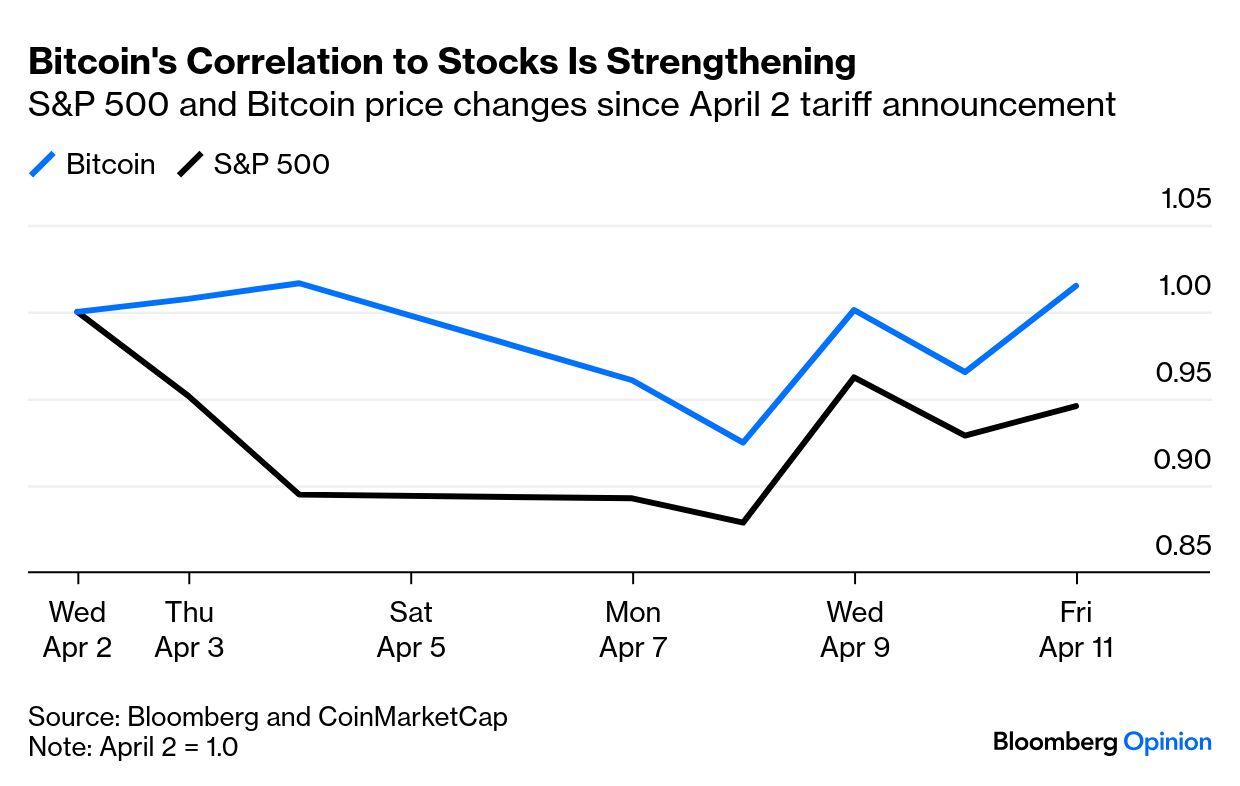

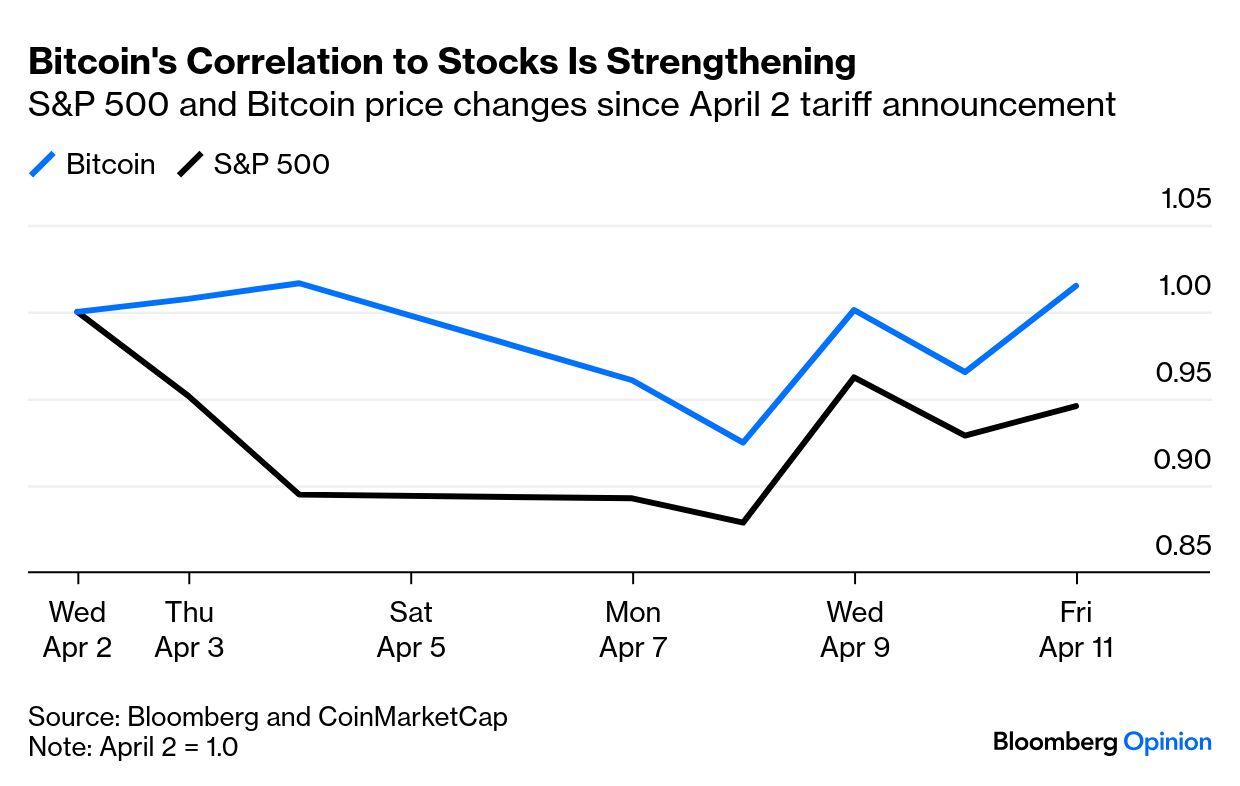

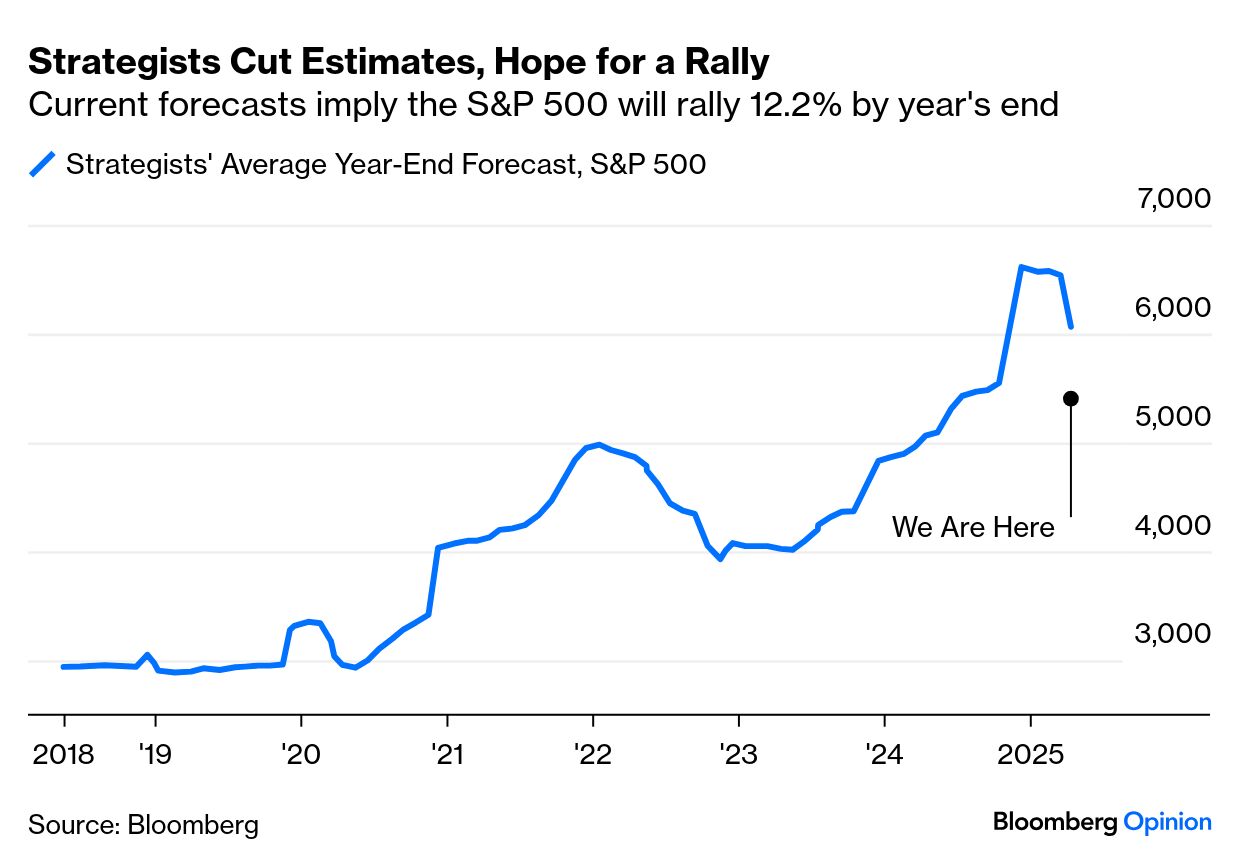

| I'm Jonathan Levin and this is Bloomberg Opinion Today, a luxurious collection of Bloomberg Opinion's opinions. Sign up here. Shop Baby Shop? In This Economy? | A few months back, the buzz was that Donald Trump's second presidency would generate boom-like conditions across the US economy. Booming consumption! Booming energy production! Booming financial markets! So far at least, no booms have sounded. As Andrea Felsted writes, the luxury goods marketplace shows how the economic outlook has been turned upside down in the past few months. On Monday, LVMH missed expectations for first-quarter sales, failing to generate growth in any of its divisions. "With the president embarking on a trade war and markets slumping amid fears of recession, the American recovery is now in tatters," Andrea writes. Things aren't exactly peachy in the energy business, either, despite Trump's promises to unleash US oil production. As Liam Denning writes, the International Energy Agency just cut its forecast for oil demand growth this year by 29% from last month's projection, which means US companies aren't exactly eager to "drill baby drill." As Liam notes, Trump may be "teeing up the worst conditions for the oil business so far this century, outside of the 2020 pandemic shock." Then there are the financial markets. The weakening US dollar and the strange behavior of Treasury securities already have some investors questioning the durability of the dollar's reserve-currency status. "This is what an emerging crisis of confidence looks like," the Editorial Board notes. Last but not least, the market for initial public offerings has largely shot