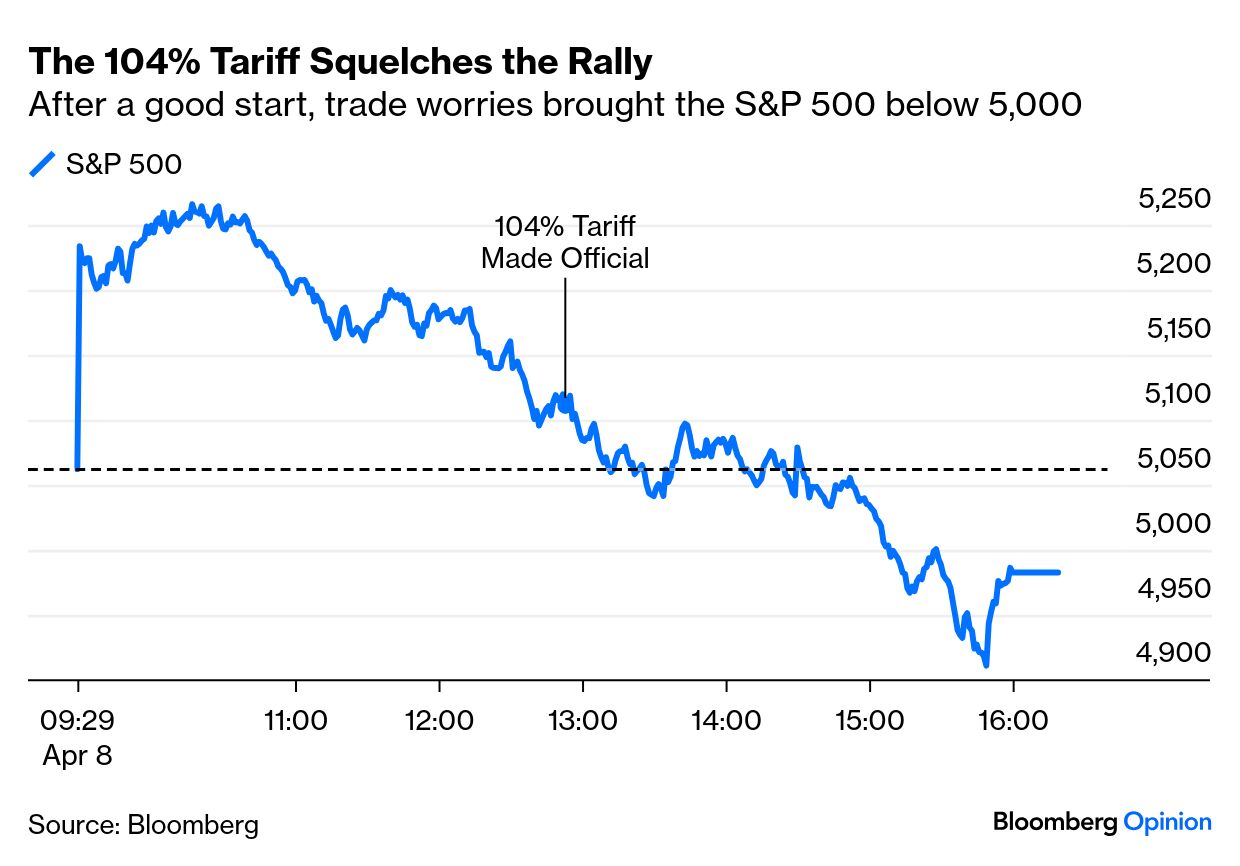

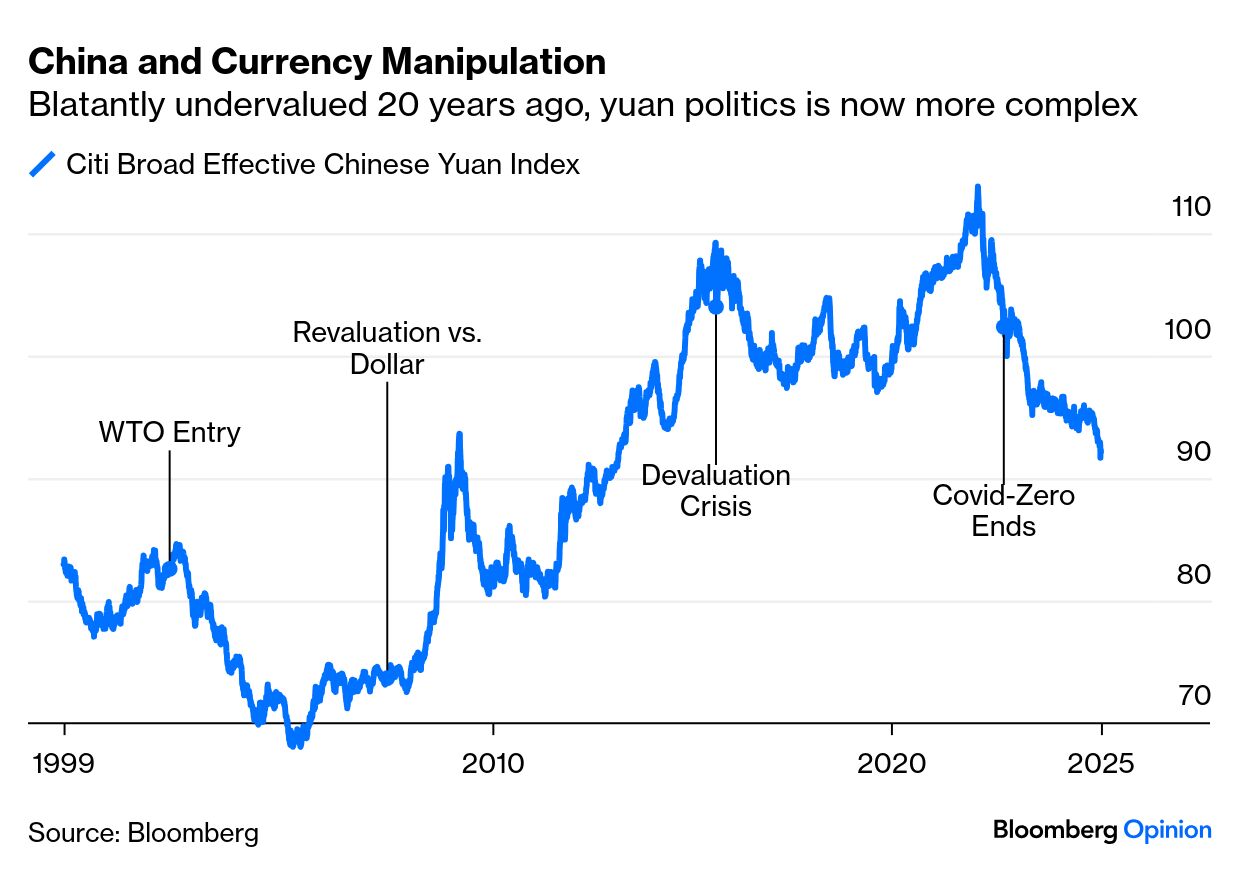

| 104% it is. At the time of writing (midnight in New York), the China-US trade dispute has reached the point where Washington is doubling the price that Americans must pay to buy Chinese. If this sticks, the world's two biggest economies have effectively fenced themselves off from each other. This is market-negative, to put it mildly. Official announcements that China would leave its retaliatory tariffs in place, and that the US would impose the 104% rate at midnight, snuffed out a market rally and brought the S&P 500 below 5,000 for the first time in 12 months: Barriers this steep between major powers aren't unprecedented; it's not long since the communist bloc closed off a large swathe of the world to western markets. Trade on the current terms has damaged those in the US who made their living from manufacturing; but nobody seriously thought that the remedy would be to end trade altogether, which is effectively what 104% tariffs do. Can we possibly stay here? The different weapons available to the two powers suggest they could both fight. First, there's the currency. China's retaliation to the additional 34% levy unleashed on Liberation Day came with other elements. On Tuesday, the offshore yuan was allowed to drop to its weakest since 2007, and the official rate followed Wednesday. That was significant because the yuan had seemed to have an effective ceiling, which is now broken: Currency is central to US complaints. Once China entered the World Trade Organization in 2001, it engineered an artificial devaluation that made the yuan far more competitive. China allowed a gradual appreciation from 2005, while the US debated whether to label it a "currency manipulator." On a real effective basis against a broad range of trading partners, taking into account inflation, the picture has been subtler for the last decade — and the recent depreciation sticks out: Weakening plays to the advantage of Chinese exporters. Standard Chartered Bank's head of China macro strategy Becky Liu explains that Beijing is allowing its exchange rate to move further as a tool to "alleviate growth pressure amid aggressive tariff hikes." Bloomberg Economics' David Qu and Chang Shu argue that this is still consistent with a "carefully managed, orderly — and probably only gradual — decline." It shouldn't necessarily be seen as a shot in the trade war. Sinology's chief executive Andy Rothman argues that the magnitude of the US tariffs makes devaluation a less potent response: If you're talking about compensating for 75% tariff for the United States, you're going to have to devalue the currency by 75% or even 30%. That's just not going to happen. The Chinese government has a lot of other tools that will not create as many side effects as a devaluation.

