Titanic Syndrome: Prepare Now

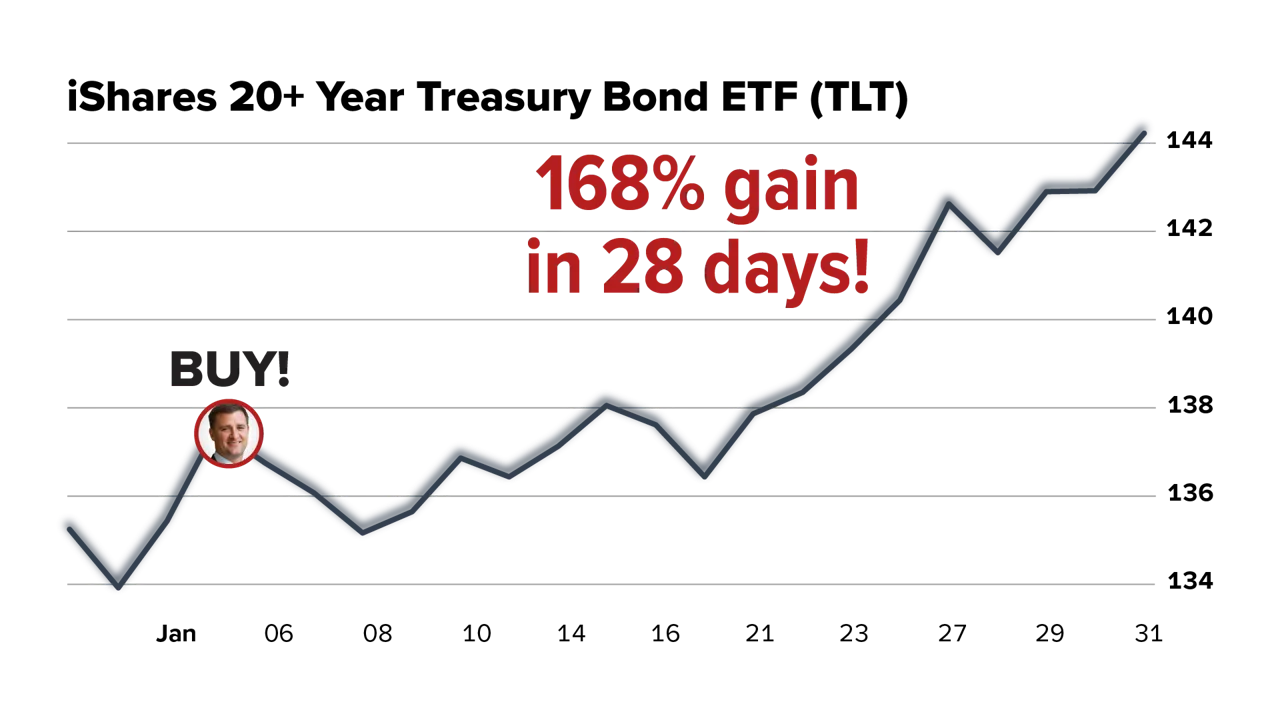

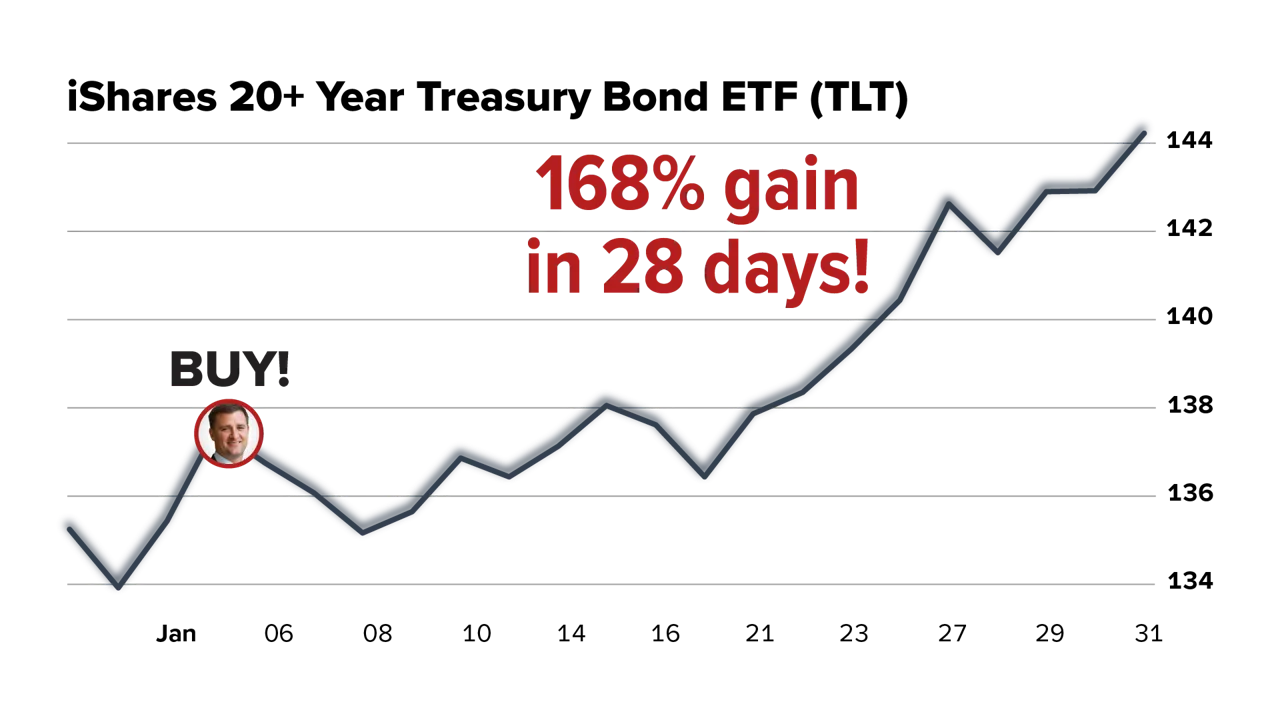

Earlier this week I wrote to you about the extremely rare bearish pattern I spotted. It's called "Titanic Syndrome"... And it's only appeared 10 times in the past 40 years. This tells me we may see several more weeks of choppy markets. And I'm not the only one saying this... Many other smart analysts stepped forward this week with big warnings. As its name indicates, this pattern may be disastrous for the equity markets. The last time it flashed was back in December 2019... Two months later, stocks crashed 34%. Do I think an even bigger crash than we've seen is looming? Not necessarily... But I do want to share one strategy that worked extremely well in the weeks after that last appearance of the Titanic syndrome. Because it's one of the best ways to use this high volatility to your advantage. It comes from former hedge fund manager and volatility expert Greg Diamond, who works with our friends at Stansberry Research. Take the volatile 2020 market, for instance... Greg spotted a bottom in bonds... and went on to recommend a play on the iShares Treasury Bond ETF, locking in a 168% gain in 28 days:

