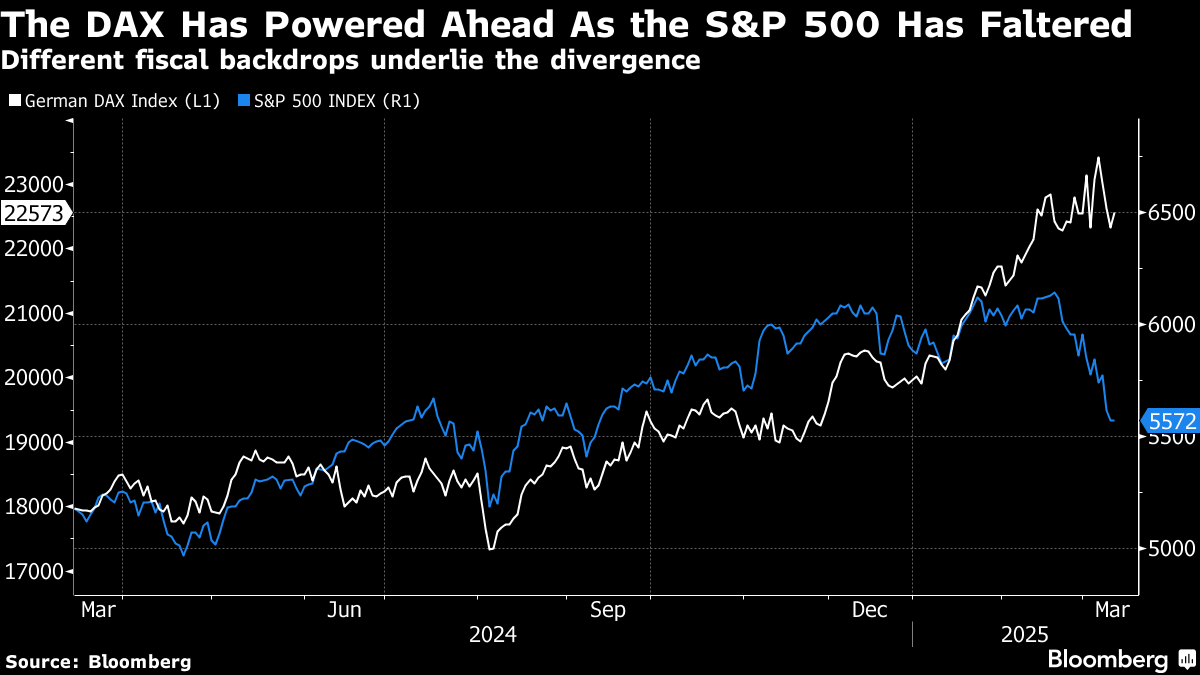

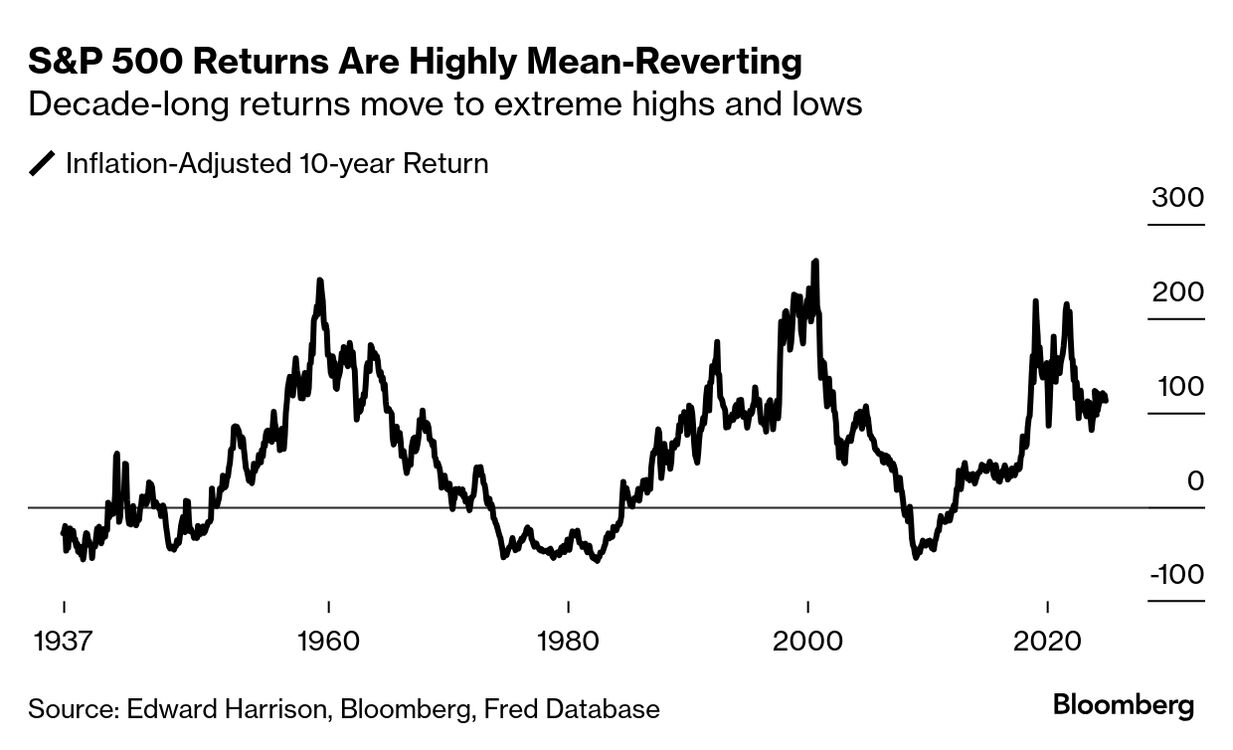

| This retrenchment by Trump points to the big difference for the US — deficits. The US budget deficits are so much bigger than Germany's that it adds an extra two or three percentage points of spending power to the US private sector relative to the German one, sometimes more. That was especially true during the pandemic, when the US went the extra mile to ensure that US households were flush with cash. Bloomberg data doesn't show the latest German figures but they are below 3% deficits. Trading economics shows the full year 2024 as coming in at 2.8%, just inside the Maastricht 3% deficit hurdle. So that 2% or 3% gap is probably more like 4% right now. Obviously Germany has made up the shortfall in domestic demand by exporting. But that doesn't make up for the domestic demand differentials from deficits. And so, German growth has been weak. This is going to change, principally because the message from the Trump administration to Europe has been that 'you're on your own'. Without the US defense umbrella and with the US starting a trade war via aluminum and steel tariffs, the Europeans have recognized an urgent need to reduce dependence on the US all around. In Germany, the incoming Chancellor Friedrich Merz is even trying to change the constitution to allow more debt in the lame duck session of the Bundestag, Germany's lower house of parliament, so as to avoid needing help from the AfD party, which has pro-Russian sympathies and may block the changes as a result. This isn't fully priced in | Just as the anti-growth aspects of Trump's agenda took a while to come into focus, this pro-growth EU agenda will also take a while to become fully apparent. And so, markets are far from having priced it in. The proof is in the legislation to increase defense and infrastructure spending and in the economic growth and earnings numbers to come. The first big hurdle