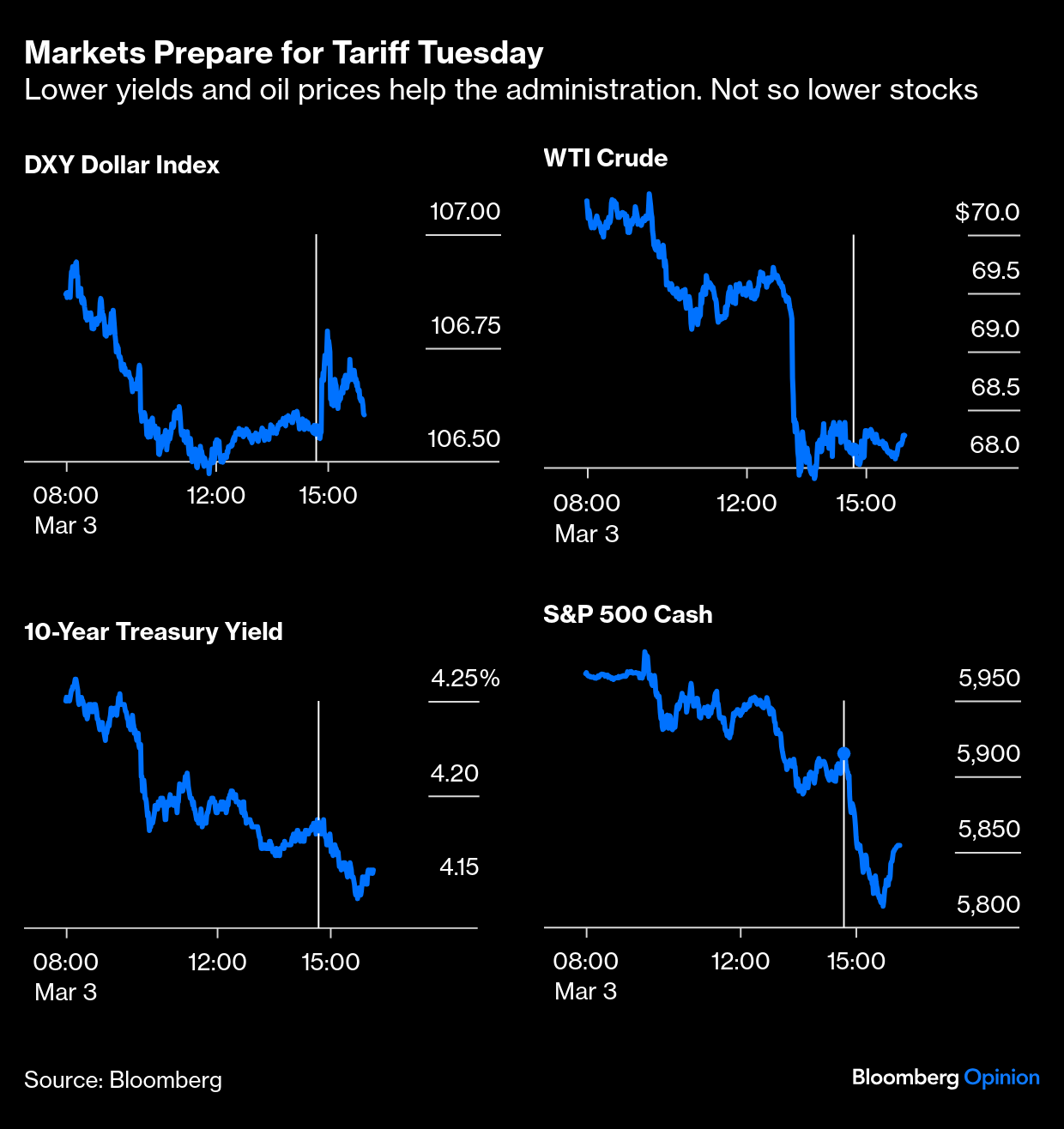

| Today's Points: Markets to Trump: Drop the Tariffs | The US president announced at 2:42 p.m. Eastern Time that tariffs on Canada and Mexico would commence Tuesday. Many had complained that the market had grown too complacent about tariffs. Judging by the instant reaction, they were right. The vertical lines in the chart indicate the timing of the announcement: The S&P 500's worst day this year showed markets disliked it, though both bonds and stocks bounced after initial selloffs. For an administration that has targeted lower 10-year Treasury yields and crude prices and a weaker dollar, the day wasn't necessarily so bad. Stocks matter a lot for Trump, and their fall could be concerning. There's a widespread theory that markets will act as the most important guardrail for economic policy; we should soon find out if that's right. The pro-growth Trump trades that took hold after the election are almost all in reverse. The following chart is indexed for Election Day and follows stocks relative to bonds, US stocks relative to the rest of the world, US growth stocks relative to value, and Bitcoin. All have turned around since January in a way that must have lost a lot of money for a lot of people. But it would be unwise to take it much further than that. The Trump trades are back where they were Nov. 5. Some extreme enthusiasm has been knocked off the top. Where they are in a year or two will depend on the impact Trump policies actually have on the economy:  It's noticeable that the biggest losers have been the investments that had the greatest profits to be taken. Nvidia Corp.'s market cap is now down by about $800 billion from its peak, and back to a level it first reached last May. That said, it's still double the size it started from last year. This is consistent with a correction of excess, and a somewhat indiscriminate retreat from risk: The deregulatory and tax-cutting parts of the Trump agenda remain as popular as ever on Wall Street. It's hard to find anyone who likes tariffs. Two comments from today are typical. This is from JPMorgan's David Kelly: The trouble with tariffs, to be succinct, is that they raise prices, slow economic growth, cut profits, increase unemployment, worsen inequality, diminish productivity and increase global tensions. Other than that, they're fine.

Carl Weinberg, chief economist at High Frequency Economics, said: If they are imposed as threatened, US industrial activity will fold at once, and we will not have to wait until the next ISM survey to know about it. Critical sectors of the economy face existential threats from the Trump tariffs and likely retaliation. Autos, energy, and aerospace are three that come to mind very quickly. Appliances, electronics goods, furniture, and clothing come to mind next.

