| Bloomberg Evening Briefing Americas |

| |

| The market chaos unleashed by Donald Trump's trade war continued for a third day as stocks, bonds and commodities all swung wildly, buffeted by both fears of a recession and speculation the financial damage will drive the Republican president to change course. After the darkening global outlook hammered markets in Asia and Europe, extending a slide that erased roughly $10 trillion from equity markets worldwide, the S&P 500 opened sharply lower, only to briefly spike as rumors raced across trading floors that Trump was poised to delay his tariffs. But prices sank again as those hopes faded—and by late morning Trump was making more threats as China ramps up its retaliatory tariffs. One senior floor trader's assessment of today's whipsaw? "This is madness." Volatility convulsed other markets as well, with traders continuing to price in a high risk of a global downturn. The VIX Index—known as the fear gauge—spiked to pandemic-era levels. Treasuries weren't much of a haven either: yields on longer-dated bonds surged, underscoring the risk that tariffs could sink the US economy and worsen the federal government's finances. At the end of the day, markets closed down, but not as dramatically as they did last week. Still, the S&P 500 remains at levels not seen since May 2024. Here's your markets wrap. —Natasha Solo-Lyons Trade wars, tariff threats and logistics shocks are upending businesses and spreading volatility. Understand the new order of global commerce with the Supply Lines newsletter. | |

What You Need to Know Today | |

| More than 1,200 separate demonstrations across the US, in Europe and elsewhere this weekend saw what organizers said were millions of protestors fill streets and surround capitals, assailing Trump and Elon Musk for their attempt to fire hundreds of thousands of federal employees and shutter agencies without Congressional legislation, and as the protestors alleged, violate American civil rights and the US Constitution. The rallies were some of the largest demonstrations of American public opposition to Trump since his inauguration in January.  Demonstrators during a protest against Donald Trump on the National Mall in Washington on Saturday, April 5. Photographer: Aaron Schwartz/Bloomberg | |

|

| With tens of millions of Americans invested in 401(k)s, the current market bloodbath has (for now anyway) done serious damage to the retirement prospects of a good chunk of the country. Making matters worse, more Americans than average were already turning to their retirement accounts for emergency cash, according to Empower, the nation's second-largest retirement plan provider by plan participants. Hardship withdrawals from 401(k)s are running about 15% to 20% above the historical norm, Empower Chief Executive Officer Ed Murphy said Monday in a Bloomberg TV interview. Any withdrawal is taxed and, for those under age 59 ½, can come with a 10% penalty. | |

|

| |

| |

|

| Germany wants the European Union to consider using its most powerful tool to retaliate against Trump's trade war. "We have to take a close look at the anti-coercion instrument, which are measures that go far beyond tariff policy," including digital services, German Economy Minister Robert Habeck said Monday, referring to a measure that would allow the bloc to target Big Tech companies. That tool, typically labeled the "bazooka" in the EU's trade arsenal, was established primarily as a deterrent option to avoid coercive economic practices by major trade partners such as China or the US. As for Beijing, after weeks of responding with only targeted measures and calling for dialogue, China signaled a tougher approach on Friday by answering Trump's "reciprocal" tariffs with blanket duties of its own and more export controls. The Communist Party's official newspaper followed that up with a Monday editorial declaring Beijing is no longer "clinging to illusions" of striking a deal, even as it leaves a door open to negotiations. | |

|

| |

|

| Google's introduction of artificial intelligence-generated answers and changes to its search algorithm have caused a significant decline in traffic to independent websites, disrupting the symbiotic relationship between Google and content creators. Many publishers have reported a 70% or more decline in traffic, leading to lost revenue and forcing some to shut down or reinvent their distribution strategy, which could eventually degrade the quality of information Google can access. | |

