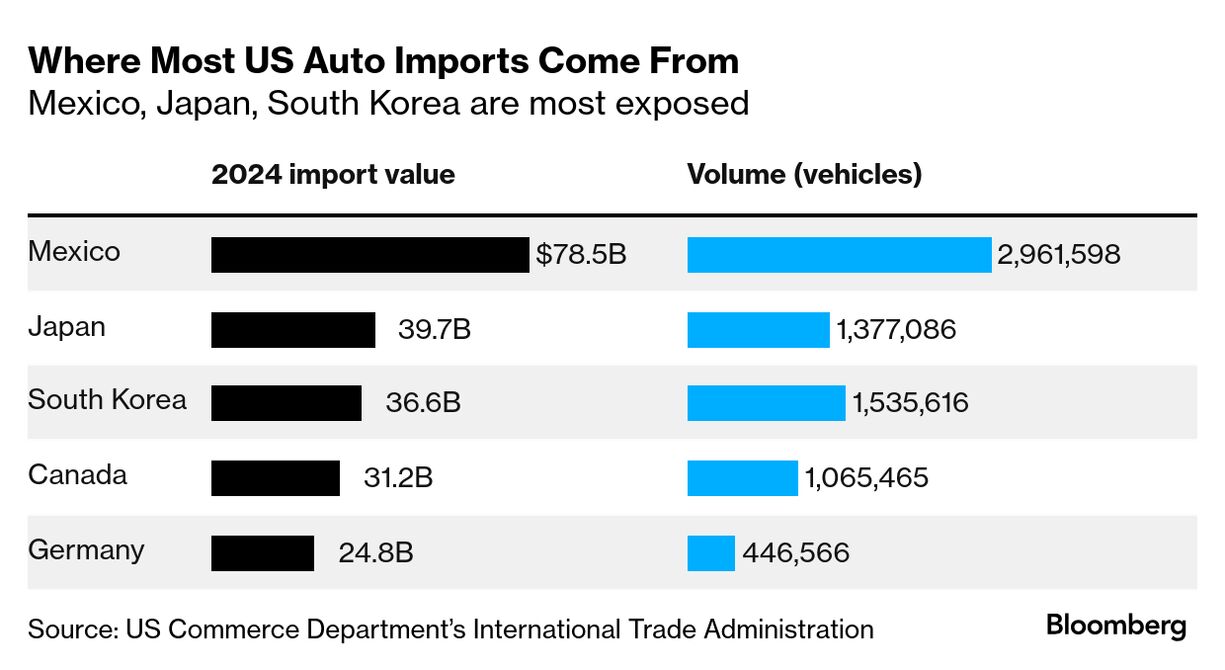

| Thanks for reading Hyperdrive, Bloomberg's newsletter on the future of the auto world. Donald Trump's sweeping tariffs have cast a dark cloud over Japanese automakers, with the already-ailing Nissan potentially facing the biggest hit. The US is the largest market for Japan's five main carmakers, accounting for around 23% of Toyota's global sales last year, 28% of Nissan's and 71% of Subaru's, according to Bloomberg Intelligence. Of the roughly 5.9 million vehicles that Japan's manufacturers sold in the US last year, roughly half were imported. While Japan's automakers operate two dozen US factories that will help alleviate the pain, some already were struggling. Nissan, in particular, is in the throes of a crisis that the tariffs will only exacerbate. Trump's 25% tariff on auto imports, which went into effect April 3, could raise US car prices by more than 14%, according to Christopher Richter, senior analyst at CLSA Securities Japan. Even before the tariffs were imposed, new cars in the US were approaching an average price of $50,000, putting them out of reach for many Americans, especially with relatively high interest rates. Trump's tariffs will send car prices up even further, rendering vehicle ownership an "upper-middle class activity," CLSA's Richter said. "It's bad news all around." The cost of shouldering the 25% tariff equates to one-third of the ¥4.7 trillion operating profit Toyota has forecast for this fiscal year, according to Bloomberg Intelligence. Even so, BI reckons the world's biggest carmaker is the least vulnerable among Japanese manufacturers, thanks to its strong profit base and diversified global presence. For Nissan, the math is much more grim, with the cost of the tariffs equating to 336% of operating profit, BI estimates. Nissan is the most vulnerable because of its slim profit margins, excess production overcapacity and profligate spending on incentives. The vehicles Nissan produces in Mexico account for a substantial share of US sales. These models included the Sentra, Versa, Kicks, and Infiniti QX50 and QX55. The rest of Nissan's US sales were produced domestically or imported from Japan. "Nissan was already saddled with incentives and selling poorly," said BI senior analyst Tatsuo Yoshida. "The impact will be huge."  A Nissan Motor Co. Infiniti QX 50. Photographer: SeongJoon Cho/Bloomberg Nissan last week stopped taking new orders for Mexico-built QX50 and QX55 sport utility vehicles. It also decided to maintain production of Rogue SUVs at its plant in Tennessee, partially reversing a previously announced plan to cut output as part of broader efforts to restructure its business. The company said it currently has ample inventory at US dealerships that's unaffected by the new tariffs. "We will continue to evaluate the impact, as well as market needs, to make any additional adjustments to production." — By Nicholas Takahashi - Top Honda executive resigns over alleged misconduct.