down. As Parmy Olson points out (free read), fintech firm Klarna Group Plc and ticketing platform StubHub recently paused their IPOs. "That suggests the last two years of declines in startup funding have further to drop," Parmy writes. Trying to Look on the Bright Side | How might we get out of this mess? Even if Trump engineers a U-turn on tariffs, it might not restore confidence to investors, businesses and consumers: The very change would be further evidence of his unpredictability. How about Congress — could enough Republican members join Democrats to take away the president's tariff power? Unfortunately, says David M. Drucker, that's not very likely. Remember four years ago, when 10 House Republicans voted to impeach Trump for his role in the Jan. 6 attack on the US Capitol? As David notes, those votes essentially ended the careers of most of the 10, and he's skeptical that many in the GOP have the stomach to take on Trump now. Thankfully, Americans worried about the economy and markets can take solace in … Social Security. As Kathryn Edwards writes, the events of recent weeks should serve as a reminder to policymakers of the importance of the program — and of pushing back against complaints about its design. According to Kathryn, detractors have long argued that Social Security would earn higher returns for retirees with market investments. "The market is for generating returns," she writes. "Social Security is for protecting against losses." On the surface, Bitcoin and stocks have looked highly correlated since Trump's "Liberation Day" tariffs on April 2. But as Aaron Brown writes (free read), markets have gone through multiple reaction stages, and it's only when they focus on the prospects of a global recession that everything seems