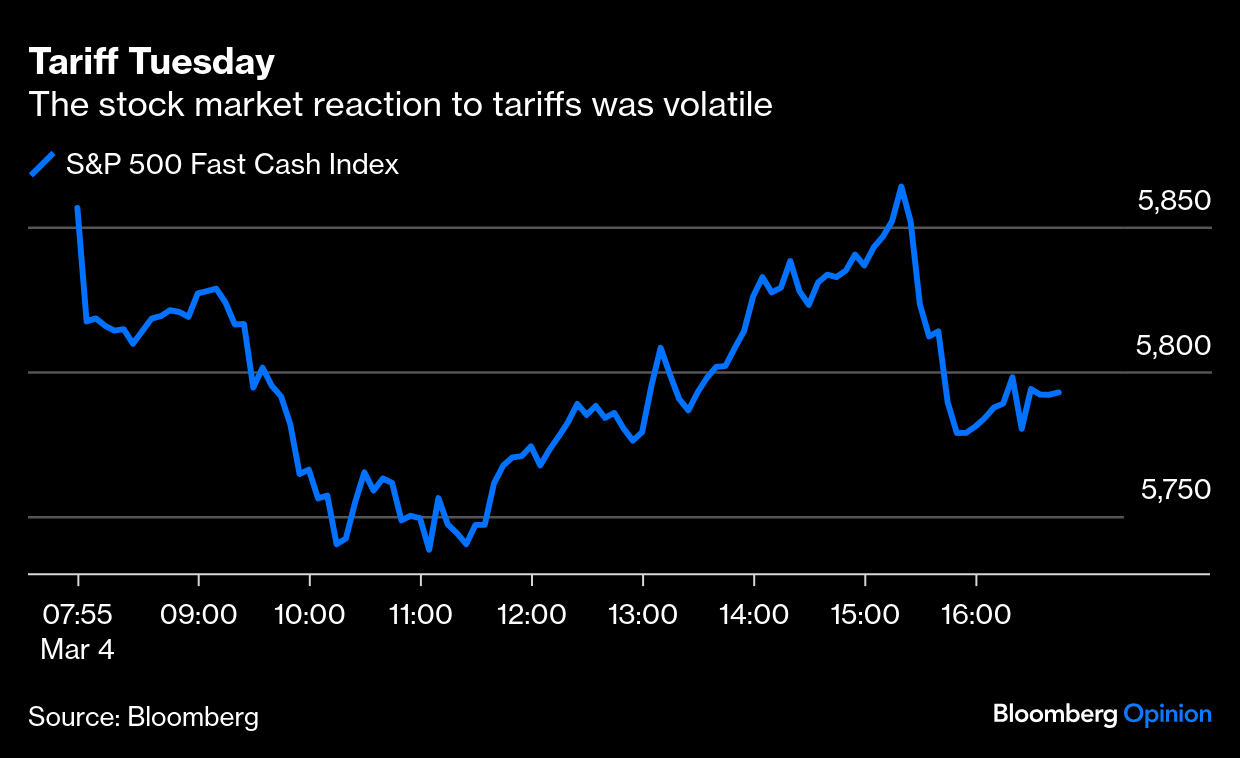

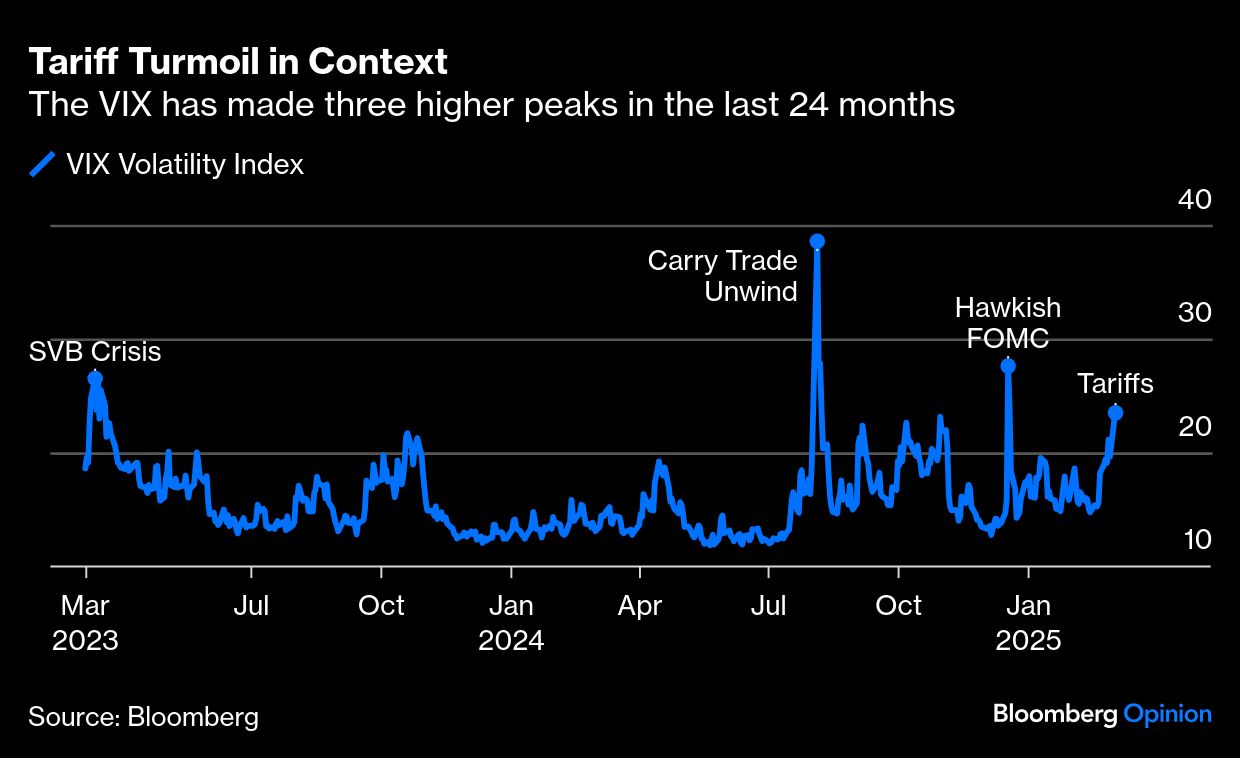

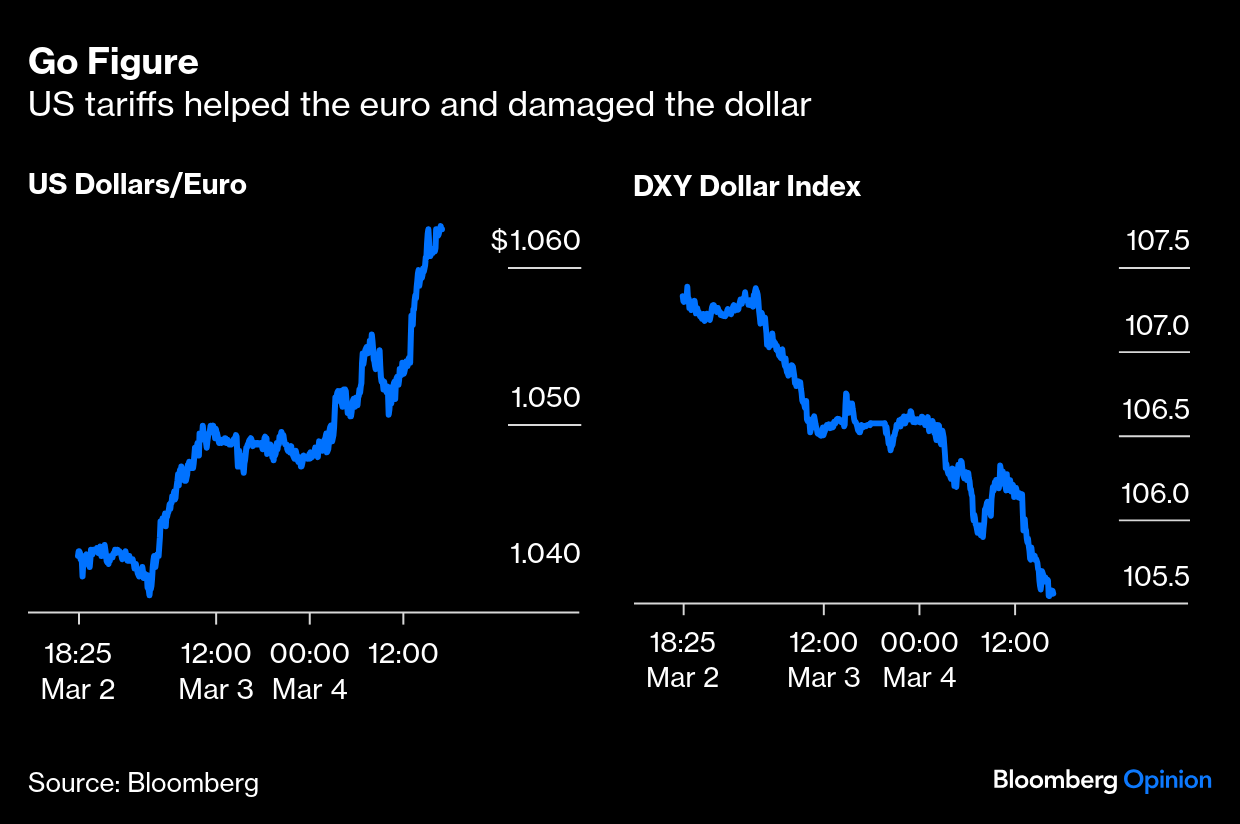

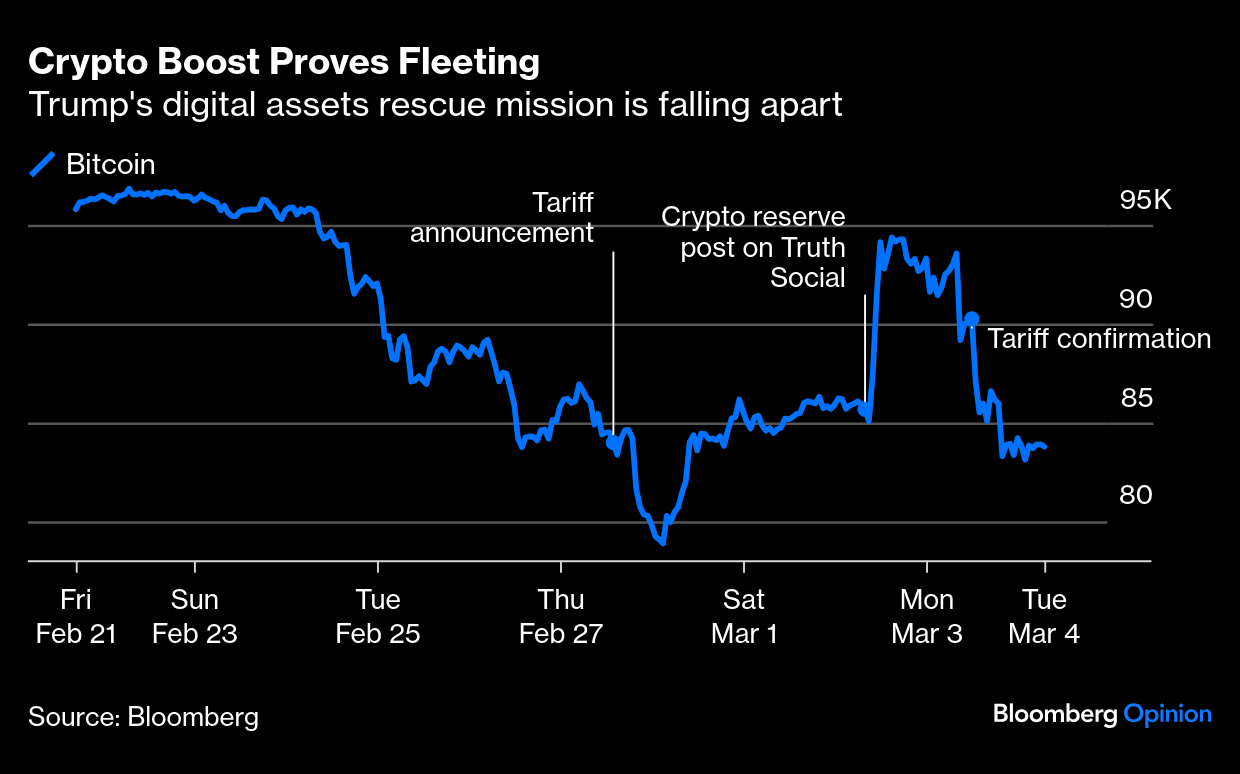

| Tariffs Tuesday is in the books, which is just as well. The US has now imposed 25% tariffs on Canada and Mexico, and brought tariffs up by 20% on China, while Commerce Secretary Howard Lutnick has just given an interview suggesting that they will be retracted or in some way reduced on America's neighbors within the next 24 hours. In such an environment of uncertainty, let's stick to what we can say with confidence, which isn't all that much. First, this is how the US stock market traded Tuesday. There's no point trying to fit a narrative to it. Volatility like this is unhealthy: However, volatility — at least as measured by the popular CBOE VIX index derived from options prices — is not as extended as you might think. It's risen sharply, but remains below the spikes caused by Silicon Valley Bank two years ago, last year's carry trade unwind, and the surprisingly hawkish December meeting of the Federal Reserve: The really startling tell came in the currency market. The European Union is next in line for tariffs — President Donald Trump has made that clear — and they will hurt. The mathematics of foreign exchange is fairly simple, and