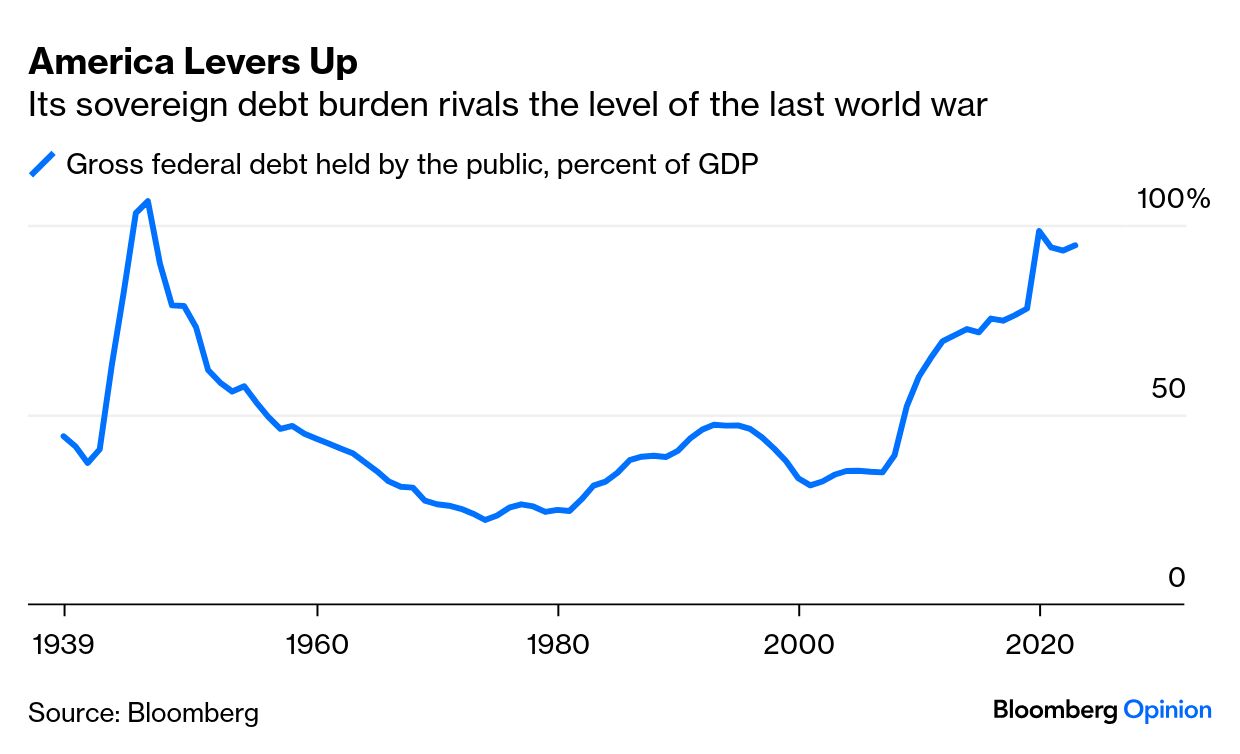

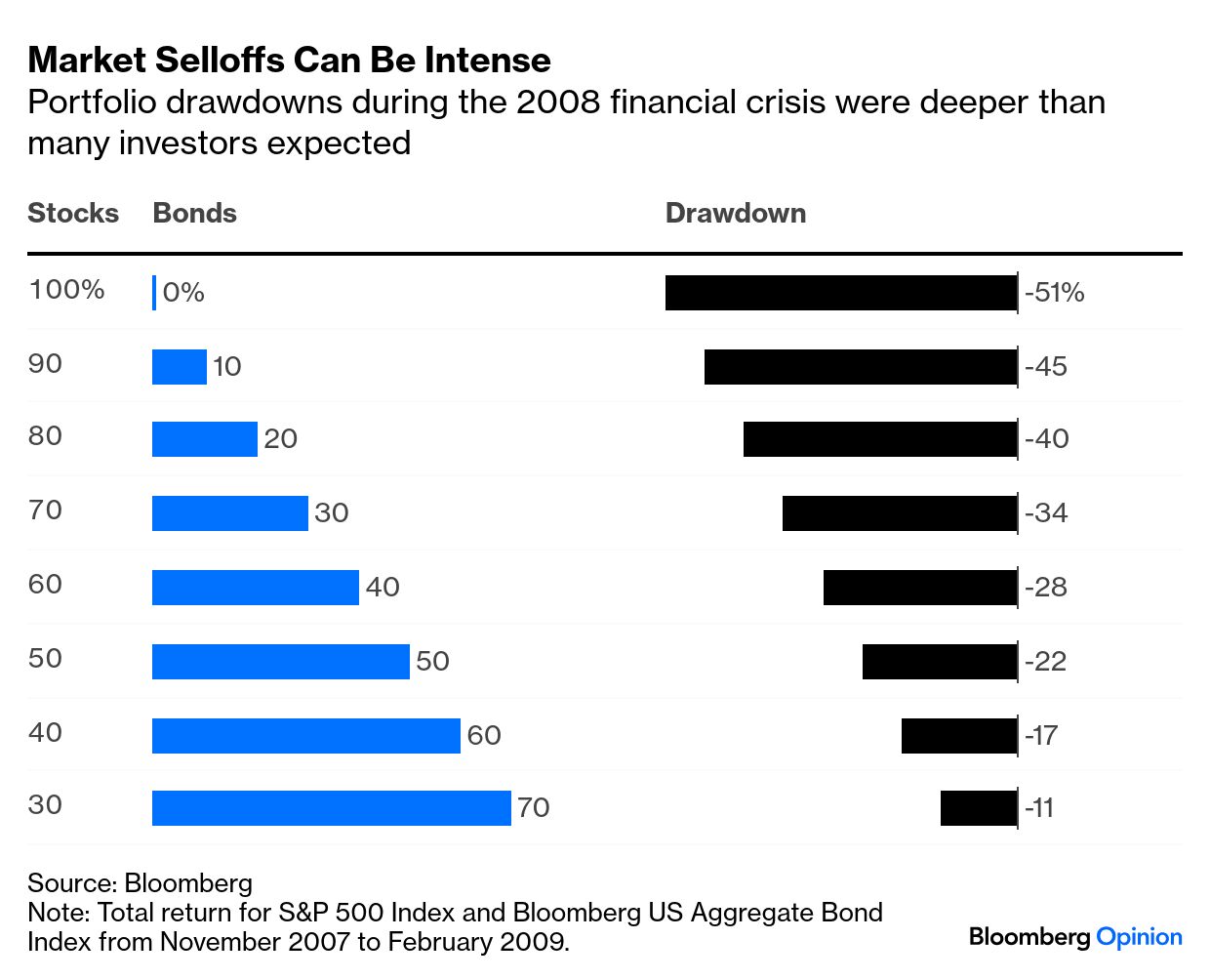

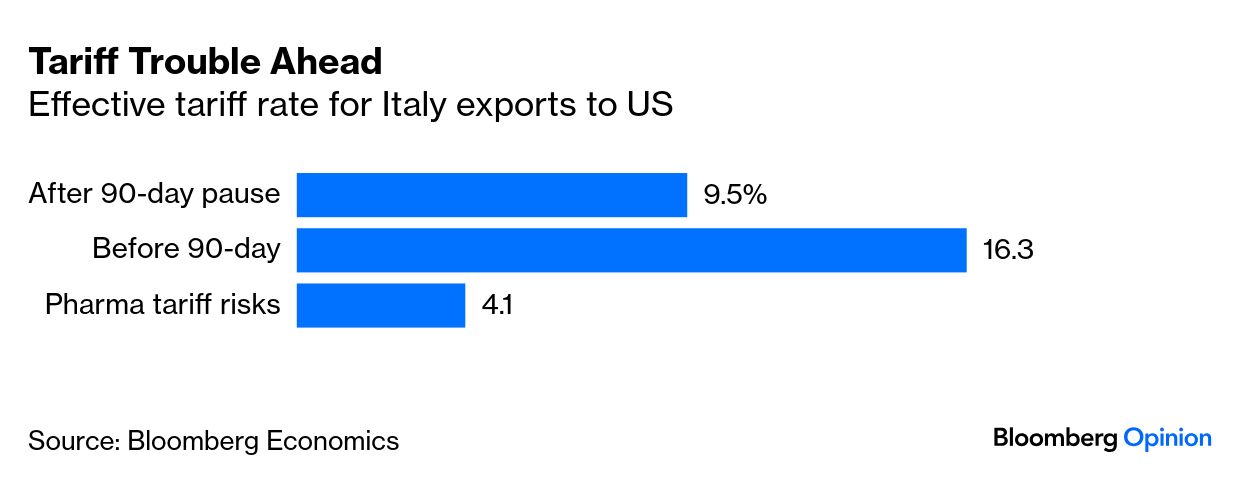

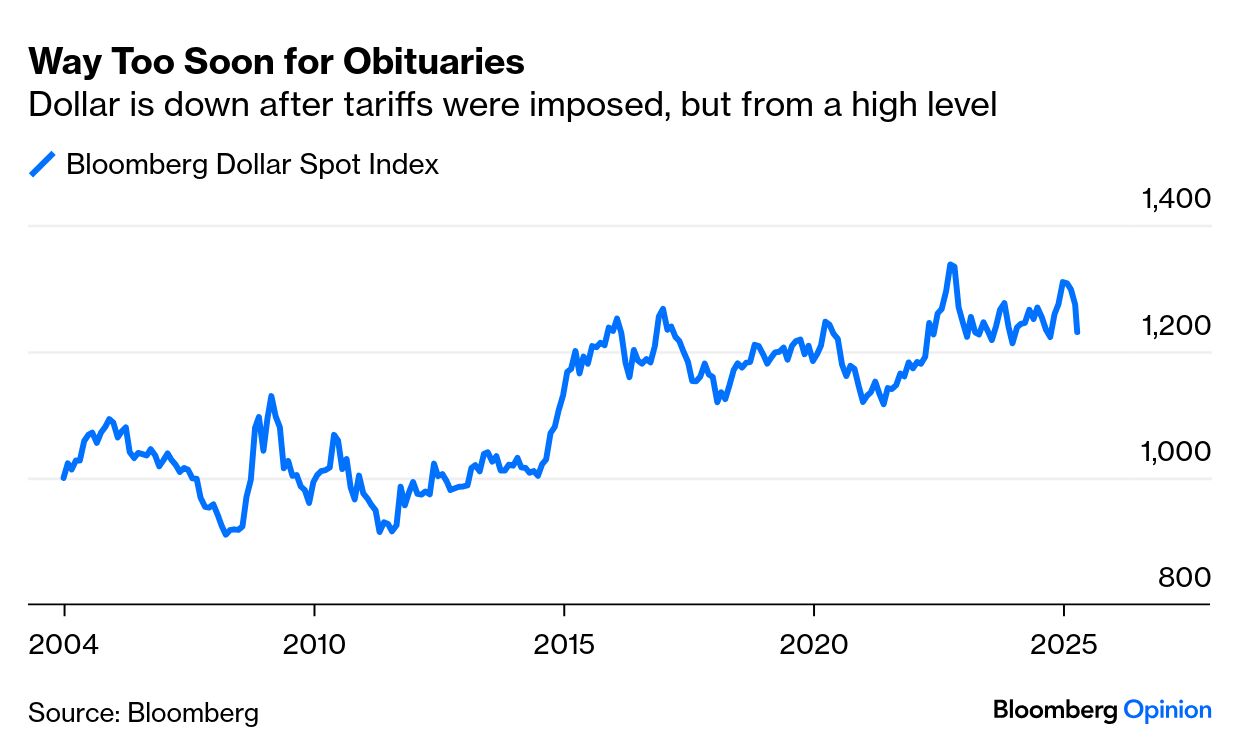

| This is Bloomberg Opinion Today, a global contagion of Bloomberg Opinion's opinions. Sign up here. The tragedy hit in the year 2008. In retrospect, all the signals were there. Spending was spiraling out of control. Up to one in every 12 Americans was caught up in it. What was being sold as security left everybody fleeced. Slick marketing promised us flexibility, but we ended up trapped inside our investments. We all wanted a comfort zone, but many were left in the cold. And the results were hideous:  The horror of the Snuggie. Photographer: Stan Honda/AFP/Getty Images Wait, you thought I meant this?  Whoops! Photographer: Cate Gillon/Getty Images Nah, the S&P 500 made up all the lost ground by 2013, and your 401(k) ended up just fine (assuming you weren't about to retire). On the other hand, nobody has ever gotten over the ignominy of wearing a Snuggie, the blanket with sleeves and a viral ad campaign. And even if a decade from now you'll look back in shame on your mesh ballet flats, at least you know we won't again fall into that whole systemically risky, global contagion-y, bail-out-the-bankers-y insanity. Right? Eek! "A financial crisis isn't out of the question," the Editorial Board writes. "Such crises follow a familiar pattern, whether the cause is a housing bust, a global pandemic or, in the current case, the premeditated actions of the world's biggest economy. The catalyst is debt, which investors use to buy many times more assets than they otherwise could … If those losses threaten the financial system and the broader economy, governments must step in with taxpayer-funded bailouts." So not only does the US have