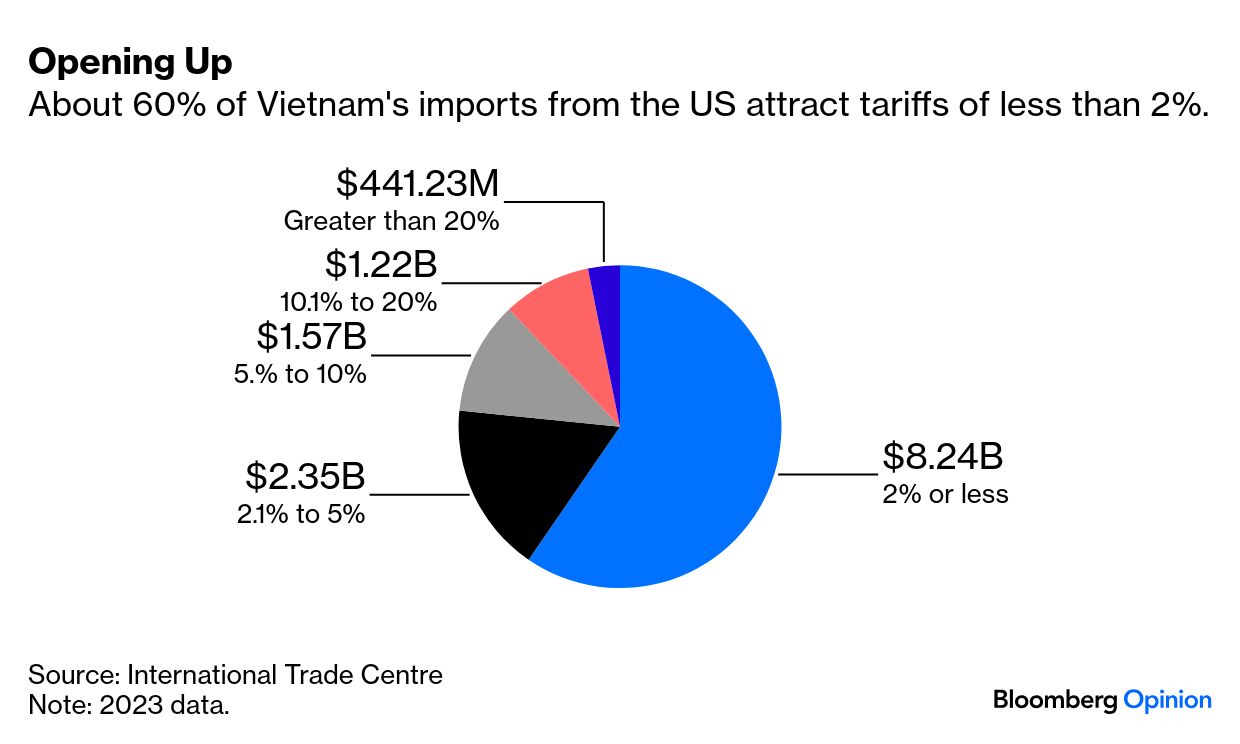

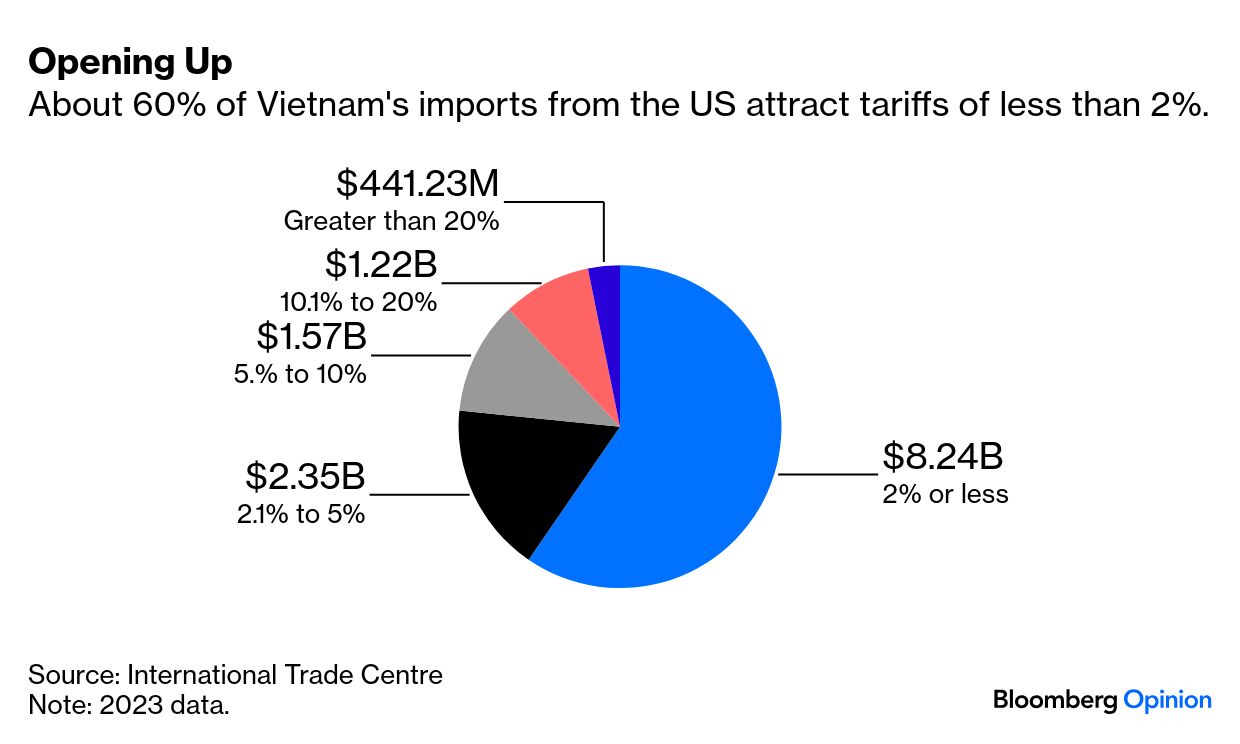

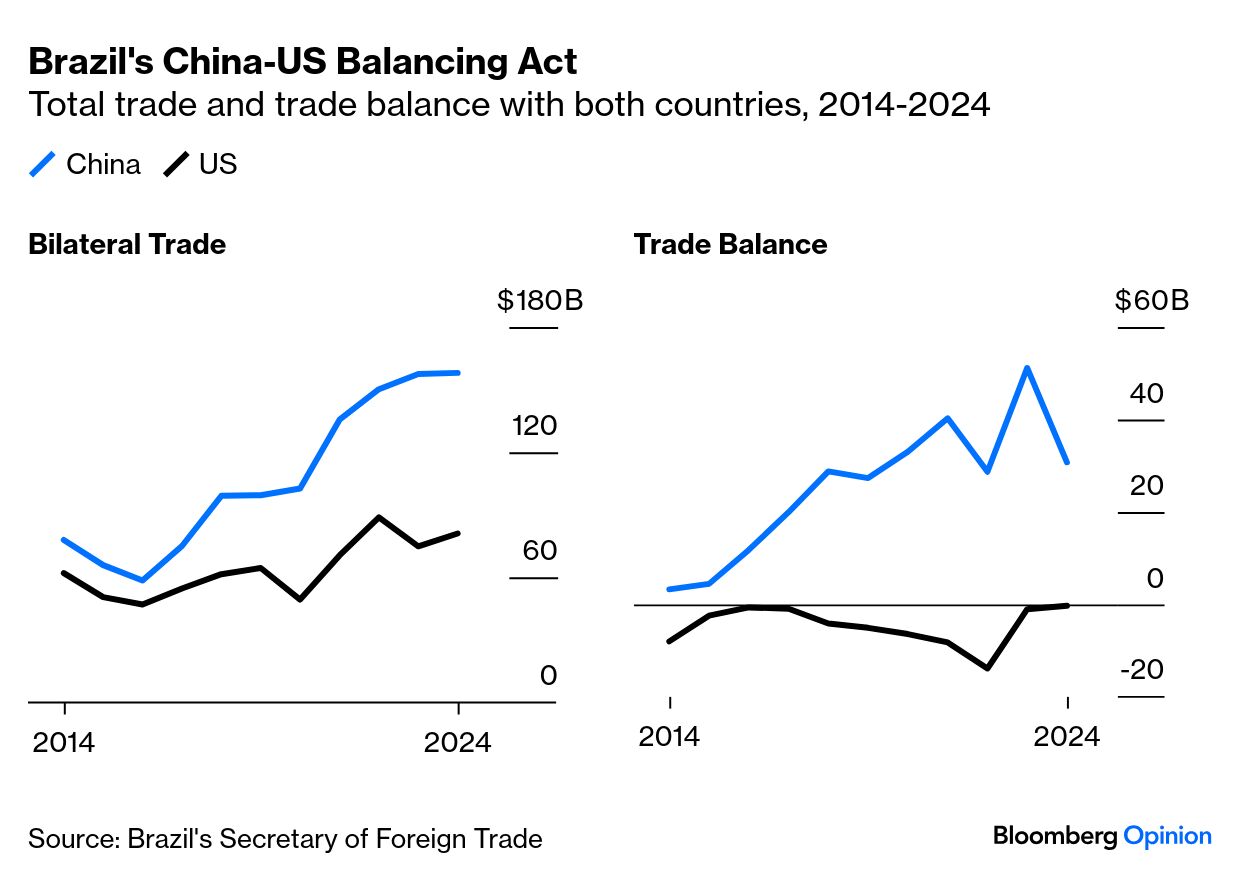

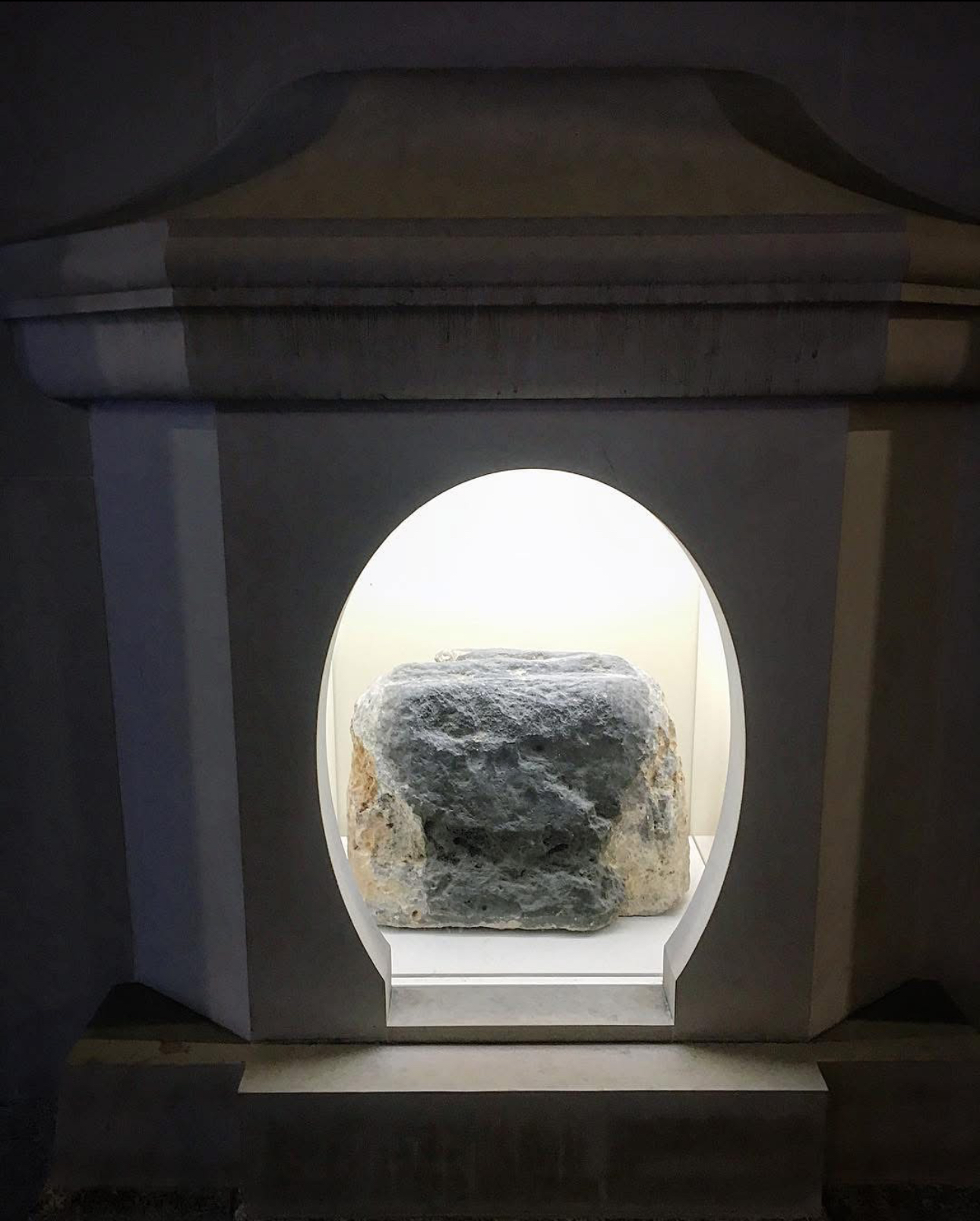

| This is Bloomberg Opinion Today, a multi-strategic hodgepodge of Bloomberg Opinion's opinions. Sign up here. What If It's a Three-Front War? | Now that we know all this Trump trade turmoil is really about China, Shuli Ren would like to say that the US will be missing out not just on cheap consumer goods from Shein and Temu but the inexpensive yet chic fashion, bags, cars and electronics that have been evolving in the Mainland since the recessionary Covid years. Says Shuli: "[L]ocal brands have had to improve their products to hold onto their customers. But alas, thanks to Trump, Americans don't get to take advantage." But that's what the US will get for walling away the increasingly sophisticated factory of the world. In two columns this week, Catherine Thorbecke raises other troubling scenarios. Donald Trump's partially paused but still volatile trade war, for the moment, has exempted semiconductors from extra duties. That's complicated enough: America's most valuable company, Apple Inc., is terribly compromised by the tariffs imposed on countries where its bestselling iPhones are assembled. And that's without any duties on the chips used to make them. In China, Tencent Holdings Ltd. and its compatriot peers may have seen their stock prices shudder along with the rest of the world, but they have a much more stable outlook because their customers and manufacturing base are in-country. Silicon Valley, on the other hand, has a much more globally exposed supply chain. Says Catherine, "The required materials and components rely on vast global supply chains, many anchored in Asia. In contrast, Chinese buildouts were already supported by government incentives." She says