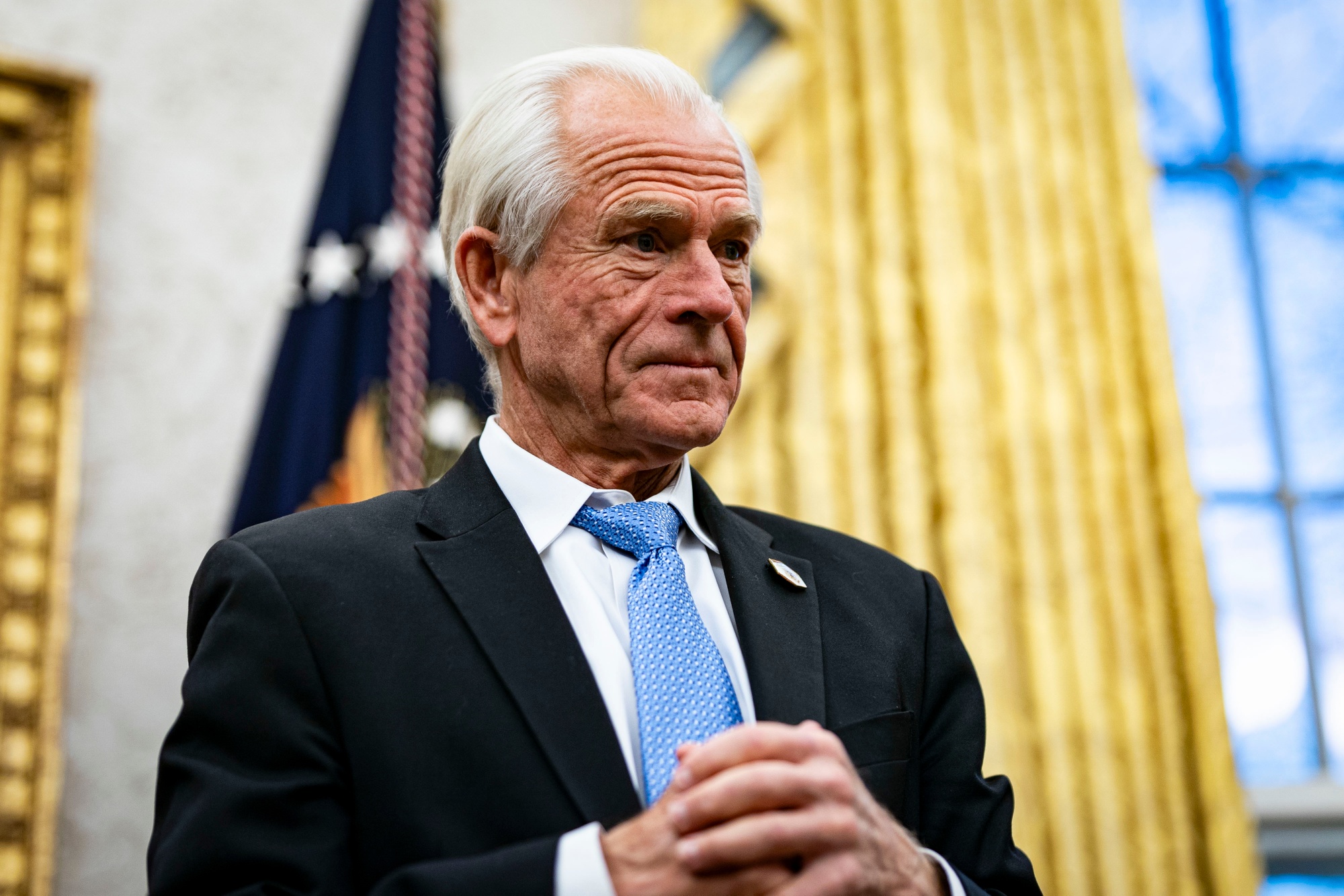

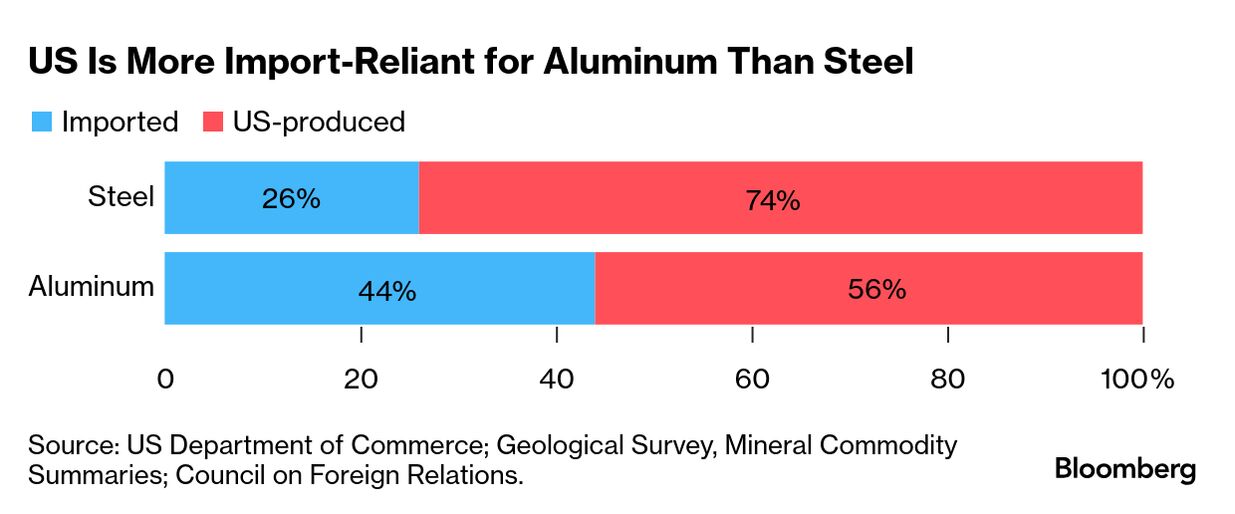

| The steel and aluminum tariffs President Donald Trump is due to impose starting this week are the latest piece being inserted into an expanding protectionist policy jigsaw puzzle. But the duties taking effect Wednesday also point to who has Trump's ear and how one industry in particular has driven his agenda. Because Trump's tariff puzzle is made of — and by — American steel and we are starting to see the consequences. In a unique moment for a sitting president, Trump on Sunday declined to rule out the possibility of the US tumbling into a recession. Instead, he pointed to a "period of transition" due to his tariffs, seeming to acknowledge the slowdown markets and economists are fretting about. If the US economy slows thanks to a combination of tariffs and other Trump policies, then you'll be able to trace it back in part to a coterie of advisers and supporters with links to the steel industry. Read More: Lutnick Says Trump Sticking to US Aluminum-Steel Tariff Timeline Peter Navarro, White House trade adviser, has been a fixture on business TV since the first Trump administration. What's often forgotten is that his documentary "Death by China," which built his brand as a China and tariff hawk, was reportedly financed by Nucor, the US's largest steel maker.  Peter Navarro, White House senior counselor for trade and manufacturing Photographer: Al Drago/Bloomberg Jamieson Greer, Trump's US trade representative, was until recently a partner at law firm King & Spalding which has represented steel firm Cleveland-Cliffs. Moreover, he is a protege of Bob Lighthizer, Trump's first-term USTR, who made his fortune as a lawyer representing US Steel and others in the industry in trade cases. The most vocal outside intellectual support for Trump's tariffs comes from two Washington groups with strong links to steel — The Coalition for a Prosperous America and the Alliance for American Manufacturing. Long History The support from steel is not a new phenomenon in American politics, to be fair. America's steel industry has a history of pushing for tariffs going back to the 19th century. Heavy industry has long had a protectionist bent with tariffs the reward delivered in an associated patronage system. Read More: US Steelmaker CEOs Urge Trump to Resist Metal Tariff Exemptions Presidents from both parties have sought to please the industry and to protect