when a country makes itself more competitive with tariffs, its exchange rate will compensate. In other words, the currency of the country imposing the levies will strengthen. That's exactly what hasn't happened: This was one of the euro's 10 strongest days against the dollar since the pandemic scrambled markets five years ago. One explanation is that Germany continues to surprise the market with more ambitious plans for fiscal easing (of which Points of Return will have more tomorrow). Forex traders are telling the EU that they really did dislike the austerity of the decade, and they're only too happy to see more spending. The broader decline for the dollar suggests something strange is afoot. Logically, it implies that investors expect tariffs to be seriously bad for the economy. That led to a sharp shift in expectations from the Fed: As the tariffs are directly inflationary in the short term, and therefore make it harder to cut rates, this move shows severe (possibly overdone) pessimism about US growth. Beyond that, two concepts are in question. The first is the "Trump Put." Until now, it has been taken as axiomatic that the president cares too much about the stock market to persist in a policy that causes a selloff. Any climbdown, as Lutnick appears to be signaling, will be taken to show that the Put remains in place, and the stock market does retain its veto over economic policy. The fact that these tariffs have actually been imposed, however, has radically challenged that belief. Second is the notion of the US as a safe haven. The well-established principle is that in times of trouble, the dollar goes up. This is true even if the source of the trouble is the US itself; in 2011, money poured into the dollar as a haven even after Standard & Poor's downgraded US sovereign credit. A big dollar fall therefore suggests that traders are at least cautiously considering whether the US can serve that function any longer. Policymaking this erratic doesn't make for the safest of havens. The biggest question for the next 24 hours is whether the tariffs stay in force. If they do, then the Trump Put is no longer operative. That would spell the end of another cozy assumption and leave markets on their own. The chaos that has shrouded policy is dragging on confidence in asset classes like crypto that were expected to benefit from favorable regulations. For a brief moment Sunday, Trump's promise of a strategic crypto reserve reversed Bitcoin's steep decline from its mid-January peak. But the reversal was no more than a dead cat bounce as crypto soon gave up all the weekend's gains, and slid even further as the new tariffs became reality: Trump's botched attempt to talk up the asset class brings into question whether his pro-crypto regime can restore the confidence it ignited post-election. As it stands, the biggest cryptocurrency has lost more than 22% of its value since the inauguration. Bulls believed lax regulations plus a strategic reserve made up of digital assets would enhance their appeal and drive prices higher. The president still says he will follow through, but his commentary hasn't delivered a meaningful rally. Are enthusiasts morphing into cynics? Or do they just need more than social media posts to remain convinced to HODL (hold on for dear life)? Either way, the plunge is a protest statement that needs unraveling. Arca Investment's Jeff Dorman compares Trump's recent comments with former European Central Bank President Mario Draghi's "whatever it takes" speech, which supported prices by simply promising action even though nothing really happened: Digital assets have never had a backstop. That's a big reason for the persistent high volatility of this asset class. Crypto has never had a "buyer of last resort" — no government intervention, no rotation from value investors. But it's possible that it now has this backstop, or will, in short order, and market participants have to start pricing this in.

