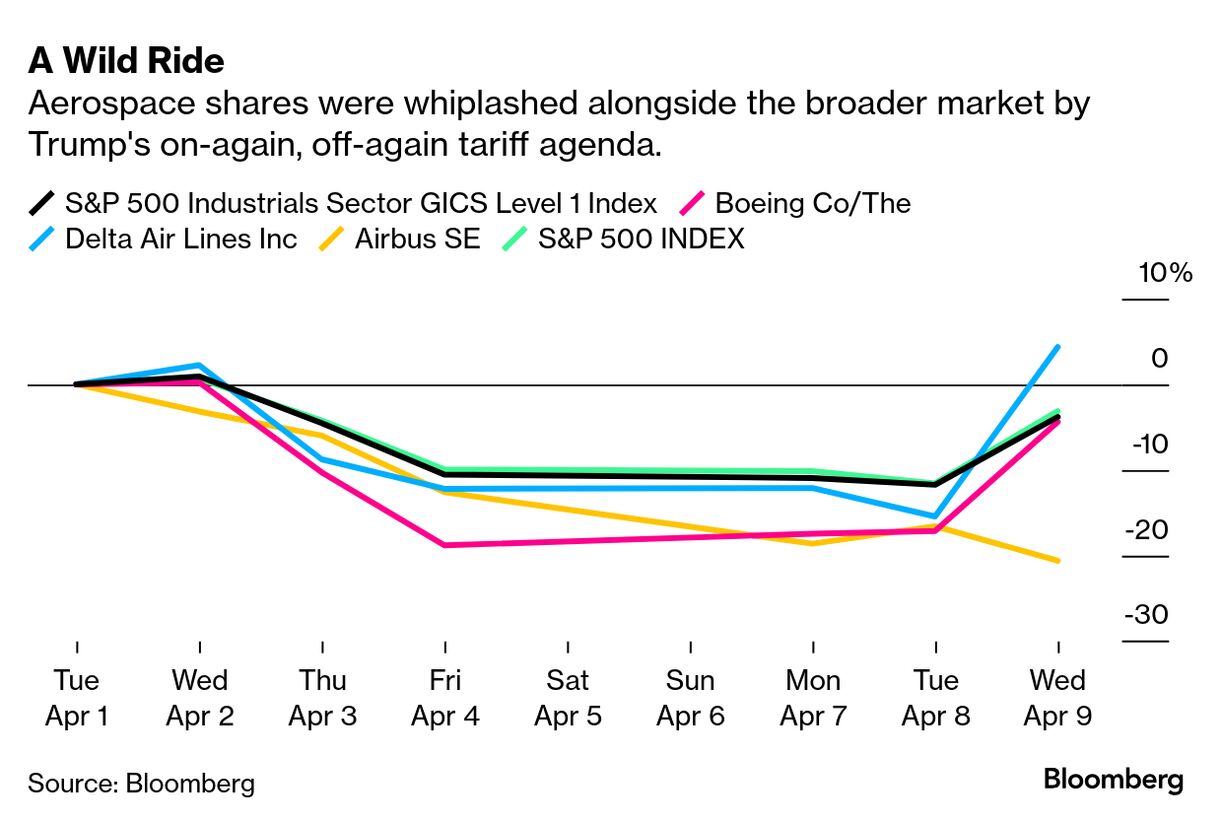

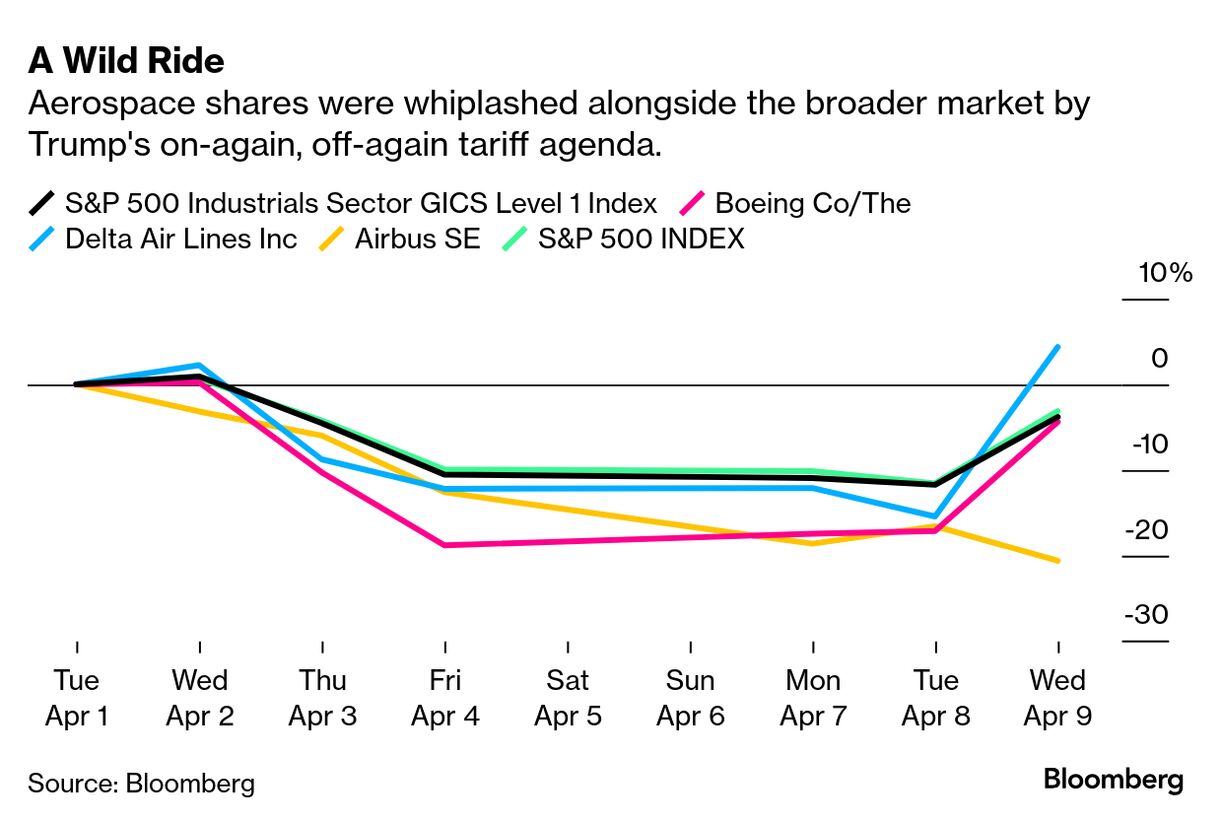

| Have thoughts or feedback? Anything I missed this week? Email me at bsutherland7@bloomberg.net. Also a programming note, there will be no Industrial Strength next week because of the holiday. Look for the next one on April 25. To get Industrial Strength delivered directly to your inbox, sign up here. The worst-case scenario of President Donald Trump's tariff policy has been postponed for at least three months, leaving the world with a still-cripplingly elevated level of import taxes and policy uncertainty. In the weeklong period of chaos between when the sky-high, sweeping "reciprocal" levies were announced and when they were halted, the aerospace industry has offered a real-time lesson on how such tariffs can upend entire supply chains. Delta Air Lines Inc. had the unfortunate distinction of being the first major industrial company to report its quarterly results in the wake of Trump's bombshell announcement last week that the US would slap a 10% tax on imports from nearly every country in the world — as well as an uninhabited island — with higher levies of up to 50% for trading partners whom Trump says have set up barriers to American goods. That 10% baseline will remain in effect during the pause, while levies on Chinese imports are set to ratchet up to at least 145% as the country retaliated with a 125% tariff on American goods. Read more: CEOs Gird for Recession Even After Tariff Reprieve Boosts Stocks

