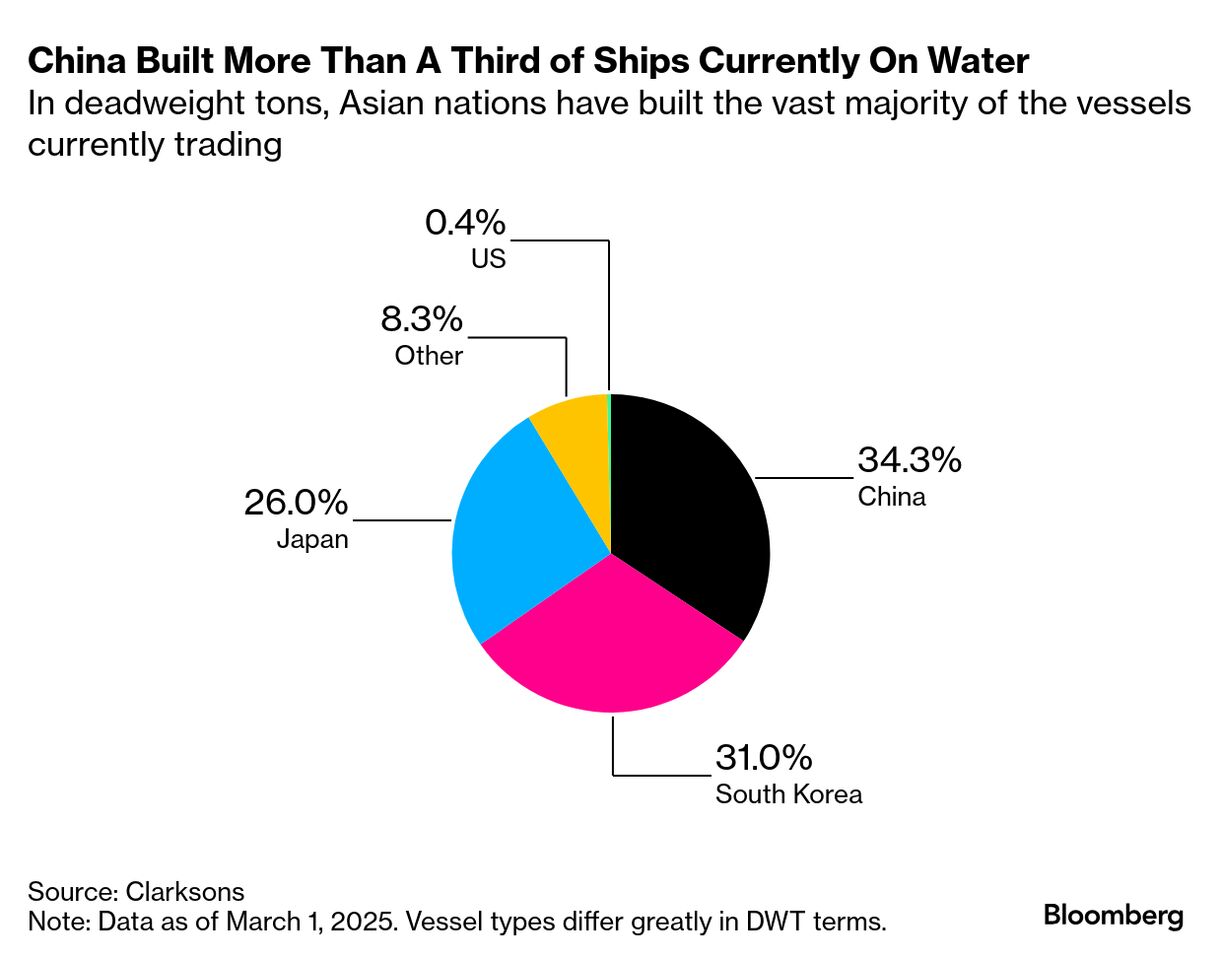

| US lawmakers, labor unions and steel manufacturers were at odds with shipping companies and farm exporters Monday over a Trump administration proposal to put million-dollar levies on China-linked ships upon entering a US port. At an Office of the US Trade Representative hearing on the proposal, more than 30 witness statements were peppered with questions from members of Congress jumping in virtually to remark on the diminished state of the US merchant shipbuilding industry. While there was broad agreement that China's dominance of the maritime industry should be addressed, there was concern that levies of as much as $3.5 million per port call would do more harm than good. Read More: Billion-Dollar Levies on Chinese Ships Risk 'Trade Apocalypse' Congresswoman Debbie Dingell said the US has lost more than 70,000 shipyard jobs in recent decades and now ranks 19th globally in global shipbuilding. "The US produces less than 10 oceanic commercial vessels a year, while China produces over 1,000," the Michigan Democrat said. Dingell said she also supports another aspect of the Trump proposal that US goods be shipped on a share of US flagged, built and crewed vessels that would increase over time. Steel industry representatives also backed the proposal, saying they were ready to ramp up capacity to meet demand for the increased steel and components needed to build new ships. (Bloomberg's Ruth Liao was at the hearing; read the full story here.) Nearly 400 comments rolled in before the hearing began. Some contained suggestions to improve the plan, while others urged the USTR to scrap the proposal entirely. There were also requests for the Trump administration to exempt certain industries. The Center for Liquefied Natural Gas argued that because there are few US-built, US-flagged vessels capable of transporting LNG, the proposal "would undermine, rather than support the Administration's energy dominance agenda and would allow foreign actors to capture US market share." "CLNG respectfully recommends that the Committee exempt the shipping of LNG and LNG vessels from application of the Proposed Action entirely," Executive Director Charlie Riedl wrote.

The hearing resumes Wednesday at 10 a.m., and will include testimony from the European Union, grain exporters, the National Mining Association and American Petroleum Institute. The panel will also hear from the National Retail Federation, which led a letter signed by 317 trade associations in opposition to the USTR's plan. Not everyone speaking Wednesday will be opposed to the plan, however. A Hanwha Shipping executive set to speak in the afternoon said in submitted comments that the fees proposed are essential, even for companies well-positioned to support a renewal of the US maritime industry. Hanwha Shipping is the vessel ownership entity of South Korea's Hanwha Group, which acquired thePhilly Shipyard last year. "The fee-generation potential, as proposed, creates a necessary foundation for financial support to enable the transfer of the Hanwha Shipping fleet into the service of the US, as US vessels," Hanwha Shipping's VP of Commercial Ryan Lynch wrote in a letter ahead of the hearing. The USTR's proposal "will facilitate the entry of our vessels into the service of the US, providing for a clear pathway" for Hanwha Shipping to support the establishment of US-maritime capabilities, he said. —Laura Curtis in Los Angeles Click here for more of Bloomberg.com's most-read stories about trade, supply chains and shipping. Bloomberg's tariff tracker follows all the twists and turns of global trade wars. |

No comments:

Post a Comment