is in Germany this week, where the Green Party has been stalling the constitutional changes because it has specific environmental wants on the infrastructure side of the ledger. They will be out of power in the coming coalition government and want to assure their agenda items get ticked off while they still have some sway. But once Germany allows for more debt, everywhere in the EU we are going to see more government spending as the Germans have been the enforcers of debt and deficit rules in the EU, as we saw during the European sovereign debt crisis. I would expect another lift in European equities on the constitutional change and yet more upside to European stocks once the money is actually spent and reflected in growth and earnings. What about the super bubble? | Meanwhile, I've decided to track the super bubble on a week-to-week basis. I want to add a blurb on it, even if short, every week to track how inexorably I think the gravitational pull of returns is likely to be as US exceptionalism fades from view. As a reminder, the thesis here is that bull markets in stocks cause long-term US equity market returns to move in long waves toward extreme overvaluation. These tops are self-correcting but eventually lead to extreme undervaluation. We're about six years into a down wave that I believe is most similar to the one that followed the 1959 market top. Here's the chart again, just for reference. If March ends with the S&P at yesterday's closing level, we would have just about a 100% return on stocks in the last 10 years in excess of inflation. That's about half of where we were six years ago, and even 3 ½ years ago during the pandemic trading bubble. It puts us to around the levels prevailing in 2018 when US exceptionalism began in earnest. If I am right that US exceptionalism is indeed over, expect those numbers to shrink further still in the coming years, with any downturn accelerating that decline. |

No comments:

Post a Comment