an unhinged administration that thinks a constant state of market shock counts as a sort of economic stability, it also has banks with short memories. "Ideally, financial companies should have ample resources to absorb losses and prevent contagion," add the editors. "They don't." Well, not to worry, all that scary stuff will really only affect other people — bankers, hedge-fund moguls, Treasury secretaries. You'll be fine. No need to even log into Vanguard. As for me, I'll just check in with my unofficial (and unpaid) personal investment adviser, Nir Kaissar. "People don't think about risk much in a rising market. And when they do, they don't focus enough on the essential question: How much of my money will evaporate in a crisis," Nir writes (free read). "The answer is more than you probably think, which explains why many investors were surprised by the depth of the declines during the 2008 financial crisis." That was NOT what I wanted to hear from the man entrusted with my children's meager inheritance. And this is not what I wanted to see from him, either: "Markets have settled into an eerie calm this Holy Week. But that doesn't mean that the pressing issues confronting investors have been resolved. Rather, trade uncertainty has been ratcheted up to a previously unimaginable level," adds John Authers. "The enthusiastic post-election 'Trump Trade,' which involved pouring into US assets over anywhere else, and favoring risk assets, has been reversed, with no clear new direction to replace it." Snuggle up, folks, it's getting chilly out there. Bonus Meltdown Reading: One of the great things about the US is how it manages to mismanage itself in so many ways, but then gets its act together when crunch time comes. Think how America built the world's greatest military after Pearl Harbor; won