| Bloomberg Evening Briefing Americas |

| |

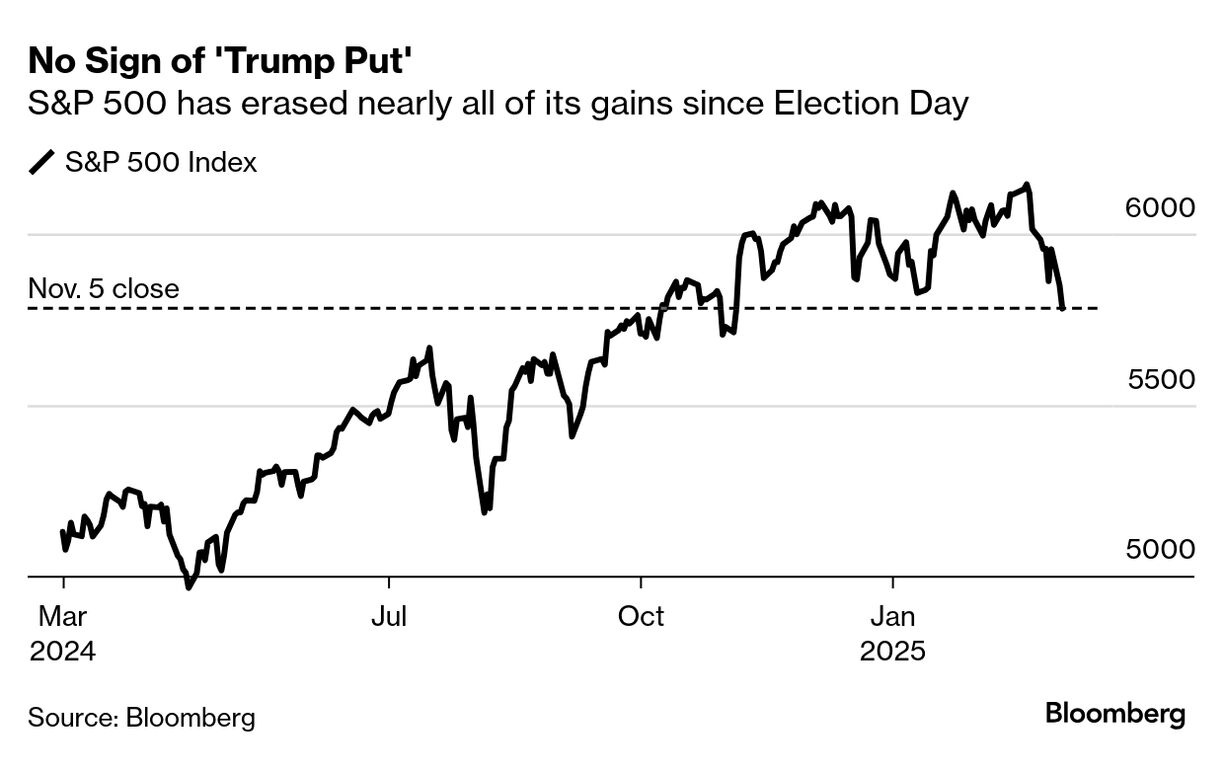

| First, what happened today. Minutes after US President Donald Trump launched his trade war, America's second and third biggest trading partners—Canada and China—fired back with powerful retaliatory tariffs of their own. The Republican's decision to finally follow through on his repeated threats to shakeup the global economy also sent the stock market deeper into the hole it started digging yesterday. Mexico, the biggest US trading partner, took a different approach. President Claudia Sheinbaum insists her government will try to negotiate with Trump, announcing (in Trumpian style) that tariffs and other measures are coming—but not until Sunday. Meanwhile, she'll speak to him on the phone and maybe they'll do a deal. Yesterday, the S&P 500 saw its worst selloff of the year, wiping out gains going back to the start of January. On Tuesday, stocks continued to plummet, wiping out gains going back to Trump's election. Wall Street veterans who once cheered the 78-year-old's return to the White House are beginning to get nervous (if not bearish) about what his policies will mean for their investments. In an interview at the Bloomberg Invest conference, former Treasury Secretary Robert Rubin said Trump's policies have stoked the greatest uncertainty in his six-decade career. Rubin warned that the US administration will undermine confidence, worsen the nation's fiscal trajectory and endanger American credibility on the global stage. Then, after markets had closed, everything changed. Maybe. On Monday, this newsletter alluded to how a Trump aide said over the weekend that maybe the president would change his mind about new tariffs, as he had done many times before. Late this afternoon, after a flood of global indignation and retaliation, a diving stock market and a report of falling poll numbers, it looks like maybe he did. —Jordan Parker Erb and David E. Rovella Trade wars, tariff threats and logistics shocks are upending businesses and spreading volatility. Understand the new order of global commerce with the Supply Lines newsletter. | |