the situation may get worse if Trump acts on his threat to impose duties on chips, including the world-class wonders manufactured by Taiwan Semiconductor Manufacturing Co. American tech giants depend on TSMC chips for their already expensive expansion plans, not just for phones but AI and its attendant data centers. President Lai Ching-te of the Republic of China (which is based in Taiwan) writes in a guest column for Bloomberg Opinion that Taipei aims to cooperate with the US regarding tariffs. As Catherine points out, such attempts to soothe Trump did not work for Apple, which pledged $500 billion in US investments but hasn't gotten any signal that the products it makes in China will receive any kind of tariff exemption. Meanwhile, as Parmy Olson writes, the European tech industry for once is savoring a likely turn in their fortunes. While their US rivals may be pulled down by higher costs out of suppliers in Asia, France's OVH Groupe SA, Italy's Aruba SpA and Scaleway can try to gain on Amazon, Microsoft and Google, which currently have 75% of the European cloud market. Says Parmy: "Trump's tariff war may end up being the geopolitical catalyst that Europe's tech sector needed." Trade wars, fortunately, aren't actual wars — even if there are several going on at once. Things could be worse. Bloomberg's Editorial Board warns that "Spiraling tensions could increase the risk of a military clash in the South China Sea or around Taiwan. … Washington's tariff warriors should remember that whatever small victories they may notch by browbeating smaller nations will amount to little if the US is locked into a risky and expensive confrontation with its greatest rival." US war doctrine says the country must be prepared to win a two-front war swiftly. Let's not find out if it will. Tech wars and trade wars are tough enough. A hot war is