Tariffs rattle supply chains

US President Donald Trump made a partial reversal on his massive tariff plan this week. He suspended higher levies on most countries for 90 days, but doubled down on a trade war with China. The move is threatening to slow down the growth of big battery projects in the US. Energy storage devices large enough to feed the electric grid have been spreading in states like Texas and California (see our story on the Moss Landing project later in the newsletter). The US is heavily reliant on imported lithium-ion batteries — with 69% of these imports made in China, according to research provider BloombergNEF.  Power transmission lines connecting to the Crimson Battery Energy Storage Project in Blythe, California. Photographer: Bing Guan/Bloomberg Solar and onshore wind might fair better in the US relative to other sectors. America's solar industry, a trade war veteran, has been preparing for this moment. As we've reported, developers have been amassing piles of solar panels for more than a year, which could help take the sting out of the new tariffs. The US also has a strong supply chain for onshore wind manufacturing, according to BNEF.

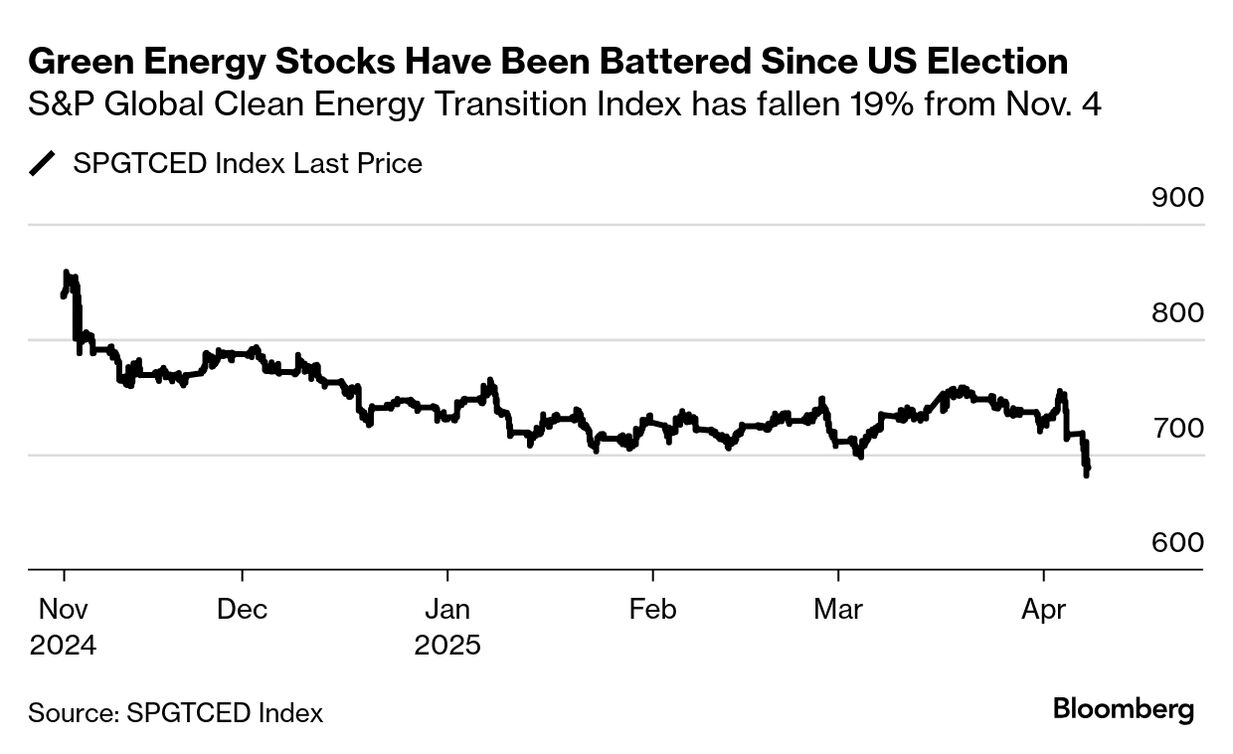

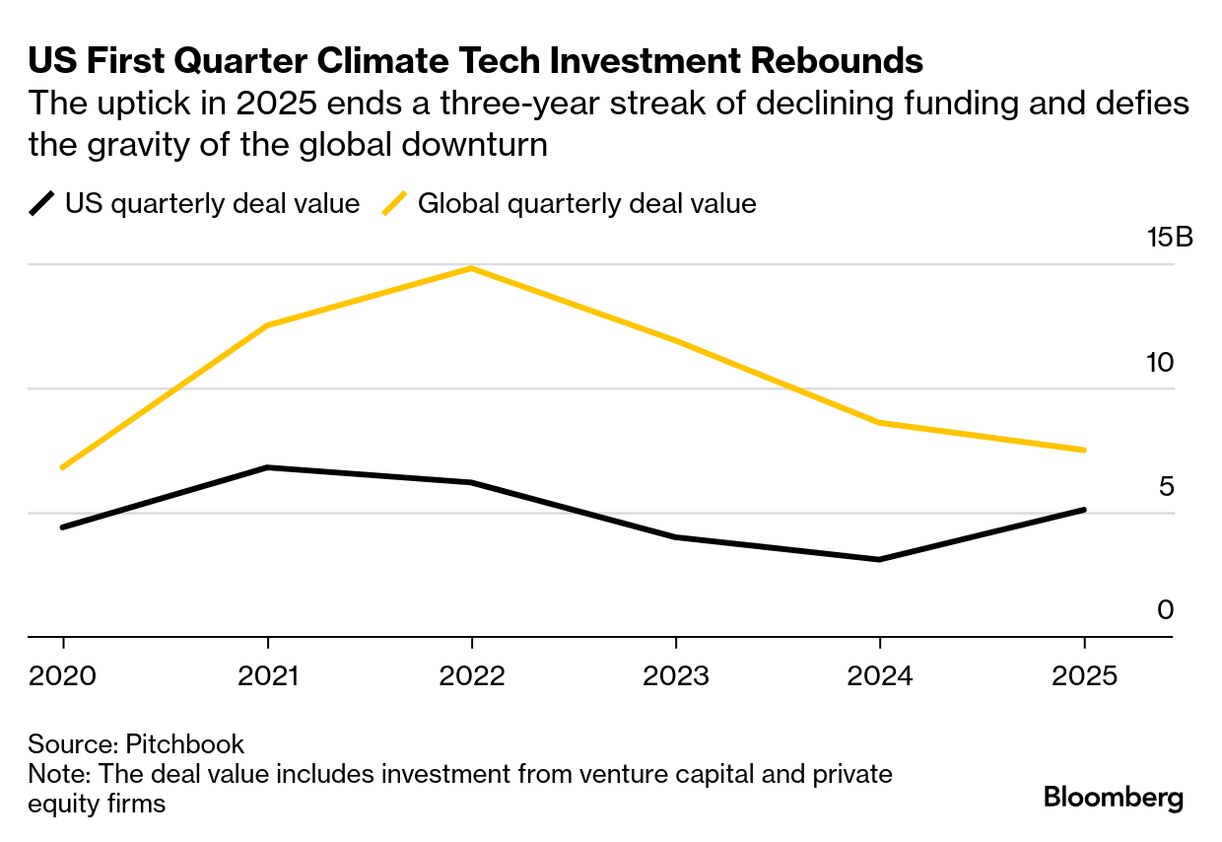

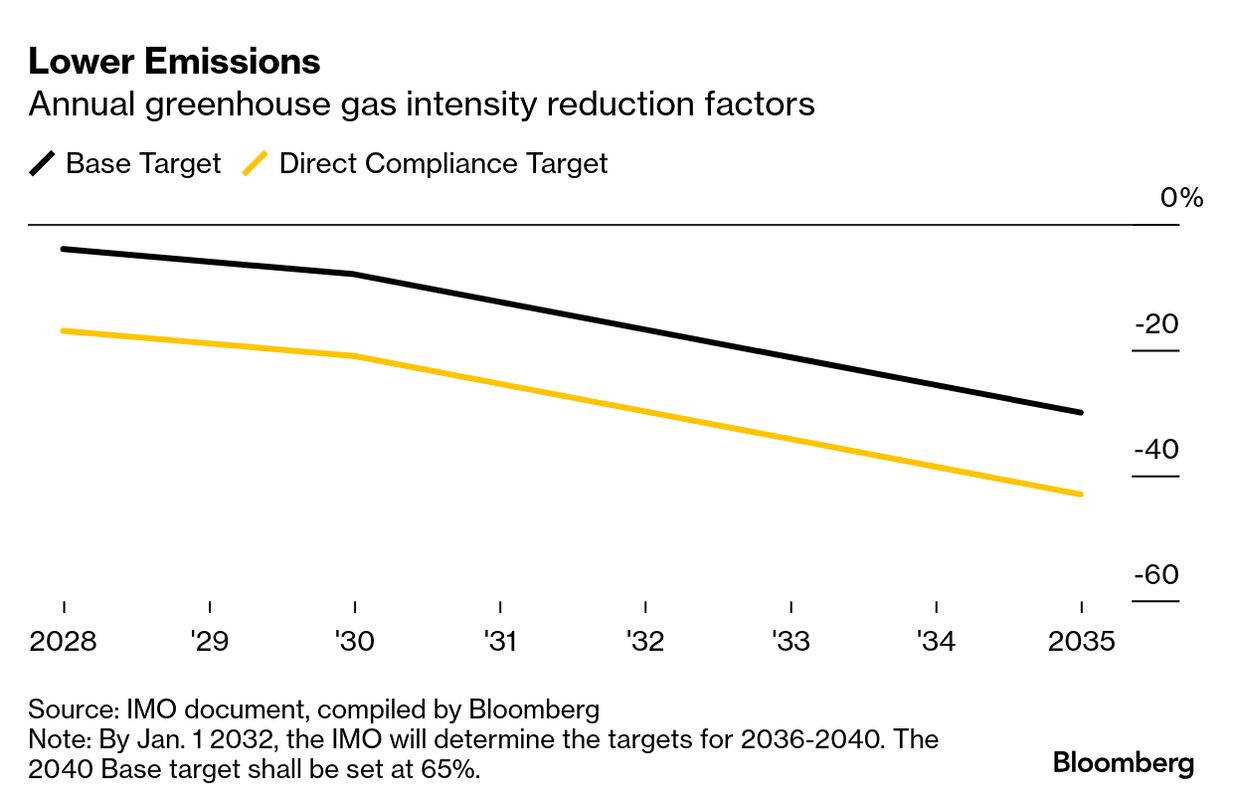

It could be a different story for offshore wind, however. Danish offshore wind developer Orsted A/S said this week it expects to take a hit from tariffs on the offshore wind farms it's building off the US east coast. Public and private markets reactStock markets took a nosedive this week on tariff news — bringing down