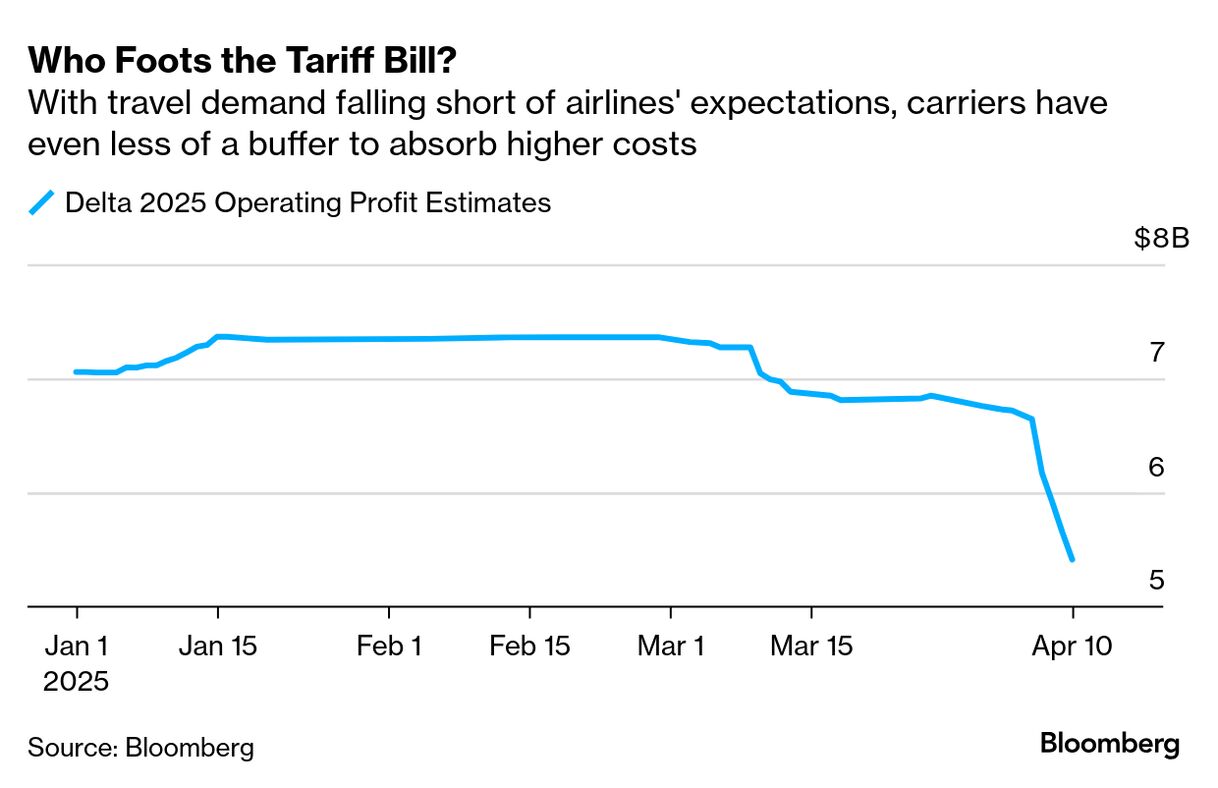

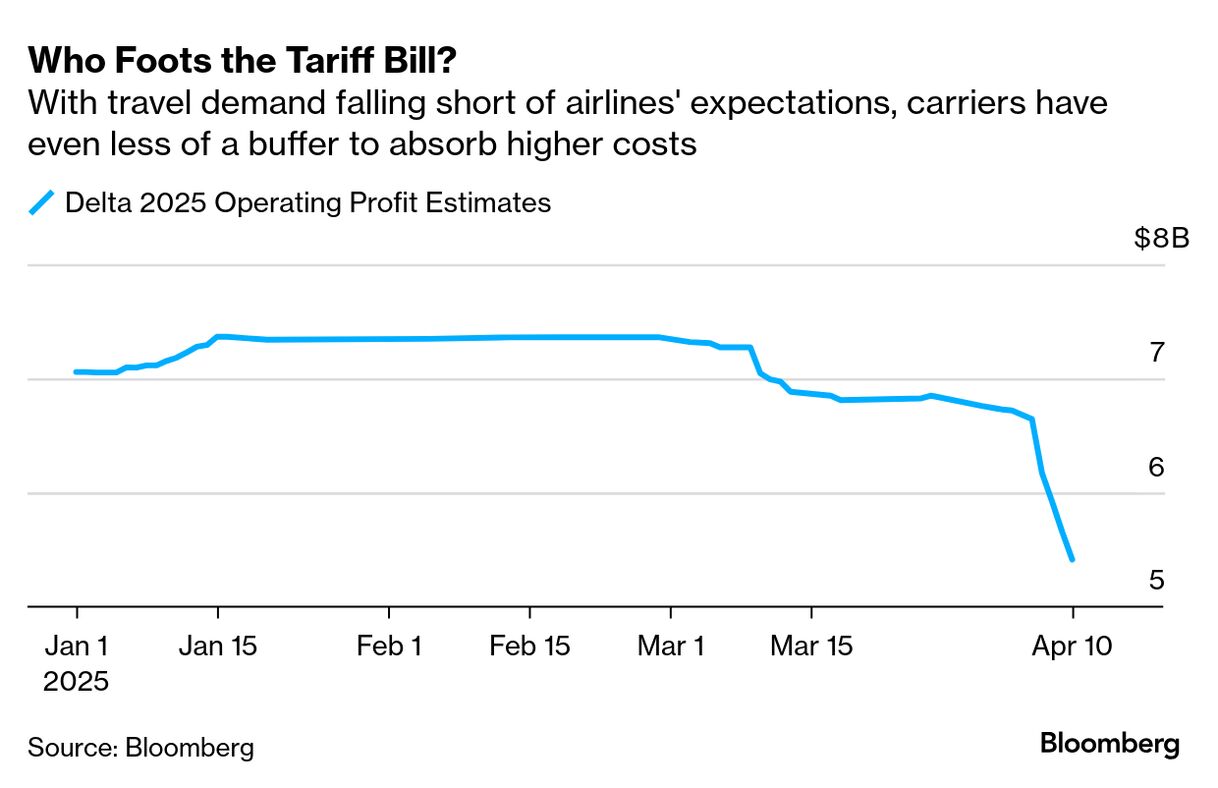

Delta pulled its full-year financial guidance, with Chief Executive Officer Ed Bastian citing a "lack of economic clarity," and slashed planned capacity growth for the second half of the year to zero. It's a sign that whatever the particulars end up being, Trump's flip-flopping trade policy is going to sap demand for travel. Bastian also said Delta will refuse to pay any tariffs on aircraft from European planemaker Airbus SE, which accounts for all of its expected deliveries this year. Airlines operate with slim profit margins in the best of times: Heading into this year, analysts on average were expecting Delta to earn only about 12 cents in operating profit for every dollar of sales this year. That forecast has already been lowered by about 20% amid cratering demand growth expectations, leaving Delta with an even slimmer buffer with which to absorb higher costs from tariffs. Passing those taxes on to the flying public risks only further exacerbating the pullback in consumer travel spending — and ultimately undermining demand for new jets, engines and other plane parts.  "These times are pretty uncertain, and if you start to put a 20% incremental cost on top of an aircraft, it gets very difficult to make that math work," Bastian said. During Trump's last trade war, Delta sidestepped millions of dollars of US tariffs on European jetliners by initially routing its new Airbus jets to far-away places such as Amsterdam and Tokyo and formally basing them overseas. Because the levies only applied to new jets that hadn't yet flown for any reason other than testing and delivery, Delta