something everyone should avoid. The High Price of the Future, As Seen From the Past | I wrote a column this week about how tariffs may affect the supply of imported fish served in New York's ultra-expensive sushi restaurants. That may be a 1% problem, but if high-grade seafood is no longer an option for the rich, that limits what the rest of us can aspire to. Inflation is corrosive — it begins slowly and then eats away at how we all approach life. Jonathan Levin cites this kind of economic mind game when he takes issue with Treasury Secretary Scott Bessent's argument that tariffs don't cause inflation. Says Jonathan: "While tariffs aren't guaranteed to cause inflation, it's misleading to pretend that they definitely can't and won't. It all depends on inflationary psychology." Mihir Sharma has a depressing take on tariffs and inflation: Trump's attempt to raise tariff walls on the world — remember, everyone's got at least a 10% hike despite the respite of a 90-day pause — reminds him of the India he grew up in, which used trade barriers to do essentially the same in an attempt to create an autarkic nation. "Consumer goods, in particular, attracted duties upwards of 50%," he writes. He imagines the fate of Americans cut off from the latest innovations in Asia and Europe. They "will start asking friends and colleagues travelling overseas to bring back something they desire. Every visitor from abroad when I was young was expected to arrive with gifts of watches, chocolates, or even non-stick cookware. These might be available at home, but the price difference meant it made more sense to spend months looking for someone to carry them over the border." He adds one irony: "It used to be the case that the upmarket department stores of Asia or Europe would be inundated with Chinese tourists rolling around suitcases that they would fill with