| Bloomberg Evening Briefing Americas |

| |

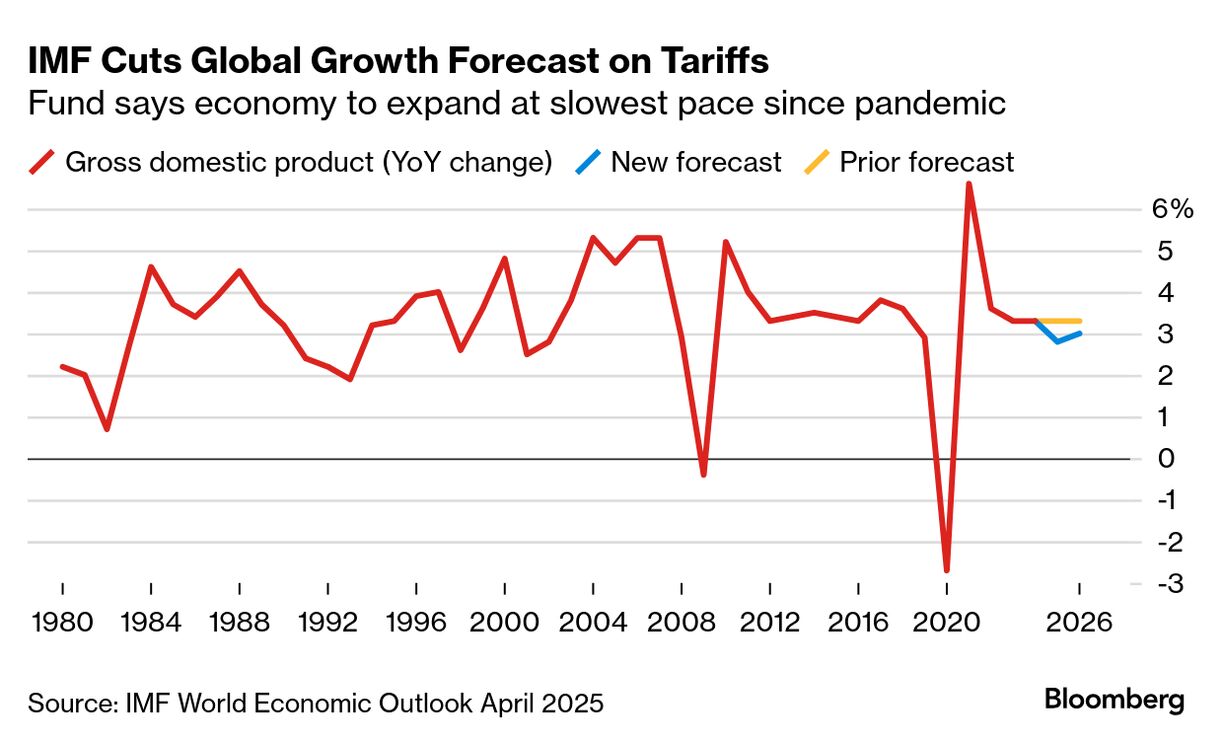

| The rotation by investors out of American assets will go on for years if President Donald Trump persists with his global trade war. This is the warning from a strategist who timed the unwind of so-called exceptionalism almost perfectly. Societe Generale's head of asset allocation Alain Bokobza was a US asset bull for a year up until September 2024, when he warned of cracks in the foundation. He reiterated his call in February, warning investors to slash exposure to US stocks and the dollar. We all know what's happened since. The Trump administration has arguably opened the door for the country's financial dominance to be challenged, with the dollar and Treasury bonds losing appeal in what may be a dire shift of fortunes for America. US equities also have been underperforming global peers this year amid fear that Trump's strategy of tariff chicken will damage growth and stoke inflation. The International Monetary Fund isn't all that amused either, seeing as the rest of the world may become collateral damage to a US crackup. It sharply lowered its forecasts for world growth this year and next, warning the outlook could deteriorate further if the US-initiated trade war escalates. The IMF cut its projection for global output growth this year to 2.8%. That's lower than its January forecast of 3.3% and would be the slowest expansion of gross domestic product since the Covid-19 pandemic arrived in 2020. It would also be the second-worst figure since 2009, in the immediate aftermath of the financial crisis. Together, the warnings add more weight to similar cautions from Wall Street banks in recent weeks, with JPMorgan and Goldman Sachs saying the chances of a recession in the US have spiked. —Jordan Parker Erb Get the Markets Daily newsletter for what's happening in stocks, bonds, currencies and commodities right now—and what will move them next. | |