the race to the moon after the Sputnik scare; came up with the Snuggie only 10 centuries after Jason and the Argonauts found the prototype. Yep, there is nothing Americans can't do with a little ingenuity, creativity and elbow grease. Well, that and our universities. Think about it: Without Stanford there is no Silicon Valley, without the University of Chicago there is no Manhattan Project, without the University of Florida there is no Gatorade, and without Harvard there is no … Harvard. And Donald Trump is doing his best to make that happen, withholding $2.2 billion in federal grants from America's oldest, most esteemed and steadfastly insufferable institution of higher learning. Noah Feldman, whose paycheck may be on the line, lays out the university's best strategy to snatch the cash. "The most resonant, principled argument Harvard can make about the cuts," he writes, "is that the Trump freeze violates Harvard's First Amendment rights. In essence, Harvard is saying, Trump is trying to condition federal funding on the university speaking the way he wants it to. That's called an 'unconstitutional condition.' The government can't take away some benefit to which you are entitled on the condition you give up a constitutional right like free speech." (Noah's looking good on video here.) If the government refuses to turn over the greenbacks, all those brainy people might just look for greener pastures, warn Lara Williams and Mark Gongloff. "There's a growing chance that the Trump administration's indiscriminate attacks on science will prompt the kind of brain drain that's affected Russia and other places in the grips of authoritarian regimes," they write. "Such an exodus would have global implications and undermine one of America's great strengths." When Italy's Prime Minister Georgia Meloni