didn't have to pay the import taxes even as some of the planes eventually made their way into the US. It's not clear if that workaround would succeed this time. But if the airlines won't pay the tariffs, then who will? In a standoff over who ultimately eats the added cost of Trump's import taxes, the most likely immediate outcome is paralysis.

Howmet Aerospace Inc., a supplier of fasteners and other metal parts for both Boeing Co. and Airbus jets, has told customers it's declared a force majeure event tied to Trump's declaration of a national emergency to justify his widespread tariffs, Reuters reported, citing a letter from the company. The legal maneuver is meant to give companies the ability to void obligations under contracts in the event of unforeseen and extreme circumstances. In this case, Howmet is seeking to give itself the option of scrapping shipments that are affected by the tariffs.

"It takes just one nut or bolt to stop" the aerospace supply chain from functioning properly, Jefferies Financial Group Inc. analyst Sheila Kahyaoglu wrote in a note. "Now the question is, who's next?" If any of the major engine manufacturers, key avionics makers or even Boeing itself follows suit in declaring force majeure to void contract obligations, that could translate into a complete stop in jet deliveries, she wrote.  Boeing CEO Kelly Ortberg has said that he's most concerned about tariffs jamming up the supply chain and leaving the company without the parts and materials that it needs to build its jets. "That's really, really expensive for us — if we're building our products and we don't have the supply-chain components," Ortberg told employees last month.