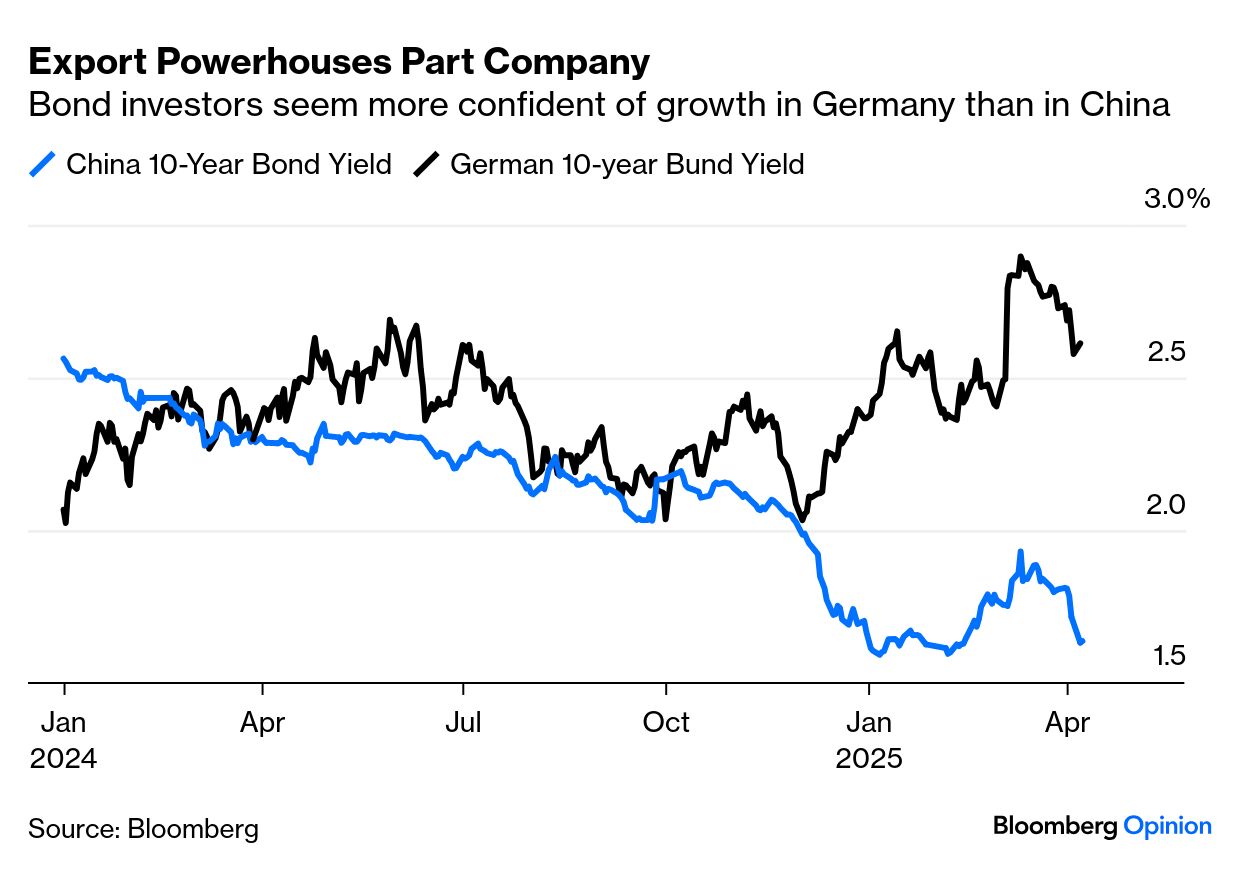

Under Trump 1.0, Beijing implemented export rebates that absorbed tariffs the US slapped on China. That won't be possible for levies of 104%. But China could ease monetary policy. That first step, argues Gavekal Research's Wei He, could be followed by direct intervention in financial markets. Monetary policy has been tighter than expected and at a press conference last month, PBOC Governor Pan Gongsheng repeated that policy rates and bank reserve requirements would be lowered this year, but seemed to indicate that this wasn't a near-term priority. That helped to drive a sharp recovery for Chinese bond yields, which the tariff tit-for-tat has now canceled. They show a serious loss of confidence in growth — particularly compared with what's happened to bunds as Germany resorts to fiscal stimulus: Yields that low enable some fiscal largesse. Finally, there's the long-running suspicion that China could "weaponize" its large holdings of Treasuries by selling them to raise US rates. Stephen Miran, chief of the president's Council of Economic Advisors, complained Monday that those holdings had caused the GFC: In the years running up to the 2008 crash, China along with many foreign financial institutions increased their holdings of US mortgage debt, which helped fuel the housing bubble, forcing hundreds of billions of dollars of credit into the housing sector without regard as to whether the investments made sense. China played a meaningful role creating the Global Financial Crisis.

It's questionable whether any other country really forced US banks into lending money to people who obviously couldn't repay it. The "savings glut" hypothesis was championed by Ben Bernanke, head of the Federal Reserve at the time, but a 2021 Chicago Fed paper suggested that China wasn't so central to low US rates. Are they selling now, though? The remarkable V-shape that the 10-year Treasury yield has sketched out since Liberation Day, illustrated in this terminal chart, does lend some credence to the notion that someone is trying to push up yields deliberately (and the selloff continued in Asian trading, with the 30-year now up a remarkable 70 basis points for the week so far, and the first time it's reached 5% since 2023): Could China be firing a warning shot this way? Probably not. Joe Lavorgna, economist at SMBC Nikko, who served in the first Trump administration, argues that the share of US Treasury securities owned by China has been declining ever since data became available in late 2011, to 12% from 30% of total foreign holdings — and that in any case, yields are no higher than they were last week. The reduction has been very stable: The Asian investor base has been significantly diversifying away from the US bond market for the past 14 years. Therefore, current tariff policy is not a factor.