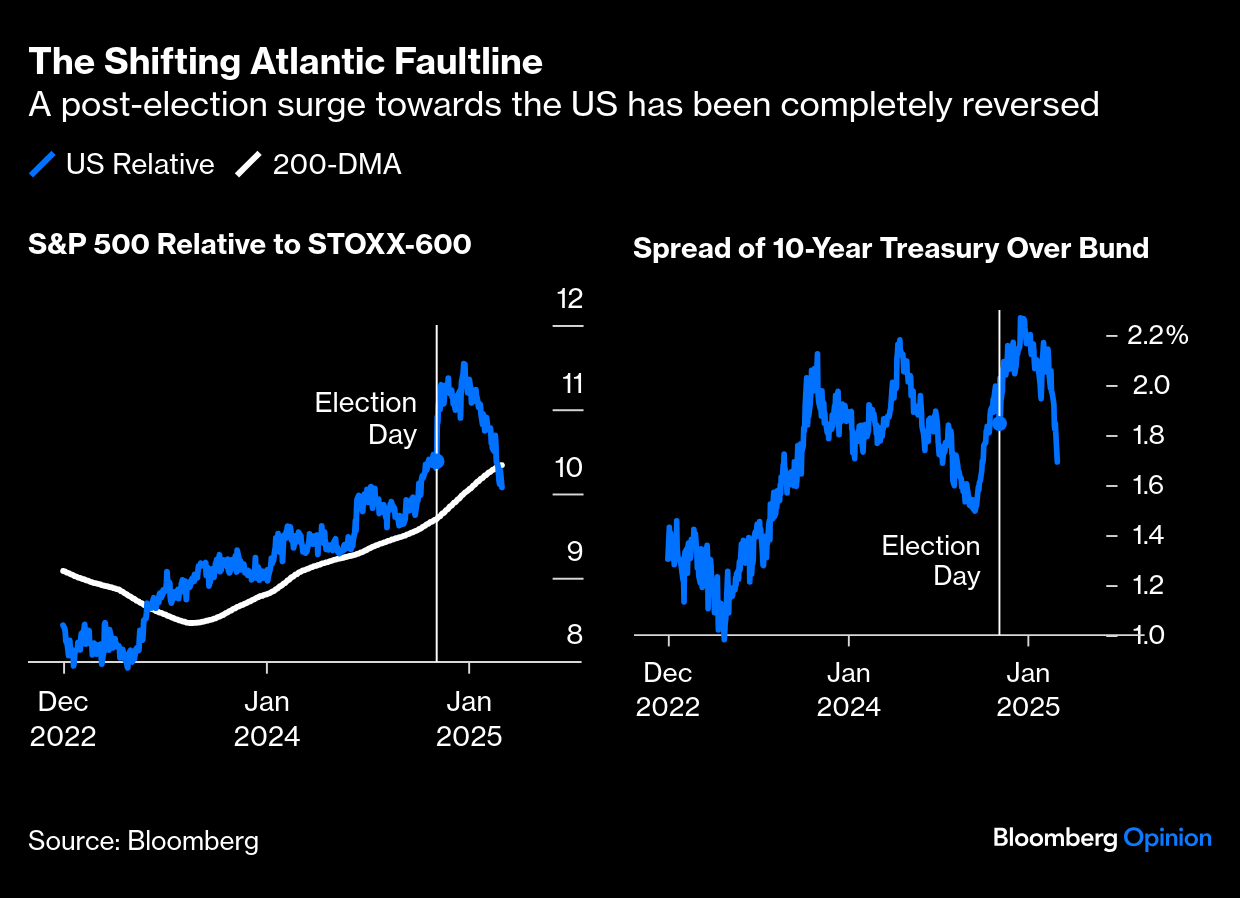

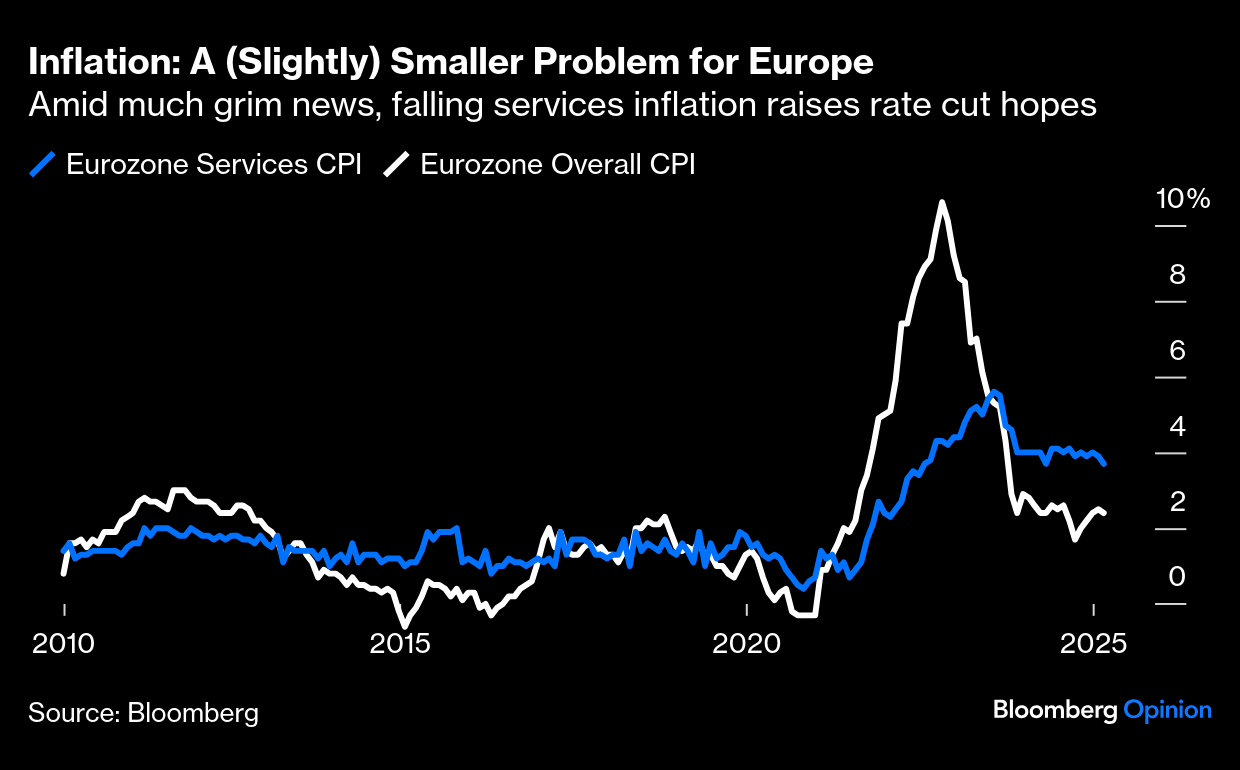

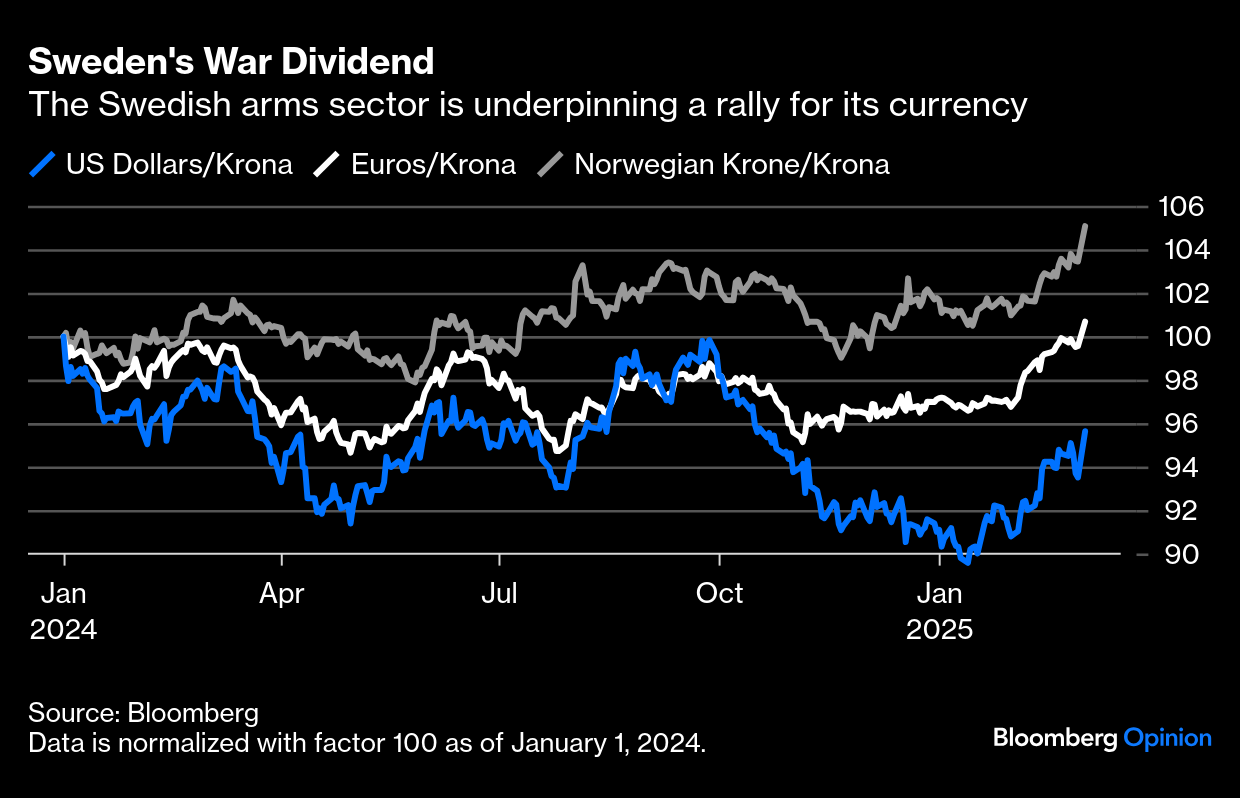

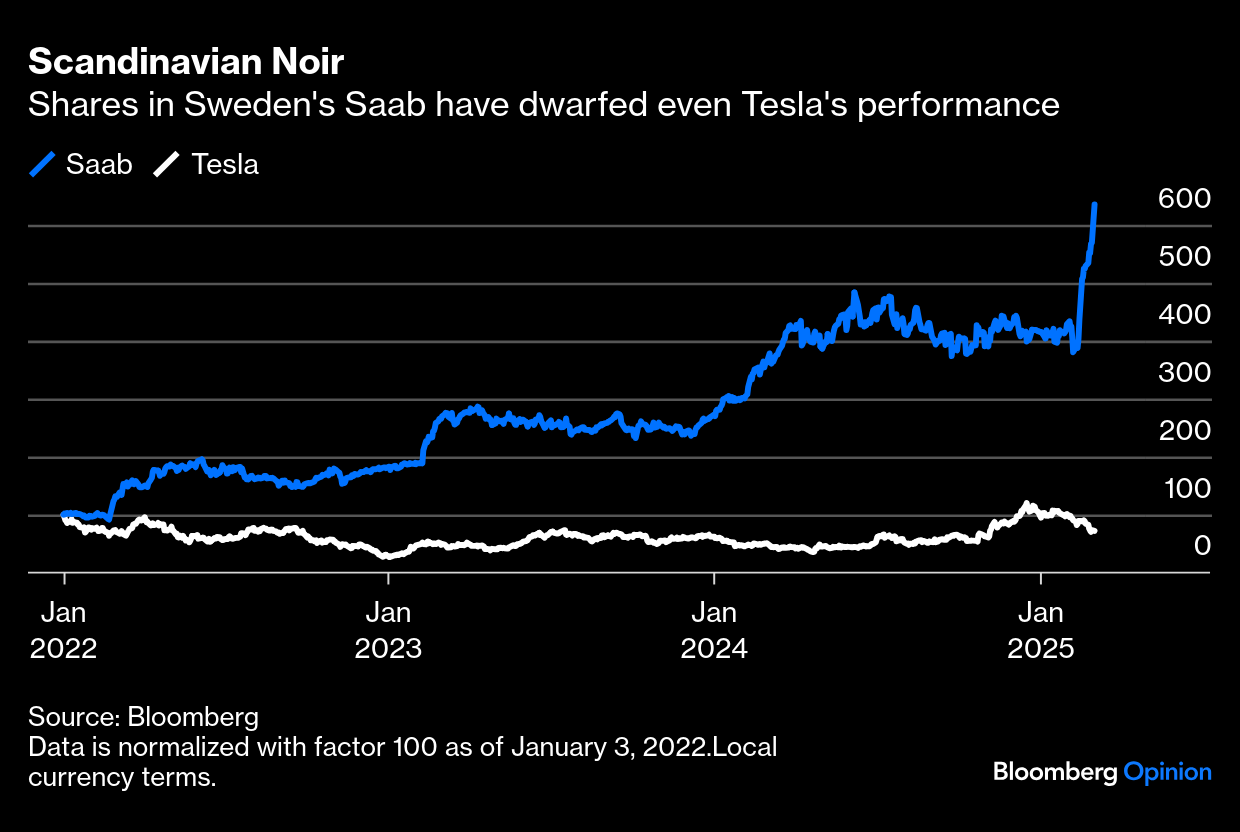

It's possible that Wall Streeters are overreacting. In Trump 2.0 trade policy, as in foreign policy, this is as big a shift as has been seen since the Second World War, and the opposition to tariffs may reflect a failure of imagination. This reaction could reverse just as the post-election euphoria reversed, once we all have some evidence to work with. But it's quite a chorus of disapproval. We know a geopolitical turning point when we see one. JD Vance's speech in Munich was such an event. So was Friday's meeting in the Oval Office involving Vance, Trump and Ukrainian President Volodymyr Zelenskiy. We all have our views on whether the new US foreign policy is good or bad. The narrow question now is what effect US withdrawal from traditional alliances will have on markets. So far, it looks as though investors expect Europe to be the greatest beneficiary, or at least to gain at US expense. American exceptionalism, as expressed by the US stock and bond markets, has taken a big step backward in the last month: Some of this is because the macro conditions are helpful. The latest euro zone inflation figures show headline CPI at almost exactly 2% while services inflation is also falling. The market is pricing in a substantial certainty of a rate cut by the European Central Bank this week, and such numbers don't get in the way of that: But geopolitics