it. During the Biden administration, a foreign investment screening committee raised concerns that allowing Japan's Nippon Steel to buy US Steel posed a risk because a Nippon ownership might be less likely to push for tariffs. This time around steel producers in the US have again been cheering Trump on as he prepares to levy 25% import taxes on all steel, aluminum and a wide range of products that use the metals as well including sewing needles, safety pins and camping stoves. (See Federal Register notice here.) No Exemptions Major producers have urged Trump not to allow any exemptions to tariffs as he did last time after big corporate steel users complained about the impact to their bottom line. Steel companies have already raised domestic prices in anticipation. The argument you hear from the Trump administration is that his first-term tariffs spurred investment in a vital industry. And there's truth to that. What they didn't create, though, was many jobs. There are today, according to official data, 83,600 people working in US steel mills. That is just 600 more than worked in them when Trump was elected in 2016. It's also an indication of how small the steel sector is. There are 12 million people working in manufacturing in the US and, according to one count, almost 12 million laboring full time as online content creators. Read More: Chemicals, Steel Firms in Europe Squeezed by China, Tariff Woes There's also evidence the steel tariffs led to a broader US manufacturing recession thanks to higher prices they caused for an essential input and retaliation by other countries. In 2019, the year after the first steel tariffs were introduced, US industrial production fell. The country also lost 45,000 manufacturing jobs. There are already warnings of a similar toll this time around coming from within the metals sector. The CEO of aluminum giant Alcoa, Bill Oplinger, warned during a recent conversation that the new aluminum tariffs would lead to 20,000 direct job losses and 80,000 indirect ones. Trump rejects such warnings. During his Fox News interview Sunday, the president treated any downturn that might result from his tariffs as a temporary hurdle. "We're bringing wealth back to America," he said. For one small sector of the economy he is close to, at least, that might be true. —Shawn Donnan in Washington Click here for more of Bloomberg.com's most-read stories about trade, supply chains and shipping. |

No comments:

Post a Comment