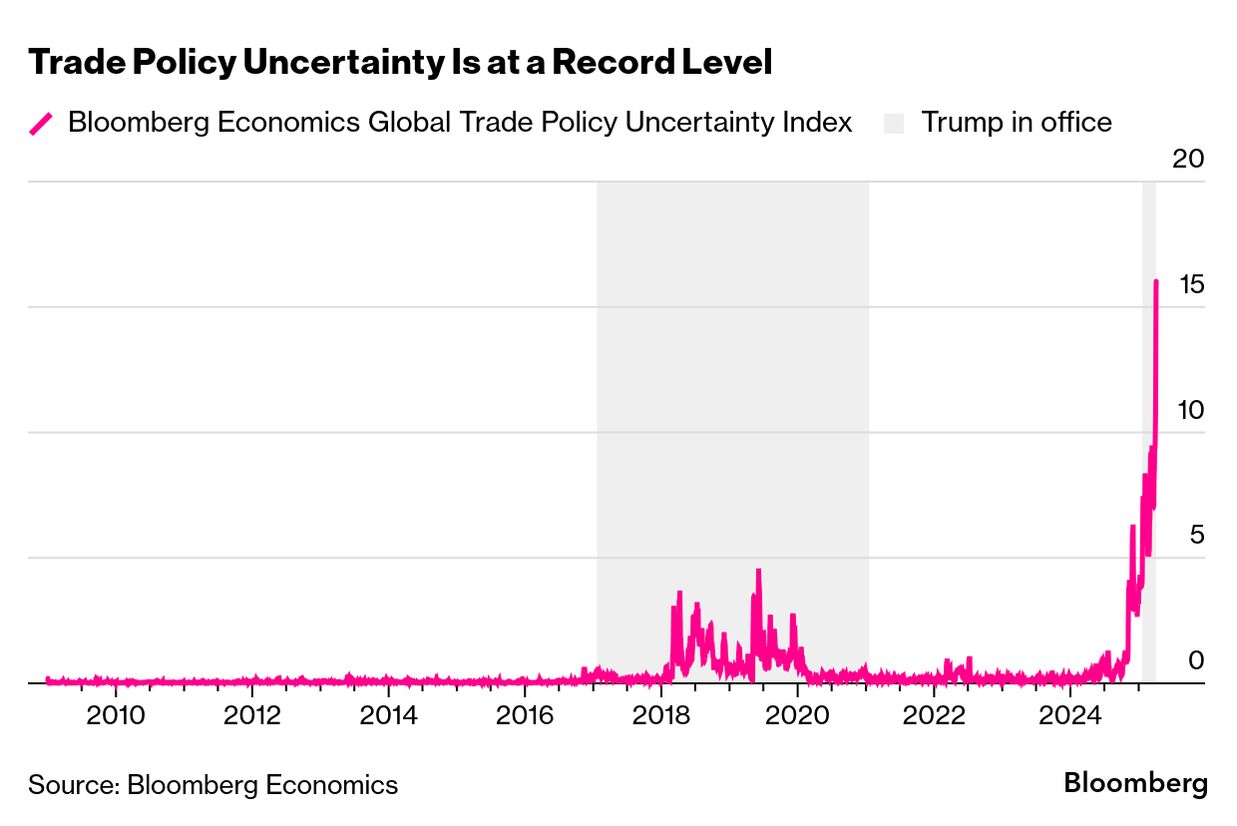

| I'm Malcolm Scott, international economics enterprise editor in Sydney. Today we're looking at how market and economic fallout from Donald Trump's tariffs will test the pain threshold of leaders in Washington and Beijing. Send us feedback and tips to ecodaily@bloomberg.net. And if you aren't yet signed up to receive this newsletter, you can do so here. While Trump's reciprocal tariffs have been cast globally, Beijing's decision to swiftly retaliate is a reminder that the US-China economic cold war lies at the center of the worldwide trade upheaval. And the signaling from both sides suggests we're in for a prolonged tussle. Speaking Sunday on Air Force One, Trump struck a determined tone and repeatedly defended his tariff barrage. "I don't want anything to go down, but sometimes you have to take medicine to fix something," he said as markets slumped in a sign of deepening turmoil. China, meantime, used its media mouthpiece to warn against panic. "The sky won't fall even though the US abuse of tariffs will cause some impact on us," the official People's Daily said in a front-page editorial on Monday. "We must turn pressure into motivation." Hours later, Bloomberg News reported that China's policymakers discussed whether to accelerate stimulus plans to bolster consumption. Measures would focus on bringing forward policies already in the pipeline, such as boosting consumer spending and subsidies for some exporters. On the monetary policy front, China said it has room to ease borrowing costs and reserve rules for lenders if needed, the flagship newspaper of the Communist Party said in its commentary. Of course, the Fed is independent of the White House, so the president can't turn on the monetary taps quite as easily as Beijing can. But economists are already repricing their Fed bets, with Goldman Sachs's Jan Hatzius and colleagues saying cuts will come sooner and a recession is more likely if tariffs aren't wound back from what was announced. With markets in freefall on both sides of the Pacific, the pain threshold for Presidents Trump and Xi Jinping is already being tested. When it comes to markets and inflation, Xi appears better placed to withstand those pressures for a couple of key reasons: - Equities play a far more prominent role in America's economy, with Trump himself in the past using the stock market level as a barometer for success. In China, frugal savers have been singed by past boom-bust cycles, meaning stock market swings tend to have less impact on broader economic trends.

