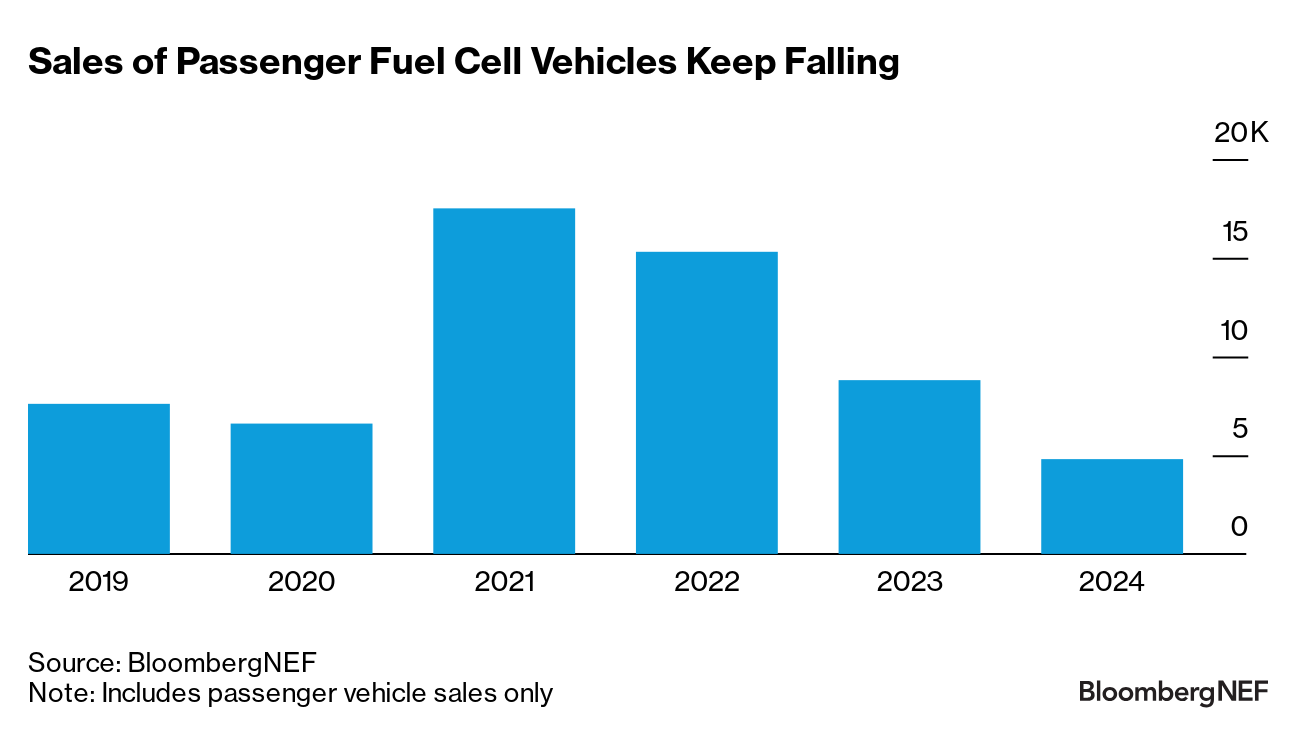

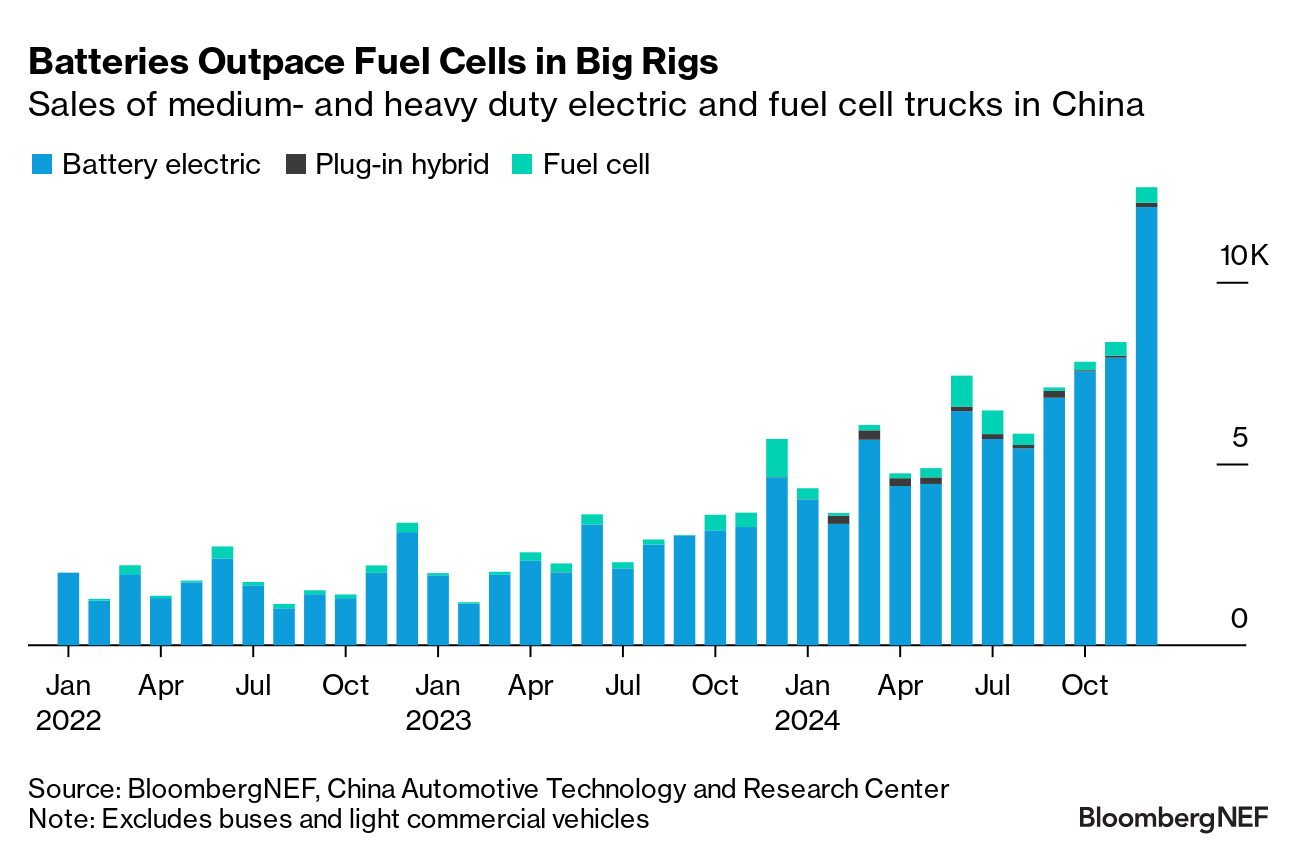

| Thanks for reading Hyperdrive, Bloomberg's newsletter on the future of the auto world. In clean energy, certain technologies come and go. The idea of using hydrogen to power vehicles reliably waxes and wanes every 10 years or so. A growing list of hydrogen fuel cell trucking bankruptcies the last few months indicates another cycle is ending. Trucking was supposed to be the most promising application for hydrogen fuel cells, but startup truckmakers Nikola, Hyzon Motors, Quantron and Hyvia all went under or ceased operations in the last six months. Despite generous incentives available in some markets, these companies struggled to scale up and cover costs. Nikola, for instance, lost more than $900,000 per truck sold, delivering just 250 fuel cell trucks by the third quarter of last year. The others didn't make substantial deliveries.  Fabric draped over a Nikola Tre fuel cell truck before its unveiling at the IAA Transportation show in Hanover, Germany, in September 2022. Photographer: Krisztian Bocsi/Bloomberg Truck manufacturing is challenging, and several companies focused on battery-electric trucks or buses, like Arrival and Proterra, also went under in the last few years. But makers of fuel cell trucks face additional challenges, including the still-high cost of hydrogen, the lack of standardization and sparse infrastructure. These dynamics have played out in previous waves of excitement around hydrogen for road transport, as the realities of cost, efficiency, distribution and infrastructure requirements all eventually reassert themselves. The story on the passenger vehicle side is similarly negative. A total of 4,800 hydrogen fuel cell passenger cars were sold globally last year. That was down from 8,800 in 2023 and over 15,000 the year prior. It's also fewer vehicles than rarefied brands like Ferrari, Lamborghini or even Rolls-Royce delivered last year. Just a few years ago, Toyota claimed that it alone would be producing 30,000 fuel cell vehicles a year by the early 2020s, and a Hydrogen Council report predicted 30 different fuel cell models would be in production by 