to fall together. "The deeper issue of Trump's aggressiveness and willingness to listen to mainstream advisers is more important," Aaron writes. "The next time something like this happens — and I'm confident there will be a next time — I'd expect stocks to react faster and more negatively, and crypto to gain," he writes.  Despite the gloom, the average Wall Street equity strategist still expects the S&P 500 to bounce back this year. As John Authers writes (with a h/t to Bloomberg's Jess Menton), strategists entered the year expecting that Trump would steer clear of antagonizing the stock market. That belief — held since Trump's first term — led them astray, and many have been hurrying to downgrade their uber-optimistic outlooks. But for the moment, all but two firms surveyed by Bloomberg continue to expect stocks to end the year higher than they are now. "Until there's some measure of certainty over whether the US is really going to press ahead with the toughest tariff regime in a century, index targets are going to involve even more guesswork than usual," John writes. The Bank of England flinched. — Marcus Ashworth British Steel is under state control again. — Matthew Brooker Javier Milei pulled a rabbit out of his hat. — JP Spinetto RFK Jr.'s autism timeline is ludicrous. — Lisa Jarvis More twists lie ahead for TikTok in the US. — Dave Lee The US must rectify its mistake with Abrego Garcia. — Patricia Lopez Investors are extraordinarily bearish. A Palestinian Columbia student is detained at a citizenship interview. Spanish police targeted a cat smuggling ring. Elephants protected their young during an earthquake. Notes: Please send flowery poetry about Social Security to Jonathan Levin at jlevin20@bloomberg.net |

No comments:

Post a Comment