| Plus, are the US and China decoupling? |

| |

| Welcome back to The Forecast from Bloomberg Weekend, where we help you think about the future — from next week to next decade. This week we're looking ahead to the ECB's rate decision, the potential for US-China decoupling, US-Iran negotiations and more. Oh, and Katy Perry is going to space. | |

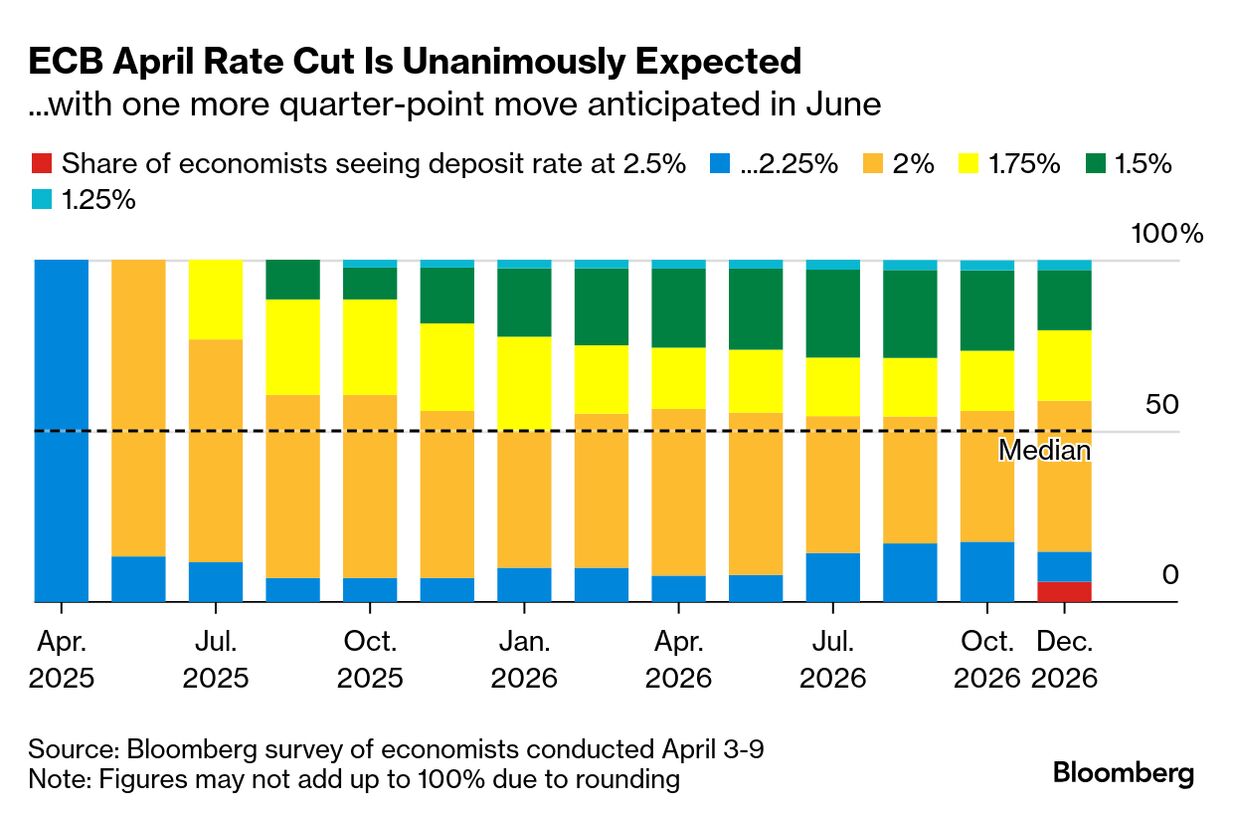

The ECB Responds to the Trade War | |

| Even after Donald Trump's decision to pause some of his "reciprocal tariffs" for 90 days, a significant hit to economic growth is now expected in Europe. That makes it increasingly likely that the European Central Bank will cut interest rates for a seventh time next week. Many policymakers refrained from signaling a preference, but conviction among investors and economists has grown that US tariffs will push them into another reduction from the current 2.5% level. Across the bloc, companies and consumers are becoming less confident. There's also the euro, which hit a three-year high on Friday. A stronger currency makes imports less expensive, putting downward pressure on consumer prices. Energy costs have also cratered in recent days. All of that's happening with inflation already nearing the ECB's goal of 2%. Economists polled by Bloomberg see rates settling around there, though some see a rising chance that they'll have to fall further if market conditions stay this way. That would mean pushing monetary policy into an accommodative stance. More