2025. The actual number was much lower, with five models in some level of commercial manufacturing. None have reached the economies of scale needed to bring costs down. Even Toyota sounds less certain these days, with chief technology officer Hiroki Nakajima stating at the end of last year that he "can't say for sure that it's a bright future for hydrogen." All this negativity hasn't stopped governments from trying to push the technology. The European Union's Alternative Fuel Infrastructure Facility published its latest round of winners in February, awarding €422 million ($455 million) in new grants. Hydrogen projects have now received 24% of the total €1.8 billion awarded through the program, despite there only being 5,000 fuel cell vehicles on European roads. That amounts to €78,000 in infrastructure spending per fuel cell vehicle in circulation, compared to just €86 per electric vehicle, a recent BloombergNEF analysis shows. China's heavy truck market is changing very quickly and is one of the few where hydrogen fuel cell vehicles have gained a toehold. Still, it's a tenuous grip. A total 3,900 fuel cell trucks were sold in China's medium and heavy-truck segments last year, compared to 75,000 electric ones. China consistently has the power to surprise, but in the rest of the world, it's getting harder to see what could reverse this trend. As hydrogen's potential role in road transport narrows further, more names may fall by the wayside.  US President Donald Trump. Photographer: Al Drago/Bloomberg US automakers are making a last-ditch effort to sway the Trump administration on tariffs set to take effect this week, contending that levies on the thousands of parts they source abroad could have catastrophic effects on the industry. Ford, GM and Chrysler parent Stellantis are lobbying the administration to exclude certain low-cost car components from the planned tariffs, according to people familiar with the matter. Executives have met with the White House, the Commerce Department and the office of the US Trade Representative to discuss the exclusion, said the people, who asked not to be identified revealing internal discussions. |

No comments:

Post a Comment