luxury-good purchases; one day soon, those tourists might be American." "Consider Vietnam. As my colleague Daniel Moss has written, the country is looking like the biggest loser on Trump's tariff list, with a quarter of gross domestic product dependent on exports to the US now being hit with a 46% levy. Little wonder, then, that the nation has been one of the first to bend in apparent supplication to Washington. … Look at the history of Vietnamese trade policy, however, and it becomes apparent that the nation is simply doing what it has been pushing for decades, while dressing it up to flatter the demagogue in Washington." — David Fickling in "Waging Economic Warfare Like a Game Show Can Easily Backfire."  "Brazil only got a 10% ticket in Trump's already infamous scorecard of tariff retaliations, which won't significantly dent Latin America's largest economy. In fact, quite the opposite: It's possible that this relatively lower barrier ends up benefiting Brazil, a top supplier of grains, meat, oil and metals. China's decision to retaliate against Trump, imposing a 34% tariff on all US imports starting April 10, means the South American nation is now poised to gain market share at the expense of American farmers and producers — as it has been doing since US-China tensions started. " — Juan Pablo Spinetto in "Silence Is Lula's Best Card in Trump's Trade War." Is there a cure for private equity indigestion? — Chris Hughes Sometimes, the enemy of your enemy is your enemy. — Matthew Brooker Keir Starmer, trade pragmatist. — Rosa Prince Need a bureaucratic setback? Call Inspector Raj. — Andy Mukherjee Imagine a global Liz Truss moment. — Marcus Ashworth and Lionel Laurent Walk of the Town: A Stone's Throw Away | Just around the corner from the Bloomberg European Headquarters in London is a vaguely classical bas-relief urn with an egg-shaped