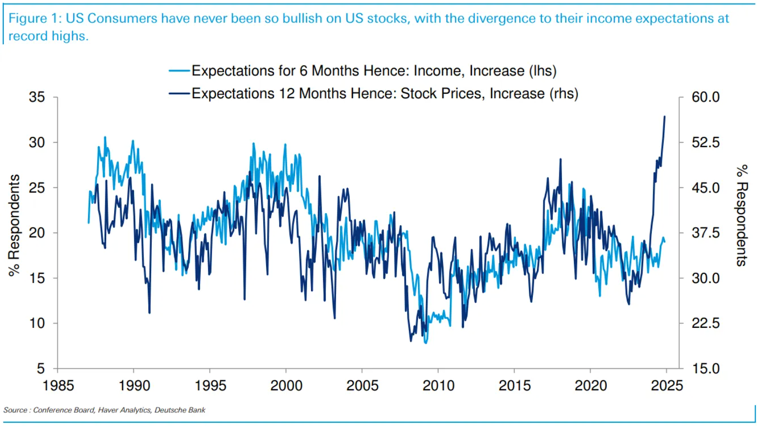

| Let's start with the obvious. Recent events have made clear that a recession and extended bear market in stocks are now the base case. Just three weeks ago, I outlined four risk scenarios — from best-case to medium to high-risk and finally worst-case — handicapping the medium-risk scenario as slightly more likely than the high-risk one. And where my low-probability tag for a best-case outcome was probably non-consensus then, it seems to be more of the status quo now. If I had to re-assess risk weightings today, I would give the "Goldilocks" outcome that keeps stock charts going up and to the right a zero weight simply because we are basically in a bear market already. Of the more negative outcomes, even the non-recession case has to be seen as lower probability. Already, companies like Delta Air and Walmart are pulling their earnings guidance. More companies will follow as firms absorb crushing tariff costs with a combination of margin loss and cost cutting that includes layoffs. So we can reasonably put recession as a base case with the question now about its severity. My current odds: 25% growth recession, 50% recession/bear market and 25% severe bear market — with a not insignificant potential for this to turn into something worse, including a financial crisis. The starting point matters | Let's remember where we're coming from because, as the saying goes, the bigger they are, the harder they fall. The more priced to perfection markets are, the more vulnerable they are to negative shocks. And upside expectations coming into this year were dangerously high. For example, last year ended with me writing about off-the-wall unrealistic expectations. Remember this chart from Deutsche Bank? The optimism was even greater than in 2000, at the height of the Internet Bubble. So when it was clear tariffs were coming, that they weren't just a negotiating tool, it quickly led to a correction in stocks. I would argue that because of the starting point — the irrational exuberance and the high valuations — the bear market in stocks is just an indication that investors have marked down medium-term expectations. It's a stumble from a high plateau, making the downdraft large. But the bear market hasn't fundamentally altered many investors' belief in American exceptionalism as embodied by Big Tech and Silicon Valley. If that belief falters, there will be a lot further to fall from here. The Super Bubble had already been deflating | Let's put this in context, though. As 2024 closed out, we had unrealistic expectations for future stock market gains. And they were met by an economic shock in the form of tariffs that eventually were revealed as unexpectedly high. That precipitated a bear market in stocks. And now we wait for tariff retaliation and how much the global economy suffers to determine if stocks have been marked down enough so far. But, remember, by my reckoning, the latest super bubble actually ended several years ago. And we are currently just moving further downward from a double peak in 2019 and 2021, four to six years ago. Where we had over 200% decade-long equity gains in excess of inflation back then, that number had been cut in half when I presented the super-bubble data last month. After the bear market, we are down to 75% inflation-adjusted gains over the last 10 years. That's not bad, but it could get a lot worse. For example, I've said 2025 is the equivalent of around 1968 in the 1959-to-1982 equity super cycle. And the inflation-adjusted 10-year returns for the S&P 500 in mid-1968 were around the same as today. But in the middle of a recession in 1970 those gains turned to losses. In the middle of the next recession just four years later, you would have lost half your money in real terms had you invested in the S&P 500 basket of shares. And that's over a decade, so not just a blip but a severe shellacking that would have diminished your retirement standard of living. In both the 25% weighted medium-risk scenario and the 50% weighted high-risk scenario, we can avoid such an outcome this time around. |

No comments:

Post a Comment