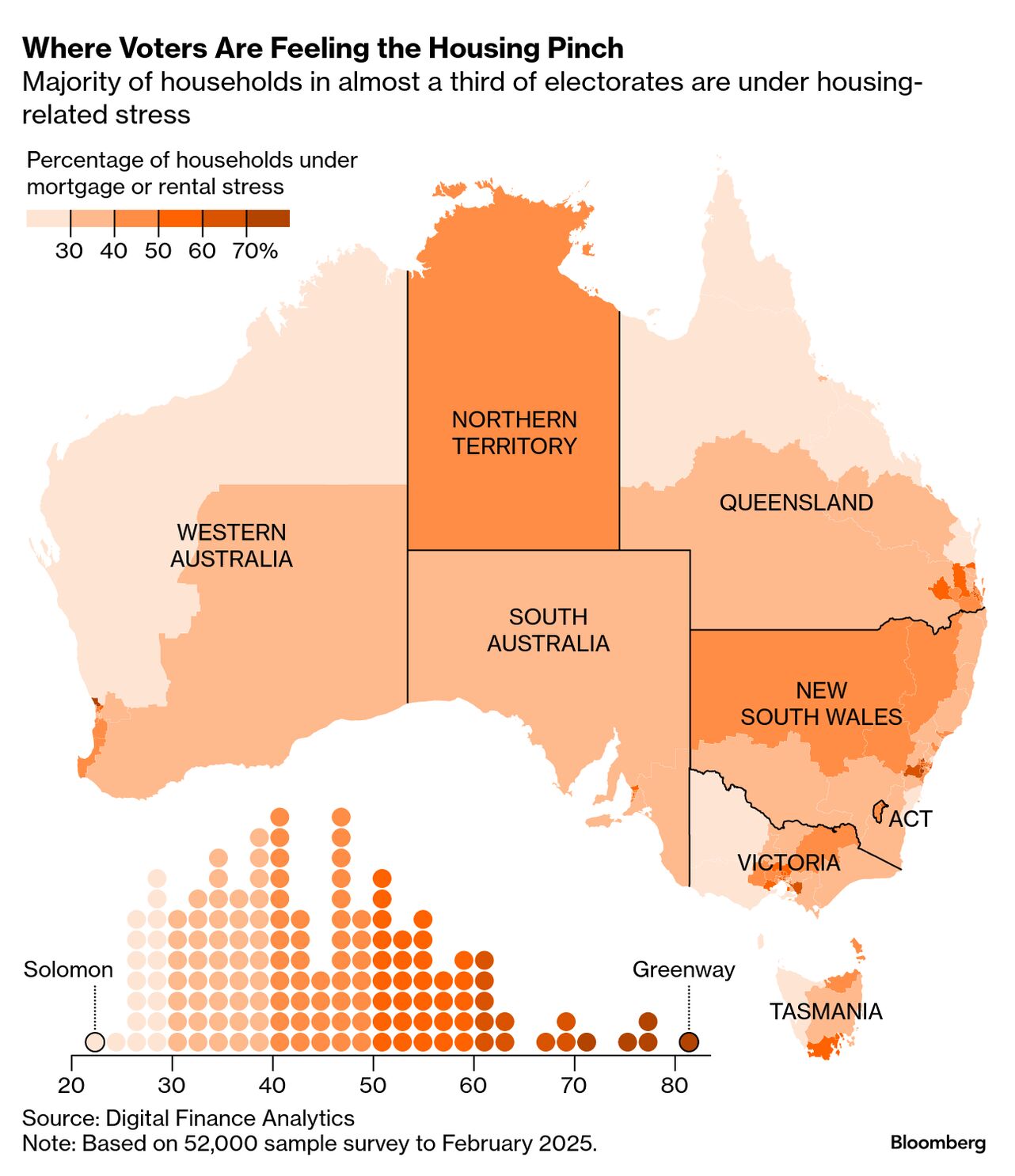

| Despite the global market uncertainty and tariffs, many Australian pension funds still think the US market will retain its investment appeal. They're focusing on long-term investments in areas such as infrastructure and private markets. "We've exhausted our home country," says Sam Sicilia, chief investment officer of the A$115 billion ($73 billion) pension fund Hostplus, after returning from the Australian Super Summit in February. But there's also concern about the US investment climate under President Donald Trump. Australian Communications Minister Michelle Rowland gave a personal guarantee to the global head of YouTube that the platform would be exempt from the country's social-media ban for under-16s, even before an official consultation process on the special carveout, according to documents obtained under freedom-of-information laws. Prime Minister Anthony Albanese said he trusts President Trump despite recent surveys showing growing disapproval of the American leader in Australia before the May 3 election. In a televised debate, Albanese also said he had "no reason not to" trust China's President Xi Jinping. Opposition Leader Peter Dutton said he didn't know either of them well enough to say. Australians' trust in the US has fallen to the lowest point in two decades in a survey following Trump's return to the White House. Australian homes are among the most expensive in the developed world. Desperate buyers are taking on more debt than ever before, and uninhabitable properties are being snapped up for millions. With housing a hot-button issue before the May 3 election, here's how the market became so out of reach. BHP Group's output from its Australian iron ore projects in 2025's first three months was steady from the year before. Copper production ramped up 10%. The world's biggest miner produced 67.8 million tons of iron ore — the key ingredient for steel — compared with 68.1 million tons for the same period last year, it said in filings Thursday. Guidance for the year to June 30 was kept at 282 to 294 million tons. Australia-listed investment firm Income Asset Management is launching so-called managed accounts for wealthy locals to invest directly in corporate loans to replace the soon-to-be scrapped contingent convertible securities. The separately-managed accounts will have a mix of between 10 and 15 corporate loans and bonds, with a minimum investment of A$250,000. |

No comments:

Post a Comment