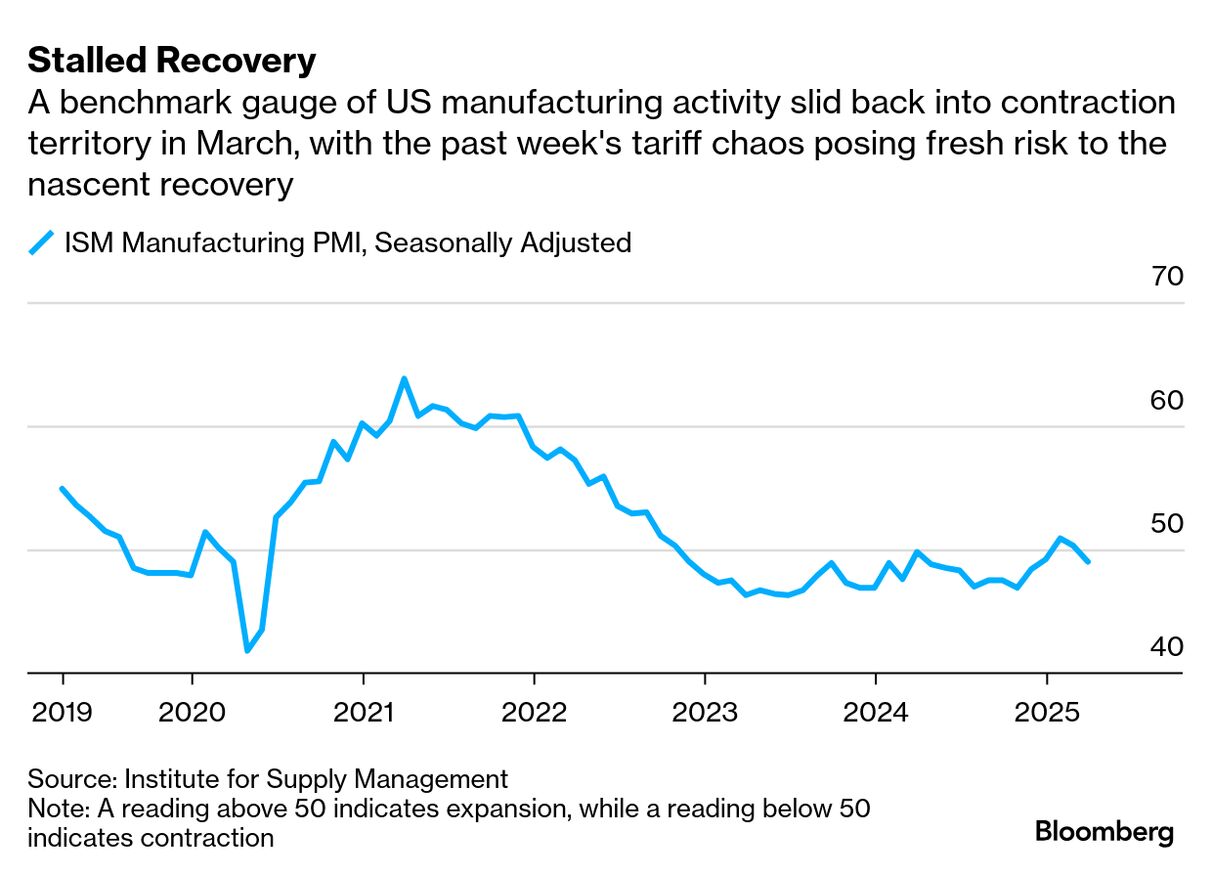

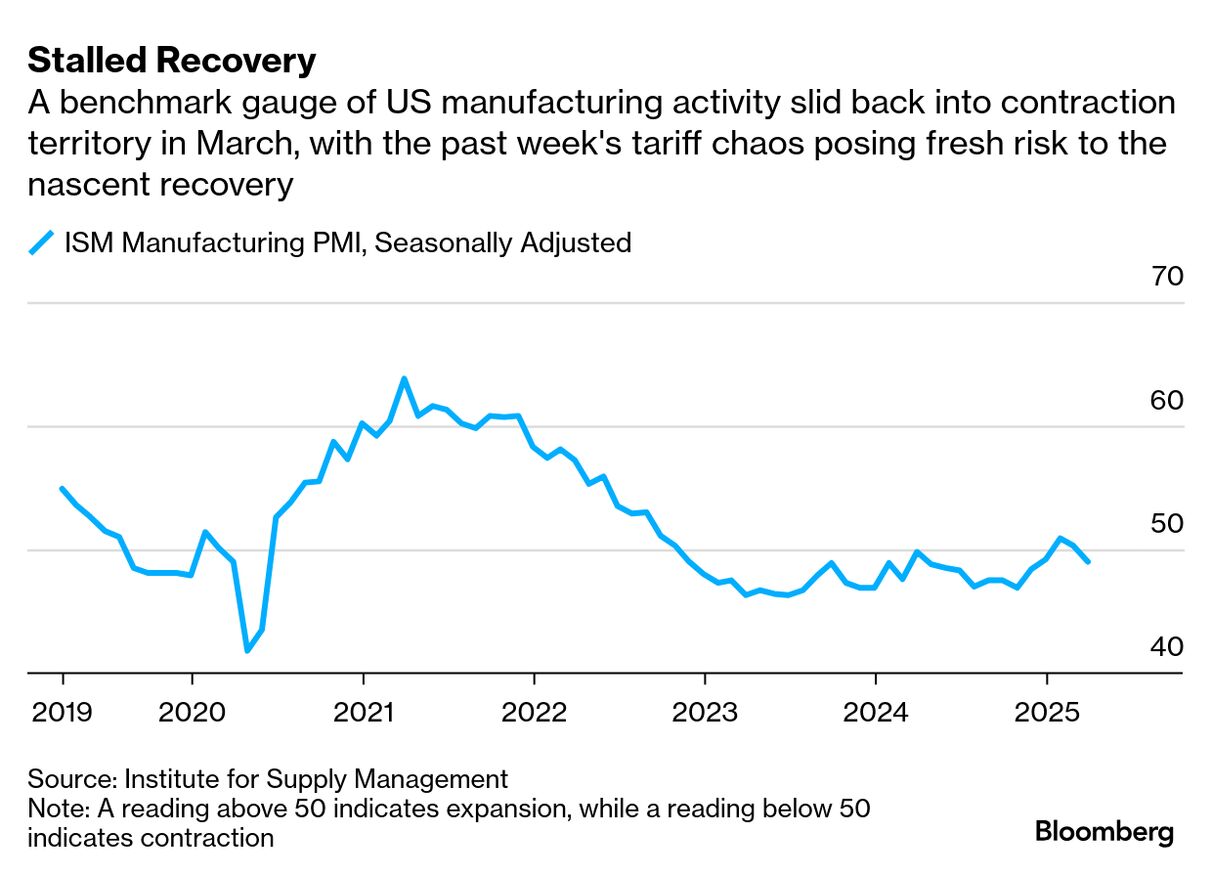

As of now, Trump's levies appear to extend to aircraft parts as well as finished jets, upending a 45-year-old trade agreement that largely allowed the industry to operate without taxes on its supply chain. That will drive up costs for Airbus at its Mobile, Alabama, plant but also for Boeing. While the US planemaker assembles its jets exclusively in America, it imports about 20% of components from around the world. Airbus' operations are more spread out, with final assembly lines in China and Europe that would be less affected by tariffs. Shares of Boeing rallied on Delta's comments in the hopes that the tariffs may steer more US plane orders its way at Airbus' expense. But about 70% of Boeing's current order backlog is linked to non-US buyers, Vertical Research Partners analyst Rob Stallard estimates, meaning the company has a lot more ground to lose in the international market than it stands to gain here at home. China in particular is a major source of future aircraft demand and the escalating tariff volleying puts Boeing at risk of being permanently locked out of that market to Airbus' benefit. China's mainland airlines last placed a major Boeing order in 2017, before Trump's first trade war and a series of safety incidents involving the planemaker.  Should the US put across-the-board 25% tariffs on airplane parts and trade partners retaliate in-kind, the price of a Boeing 787 jet would likely jump by $40 million, Aengus Kelly, CEO of aircraft lessor AerCap Holdings NV, told CNBC last month. "No one is going to pay that," he said. "The airlines who can't afford the airplane will call Airbus. In a worst-case scenario, what would happen over time is that Boeing would end up with the United States — about 20-25% of the global market. Airbus would end up with the rest of the world — about 75-80% of the global market." Airbus has said it could prioritize its considerable backlog of orders from non-US companies if tariffs complicated deliveries to American airlines. That's not a victory for Boeing, nor is it a victory for Delta, which presumably had a reason for buying Airbus jets in the first place and whose fate is closely intertwined with that of global trade and international travel. "The aerospace industry is an export industry, and so a global trade war is most definitely