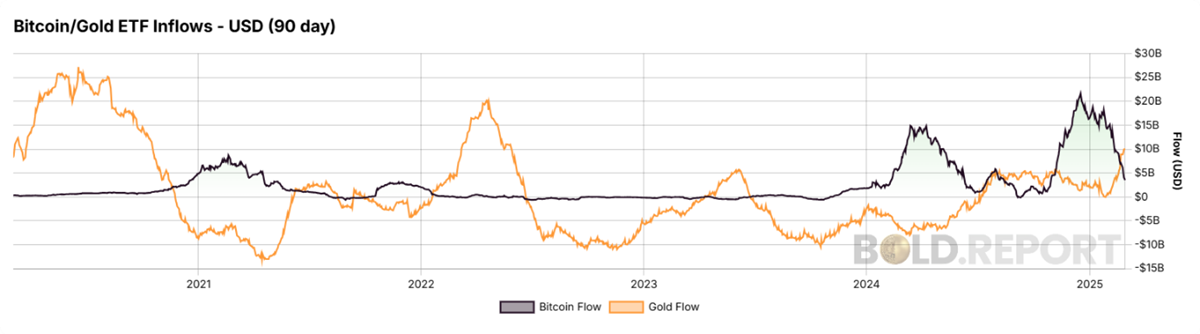

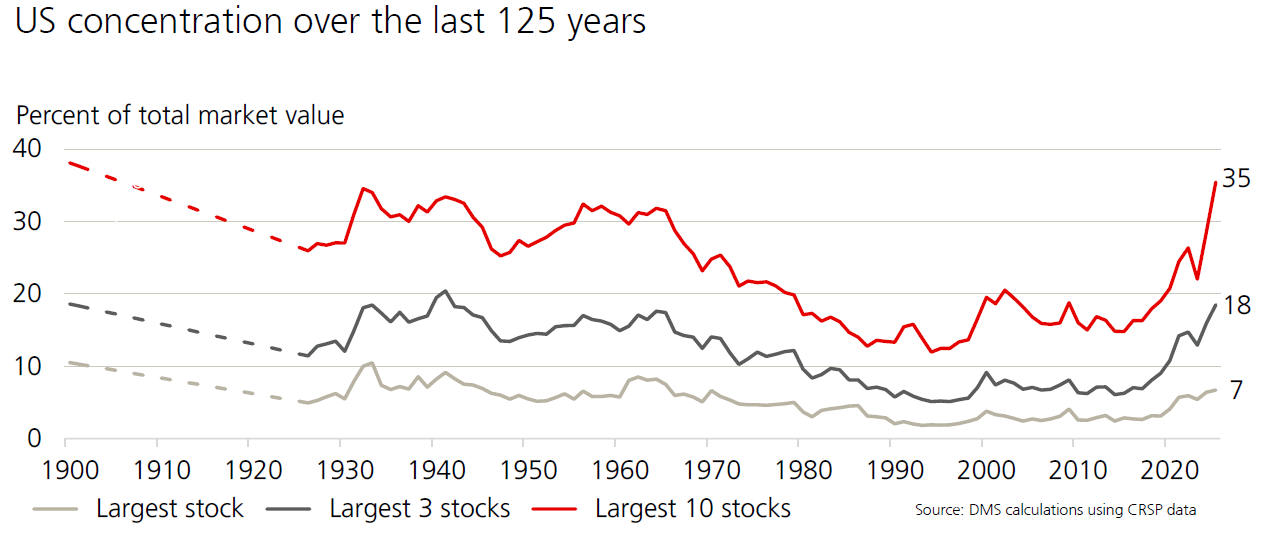

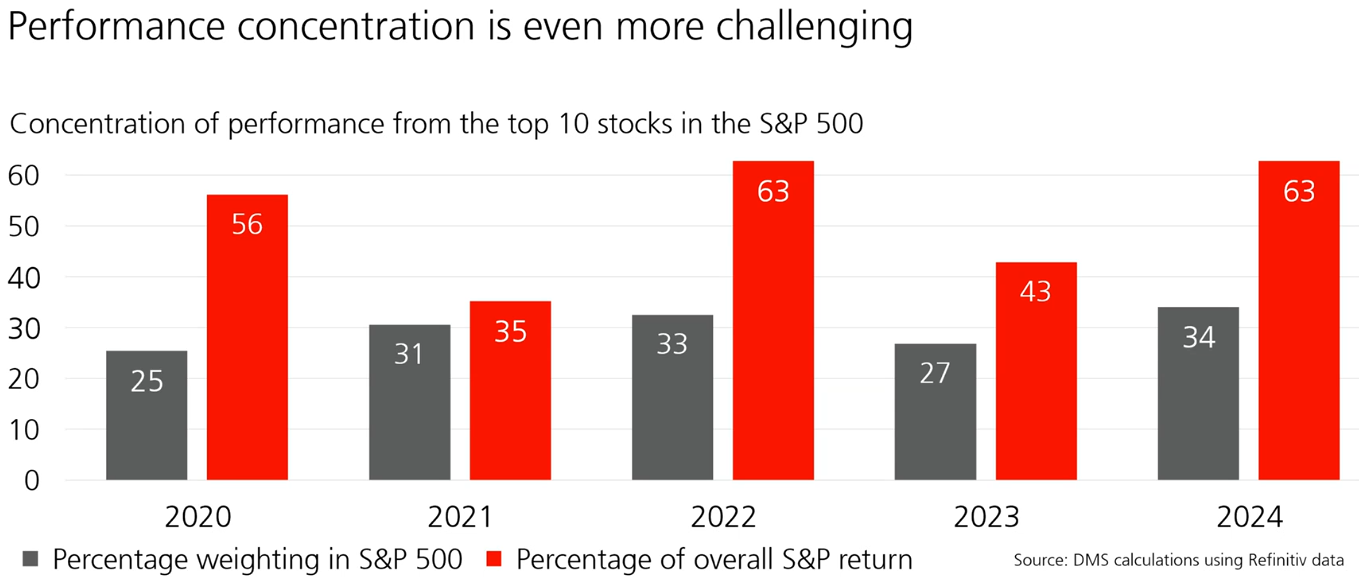

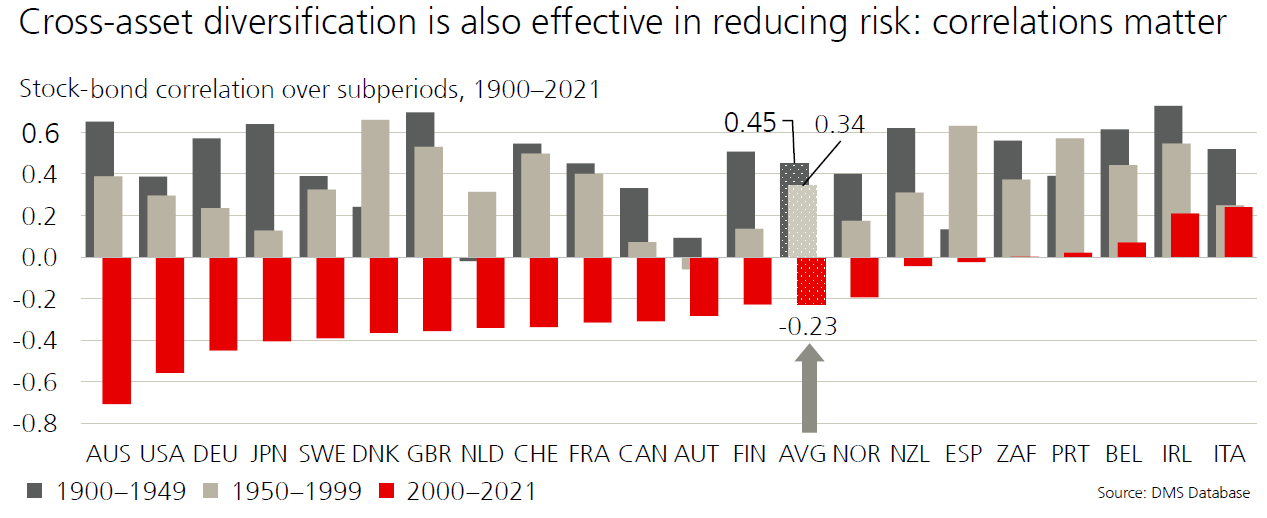

Implementing the reserve won't get an easy pass. Trump's announcement suggests it would hold more than Bitcoin, raising eyebrows over the other chosen digital assets. Frnt Financial's Stephane Ouellette argues that including tokens like ADA and XRP was not broadly popular. "Most classify Bitcoin in a segment of its own, which is fair because, at this point, other tokens aren't even positioning themselves as money," he says. Still, the short-lived relief Trump granted Bitcoin prices points to other factors that have driven this selloff. Its surge was assisted by exchange-traded fund inflows, which have turned negative, ByteTree's Charlie Morris notes. "It's not massive, but negative, and that is unhelpful to this bull market."  Source: Bold.report The flight from Bitcoin looks ever more like a typical risk-off event caused by the heightened uncertainty. As illustrated in this ByteTree chart, which compares Bitcoin and gold ETF flows in dollars, digital assets investors are fleeing to haven assets. Essentially, they're embracing gold as patience for Bitcoin wears thin: It's too early to say Bitcoin has lost its mojo. Perhaps, as a haven asset, gold remains the standard. But Ouellette points out that, over the last 15 years, digital assets have almost definitely grown faster from the start than any industry before, despite strict regulatory scrutiny. If Trump follows through, Bitcoin can run much further. —Richard Abbey Meanwhile, in the Long Run... | In the long run, we are all dead. It's Keynes' least controversial