| In 2020, a Melbourne-based developer, Beulah, proposed a A$2.7 billion project to build Australia's tallest skyscraper, but five years on, the project still doesn't have a builder due to soaring construction costs.

Australia's pension funds control a combined A$4.2 trillion, a lot of which is held in offshore assets with direct and indirect exposure to Trump's tariff war. This week on the podcast, host Chris Bourke and ASFA CEO Mary Delahunty unpack the major parties' election platforms relating to retirement savings.  The Reserve Bank of Australia said its next rate-setting meeting in May will provide an "opportune time" to revisit policy settings. It pointed to further clarity on "the likely evolution of trade policies," in addition to jobs and inflation data that will inform its decision on borrowing costs.

Rio Tinto iron ore shipments fell to a six-year low in the first quarter after tropical cyclones disrupted exports. The 70.7 million tons shipped fell below analyst estimates, but have not led the miner to alter its full-year guidance. Australia's top polluters are relying on carbon credits to reduce their impact on climate change and have made only small reductions to actual emissions, new data shows.

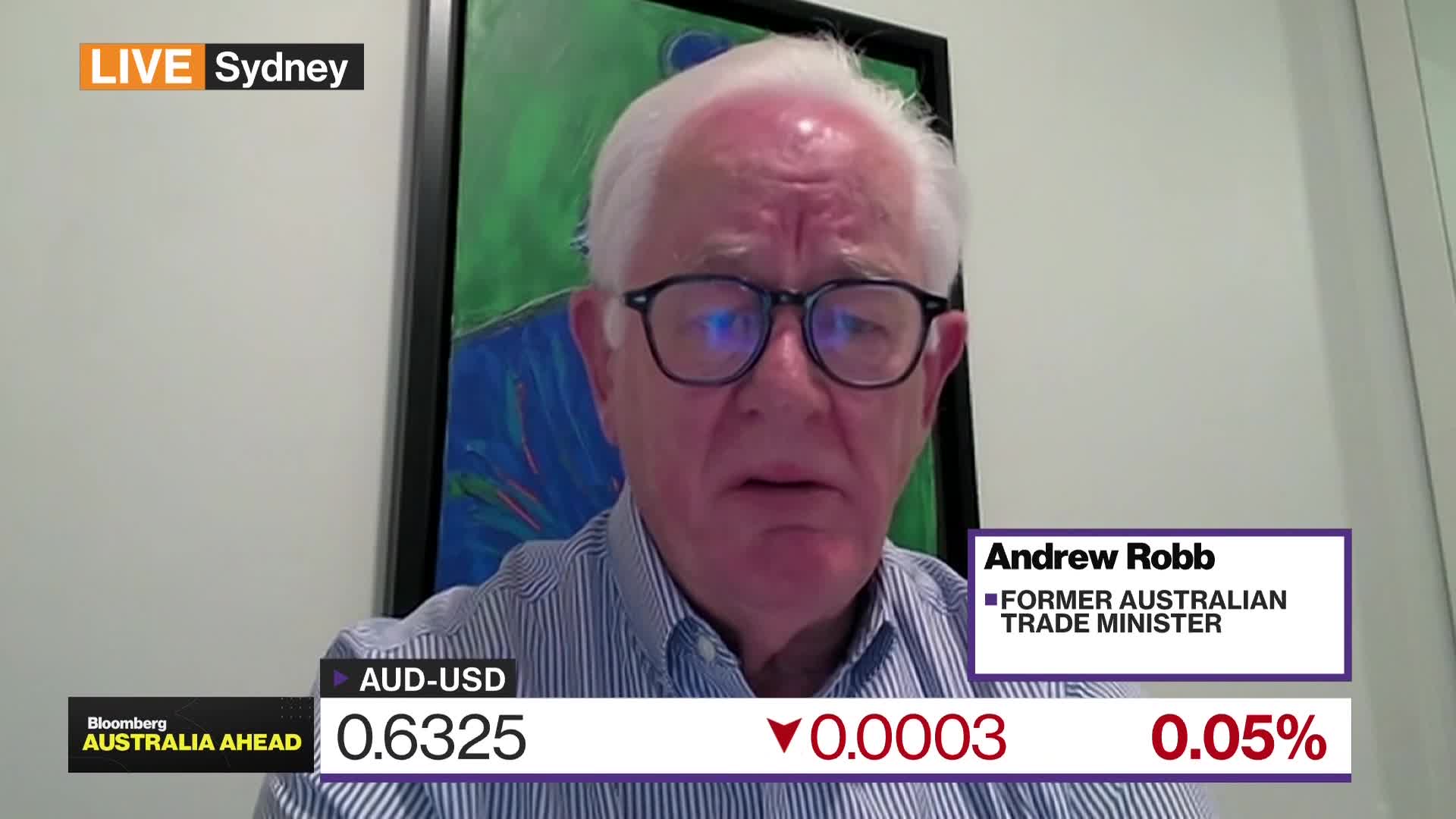

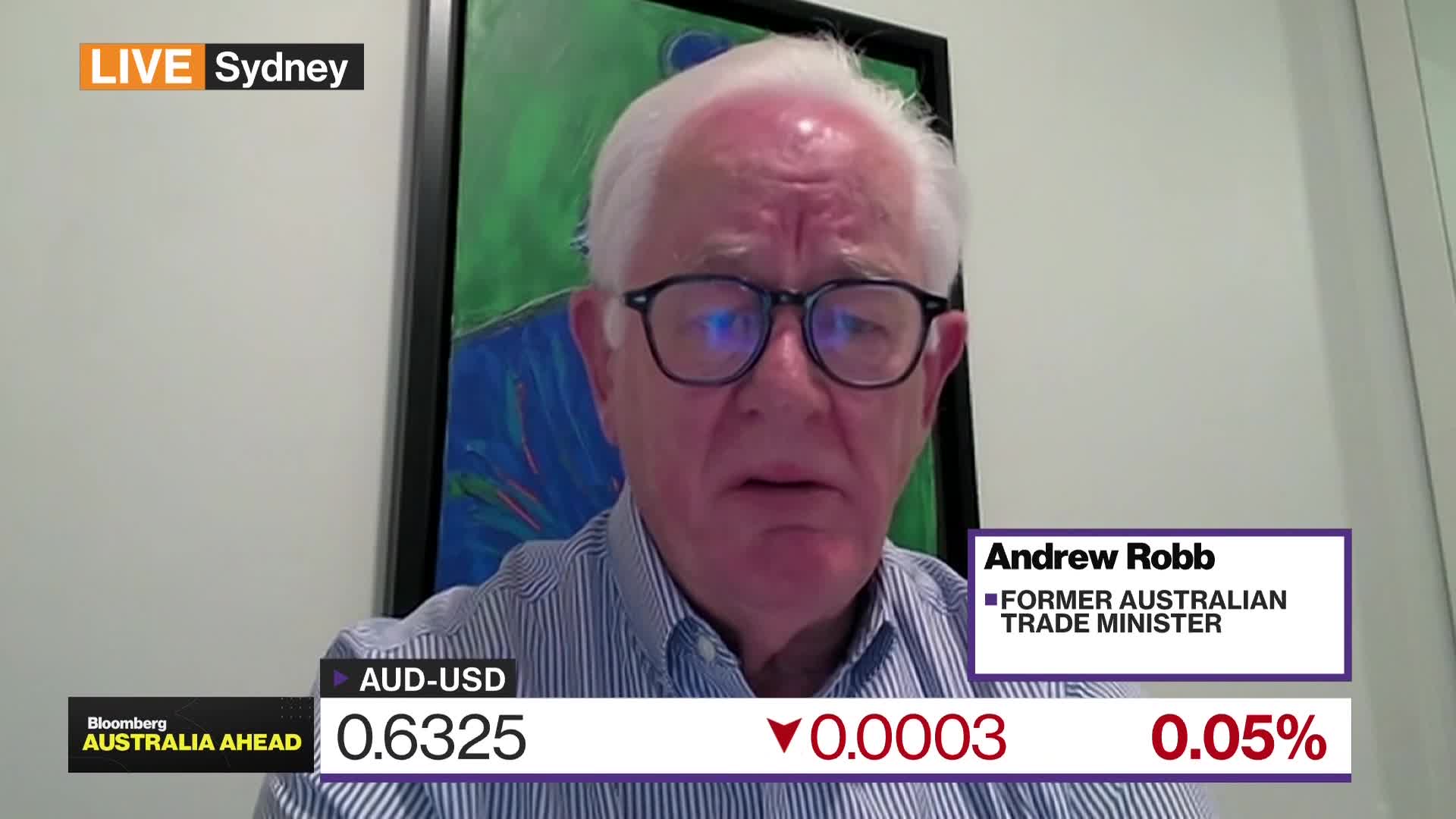

Australia should steer clear of the trade friction between the US and China, former Australian trade minister Andrew Robb, said on Bloomberg's Australia Ahead. He sees "no justification" for Australian goods to face a 10% levy from Washington. Click the image to watch.  Andrew Robb, former Australian trade minister. Click the image to watch. Bloomberg Star Entertainment suffered a A$136 million loss, according to delayed first-half results that showed a 25% drop in revenue. The results reveal the pressures facing the company, which last week agreed to a funding deal that could hand control of the business to a US casino group. |

No comments:

Post a Comment