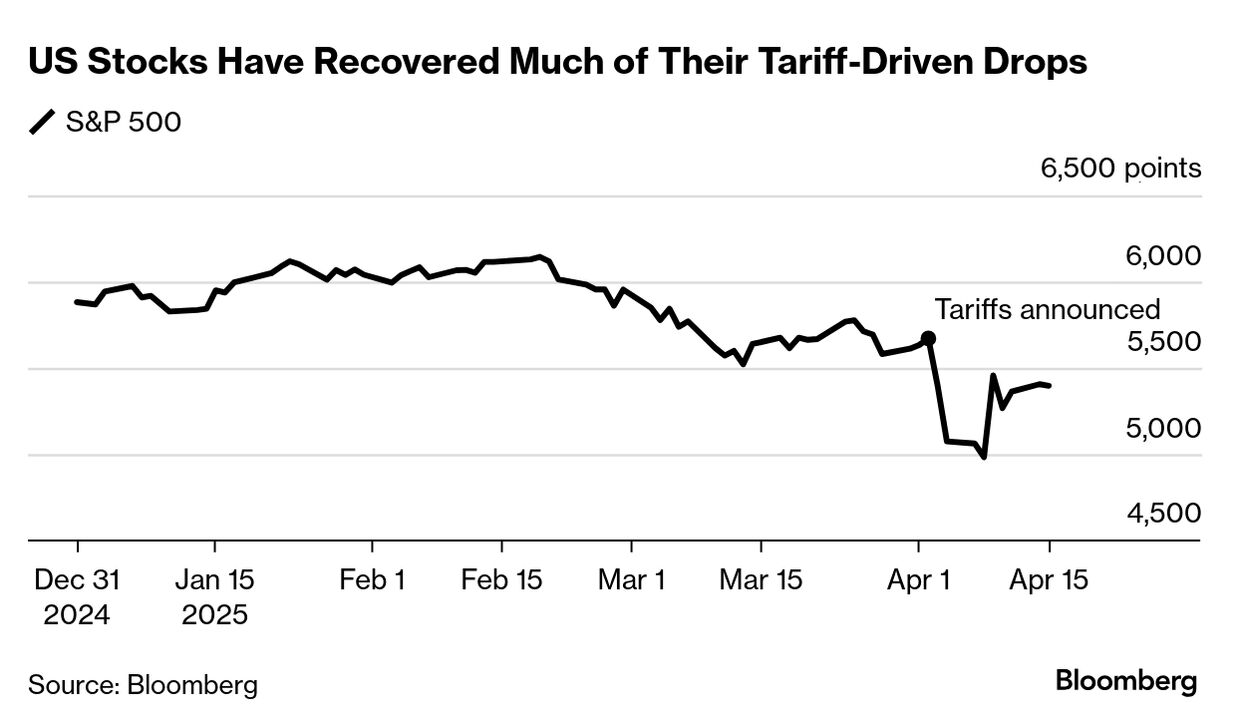

| America's loss is proving to be Europe's gain in financial markets. The euro is the strongest in three years. German 10-year bonds last week beat Treasuries by the most ever. And while European shares have been knocked by the trade war, they're turning out to be far more resilient than American ones. It's the result of a push-pull dynamic, as investors reject the Trump administration's unpredictable and damaging trade policies that are undermining years of US exceptionalism. And where European markets were once seen as something of a backwater, hamstrung by the region's struggle to generate meaningful growth, Germany's recent decision to spend billions of euros on infrastructure and defense is transforming the long-term outlook. "There's this feeling that Europe is just a museum; well, the museum is now coming to life," said Catherine Braganza at Insight Investment in London. It's a remarkable, rapid turnaround from just six months ago, when the US's hot AI stocks, the ascendant dollar and an imminent wave of tax cuts and deregulation dominated conversation. Last week, the dollar, US Treasuries and equities were all falling in tandem, a pattern more typically associated with emerging markets rather than the world's largest economy. A Bank of America global fund manager survey this week found a record number of respondents intend to cut exposure to US stocks. To be sure, 20% trade tariffs are bad news for the EU, and a Bloomberg News report Tuesday suggests few will be lifted for good once the 90-day respite period is over. A US recession, increasingly incorporated into analysts' forecasts, would inevitably drag the rest of the world down with it. But Europe's markets have a lot going for them, a fact that's not lost on some of the biggest names in finance. Goldman Sachs sees the euro pushing higher to $1.20, extending a red-hot rise from $1.01 just 10 weeks ago. Citigroup this week downgraded US equities to neutral while staying positive on Europe. And Vanguard International likes short-dated bonds that stand to gain as the European Central Bank cuts interest rates further. —Alice Gledhill |

No comments:

Post a Comment