pronouncement. But there is value in looking at the very long run, particularly when the present is as confused as now. And we can rely on the Dimson, Marsh and Staunton Global Investment Returns Yearbook. Named for the academics Elroy Dimson, Paul Marsh and Mike Staunton and now sponsored by UBS, this is a long-running effort to compare the performance of stocks, bonds and cash in a range of global markets, going back to 1900. It's updated annually, the latest edition, published this week, is here, and everyone involved in managing money should try to read it. This year, the researchers have looked into US exceptionalism and the extraordinary performance of a few large US stocks, the theme of the moment. Viewed in historical perspective, the US is indeed as concentrated as it appears. The 10 largest stocks have their greatest share of US market cap in at least 92 years. Concentration was a bit higher in 1900, before antitrust had caught up with the activities of J.P. Morgan: The dominance of the big stocks has had a huge impact in the years since the pandemic, which is emphatically unlike anything seen in at least the preceding 50 years: So, yes, when we feel that the dominance of the Magnificent Seven is very unusual, we're right — this certainly is unusual. One political response might be that it's time for another dose of antitrust enforcement to match what Theodore Roosevelt unleashed the last time the market was this concentrated. That would be in line with the populist spirit of the times, but doesn't seem likely for the next four years. Over time, the research confirms that US outperformance is the norm, although not to the extent that we've witnessed recently. The last two