|

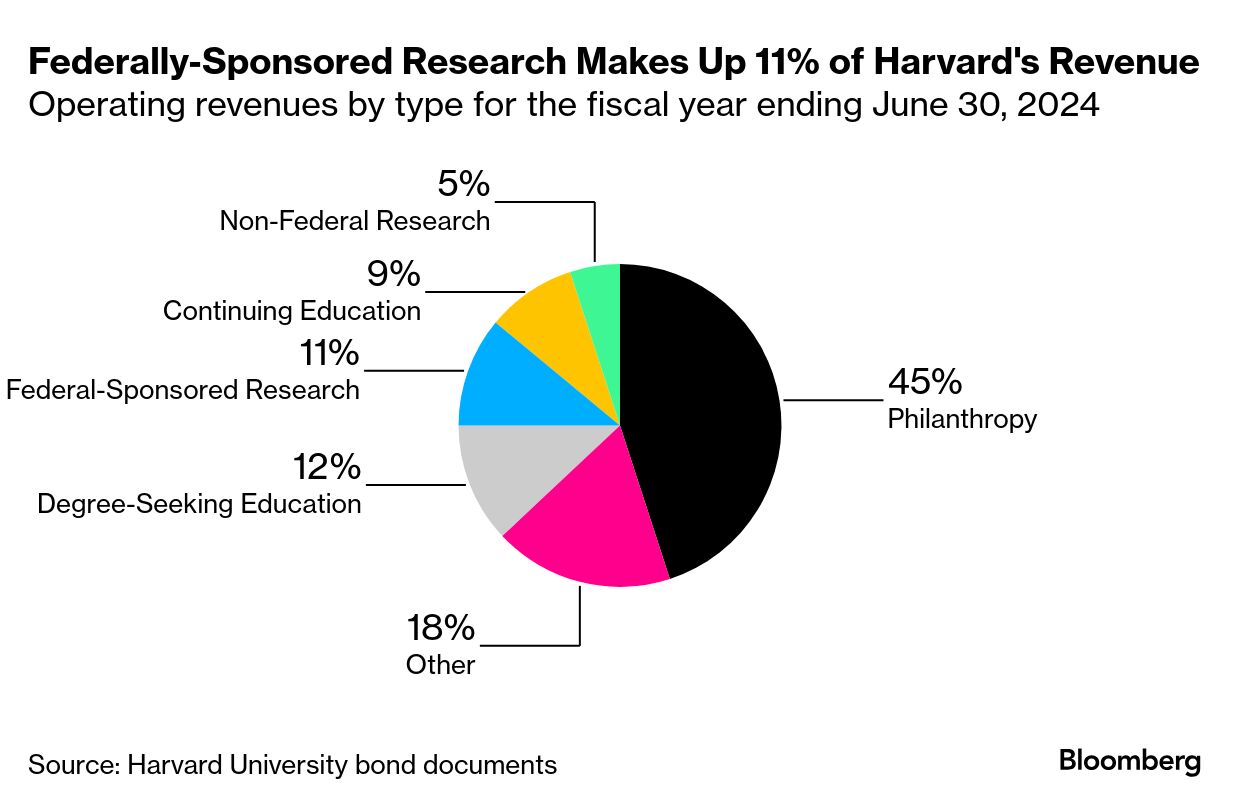

| Harvard University plans to borrow $750 million from Wall Street amid mounting threats to its federal funding from the Trump administration. "As part of ongoing contingency planning for a range of financial circumstances, Harvard is evaluating resources needed to advance its academic and research priorities," a spokesperson for the university said. The debt will be taxable, and proceeds will be used for general corporate-purposes, according to bond documents. Goldman Sachs is the sole bookrunner on the transaction. Princeton University is also considering the sale of taxable bonds. The school announced last week that US government agencies have suspended dozens of its research grants. | |

What You'll Need to Know Tomorrow | |

| |

| |

| |

| Enjoying Evening Briefing Americas? Get more news and analysis with our regional editions for Asia and Europe. Check out these newsletters, too: Explore all newsletters at Bloomberg.com. | |

| | This newsletter is just a small sample of our global coverage. For a limited time, Evening Briefing readers like you are entitled to half off a full year's subscription. Unlock unlimited access to more than 70 newsletters and the hundreds of stories we publish every day. | | | | | | |

| |

Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. Want to sponsor this newsletter? Get in touch here. | | | You received this message because you are subscribed to Bloomberg's Evening Briefing: Americas newsletter. If a friend forwarded you this message, sign up here to get it in your inbox. | | |

No comments:

Post a Comment