| Bloomberg Evening Briefing Americas |

| |

| On Thursday, Donald Trump signed a few more executive orders. Among the scores he's churned out since taking office, these were unique, since they partially reversed orders from just two days ago. It was the latest backpedal by the White House in the face of furious fallout both at home and abroad to his 25% sanctions against Canada and Mexico. With markets plummeting, automakers yowling and Canada pounding its chest, Trump announced he would exempt some goods from both countries, but only for a month. If that sounds familiar, it's because this is the second month-long delay Trump granted on his own tariffs. Today's announcement came after Trump spoke with Mexican President Claudia Sheinbaum, who has sought to negotiate with the 78-year-old president while Canada Prime Minister Justin Trudeau struck a more strident tone. The Trump administration did take pains to say its other threatened tariffs would move forward as planned in the coming weeks and months, but after weeks of threats, little follow through and now reversals, Wall Street has apparently decided the only safe thing to do is sell. The S&P 500 fell to a four-month low. —Jordan Parker Erb and David E. Rovella From today's Supply Lines newsletter: Thousands of executives managing global shipping and supply chains gathered this week near America's busiest port, trying to figure a way forward amid a shifting landscape of tariffs and retaliation. To learn more about how these insiders see the future of global trade, read today's edition of Supply Lines, a newsletter exclusively for Bloomberg.com subscribers. | |

What You Need to Know Today | |

| The Nasdaq 100 got slapped around as well. It tumbled 2.5% on the heels of Trump's tariff flip-flop and is now down more than 9% since hitting record highs on Feb. 19. It would seem that the prospect of Trump's trade war, sticky inflation and mass firings triggering a recession—or even worse stagflation—have traders looking at what they should sell rather than buy. And their targets are companies that have been the biggest winners over the past few years—tech stocks, specifically chips. Yes, the Magnificent 7 are getting dumped. Here's your markets wrap. | |

|

| The Trump administration could revoke legal status for Ukrainians who fled the war with Russia, Reuters first reported. The decision could go into effect as early as April. Meanwhile, European officials have been told that Trump wants to link the proposed US-Ukraine minerals deal to demands for Kyiv to commit to a quick ceasefire with Russia, one that would likely require it give up territory to the Kremlin's invading forces. The developments come after the Trump administration, which has been seeking warmer ties with Vladimir Putin, cut off military aid and some intelligence-sharing to Ukraine earlier this week. In response, Ukraine's former top military commander warned that the US is "destroying" the world's established order. Valerii Zaluzhnyi accused the White House of jeopardizing the "unity of the Western world" and warned that the North Atlantic Treaty Organization "may cease to exist."  US President Donald Trump has distanced America from its formerly close ally Ukraine while warming to Russian leader Vladimir Putin. Above Ukrainian servicemen during training exercises. Photographer: Genya Savilov/AFP | |

|

| Citadel Securities reported its largest ever trading haul, with full-year trading revenue rising to $9.7 billion from the previous year. The 55% increase vaults Citadel Securities ahead of lenders including Deutsche Bank and Barclays, but it still has a way to go before catching up to some of its US peers, including Bank of America and Goldman Sachs. | |

|

| The European Central Bank lowered interest rates for the sixth time since June and indicated that its cutting phase may be drawing to a close as inflation cools and the economy digests seismic shifts in geopolitics. The deposit rate was reduced by a quarter point to 2.5%, as predicted by all but one analyst in a Bloomberg survey. Analysts vary on where rates go from here: One sees no more reductions while others reckon the benchmark will go all the way to 1% in early 2026.  Christine Lagarde, president of the European Central Bank, at a rates decision news conference on Thursday. Photographer: Alex Kraus/Bloomberg | |