months have indeed been extraordinary: The research also suggests that the period of extremely low interest rates that started at the beginning of this century and ended amid the inflation scare of 2022 should be treated as an aberration. Over the 20th century, across the countries in the sample, stocks and bonds were strongly correlated — as bonds gained, and yields went down, so stocks would also gain. From 2000 to 2021, this correlation was turned on its head, except in a few European countries. At this point, rising bond yields were taken as an encouraging sign of growth and so stocks went up: The critical implication was that bonds worked as a hedge for poor stock returns for two decades. Now that inflation is back on the horizon, it might be unwise to expect this to continue. The most recent correlation in the US, as measured by Dimson, Marsh and Staunton, is 33%, which is exactly in line with the average for the 20th century: Wherever trade and defense policy go in the months ahead, it would be as well to take this on board. It's best to take a correlation of about 33% as a base case from here on in. Some more music for when you need to hit the panic button. Try John Coltrane's Blue Train, or Howard Skempton's More Sweet Than My Refrain, the Pie Jesu from Faure's Requiem, For those who deal with circumstances like this with more cynical detachment, try Tom Lehrer's So Long Mom (a Song for World War III) or (of course) REM's It's The End of the World as We Know It (and I Feel Fine). Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. More From Bloomberg Opinion: Want more Bloomberg Opinion? OPIN . Or you can subscribe to our daily newsletter. |

No comments:

Post a Comment