is driving this more than anything. The news out of Germany is that Trump and Vance appear to have galvanized the three biggest parties in the current legislature — the center-left Social Democrats, center-right Christian Democrats and the Greens — to agree on big extra borrowing to fund not only defense but also infrastructure. Combine the German electorate's enthusiasm for the far-right Alternative für Deutschland with the US withdrawal from its European alliance, and the existing German establishment suddenly does what it had steadfastly refused to do for a generation. Then there is the surprisingly swift progress of talks on European support for Ukraine, which may benefit from not being under the cumbersome aegis of the European Union. It appears from events over the weekend that the US volte-face has managed to bring not only the big EU powers but also the UK, Norway and Turkey together and working coherently. We've already had to jettison the assumption that the US will always have Europe's back; now perhaps we should no longer prejudge that Europe will never get its act together. The prospects for the European defense sector are transformed, and market excess is appearing in unlikely places. In relation to its size, Sweden probably has Europe's biggest armaments sector. This is what has happened to the currency since the beginning of last year: Despite the dark reasons, the new political climate is perceived to be good for Sweden. It's led to trades that are almost the reverse of what had been expected two months ago. Vladimir Putin and Trump have combined to drive a great rally for Saab AB, the country's biggest defense contractor. The chart starts in 2022, just before the invasion of Ukraine, and shows Elon Musk's Tesla Inc. as a handy comparison: The surge in shares of Rheinmetall AG, a German industrial group that focuses on defense, has been if anything even more impressive since the US election. It's compared on this chart with Bitcoin: Large old-line European manufacturing groups are beating the greatest standard-bearers of the new economy and the Trump Trade to an almost comical extent. What could possibly go wrong with the MEGA scenario? First, Europe might well not, in fact, get its act together — or at least may take too long to do it. Both current leaders and their electorates are quite capable of thwarting this agenda, and they start with a weak economy. Second, expansive fiscal policy brings with it the risk of higher rates. Bond vigilantes can't be safely ignored. Third, Europeans must still find someone to buy their stuff. The US is resorting to tariffs, while Russia and China aren't reliable options. Then there's the risk that Putin's Russia establishes dominion over the continent's east before the west has completed building its armory. And finally, there's the risk of all-out war. Previous arms races involving the European powers didn't end well.  