a bad thing," Stallard wrote in a note. "Whether you're a corporate manager trying to figure out whether you want to step forward on an investment, whether you're a bond trader or in the markets trying to allocate capital, or even as a consumer, I think everything has stalled… I think we're acting as if we're going into a recession." — Delta CEO Ed Bastian Bastian made the comments in an interview with CNBC after the company pulled its earnings guidance, slashed its capacity growth plans and pledged to cut costs and adjust spending. While Trump's announcement of a pause on higher tariffs for countries other than China has led economists from Goldman Sachs Group Inc. and elsewhere to dial back their recession forecasts, the average US tariff rate is still rising almost 24 percentage points since Trump started his second term, according to calculations by Bloomberg Economics. Read more: Global Trump Trade Chill Begins as Companies Pause Orders Perhaps most importantly, businesses still have no clarity on what the end game is for this tariff standoff and whether or not there is any kind of permanent off-ramp. It's an impossible environment in which to make any kind of spending decision, raising the risk that the damage from Trump's efforts to reorder the global economy in one fell swoop has already been done. Deals, Activists and Corporate Governance | United States Steel Corp. may get a fresh chance to argue for its planned sale to Japan's Nippon Steel Corp. after President Donald Trump ordered another review of the transaction by the Committee on Foreign Investment in the US. President Joe Biden had blocked the deal on national security concerns after a previous review by CFIUS. The two companies subsequently filed a lawsuit to appeal a decision that they said was actually driven by political reasons. Trump had also criticized the sale of US Steel to a foreign entity during his campaign, and it's not clear that he would bless the full takeover that Nippon wants, either. He later said that he didn't want US Steel to "go to Japan," while also dismissing the prospect of other foreign buyers and asking why the company even needed a deal. Nippon had pledged to invest $2.7 billion in unionized US Steel factories, before accounting for maintenance spending, and had also dangled the possibility of a US government veto over any reductions in production capacity. US Steel has said that without Nippon's financial backing, the company will need to pivot away from legacy blast furnaces, putting thousands of jobs at risk.

