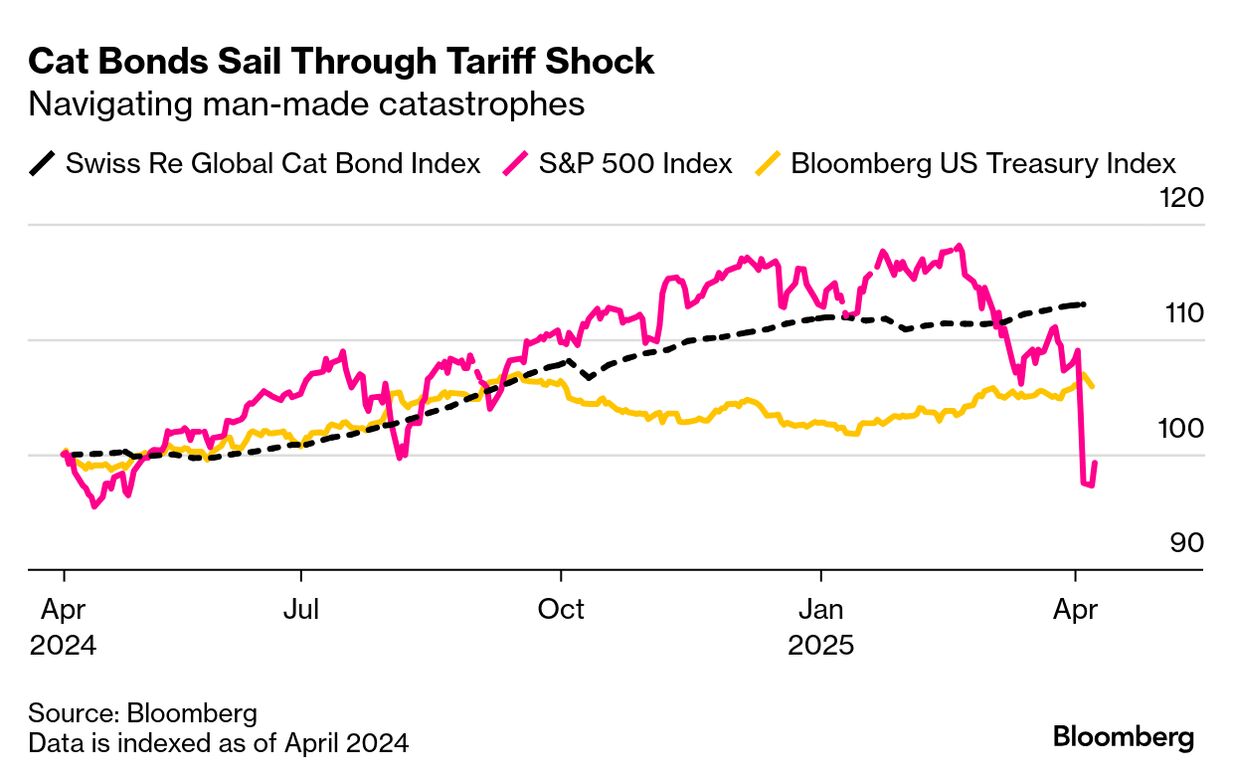

| By Danielle Bochove Last month, in his first speech as Canada's prime minister, Mark Carney vowed to make the nation "a superpower in both conventional and clean energy." The "conventional" reference could be seen as matter of course in a nation whose energy sector is still dominated by oil and gas. But it also shows the fine line that Carney, the Liberal Party leader, needs to tread as he squares off against Conservative Pierre Poilievre ahead of Canada's general election on April 28, while simultaneously fighting a brutal trade war initiated by US President Donald Trump. "I think the political incentives for him align for that kind of compromise," said Jessica Green, a political scientist at the University of Toronto.  Canadian Prime Minister Mark Carney speaks to members of the media. Photographer: James Park/Bloomberg Voters are focused on issues that seem more immediate and frightening than climate change, she said, from a fraying social safety net, to economic fears, to the rise of authoritarianism. Meanwhile, opposition leader Poilievre has blamed climate policies — especially the consumer carbon tax implemented by former Prime Minister Justin Trudeau — for rising household costs. In an election campaign that has frequently seen the parties in a dead heat, "it makes sense not to talk about climate," Green said. A spokesperson for the Carney campaign said he had not chosen "to downplay or dial down climate." "Climate change is very important to many Canadians, but we would also be remiss if we didn't talk about other things Canadians care about, such as affordability, our relationship with the United States, security and so on," she said. Read the story for a look ahead at this month's election and what it means for the fate of Canada's industrial carbon tax. President Donald Trump's trade war threatens to slow down a fast-growing technology that's key to the clean-power transition and preventing blackouts — big batteries. Energy storage devices large enough to feed the electric grid have been spreading across the US, with deployments surging 33% last year. Officials in California and Texas credit them with helping prevent blackouts during heat waves, when electricity demand soars, and integrating variable solar and wind power onto the grid. But despite efforts by former President Joe Biden to build a domestic supply chain, the US still relies heavily on imported lithium-ion batteries — with 69% of the imports made in China, according to the BloombergNEF research provider. Now, Trump's tariffs are piling costs onto new battery projects. BNEF analysts warn the increased costs will likely lead to cancellations and delays, cutting the industry's torrid growth.  BYD Cube Pro lithium-ion energy storage batteries at the Crimson Battery Energy Storage Project in Blythe, California. Photographer: Bing Guan/Bloomberg Clean energy becomes a focus for take-private deals. Clean energy dealmakers are anticipating a new wave of take-private opportunities in the sector as US President Donald Trump's tariffs rattle global public markets. Exxon has a quiet proxy season. For first time in 25 years, the oil giant isn't facing a single shareholder proposal. The company said in a statement late Monday that it received only one proposal this year and the SEC agreed it should be discarded because "it tried to micromanage the company." Trump signs order to expand coal power. President Donald Trump signed a raft of measures he boasted would expand the mining and use of coal inside the US, a bid to power the boom in energy-hungry data centers and revive a flagging US fossil fuel industry. A bond market designed around natural catastrophes is proving remarkably resilient to a man-made market meltdown. While most markets have seen deep selloffs since Donald Trump's "Liberation Day" tariff announcement, investors in catastrophe bonds have sailed through with hardly a ripple. Fermat Capital Management, a Connecticut-based hedge fund specialized in insurance-linked securities, says the market for catastrophe bonds "has been trading in an orderly fashion" and investors who bought them "are seeing the benefit." |

No comments:

Post a Comment