He's probably right about this. China is one of many factors moving the Treasury yield, and shouldn't be singled out in the way Miran did. For China, the best response is to boost domestic consumption, as it has been trying to do for years. That will likely mean a fiscal expansion before long — which the trade war only makes more urgent. —Richard Abbey Every so often, extreme policy moves designed to shock the market into submission fail. They have to be credible to work. The classic example is sterling's Black Wednesday exit from the European exchange rate mechanism in 1992. The pound was obviously overvalued and under intense attack, so on the fateful day the Bank of England raised its target rate to 12% from 10% and then, at lunchtime, to 15%. The selling continued, because traders saw that the stance wasn't credible. The great majority of British mortgages were on a variable rate, and would immediately follow the BOE's changes. That higher rate meant that homeowners' mortgage payments would rise by 50% from one month to the next. Brilliant traders skillfully saw that the threat was empty. One of those traders was Scott Bessent, then employed by the hedge fund manager George Soros and now the US Treasury secretary. Now, consider the imposition of a 104% tariff on Chinese imports to the US. As is known, Americans buy a lot of stuff from there. A tariff this extreme can only have an immediate impact on inflation. Omair Sharif of Inflation Insights LLC offers this back-of-the-envelope calculation: The old 54% tariff rate on China boosted total CPI by 0.35 percentage points. The new 104% rate would lead to a rise in total CPI of 0.67 percentage points.

In other words, if the 104% tariff proves to last longer than the Bank of England's 15% rate (which was withdrawn hours before it was due to take effect), then you should add an extra two-thirds of a percentage point to your inflation forecast. The latest reading of headline CPI is 2.8% (the next is due Thursday). All else equal, the tariffs on China should raise this to just under 3.5%. It hasn't been that high in 12 months. There seems rare unanimity among pollsters that Trump owed his victory to inflation, more than any other single issue. Inflation by its nature hurts the poorest the most. The people buying cheaper Chinese imports will disproportionately be his supporters. Can this threat possibly be credible? |

No comments:

Post a Comment