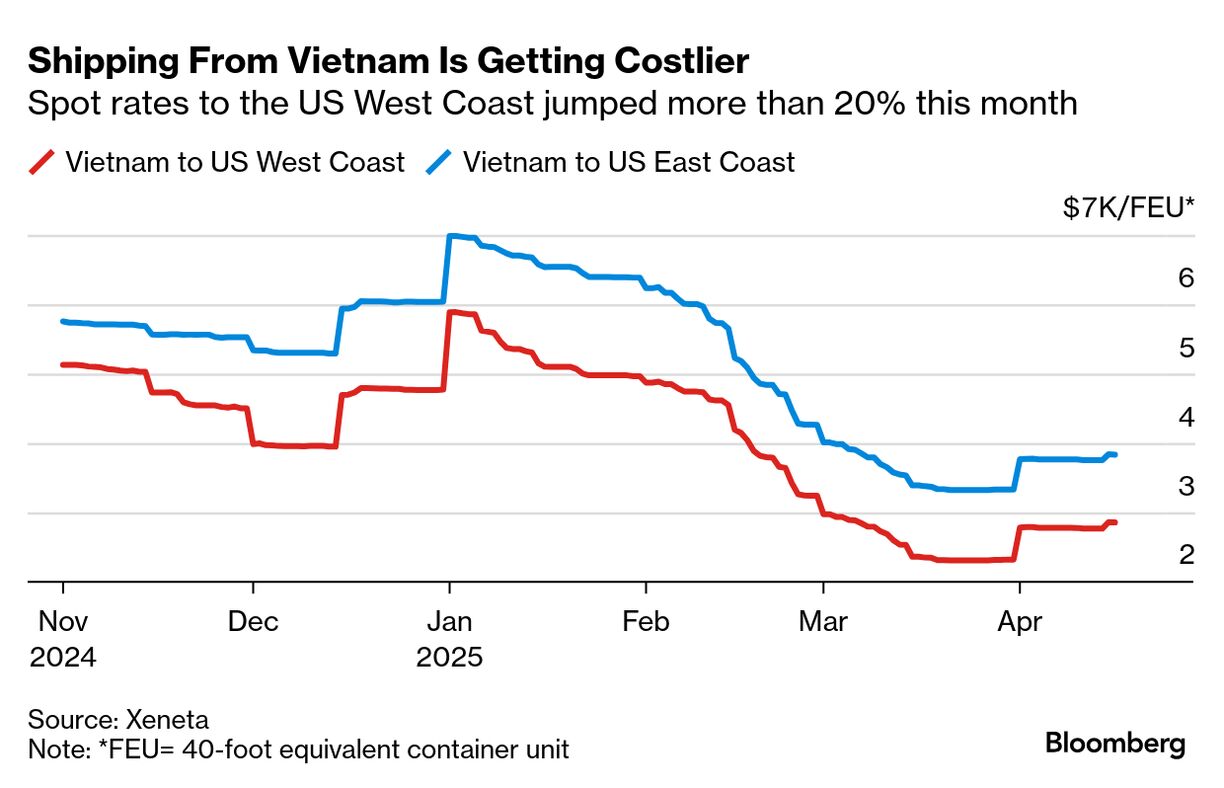

| For exporters in Southeast Asia and especially those in Vietnam, peak shipping season is arriving a few months early amid a surge in demand that's expected to push freight rates higher. The catalyst is a 90-day pause in US President Donald Trump's peak tariff rates, which were proposed in a range of 10%-50% earlier this month. But the higher rates were suspended soon after, with the so-called reciprocal tariff temporarily capped at 10% for every country except China, whose exports to the US are subject to levies exceeding 100%. Read More: Tariff Threat Throws Vietnam's Factories Into Race to Ship Goods Given that they have until early July to import as much as possible before the higher border levies on Southeast Asia nations potentially are reinstated, American cargo shippers are canceling orders from China and sourcing as much as they can from places like Vietnam. As a result, the spot rate to ship a 40-foot container to the US West Coast from Vietnam has jumped about 23% this month to $2,856 as of Wednesday, according to data from Xeneta, a digital freight platform based in Oslo. It's probably headed even higher. "Volumes out of China are significantly down," said Emily Stausbøll, a senior shipping analyst at Xeneta. "I would expect to see spot rates out of Vietnam to continue rising in the coming days and weeks as they don't yet fully reflect the upwards pressure." Global trade wars may contribute to a small contraction in worldwide merchandise trade this year and perhaps an even bigger decline if the US reciprocal rates take effect, the World Trade Organization predicted this week. Mixed messages coming from Washington about tariffs mean companies that ship cargo "are paralyzed," said Sanne Manders, chief operating officer with Flexport, a digital logistics platform. "They know they need to do something, but they don't know what because the context is changing all the time." Record Bookings He described Trump's 90-day reprieve on reciprocal tariffs as an opportunity for logistics managers to reroute their goods through countries like Vietnam, where suppliers are ramping up. Flexport's bookings out of Vietnam earlier this week hit a record, he said. Read More: Vietnam Is Running Out of Sand to Fuel an Economic Boom If that continues in the near term, container carriers will probably start charging a premium to ship goods from Southeast Asia and Vietnam's ports might become congested, Manders said. Both of those would put upward pressure on shipping rates. Some importers in North America are also looking at costlier bonded warehousing and free trade zones across where tariff costs can be deferred. That can help importers that have adopted a wait-and-see approach to Trump's trade policies, and those needing to smooth out higher cash-flow requirements. "Ultimately it will come down to retooling your supply chain," Manders said. —Brendan Murray in London Bloomberg's tariff tracker follows all the twists and turns of global trade wars. Click here for more of Bloomberg.com's most-read stories about trade, supply chains and shipping. |

No comments:

Post a Comment