Can they get it together? Photographer: Neil Hall/EPA An unthinkable reversal by the US has allowed investors to envision something previously even harder to imagine — that Europe might pull itself together and do what is necessary. The chances certainly look much better than before Vance spoke in Munich. But we don't yet know how this story will end, and MEGA may already be an overcrowded trade. The bruises that the post-pandemic economy dealt to recession models haven't fully healed. Talk of a recession or hard landing slowly faded as consumer resilience and stealth fiscal easing by the Biden administration buoyed the economy last year. Trump 2.0's pro-growth agenda was viewed as the catalyst for a boom, as shown by markets' euphoric reaction to his victory. An economy that hums along remains the most plausible outcome. But signs of strain are increasingly hard to ignore. This is in large part, though not entirely, due to the policy uncertainty that has accompanied Trump and provides a new meaning to otherwise benign signs of economic weakness. The world's largest economy advancing at a 2.3% pace in the last quarter, after a remarkable 3.1% in the prior quarter, hardly signals trouble. However, Ryan Sweet, chief US economist at Oxford Economics, warns that the downward revision to real business equipment spending, which has not seen a post-election reprieve, is a telltale sign of imminent trouble: Policy uncertainty could easily be a larger drag than we anticipated, but the uncertainty around tariffs could cause some front-loading of imports, which should boost inventories and help offset any drag from the widening in net exports...

