects it has to do with threats to US exceptionalism and the global trading system, along with burgeoning federal debt. Most importantly, he worries about a loss of faith in America's economic stability. John — the other one! — meanwhile, wonders whether the blip in the Treasury matrix means "that someone somewhere had to make forced sales to raise cash." If that's the case (and it's sure looking like it is), Matt Levine says the end of the basis trade — where "hedge funds borrow money, buy Treasuries, sell Treasury futures to asset managers and collect a tiny spread" — may be nigh. Then there's Kyla Scanlon's working theory, which is that tariffs are inflationary and the Fed might need to intervene. There's just one problem with that assumption: The last time inflation reared its ugly head — cough, cough, Covid — central bankers completely mischaracterized it as transitory. "The result is a Fed whose political independence and market credibility are as shaky as they have been since the late 1970s and early 1980s," writes Mohamed A. El-Erian. It's safe to say that there's no room for error this time around. As for the stock market volatility we've been seeing, Nir Kaissar says it's best for traders to wait it out on the sidelines: "To me, all of this — the fact that the selling so far seems to be motivated by emotion more than calculation, and that the market is already down a good portion of the amount one would expect in anticipation of recession — is good reason not to join in the selling." |

No comments:

Post a Comment