the already beleaguered clean energy sector as well. Share prices have struggled against Trump's bullish fossil-fuel agenda, and the further fall in valuations may make some publicly-traded renewable energy and clean technology companies interesting targets for acquisition and de-listing, according to private funds and lenders that spoke with Bloomberg News. Meanwhile, despite the White House's anti-clean-energy policies, investors in early stage companies haven't been shying away from the sector. In the first quarter of 2025, venture capitalists and private equity firms poured more than $5 billion into climate tech startups across the country, a nearly 65% uptick compared to a year ago, according to data from market intelligence firm PitchBook. That bucks the global trend in climate tech investing, which dropped 10% in the quarter. Trump gives coal another lifelineThe president signed a raft of measures he boasted would expand the mining and use of coal inside the US, a bid to power the boom in energy-hungry data centers and revive a flagging US fossil fuel industry. Under an executive order, Trump directed Energy Secretary Chris Wright to aid the development of coal technologies, including more ways to put its byproducts to use in batteries, graphite and building materials. The order also mandates efforts to accelerate the export of US coal and move to lower the royalty rates charged for extracting it from federal land. Reporters Ari Natter and Jennifer A. Dlouhy cover the full scope of the measures, including what they mean for pollution rules, here. Trump simultaneously launched a potentially wide-ranging legal broadside against state and local policies he cast as "unconstitutional" measures putting coal miners out of work. The order singles out state laws "purporting to address 'climate change,'" including carbon taxes and other measures taking aim at the greenhouse gases that drive global warming. Amid the chaos, a landmark climate regulation gets approvedShipping's international regulator agreed new rules to slash the industry's future greenhouse gas emissions, paving the way for the end of oil as a maritime fuel in the decades to come. The UN's International Maritime Organization approved draft amendments to MARPOL Annex VI — the main treaty on preventing air pollution from ships — that will force the industry to reduce and pay for at least some of its emissions. The agreement comes despite the US earlier abandoning the talks that forged the rules. The rules still need to pass the potentially significant hurdle of adoption at the IMO, which is scheduled for October. They would then come into force in the spring of 2027 and be legally binding. As reporter Jack Wittels earlier reported, companies that can make lower carbon fuels for shipping have been waiting for an emissions deal. Yara International ASA, one of the world's biggest ammonia producers, said last month it'd be ready to expand if new rules spurred demand. --With reporting from Akshat Rathi, Michelle Ma, Arvelisse Bonilla Ramos, Josh Saul, Shoko Oda, Jennifer A Dlouhy, Will Mathis, Coco Liu, Ari Natter and Jack Wittels. For unlimited access to climate and energy news, please subscribe. |

No comments:

Post a Comment