What You Need to Know Today | |

| Corporate America isn't waiting to figure it out, though: It's preparing consumers for more inflation. Target is telling customers they will have to pay more money because of Trump's tariffs. While it's still too early to predict which items will get more expensive and when, items with a shorter supply chain—like fresh produce—could be affected quickly, executives said. Best Buy also echoed the price warnings on its earnings call, telling investors that increases are "highly likely" on its gadgets and appliances.  Target Chief Executive Officer Brian Cornell warned shoppers to expect higher prices as a result of Trump's tariffs. Photographer: David Paul Morris/Bloomberg | |

|

| The Trump administration is walking back a directive ordering federal agencies to cut probationary employees after a judge last week ordered a pause to the mass terminations. The Office of Personnel Management's revised guidance clarifies the administration is not directing agencies to terminate probationary workers, typically those who have been in their current positions for less than a year. The change gives agencies the potential to rehire workers who they cut in recent weeks, if they choose to. The National Science Foundation said earlier this week it is rehiring about half of the 170 people it fired two weeks ago. However, in some instances of federal workforce dismissals, employees, advocates and unions have said the Trump administration hasn't followed federal court orders to pause or reverse course. | |

|

| Goldman Sachs is gearing up for its annual firings. The planned cuts are to focus on the bank's vice presidents, with about 3% to 5% of staff expected to be dismissed. The latest round will take place in the spring of this year. Goldman's headcount totaled 46,500 at the end of 2024, according to its latest annual filing. The bank had 45,300 staff at the end of 2023, down from 48,500 the year before. | |

| |

|

| In a victory for Trump, BlackRock will buy a few Panama Canal ports. Hong Kong-based conglomerate CK Hutchison agreed to sell control of a unit that operates ports near the canal. The deal comes after pressure from Trump to limit Chinese interests in the region, and his threat to take the sovereign nation's canal by force. The agreement was reached alongside a deal in principle for a consortium led by BlackRock to acquire units that hold 80% of the Hutchison Ports group, which operates 43 ports in 23 countries. CK Hutchison said it would receive cash proceeds of about $19 billion from the broader ports deal. It also removes itself from a major headache, since Panama's government had been weighing canceling the company's contract to operate the ports, Bloomberg reported last month. | |

| |

|

| Saudi Aramco plans to trim the world's biggest dividend, lowering a key source of funds for Saudi Arabia's budget while relieving stress on its own finances. Aramco said it expects the total payout to be about $85 billion in 2025, compared with $124 billion last year, it said in a statement Tuesday. The decision represents a crucial choice for the Saudis: Risk increasing stress on Aramco's balance sheet or let the kingdom's budget deficit widen. The company had recently flipped into a net-debt position, a sharp turnaround from the more than $27 billion in net cash a year ago. Last year, the total dividend was almost $40 billion higher than free cash flow—the money left over from operations after accounting for investments and expenses. | |

|

| Texas reported 13 new cases of measles Tuesday as the US Centers for Disease Control and Prevention—which has seen at least 1,300 employees terminated by Trump—sends a team of epidemiologists and doctors to help the state with the growing outbreak. Texas has now reported a total of 159 cases since the outbreak began Jan. 23. State officials said 22 people have been hospitalized. Trump's Secretary of Health and Human Services, Robert F. Kennedy Jr., originally said the outbreak, which has killed a young child, was "not unusual." The once avowed vaccine skeptic later altered his stance on the outbreak. | |

|

| |

What You'll Need to Know Tomorrow | |

| |

| |

| |

| Enjoying Evening Briefing Americas? Get more news and analysis with our regional editions for Asia and Europe. Check out these newsletters, too: Explore all newsletters at Bloomberg.com. | |

| |

Like getting this newsletter? Subscribe to Bloomberg.com for unlimited access to trusted, data-driven journalism and subscriber-only insights. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. Want to sponsor this newsletter? Get in touch here. | | | You received this message because you are subscribed to Bloomberg's Evening Briefing: Americas newsletter. If a friend forwarded you this message, sign up here to get it in your inbox. | | |

No comments:

Post a Comment