CEOs head for the exits. Spirit Aviation Holdings Inc. CEO Ted Christie and Harley-Davidson Inc. CEO Jochen Zeitz both announced unexpected departures this week, with their respective companies now on the hunt for permanent replacements. Spirit emerged from bankruptcy last month after rejecting a last-minute takeover proposal from Frontier Group Holdings Inc. The company had struggled to return to profitability as it faced increased competition from larger airlines for budget travelers and dealt with the impact of an engine manufacturing glitch that grounded much of its fleet. An earlier deal to sell itself to JetBlue Airways Corp. was blocked by antitrust regulators. In his five years as Harley's CEO, Zeitz has grappled with lackluster interest among younger generations for the company's signature motorcycles and higher interest rates that have made such big-ticket purchases more expensive. Harley rolled back some of its diversity, equity and inclusion initiatives last year amid criticism by right-wing activists. A director representing the company's second-largest shareholder resigned from the board this month, citing concerns about Harley's work-from-home policy and the management of its business. - No one knows what Trump wants from tariffs, including world leaders

- Pause or not, damage may already be done from Trump's sweeping tariffs

- US Virgin Islands see opportunity to benefit from tariff loophole

- Explosive tariff battle pushes US and China to brink of decoupling

- Trump launches review of all major defense acquisitions programs

- Trump administration is revising China ship fees to protect exports

- Soaring China tariffs leave both retailers, suppliers powerless

- Blackstone bets US warehouse demand can withstand trade turmoil

- Three-way hit from tariffs makes Audi's best-selling SUV unsellable in US

- China reacts to tariffs with rare earth curbs that hit manufacturing

- Jeep maker Stellantis offers to help suppliers defray tariff costs

- Businesses freeze hiring, raise prices to deal with Trump's import taxes

- 2016 boost to de minimis exception shows where trade went wrong

- Classic cars score rare exemption from Trumps' sweeping tariffs

|

No comments:

Post a Comment