isn't cosplaying The Lord of the Rings or stalking chat rooms as a dragon, she's been busy toadying up to Trump and trying to cut a sweetheart deal with Elon Musk. "It's always a good time to try personal flattery and ego-stroking with this president," is the advice Lionel Laurent gives the White House-bound populist. "The question for Meloni to ask is: What, if anything, does the US really want?" Tariff money, for one. While we look back in anxiety over what happened in 2008, Dan Moss is reaching further back — to 1971, when President Richard Nixon chose to end the system of fixed exchange rates. "The dollar's time as the anchor of world commerce was coming to a close — or so a popular narrative has gone," he recalls. But it didn't happen then, and no matter how badly Trump's Liberation Day shook the world, Dan says, "the advantages of incumbency are so significant, and would-be rivals have too many important drawbacks, that the dollar looks impregnable." Women Went to Space, But Men Still Want to Own It (free read) — Beth Kowitt AI Needs Your Data. That's Where Social Media Comes In — Dave Lee China's Boeing Ban Is Inviting Scrutiny on Its Own Planes — Matthew Brooker The US Has Greenland (and Foreign Policy) Exactly Upside Down. — Andreas Kluth If Japan Can't Get a Good Trade Deal, Can Anyone? — Gearoid Reidy The ECB Should Wheel Out Its Monetary Bazooka — Marcus Ashworth When Will China Start to Devalue the Yuan? — Shuli Ren A Singapore soap opera worth billions. The Pentagon is a leaky ship. Is Andrew Cuomo artificially intelligent? Governor Stefanik? This racoon passed the Tide pod challenge. Don't get stuck in the elevator with her. 3 BR/2 BA/1 torture BSMT. Notes: Please send comments and Skittles Snuggies to Tobin Harshaw at tharshaw@Bloomberg.net

|

No comments:

Post a Comment