What You Need to Know Today | |

| |

| |

|

| Rite Aid is preparing to sell itself in pieces as it heads toward its second bankruptcy. The move comes less than a year after the drugstore chain's emergence from Chapter 11, closing hundreds of stores and cutting about $2 billion of debt in the process. The liquidity-strapped retailer is seeking a debtor-in-possession loan to help fund itself during the process. The process could see some locations in certain regions sold to bidders, while those that aren't sold would be wound down entirely. | |

|

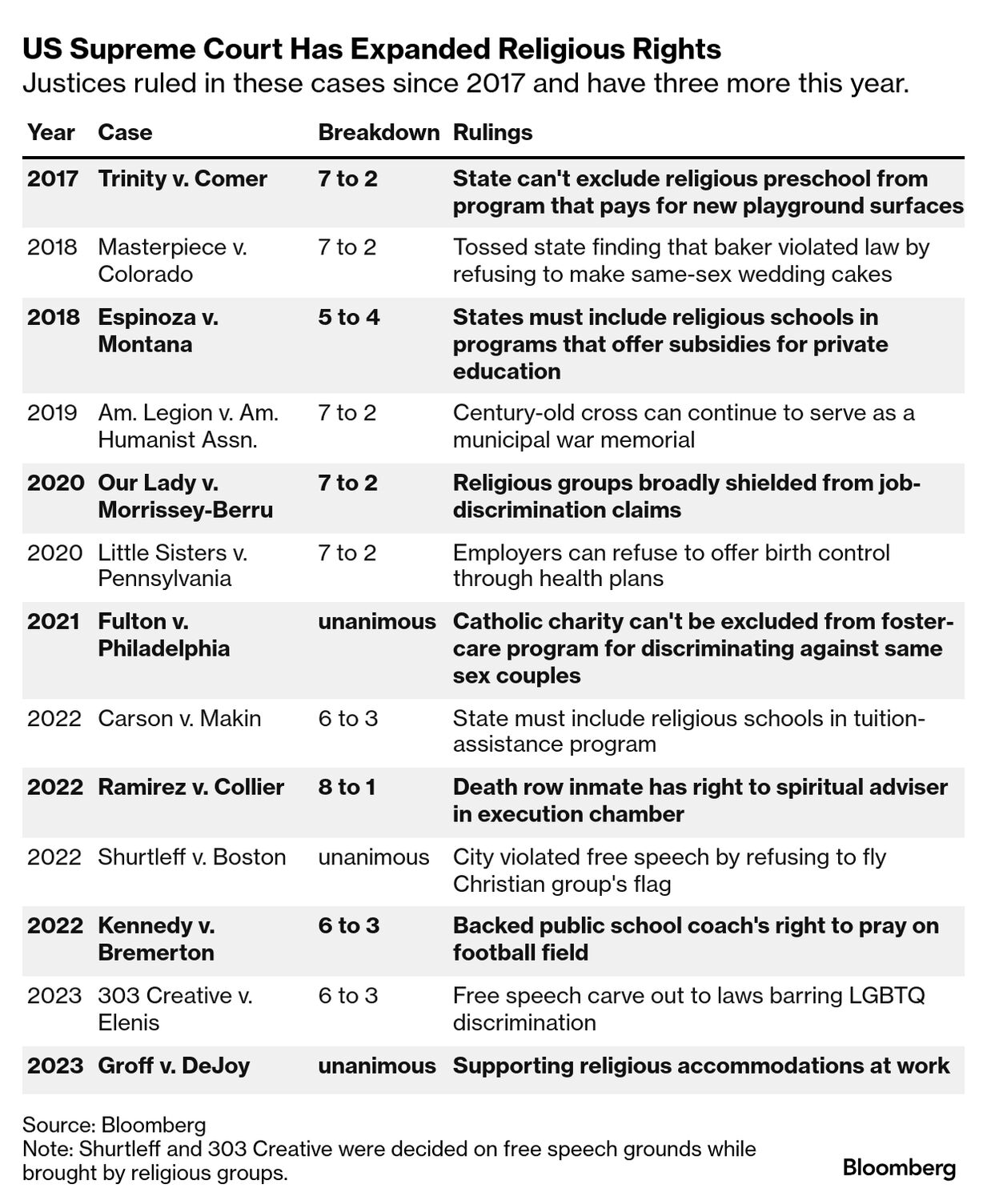

| The US Supreme Court's Republican-appointed supermajority signaled it will back parents seeking to opt out of classroom lessons that incorporate LGBTQ-friendly books, as the justices heard a case that could further expand religious rights. The court on Tuesday scrutinized a Maryland public school program whose materials include books about a puppy that gets lost at an LGBTQ-pride parade. Some justices suggested support for parents who want the ability to pull their children from classes that include the books. The parents "are not asking the school to change its curriculum," said Associate Justice Samuel Alito, one of the court's most-conservative members. "They're just saying, 'Look, we want out.' Why isn't that feasible? What is the big deal about allowing them to opt out of this?" | |

| |

|

| Yale University's endowment is exploring sales of private equity fund stakes as Ivy League schools face budget challenges stemming from lackluster investment performance and Trump's unprecedented campaign to gain control over higher education by threatening federal funding. Evercore is advising the $41 billion endowment on a process that's been in the works for months, according to a Yale spokesperson. Yale has not disclosed a target size for a sale, but an earlier report said the university may sell up to $6 billion of its private equity portfolio. Trump has already sought to suspend research funding at Ivy League institutions including Harvard, Princeton and Columbia—albeit in some cases he's already been sued for constitutional overreach. | |