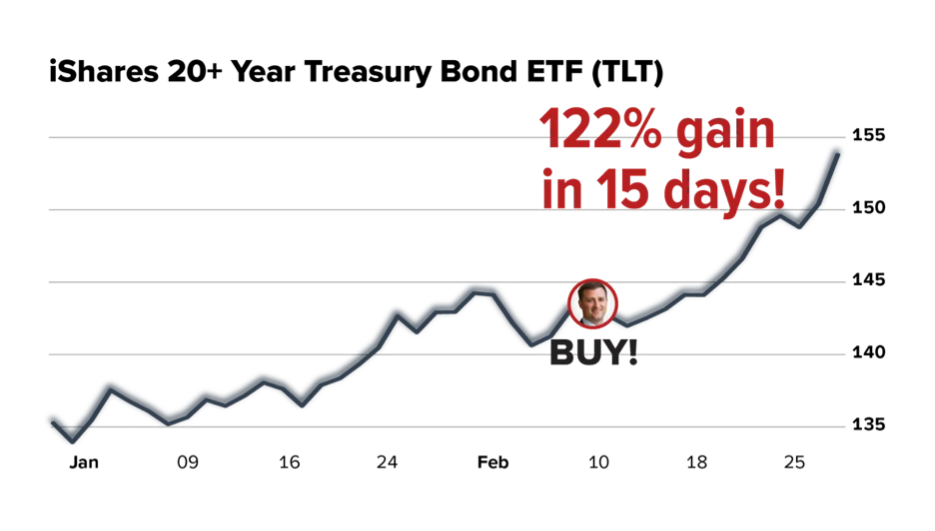

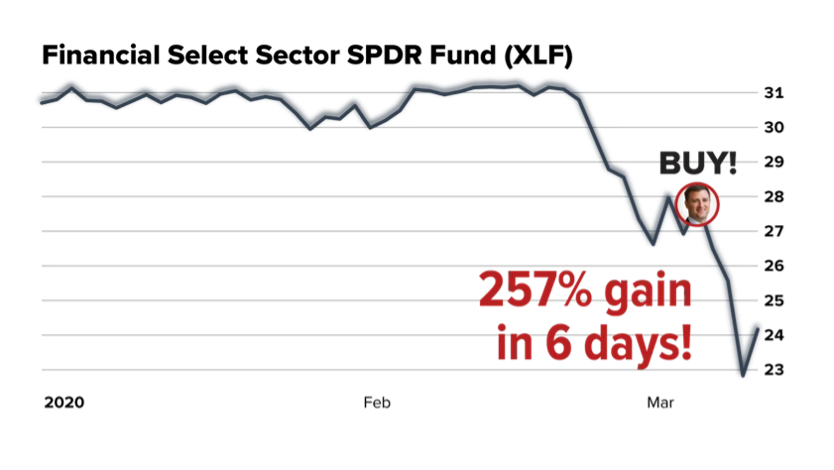

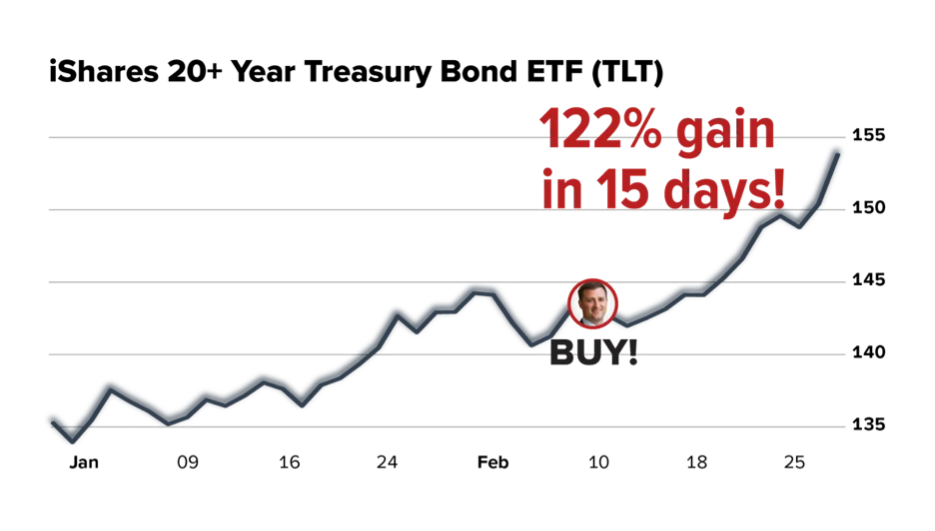

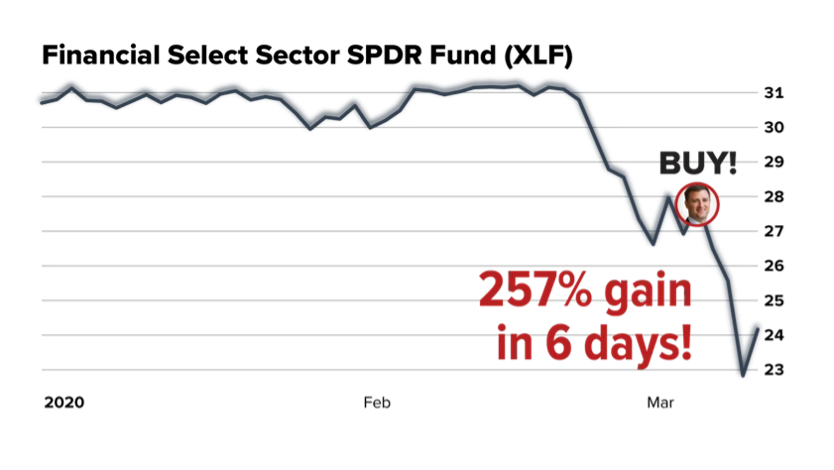

He did the same a month later, booking a 122% gain on the same ticker – this time in just 15 days:  And then in early March, when the market saw the fastest correction ever... He spotted some major moves in the financial sector, and booked a 257% gain on the Financial Select Sector SPDR Fund – in just 6 days:  This is something Greg's done over and over again throughout his 20-year career, both as a professional money manager, and now writing for Stansberry. During Trump's first term, for instance, marked by some of the most extreme volatility I've lived through... Greg found 17 different ways to double your money, in as little as 24 hours. Meaning, if this volatility continues in the coming weeks (as I expect it will), or we see a huge crash like we saw following the last appearance of the Titanic syndrome (and we might)... Greg's new warning is something you should take seriously. Regards, Marc Chaikin

Founder, Chaikin Analytics P.S. Here's a look at all the doubles that Greg has booked just since 2018: 100% in 17 days on the iShares Russell 2000 Fund

168% in 9 days on Advanced Micro Devices

197% in 19 days on Caterpillar