cautious ECB officials point to the large-scale fiscal stimulus that's being prepared by the German government. The question is whether the impact will arrive soon enough to warrant a reaction from the central bank. That's likely to become a key point of discussion when the Governing Council meets on Wednesday and Thursday. — Alexander Weber, Bloomberg News | |

| |

| Jamie Dimon "expects 'a kerfuffle' in the US Treasury market that prompts a Federal Reserve intervention." — Hannah Levitt, Bloomberg News "A gauge of forward guidance that compares corporate forecasts with the Wall Street consensus has sunk to its lowest in a decade," as companies withdraw guidance in response to tariffs. — Katrina Compoli, Georgie McKay, and Jaewon Kang, Bloomberg News "Apple is unlikely to move iPhone production to the US in the foreseeable future." Its biggest facilities in Asia are "almost towns themselves" and the US lacks the labor, facilities and suppliers to support them. — Mark Gurman, Bloomberg News The "Beauty Salon recession indicator" is flashing red: "Stylists from Manhattan to rural New Hampshire are seeing regular clients start to skip cuts and blowouts… It echoes 2009, when the media dubbed a do-it-yourself styling phenomenon 'recession hair.'" — Ben Steverman, Bloomberg Businessweek Owning your refrigerator is "so last decade." That's why Jessica, a documentary writer in Seoul, purchased LG's appliance subscription instead. — Yoolim Lee, Tech In Depth newsletter | |