cutout revealing a time-worn block of stone. Above the urn are the words "London Stone." A definite article would have made it feel less generic ("Why am I looking at a local rock?") because this is the London Stone, a famous piece of limestone, even if people can't agree why. There is some consensus that it's a remnant from Roman Londinium. The stone has been more or less here since the seat of the empire's appointed administrator held office in space now occupied by Cannon Street Station. It's the same kind of material used to erect buildings and classical statues. It's been enshrined in English literature by William Shakespeare (who had a doomed rebel declare himself king on it) and William Blake (who conjures up bloody Druidic sacrifices on the rock). Contemporary fantasy fiction has also worked in the London Stone, including China Miéville's Kraken. What we do know is that it survived the Great Fire of 1666 and then was built into the side of Christopher Wren's St. Swithin's Church until that structure was destroyed by German bombing in World War II. Whatever it originally was, the London Stone is the great survivor of the city. And when, late and soon, the world gets to be too much for me, I wander over to ponder its powers of persistence. N.B.: Thank you to all who wrote me kind messages about my injury. I am still a little halted but able to walk beyond the London Stone. Apropos this Daniel Moss column on sidelined central banks: Don't you miss the simple things? Birds and bees, flowers and trees, hawks and doves?  "Oh, stop with the attitude. No one cares what we think nowadays." Illustration by Howard Chua-Eoan/Bloomberg Notes: Please send avian flukes and feedback to Howard Chua-Eoan at hchuaeoan@bloomberg.net. Sign up here and find us on Bluesky, TikTok, Instagram, LinkedIn and Threads. |

No comments:

Post a Comment