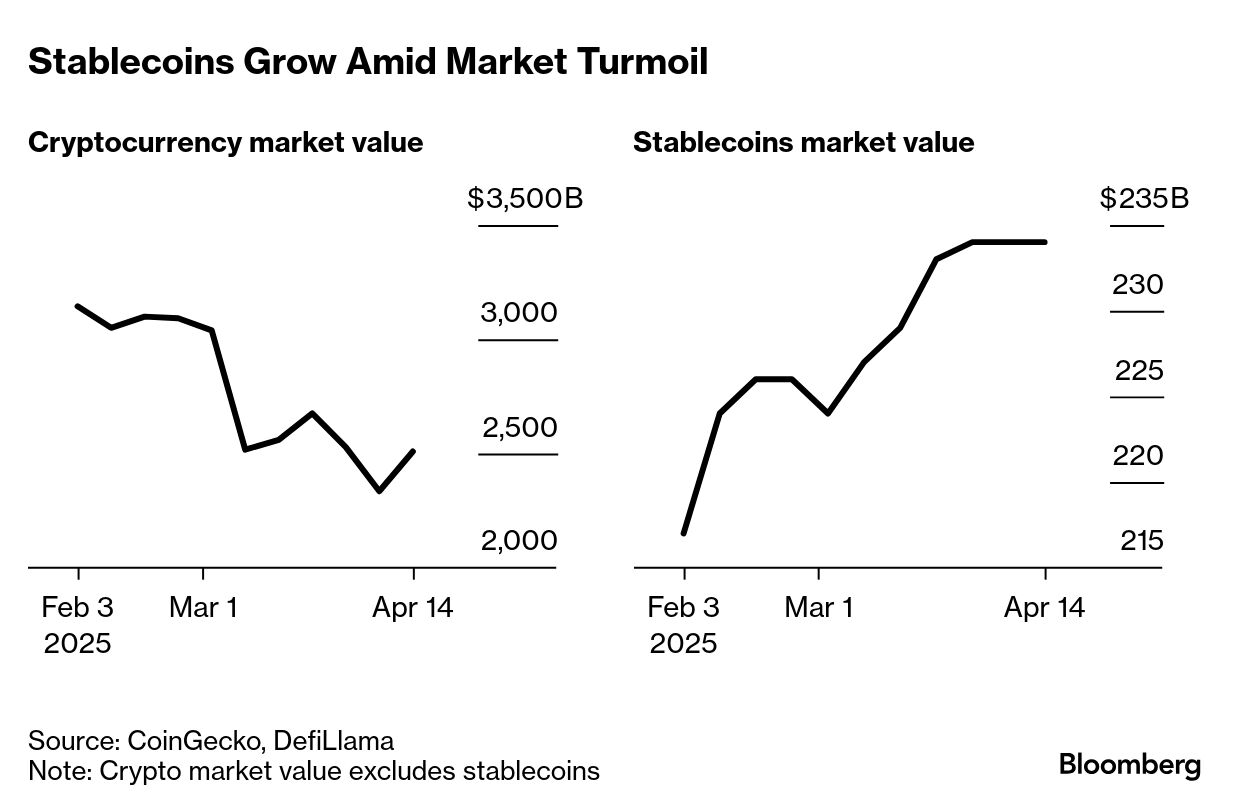

| Suvashree Ghosh finds an oasis of calm in otherwise turbulent market action. As volatility took over global markets over the past couple of months, one part of the volatile digital asset market quietly grew: stablecoins. Often touted as a proxy for cash, crypto investors took refuge in stablecoins in recent weeks as markets swung between risk-on and risk-off mode. Typically pegged one-to-one to the dollar or other fiat currencies and backed by cash and Treasury bills, stablecoins are seen as highly liquid havens for investors who want to move out of crypto tokens without having to exchange into traditional currencies. Stablecoins helped crypto traders sit out the volatility as they waited patiently to re-enter the market, said Greg Waisman, co-founder and chief operating officer at Cyprus-based digital tokens payments infrastructure platform Mercuryo. These are a "safe harbor" for traders since they remove "the volatility so inherent in digital assets while also providing the capacity to quickly re-enter to take advantage of a favorable market move," Waisman said. The total market value of stablecoins rose about 4.5% from the end of February to a new high of about $234 billion this month while the value of all other cryptocurrencies fell 7% to $2.5 trillion, according to data on DefiLlama and CoinGecko. The proportion of stablecoins in crypto transactions increased to about 47% in the first week of April from about 37% in early January, according to data on Mercuryo. There are more than 200 stablecoins in the market, according to DefiLlama, yet the sector is dominated by Tether's USDT with a 62% market share and Circle's USDC with about 26%. USDC's market value grew at a faster rate since the end of February, however, rising about 8% to more than $60 billion versus growth of 1.6% for USDT, according to CoinGecko. It's notable that stablecoins acted as a haven in crypto markets even at a time when the value of US Treasuries — long considered the safest of financial assets — swung wildly. While the turmoil in the market for US government bonds was mostly centered on the longer end of the curve this time, the fact that stablecoins tend to rely on short-dated Treasuries as reserves to back their value should not be lost on investors — not to mention members of US Congress who will be asked to vote on stablecoin legislation — when thinking about what exactly constitutes a "safe" asset, or even if one exists. |

No comments:

Post a Comment