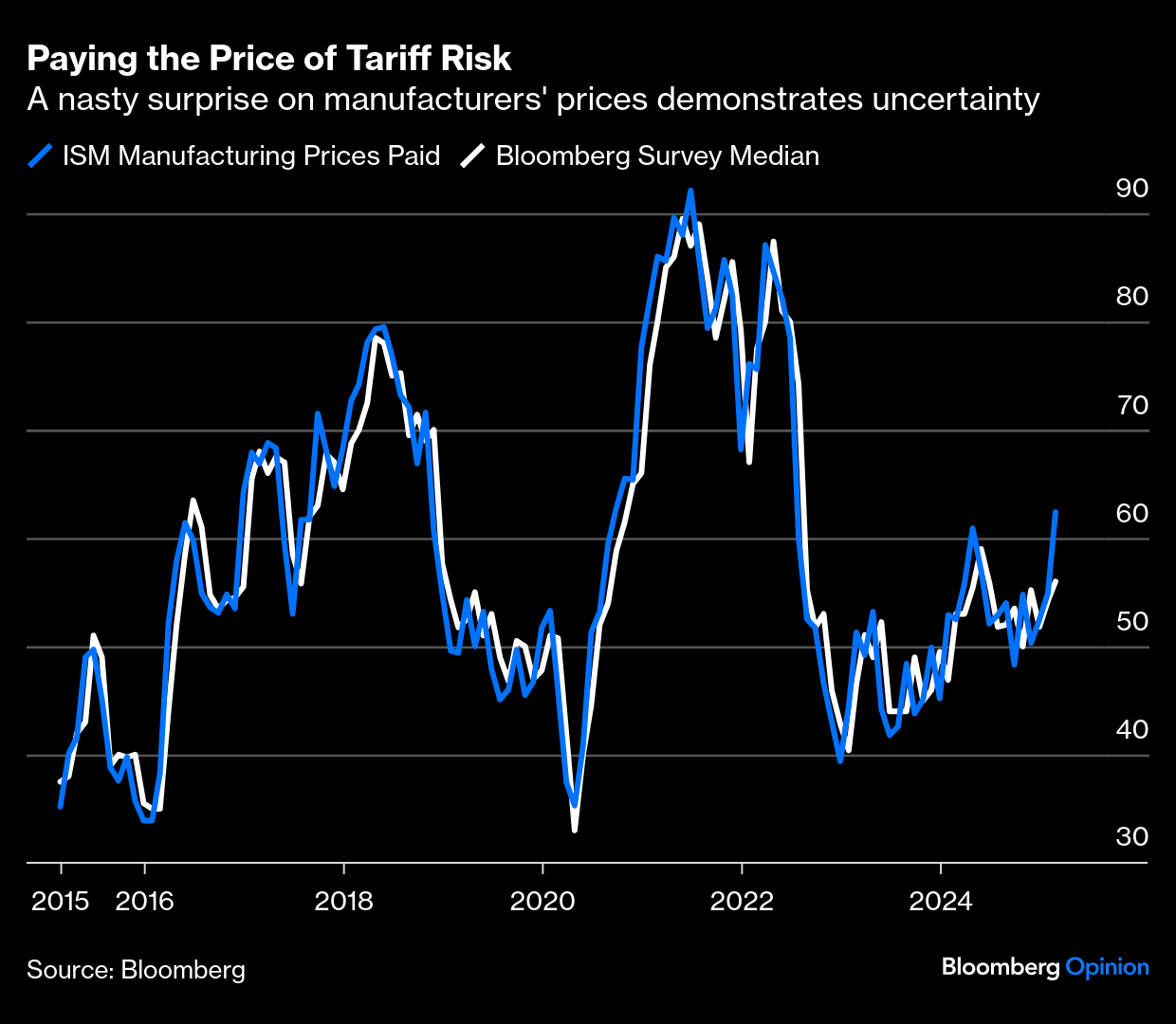

Working out what to do about tariffs is a headache. Speculation has fueled inflation expectations, and appears already to have impacted businesses' behavior. The latest ISM supply manager survey for March showed manufacturers reporting a sharp rise in the prices they pay. The measure is its highest in 30 months: This makes it far harder for the Federal Reserve to cut rates. That in turn piles on consumers' pain from high interest. Data from VantageScore, a credit scoring agency, show credit balances at a five-year high as housing costs and interest rates compound mortgage repayment strains. Auto-loan delinquencies are rising while new credit card account growth has fallen, suggesting borrowers are prioritizing managing existing debt. At the other end of the credit spectrum, last week also saw the return of distinct unease to investment grade corporates, two years on from their last major shock, the regional banking crisis. Spreads, and therefore implied risk, remain far lower than they were then, but have jumped to their highest in five months, and above the 200-day moving average. It's a sign of concern that credit risk, even at big companies, is underpriced: Signs of weakness in top-income households are impossible to overlook. Their huge proportion of total spending helped prop up the economy as lower-income households struggled. SMBC Nikko's Troy Ludtka argues that stress is showing as these wealth effects fade: This is particularly the case with travel. In December 2024, a record 24.1% of people planned to travel to a foreign country. Recently, however, travel enthusiasm has been waning, in a possible indication that spending from asset-price-sensitive households — which has supported overall spending — may be coming under pressure.