| |

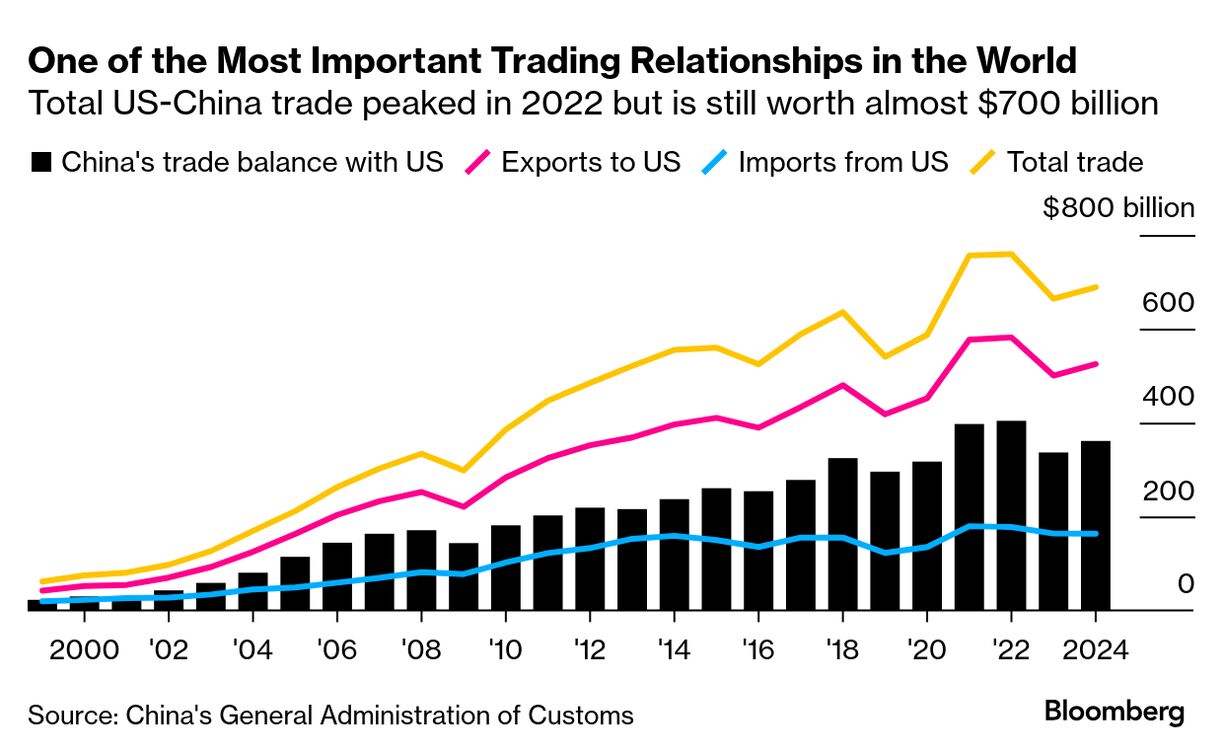

| The $700-Billion Question Are the US and China on the verge of economic decoupling? With tariffs on both sides exceeding 100%, $700 billion in goods traded each year between the two countries are suddenly at risk — as well as potentially the flow of investments, people and ideas between the world's two largest economies. So far, neither side has signaled much appetite for detente. The White House says Trump "has a spine of steel and will not break." Beijing, meantime, has vowed to "fight to the end." In the medium term, if these tariffs stick, trade between the two countries could be eliminated almost entirely. Longer term, Bloomberg's Daniel Ten Kate contemplates a frightening possibility: "It's become clear that the US and China are reshaping the global economy to prepare for a war with each other that neither actually wants," he writes. "Everyone else on the planet must deal with the fallout, while thinking long and hard about whether to trust either country — or to arm up themselves." — Bloomberg Weekend Read more: | |

| |

| |

| |

| |

| Sunday: Ecuador holds its presidential run-off. Monday: Goldman Sachs reports earnings; China reports exports; former South Korean president Yoon Suk Yeol's trial begins; a US antitrust trial over Meta's Instagram acquisition begins; Katy Perry will go to space as part of Blue Origin's first all-female crew. Tuesday: Bank of America and Citigroup report earnings; Canada, France, India, Israel, and Saudi Arabia report CPI; the UK reports jobless claims. Wednesday: The US reports retail sales; China reports GDP; Canada's central bank will most likely hold rates steady, though some analysts expect a quarter-point cut; the UK, Eurozone, Italy and Nigeria report CPI; ASML reports earnings; the WTO publishes its trade forecasts. Thursday: The ECB is expected to cut rates by a quarter-point; Italian Prime Minister Giorgia Meloni meets with Trump; IMF Managing Director Kristalina Georgieva gives a curtain-raiser speech ahead of IMF-World Bank spring meetings; South Korea's and Turkey's central banks both announce interest rate decisions; TSMC reports earnings. Friday: Markets closed in the US, among other countries, for Good Friday; Japan reports CPI. | |

| Have a great Sunday and a productive week. —Walter Frick and Kira Bindrim, Bloomberg Weekend; Alexander Weber, Bloomberg News | |

| Enjoying The Forecast? Check out these newsletters: Explore all newsletters at Bloomberg.com. | |

| |

Like getting this newsletter? Subscribe to Bloomberg.com for unlimited access to trusted, data-driven journalism and subscriber-only insights. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. Want to sponsor this newsletter? Get in touch here. | | | You received this message because you are subscribed to Bloomberg's The Forecast newsletter. If a friend forwarded you this message, sign up here to get it in your inbox. | | |

No comments:

Post a Comment