116% in 35 days on the VanEck Semiconductor Fund

159% in 41 days on Nvidia

101% in 24 hours on Advanced Micro Devices

127% in 15 days on Caterpillar

180% in 49 days on FedEx

138% in 10 days on the ProShares UltraPro QQQ Fund

104% in 12 days on Advanced Micro Devices

167% in 34 days on the SPDR S&P 500 Fund

257% in 6 days on the Financial Select Sector SPDR Fund

345% in 19 days on the VanEck Gold Miners Fund

110% in 9 days on Tesla

107% in 8 days on SPDR Gold Shares

166% in 13 days on the iShares 20+ Year Treasury Bond Fund

150% in 16 days on Advanced Micro Devices

123% in 14 days on the iShares 20+ Year Treasury Bond Fund

105% in 6 days on Advanced Micro Devices

197% in 13 days on Tesla

329% in 16 days on the VanEck Gold Miners Fund

111% in 5 days on the VanEck Semiconductor Fund

100% in 2 days on the ProShares UltraPro QQQ Fund

171% in 43 days on the VanEck Gold Miners Fund

137% in 20 days on the SPDR S&P 500 Fund

180% in 11 days on the SPDR S&P 500 Fund

108% in 7 days on Advanced Micro Devices

101% in 5 days on FedEx

168% in 28 days on the iShares 20+ Year Treasury Bond Fund

100% in 5 days on the ProShares UltraPro Dow30 So don't be phased by this volatility – embrace it. Here's Greg's full playbook for 2025. |

No comments:

Post a Comment