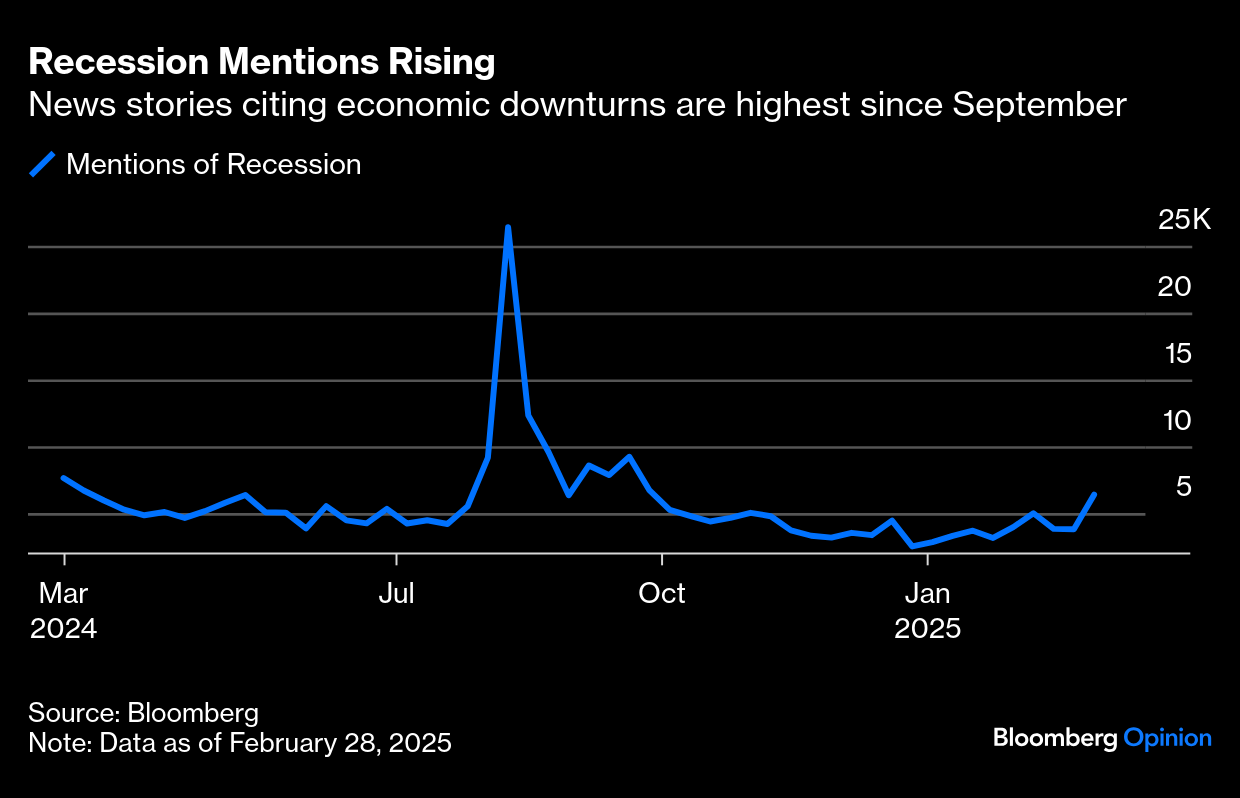

This SMBC chart puts the softening in context: Add this together, and the tariffs announcement comes just as a growth scare was taking shape. A Bloomberg news trends analysis shows that by the end of last week, the number of headlines mentioning recession had climbed to its highest since September: In Trump 1.0, big tax cuts came first, boosting markets and broader sentiment. Tariffs came later. Reversing the sequence this time, at a point when nerves about the economy are increasing, is a risky gambit. —Richard Abbey Just keeping up with everything that's happening is mighty stressful. So here are a few of my favorite panic-button songs for times like this: try Miles Davis' So What?, the second movement of Mozart's Concerto for Flute and Harp, Josquin Desprez's Missa Pange Lingua, or The Sea by Morcheeba. Other suggestions gratefully accepted.

Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. More From Bloomberg Opinion: - Andreas Kluth: America's Loss of Soft Power Is Putin's Gain

- Lionel Laurent: Europe Needs Nerves of Steel Against Trade Coercion

- Hal Brands: If Ukraine Deal Wasn't Perilous Before, It Is Now

Want more Bloomberg Opinion? OPIN . Or you can subscribe to our daily newsletter. |

No comments:

Post a Comment