| US equity futures plunged, extending a slide that wiped out nearly $6 trillion from the S&P 500 Index in two days, as the Trump administration dug in on a trade war economists warn could tip the world's largest economy into recession. Contracts on the S&P 500 Index plunged 4.6% at 6:02 p.m. in New York, after the underlying index sank 10% in two days. And shell-shocked investors are piling into US Treasuries on concern that Trump's trade war will trigger a worldwide recession. At home, the Australian dollar is looking to recover from its worst drop since 2008, when the collapse of Lehman Brothers set off a global credit crunch. In stocks, The S&P/ASX 200 Index futures fell 4.3%, futures relative to fair value suggest early loss of 4%. And it looks like this all means that Aussie and kiwi stocks and currencies will be under pressure until someone offers an olive branch of some kind, according to my colleague, market strategist Mike "Willo" Wilson in Sydney bureau (more from him later on). To catch you up, the market crash Trump stoked last week was one for the history books. The Nasdaq 100 plunged into a bear market. Commodities collapsed, and corporate-bond investors frantically bought insurance contracts that shield them from default. Don't forget about your superannuation. Jonathan Levin writes for Bloomberg Opinion that the tariffs are already coming at the expense of retirees. First and foremost, that's because Trump's grand experiment is precipitating the swift collapse of the S&P 500, the underpinning of tens of millions of retirement savings accounts.

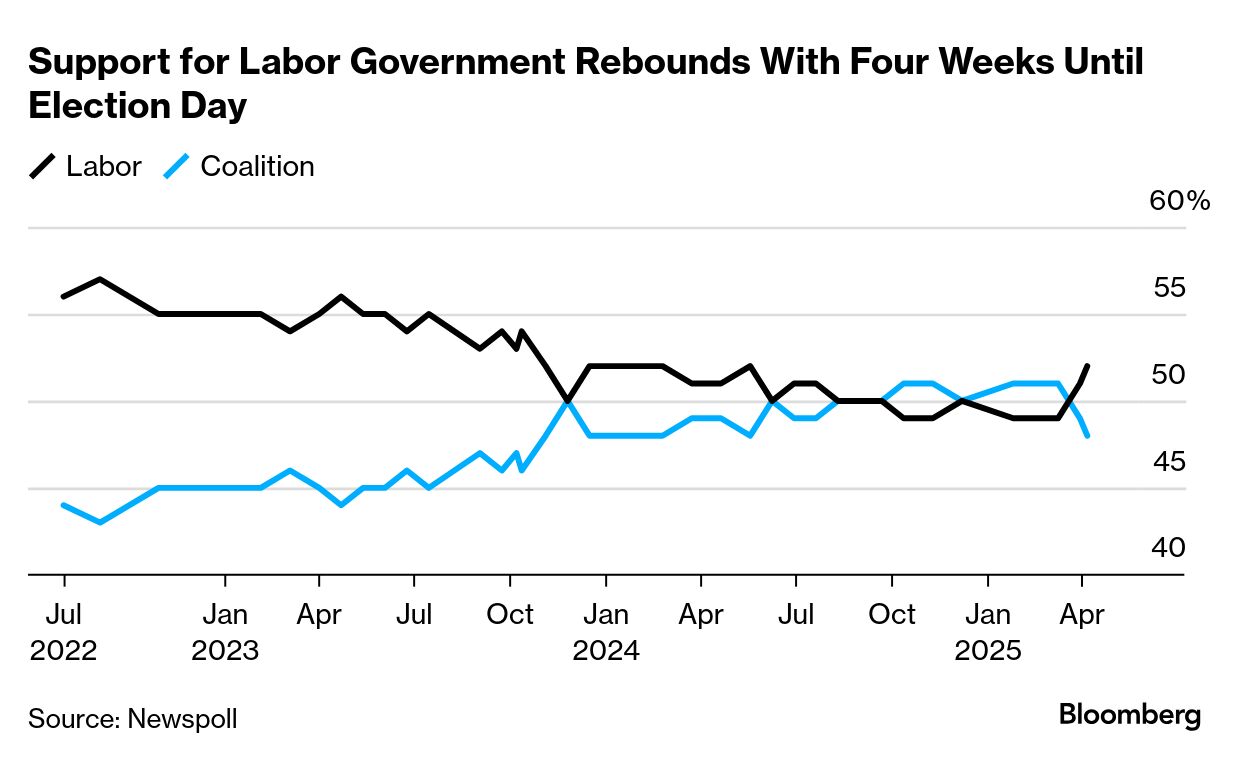

And there's an election happening too... Support for Prime Minister Anthony Albanese's Labor government has risen to its highest point in 11 months ahead of a vote on May 3. The center-left Labor Party saw its vote rise to 52% on a two-party preferred basis in a Newspoll survey released by The Australian newspaper on Sunday, up a point from last week and its strongest result since May 2024. Support for the opposition Liberal-National Coalition fell one point to 48%.  Over the weekend, Albanese pledged to slash household energy bills with a A$2.3 billion plan to lower the price of home batteries. Households, small businesses and community facilities will be eligible for a 30% discount on installed battery costs, saving about A$4,000 on a typical system. Opposition Leader Peter Dutton said the Liberal-National coalition will reduce the allocation of international students if it wins office next month, saying the move would ease pressure on the nation's overstretched housing market. Australia plans to wrest control of a Chinese-owned port in the country's north after the election next month as concerns grow over a more assertive Chinese military presence. Dutton will take immediate action to bring the Port of Darwin under Australian control or into a model that will give greater assurance about the operator within six months if elected, while Albanese late Friday made a similar commitment. |

No comments:

Post a Comment