- UK eases its electric-vehicle sales mandate.

- Jaguar Land Rover pauses exports to US due to tariffs.

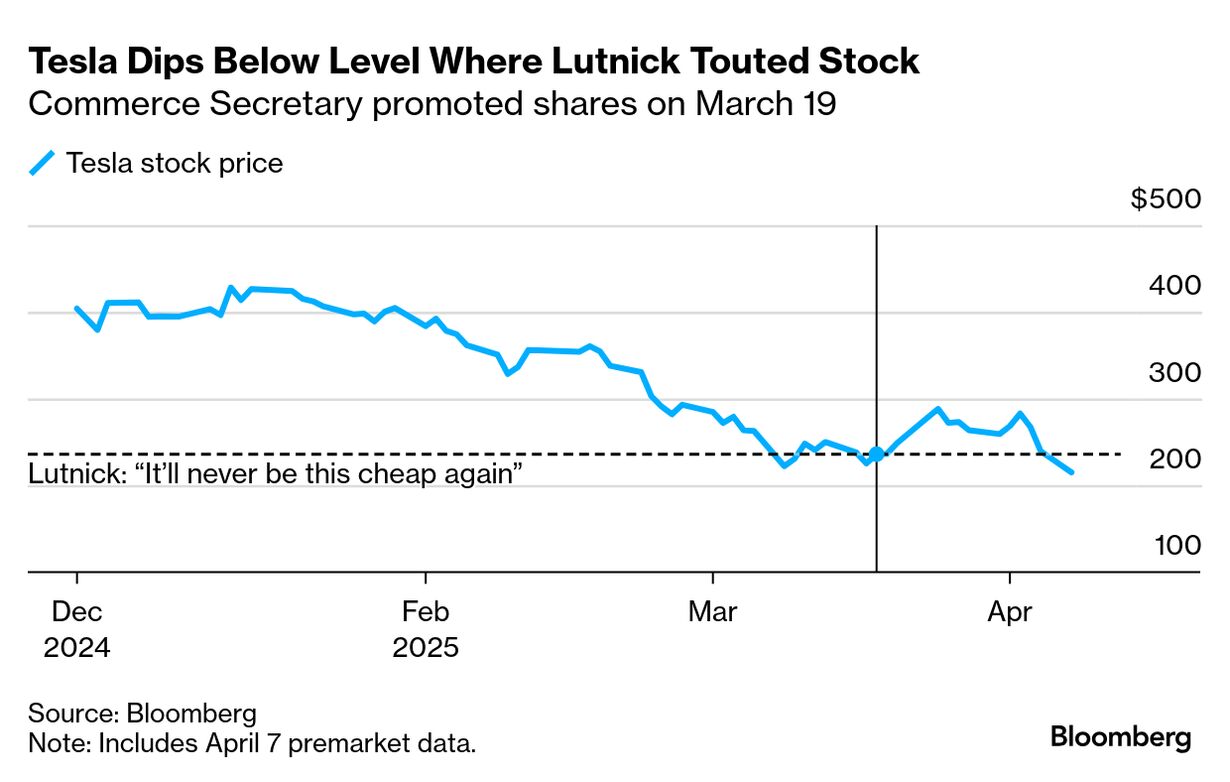

Tesla's stock extended losses in early trading Monday, dropping below a price at which US Commerce Secretary Howard Lutnick predicted they'd never fall to again. The shares plunged more than 10% to $214.80 amid a broader rout in global equity markets. Lutnick said during a Fox News interview on March 19 — when Tesla closed at $235.86 — that viewers should buy the stock, saying "it'll never be this cheap again." CEO Elon Musk told Tesla employees the following day that they should hang on to their shares. |

No comments:

Post a Comment