|

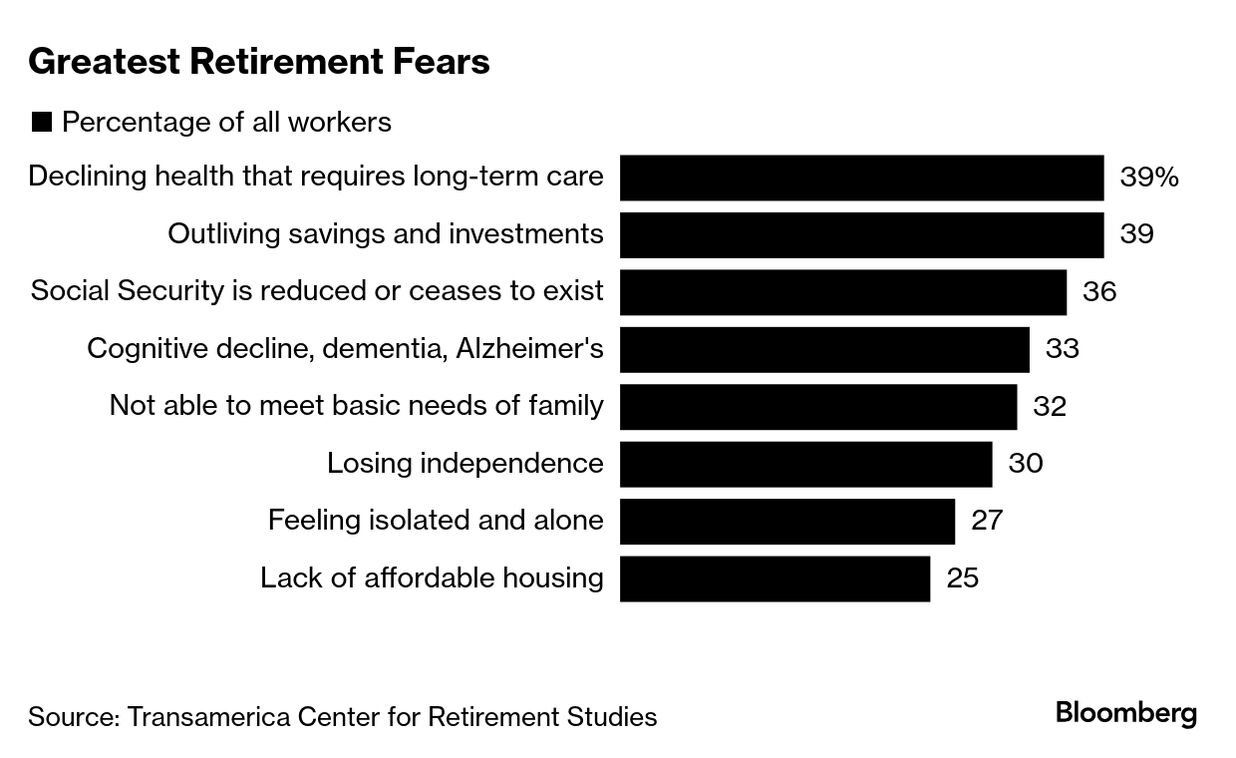

| New retirement plan: Not actually retiring. Millions of Americans plan to either extend full-time work, work in retirement or simply never retire, according to a report released Thursday by the retirement studies division of the Transamerica Institute. Some 36% of workers who aren't self-employed plan to retire at 70 or older and 53% say they plan to work in retirement. Americans are increasingly adjusting their expectations for retirement, with many worrying they won't be able to afford it. Nearly 40% of all surveyed workers said one of their greatest retirement fears was outliving their savings. | |

|

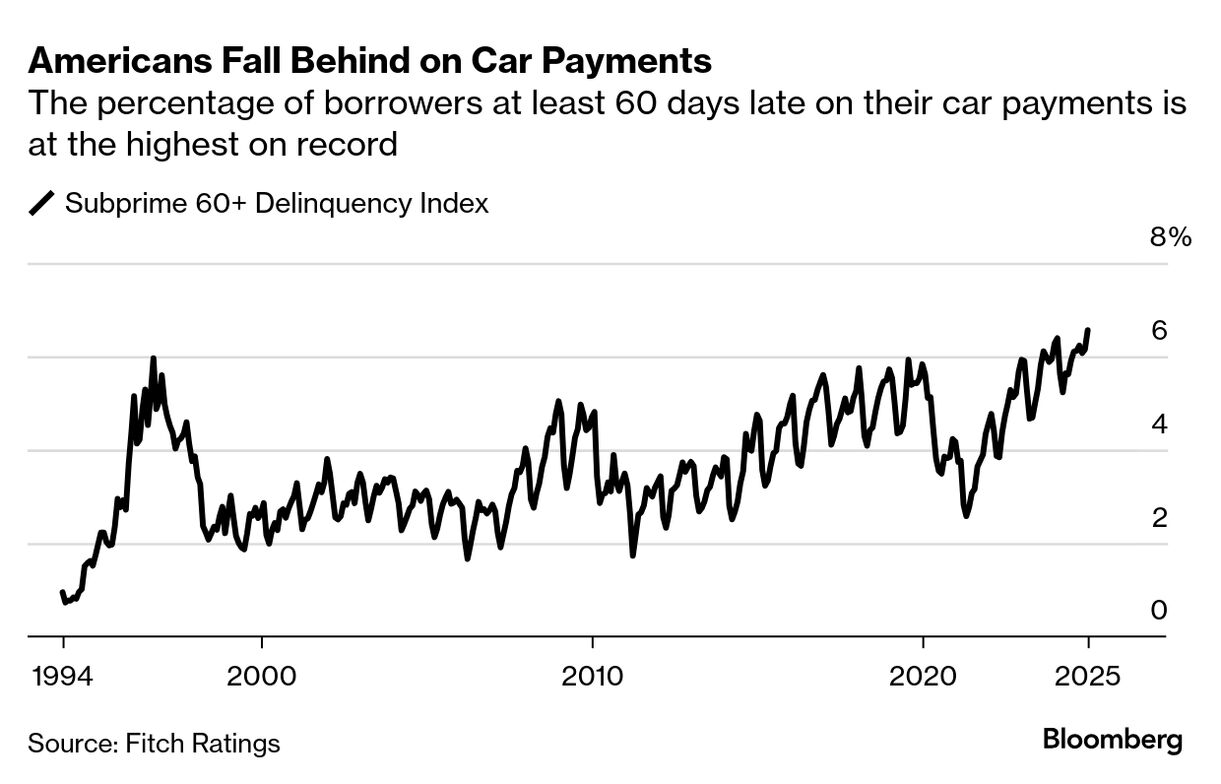

| Car owners are missing their monthly payments at the highest rate in more than 30 years. In January, the share of subprime auto borrowers at least 60 days past due on their loans rose to 6.56%, the most since the data collection began in 1994, according to Fitch Ratings. A slowing economy and the ongoing impacts of residual inflation have made it harder for many consumers to stay current on their bills. Auto loans have been a particular pain point, with higher car prices and elevated borrowing costs driving a surge in repossessions. | |

|

| |

What You'll Need to Know Tomorrow | |

| |

| |

| |

| Enjoying Evening Briefing Americas? Get more news and analysis with our regional editions for Asia and Europe. Check out these newsletters, too: Explore all newsletters at Bloomberg.com. | |

| |

Like getting this newsletter? Subscribe to Bloomberg.com for unlimited access to trusted, data-driven journalism and subscriber-only insights. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. Want to sponsor this newsletter? Get in touch here. | | | You received this message because you are subscribed to Bloomberg's Evening Briefing: Americas newsletter. If a friend forwarded you this message, sign up here to get it in your inbox. | | |

No comments:

Post a Comment