Yale University's endowment is considering sales of private equity fund stakes as Ivy League schools face increasing budget challenges. Photographer: Joe Buglewicz/Bloomberg | |

|

| Canadian Prime Minister Mark Carney wants the country to become the housing factory of the world. Carney sees factory-built homes as a solution to the two most urgent crises facing Canada: the unaffordable cost of housing and Trump's trade war. And while the prefabricated housing industry has long touted itself as a way to help relieve Canada's housing shortage, financing struggles, unpredictable demand and inconsistent zoning rules have kept it from becoming a big player in the market. That's where Carney might come in. The central plank of his housing platform is a plan to make the government both a customer and financier of pre-fab factories. It amounts to a promise to help the industry achieve economies of scale that could lower home prices nationwide, while creating manufacturing jobs that could replace some of the ones being lost due to US tariffs. | |

|

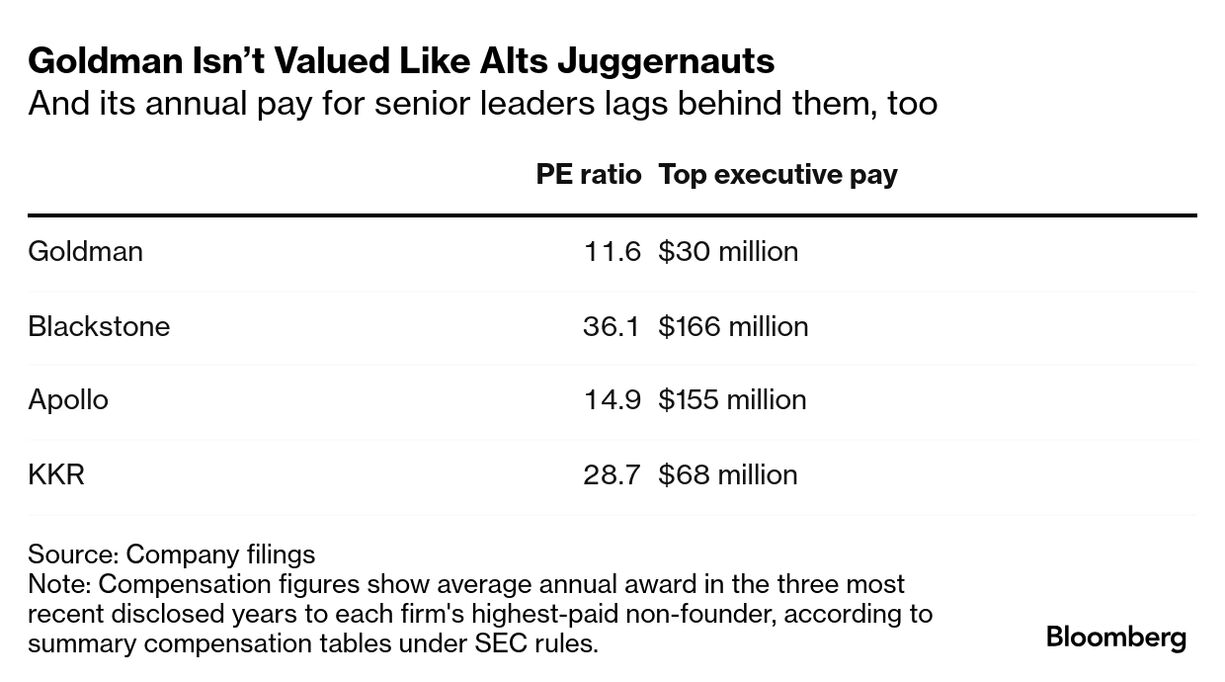

| Goldman Sachs is asking shareholders to back $160 million in special bonuses for its top two executives—and hoping they agree the firm is far more than an investment bank. The retention packages for Chief Executive Officer David Solomon and President John Waldron give the latter more reason to stick around—but Goldman's justifications go beyond that. It says their compensation needs to reflect their status as the heads of a private-markets giant. Now, in a non-binding vote, shareholders are poised to weigh in at an annual meeting in Dallas on Wednesday with an unusually controversial ballot on Goldman's compensation practices. | |

| |

|

| |

What You'll Need to Know Tomorrow | |

| |

| |

| |

| Qatar Economic Forum: Join us May 20-22 in Doha, where since 2021 the Qatar Economic Forum powered by Bloomberg has convened more than 6,500 influential leaders to explore bold ideas and tackle the critical challenges shaping the global economy. Don't miss this opportunity. Request an invitation today. | |

| Enjoying Evening Briefing Americas? Get more news and analysis with our regional editions for Asia and Europe. Check out these newsletters, too: Explore all newsletters at Bloomberg.com. | |

| |

Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. Want to sponsor this newsletter? Get in touch here. | | | You received this message because you are subscribed to Bloomberg's Evening Briefing: Americas newsletter. If a friend forwarded you this message, sign up here to get it in your inbox. | | |

No comments:

Post a Comment