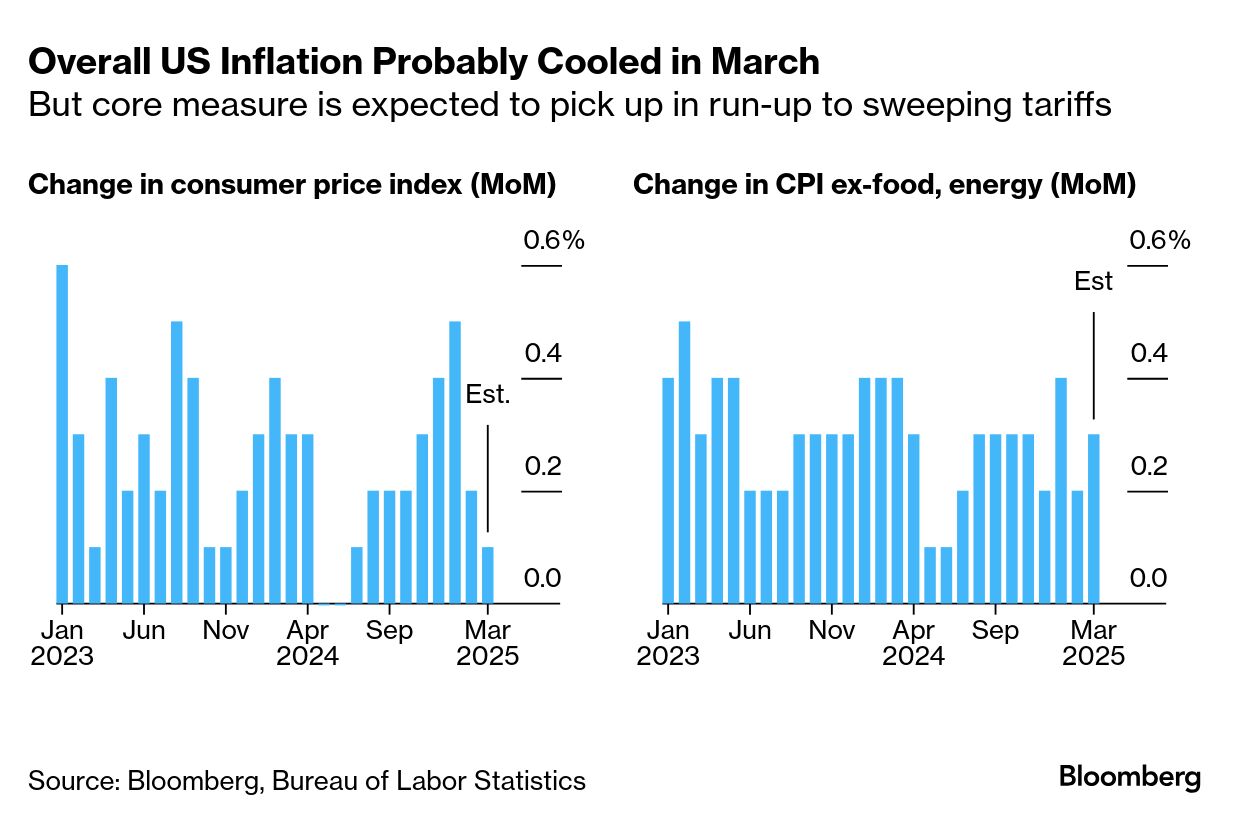

- As for prices, China is battling deflation, giving it more scope to digest any upward pressure due to its retaliatory tariffs on imports from America. The US has only just gotten inflation back in check, with widespread tariffs now set to test Fed Chair Jerome Powell's assessment that resulting price pressures will prove "transitory."

Bloomberg Economics reckon Beijing's retaliation suggests Trump's tariffs crossed China's "economic pain threshold." The pushback brings the global trade war to a "perilous new phase" and may represent Beijing's bet that striking back is the best way to get Trump to the negotiating table. What comes next? That will depend in large part on whose economy takes the bigger hit and whose leader blinks first. The Best of Bloomberg Economics | US households probably experienced slightly less overall inflation last month, a reprieve that economists view as temporary in the wake of Trump's tariff tsunami. Bureau of Labor Statistics figures on Thursday are projected to show that the consumer price index edged up 0.1%, which would be the smallest rise since July, based on the median estimate of economists surveyed by Bloomberg. The core CPI, a better measure of underlying inflation because it excludes often-volatile food and energy costs, is seen climbing 0.3% from February and 3% from a year ago. The annual pace would be the slowest since 2021. Elsewhere, China's inflation data, UK gross domestic product and rate decisions from New Zealand to India to Peru will be in focus. See here for the rest of the week's economic events. The European Union's security push faces substantial gaps in military equipment, according to research published by the think tank Bruegel. Additionally, the defense market is fragmented and weakened by home bias in procurement, low order numbers and technological gaps, according to Guntram Wolff, Armin Steinbach, and Jeromin Zettelmeyer. The researchers suggest that the best way to solve these issues would be the creation of a so-called European Defense Mechanism, which "would undertake joint procurement and plan for the provision of strategic enablers in specified areas, with a capacity to fund these roles." The advantage of such a plan would be that it would: - create a defense industry single market among EDM members,

- create a financing vehicle that might make large-scale projects fiscally feasible, and

- include non-EU democracies such as the UK on an equal footing, while also giving an opt-out to EU countries that lack the political appetite for more defense integration, or that have national constitutional constraints.

|

No comments:

Post a Comment